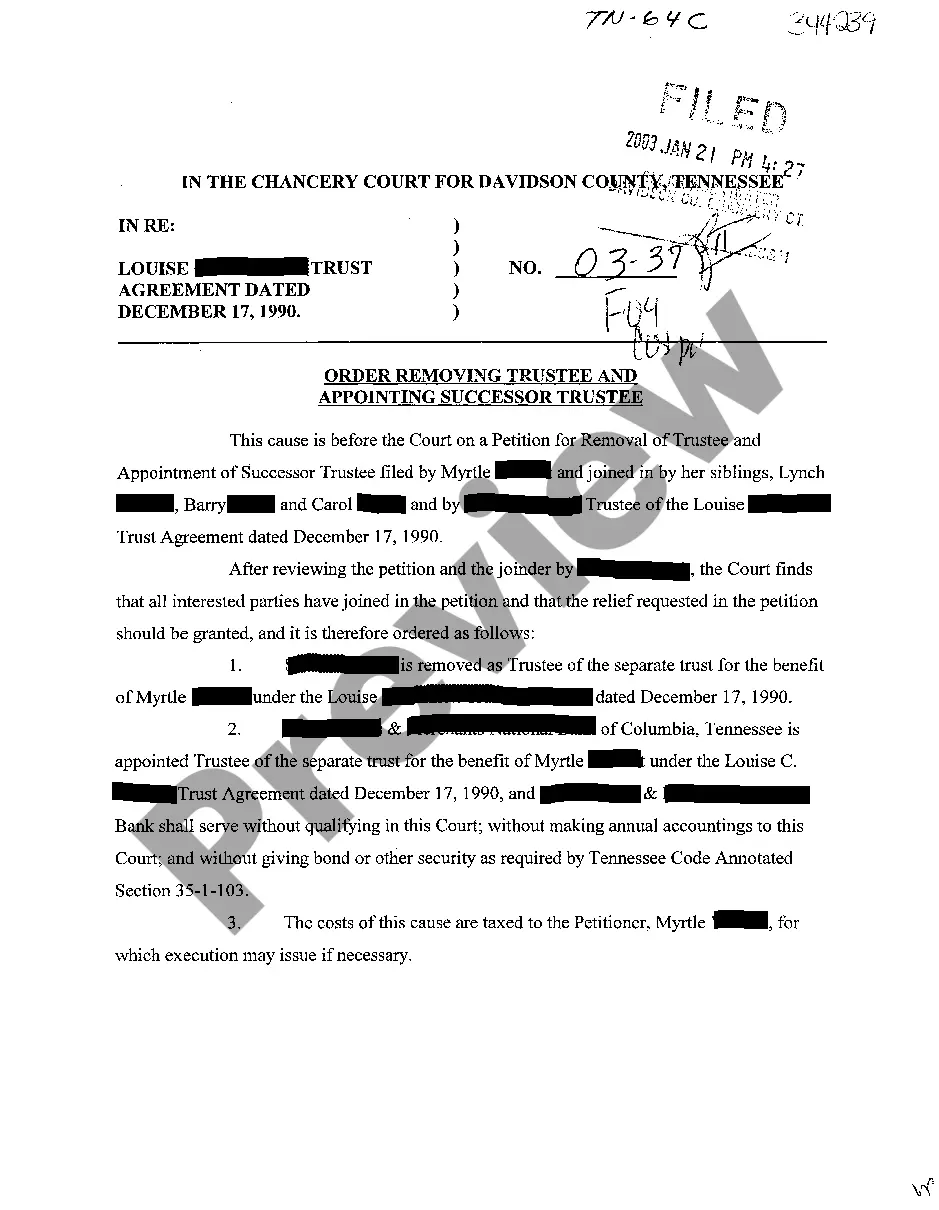

Tennessee Trust Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Tennessee Trust Agreement?

Access to high quality Tennessee Trust Agreement templates online with US Legal Forms. Steer clear of days of wasted time searching the internet and dropped money on documents that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Get more than 85,000 state-specific legal and tax forms that you can save and complete in clicks within the Forms library.

To receive the example, log in to your account and then click Download. The file is going to be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide listed below to make getting started simpler:

- Check if the Tennessee Trust Agreement you’re looking at is suitable for your state.

- See the sample utilizing the Preview option and read its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay out by credit card or PayPal to complete creating an account.

- Pick a preferred format to save the document (.pdf or .docx).

You can now open up the Tennessee Trust Agreement example and fill it out online or print it out and get it done yourself. Take into account mailing the papers to your legal counsel to be certain things are filled in appropriately. If you make a mistake, print and complete sample once again (once you’ve created an account all documents you save is reusable). Make your US Legal Forms account now and get much more samples.

Form popularity

FAQ

While many people can make a living trust without the help of an attorney, there are some situations require individualized legal advice. For example, don't try to make your own living trust if: You don't have anyone to name as trustee.See a lawyer for advice.

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.

Both are useful estate planning devices that serve different purposes, and both can work together to create a complete estate plan. One main difference between a will and a trust is that a will goes into effect only after you die, while a trust takes effect as soon as you create it.

Revocable Trusts. Irrevocable Trusts. Testamentary Trusts.

A trust agreement is a document that allows you (the trustor) to legally transfer the ownership of specific assets to another person (trustee) to be held for the trustor's beneficiaries.Assets controlled in the trust. Powers and limitations for the trustee. Compensation for the trustee.

When they pass away, the assets are distributed to beneficiaries, or the individuals they have chosen to receive their assets. A settlor can change or terminate a revocable trust during their lifetime. Generally, once they die, it becomes irrevocable and is no longer modifiable.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

The costs for establishing a living revocable trust varies from state to state, depending on laws, and can also be affected by the size of the estate. The national average cost for a living trust for an individual is $1,100-1,500 USD.

Identify what should go into the trust. Choose the appropriate type of living trust. Next, choose your trustee, who will manage the trust. Now create a trust agreement. Then sign the trust document in front of a notary public. Finally, transfer your property into the trust.