Tennessee Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

About this form

The Fiduciary Deed is a legal document used by executors, trustees, trustors, administrators, and other fiduciaries to transfer property ownership. This form is unique as it allows individuals acting in a fiduciary capacity to convey property, which could include real estate, from an estate or trust to designated beneficiaries. It differs from standard deeds by specifying that the person signing the deed is doing so by virtue of their role as a fiduciary, ensuring that the transfer complies with estate planning and probate laws.

Key components of this form

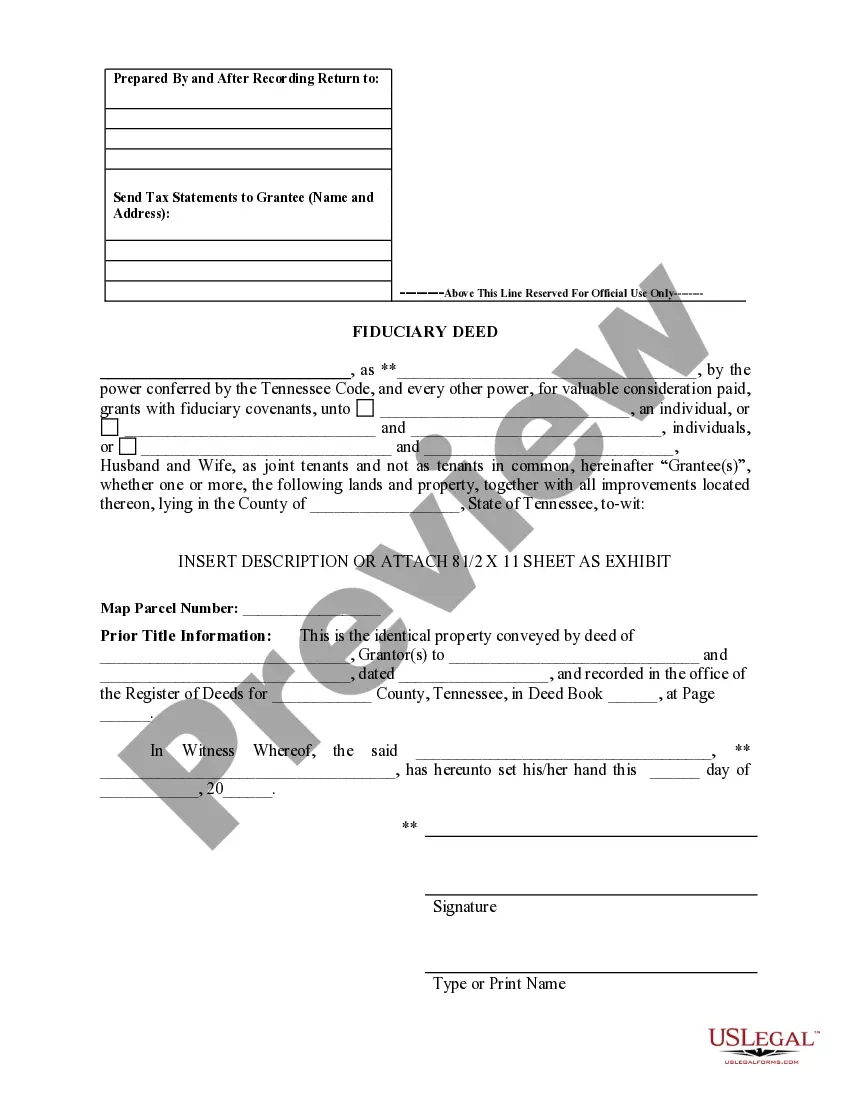

- Grantor information: Includes the name and title of the fiduciary executing the deed.

- Grantee identification: Specifies who receives the property (individuals or entities).

- Description of property: Detailed information or an attachment specifying the property being transferred.

- Prior title information: References the previous ownership of the property for clear title transfer.

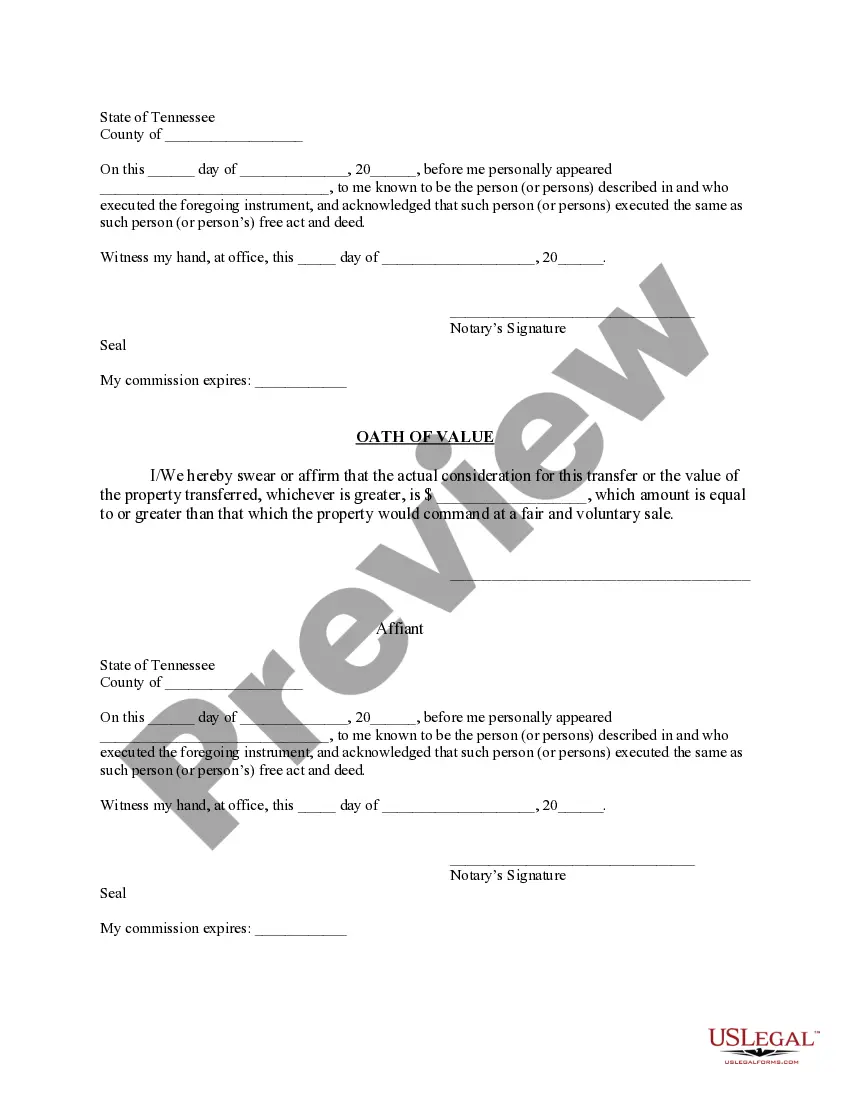

- Signature and notary section: Requires the fiduciary's signature along with a notary acknowledgment.

- Oath of value: Certifies the fair market value of the property being transferred.

When to use this document

This form is typically used when a fiduciary needs to transfer real property from a deceased person's estate, a trust, or when managing the affairs of a ward. Common situations include disbursing assets to heirs as part of estate settlement or managing property under a trust agreement. If you are acting as a guardian for an individual or managing assets under court direction, this deed is essential for legally transferring property rights.

Who this form is for

- Executors of a will who need to transfer property to beneficiaries.

- Trustees managing a trust that includes real estate assets.

- One serving as a guardian or conservator for another person's estate.

- Administrators of an estate where property needs to be conveyed.

- Any fiduciary looking to ensure proper legal documentation when transferring property.

Instructions for completing this form

- Identify the parties: Clearly list the grantor (fiduciary) and grantee (recipient of the property).

- Specify the property: Provide a detailed description of the property being transferred, including any parcel numbers.

- Complete prior title section: Include information about the previous transaction to establish a clear title.

- Sign the deed: The fiduciary must sign the document in the presence of a notary public.

- Include notary acknowledgment: Have the notary fill in their information and affix their seal.

- Complete the oath of value: Verify and state the property's value as required under the law.

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include all required signatures, especially the notary's.

- Omitting the property description or providing an inaccurate description.

- Not verifying the value of the property before completing the oath section.

- Using outdated forms that do not comply with current Tennessee regulations.

Why use this form online

- Convenience: Download and complete the form from anywhere at any time.

- Editability: Easily fill out necessary fields on your computer before printing.

- Reliability: Forms are drafted by licensed attorneys, ensuring compliance with state laws.

- Time-saving: No need to visit an attorney or print out physical copies until completed.

Looking for another form?

Form popularity

FAQ

Tennessee does not allow real estate to be transferred with transfer-on-death deeds.

Typically the answer is no. However, there may be an exception to this general rule. Accordingly, please call Ascent Law LLC (801) 676-5506 for your Free Consultation.

In most states, an executor's deed must be signed by a witness and notarized. An executor's deed should be recorded in the real estate records of the county in which the property being conveyed is located.

Executor's Deed: This may be used when a person dies testate (with a will). The estate's executor will dispose of the decedent's assets and an executor's deed may be used to convey the title or real property to the grantee.

Once the COURT appoints you as executor, you will record an affidavit of death of joint tenant to get your mother's name of the property. Then, when you get an order for final distribution, you will record a certified copy to get the property into the names of the beneficiaries under the will.

Again, the Executors of the Estate have overall authority, so can accept an offer from a potential buyer. But again, the Executors must act in the Beneficiaries' best interests, and so have a duty to sell the property for a reasonable sum.