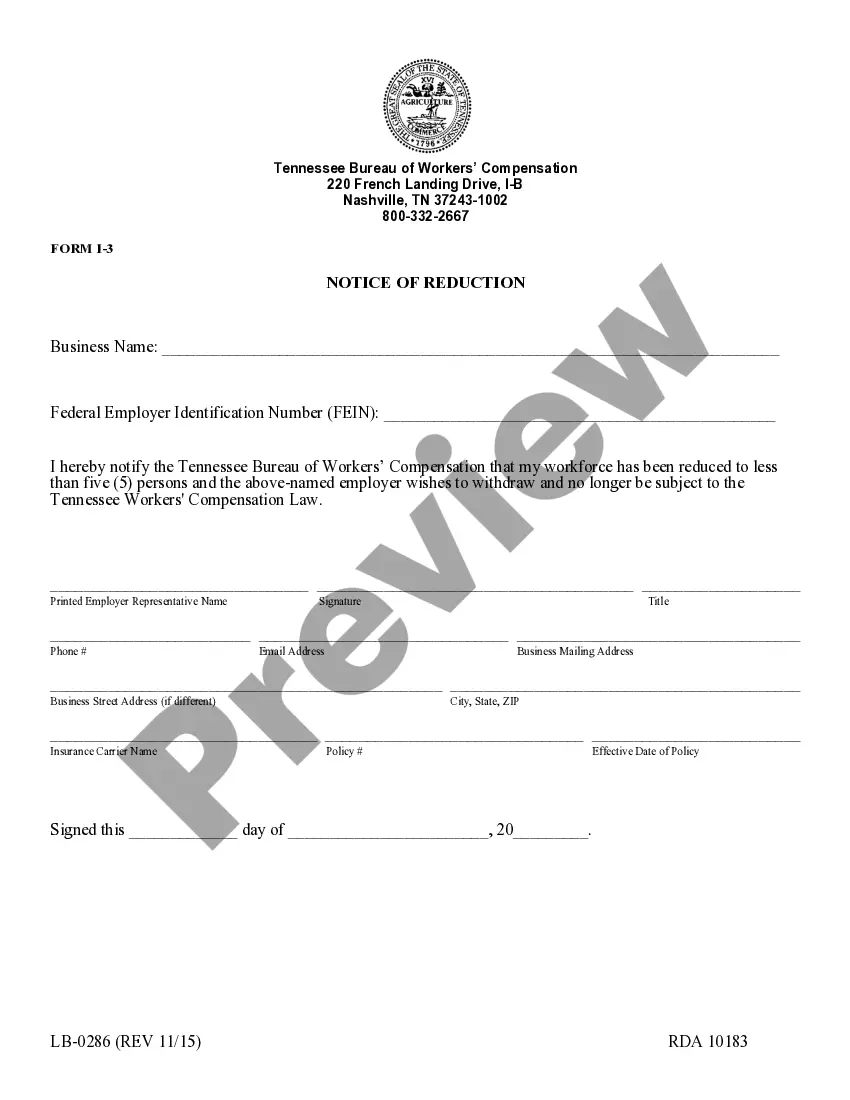

Official Workers' Compensation form in pdf format.

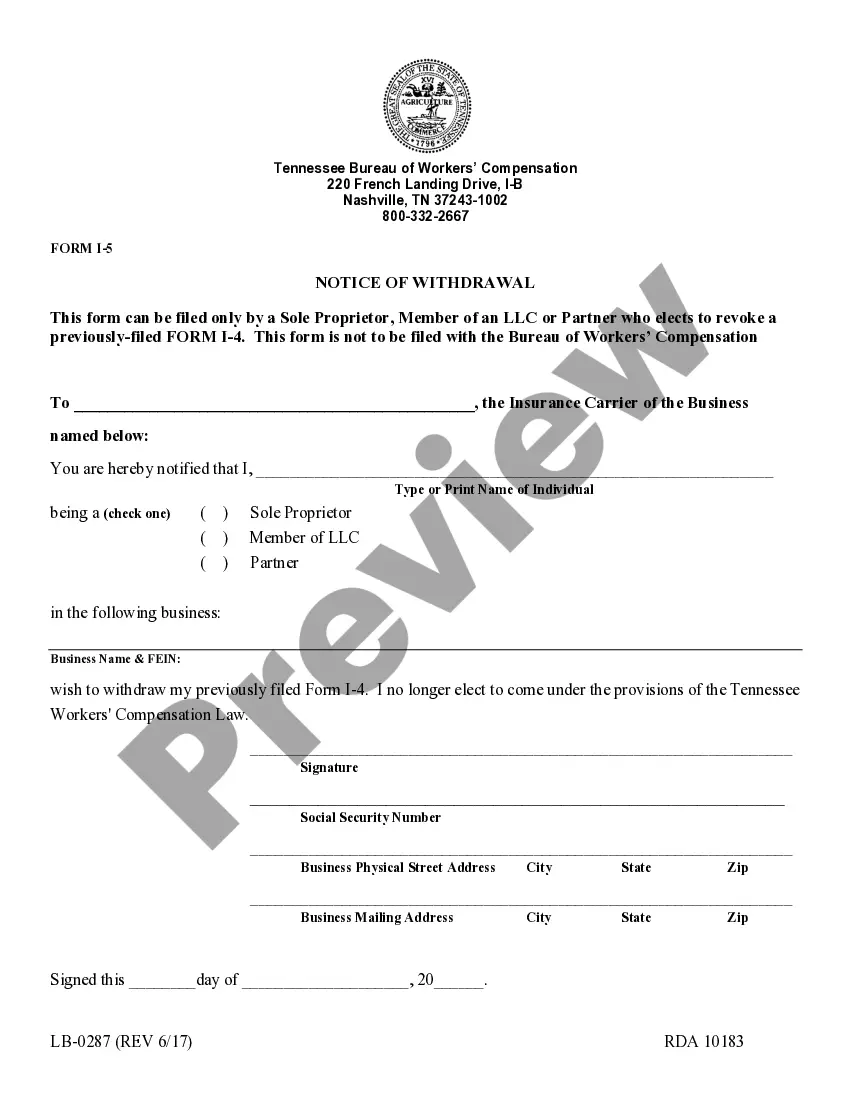

Tennessee Notice of Withdrawal of Exemption Employers Voluntary Election

Description

How to fill out Tennessee Notice Of Withdrawal Of Exemption Employers Voluntary Election?

Access to top quality Tennessee Notice of Withdrawal of Exemption Employers Voluntary Election forms online with US Legal Forms. Prevent hours of misused time browsing the internet and dropped money on files that aren’t updated. US Legal Forms provides you with a solution to just that. Get around 85,000 state-specific legal and tax forms that you could save and fill out in clicks within the Forms library.

To find the sample, log in to your account and click Download. The file will be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- See if the Tennessee Notice of Withdrawal of Exemption Employers Voluntary Election you’re looking at is suitable for your state.

- Look at the form using the Preview option and read its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to go on to sign up.

- Pay out by card or PayPal to finish making an account.

- Pick a favored file format to save the document (.pdf or .docx).

You can now open up the Tennessee Notice of Withdrawal of Exemption Employers Voluntary Election template and fill it out online or print it out and do it by hand. Think about giving the file to your legal counsel to make sure all things are completed appropriately. If you make a error, print out and complete sample again (once you’ve made an account all documents you download is reusable). Create your US Legal Forms account now and access a lot more samples.

Form popularity

FAQ

An injured worker's wage paid is 66 2/3%. The weekly payment minimum is $112.80. The weekly maximum is $752, 100% of the Tennessee state average weekly wage. Maximum period of payments is 400 weeks and the maximum amount payable is $300,800.

Workers Comp. Exemption Registry @tn.gov, or by calling (615) 741-0526. The application is hand printed in ink or computer generated and mailed along with the required filing fee to the Secretary of State's office at 6th FL - Snodgrass Tower, 312 Rosa L.

Tennessee mandates strict workers' compensation insurance coverage for most employees. Every firm with five or more employees must provide workers' comp insurance.Construction business or trades that have one or more employees must have workers' comp.

Some of the common reasons workers compensation insurance companies stop paying benefits are:Your employer offers you suitable light duty work. A doctor says you have reached maximum medical improvement. The insurance company determines you were injured somewhere other than work, and.

A: Failing to have workers' compensation coverage is a criminal offense. Section 3700.5 of the California Labor Code makes it a misdemeanor punishable by either a fine of not less than $10,000 or imprisonment in the county jail for up to one year, or both.

Tennessee workers' comp laws provide compensation for lost or reduced wages due to your inability to work.Temporary total disability benefits are two-thirds of your average weekly wage at the time of your injury, subject to a statutory maximum. As of July 1, 2017, the maximum weekly benefit is $992.20.

In NSW, it is compulsory to have a workers compensation policy if: You engage workers or contractors deemed to be workers and pay, or expect to pay, more than $7,500 a year in wages, or. You engage apprentices or trainees, or you are a member of a Group for workers compensation purposes.

Tennessee mandates strict workers' compensation insurance coverage for most employees. Every firm with five or more employees must provide workers' comp insurance.Construction business or trades that have one or more employees must have workers' comp.

Employers with five or more employees must carry workers' compensation coverage. All construction businesses with one or more employees (including part-time, full-time, temporary, and seasonal) require coverage.