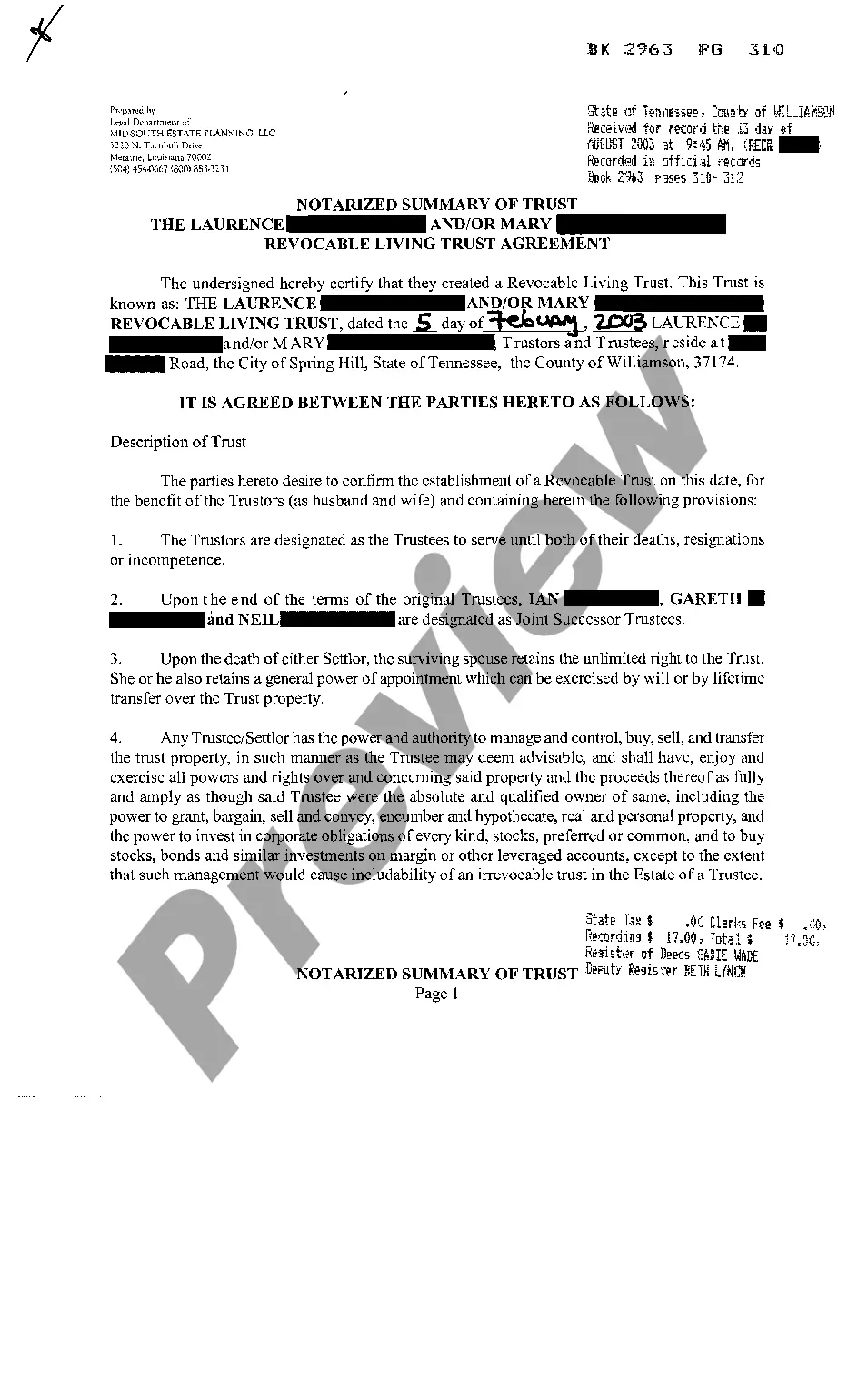

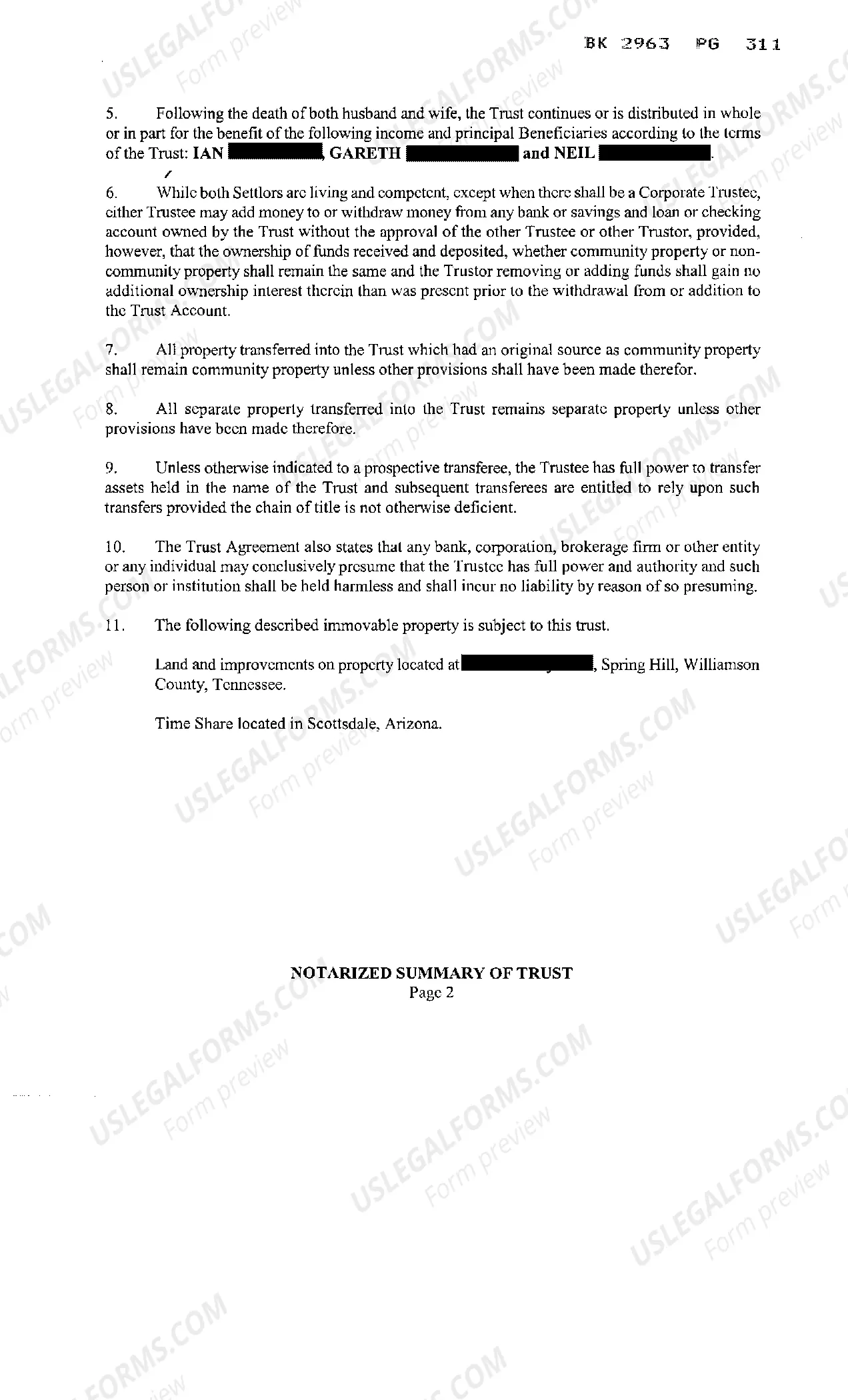

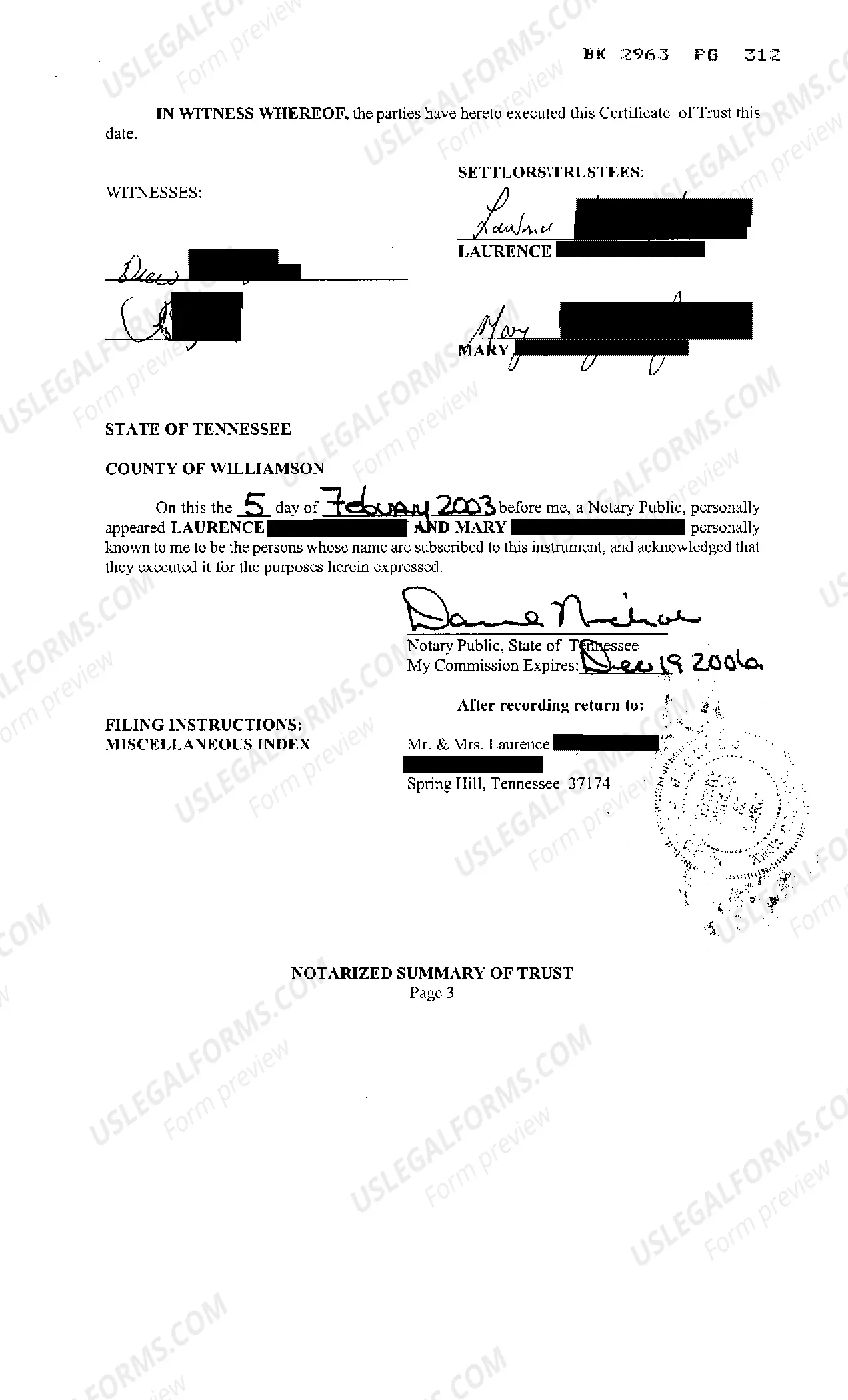

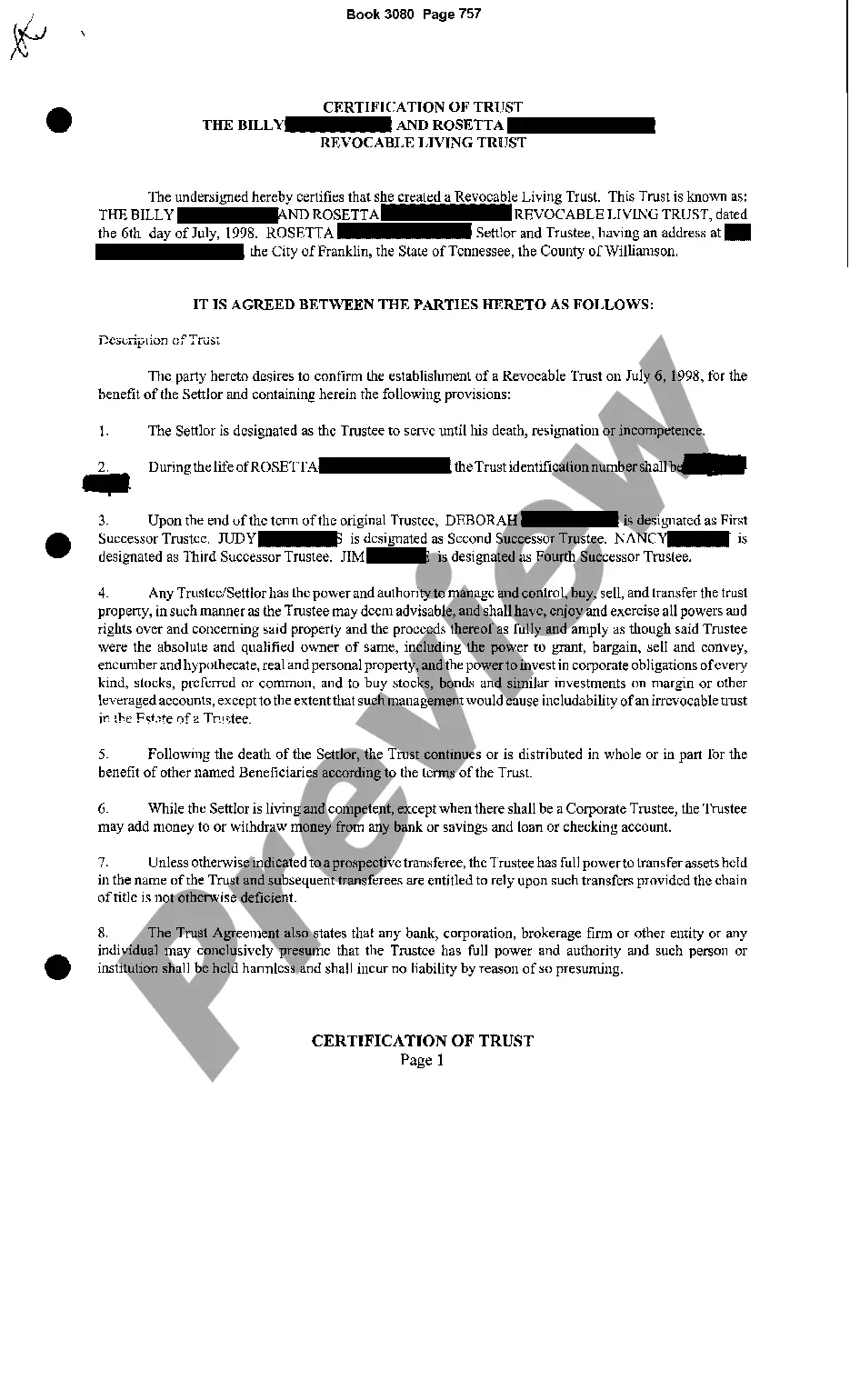

Tennessee Revocable Living Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Tennessee Revocable Living Trust?

Get access to top quality Tennessee Revocable Living Trust samples online with US Legal Forms. Steer clear of days of wasted time searching the internet and lost money on files that aren’t up-to-date. US Legal Forms provides you with a solution to just that. Find around 85,000 state-specific legal and tax samples you can download and fill out in clicks within the Forms library.

To find the sample, log in to your account and click on Download button. The document is going to be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide listed below to make getting started easier:

- Verify that the Tennessee Revocable Living Trust you’re considering is suitable for your state.

- See the form using the Preview function and read its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay by card or PayPal to complete creating an account.

- Choose a preferred format to download the document (.pdf or .docx).

You can now open the Tennessee Revocable Living Trust template and fill it out online or print it and get it done yourself. Take into account sending the papers to your legal counsel to make certain all things are filled out correctly. If you make a error, print and fill sample once again (once you’ve registered an account all documents you save is reusable). Make your US Legal Forms account now and get much more forms.

Form popularity

FAQ

Many people use a revocable living trust because it gives them more control over the trust assets. Putting your house in a revocable trust still allows you to change the terms of the trust or remove the house from the trust if you want to.

Creation of a Trust To create a trust, the property owner (called the "trustor," "grantor," or "settlor") transfers legal ownership to a family member, professional, or institution (called the "trustee") to manage that property for the benefit of another person (called the "beneficiary").

A will lays out your wishes for after you die. A living revocable trust becomes effective immediately. While you are alive you can be in full charge of your trust.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

Funding a Trust Is Expensive... This is the major drawback to using a revocable living trust for many people, but it's not worth the time, money, and effort to create one if the trust isn't fully funded.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

As far as the Internal Revenue Service is concerned, trust property belongs to the grantor. The grantor names a trustee to manage the assets, but during their lifetime, most people name themselves in this position. A successor trustee is named to carry on when the grantor dies or becomes incapacitated.

There are pros and cons to revocable living trusts. Some of the Pros of a Revocable Trust. It lets your estate avoid probate. It lets you avoid ancillary probate in another state. It protects you in the event you become incapacitated. It offers no tax benefits. It lacks asset protection.