Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal

Description

Key Concepts & Definitions

Cost Bond to Act as Surety for Payments of Costs: This is a type of surety bond required in certain legal and construction scenarios to ensure the financial obligations towards project costs are met. Surety Bonds: A surety bond involves three parties the principal who needs the bond, the obligee who requires the bond, and the surety company that underwrites the bond, guaranteeing the principal's obligations will be performed.

Contractor Bonds: These are specific types of surety bonds used in the construction industry to protect against disruptions or financial loss due to a contractor's failure to complete the project or meet contractual specifications.

Step-by-Step Guide on Obtaining a Cost Bond

- Determine the Requirement: Identify if your project or legal situation requires a cost bond to act as surety for payments.

- Choose a Surety Company: Select a company that offers surety bonds and has a good reputation for financial stability and service.

- Application Process: Fill out the application form provided by the surety company, which will include details about the project and your financial status.

- Assessment and Approval: The surety company will evaluate your financial strength and risk before issuing the bond.

- Payment and Bond Issuance: Upon approval, pay the bond premium and receive your cost bond.

Risk Analysis for Surety Bonds

- Financial Instability: Poor financial situations can lead to claims on the bond, costing the surety money and potentially harming the principals credit and project continuity.

- Legal Challenges: Non-compliance with the bond terms can lead to legal disputes or penalties.

- Project Delays: Delays in construction projects can increase costs unexpectedly, impacting the capability to fulfill the bond conditions.

Pros & Cons of Using Cost Bonds

Pros:- Guarantees financial responsibility and project completion.

- Enhances trust among project stakeholders.

- Reduces the risk of financial losses.

- Can add upfront costs to projects in the form of bond premiums.

- Qualifying can be difficult for companies with less stable financial histories.

Case Studies / Real-World Applications

An analysis of several large construction projects shows that surety bonds have significantly reduced defaults and financial disputes. For example, a major urban development project in Texas utilized payment and contractor bonds to ensure all subcontractors and suppliers were paid promptly, avoiding delays and legal issues.

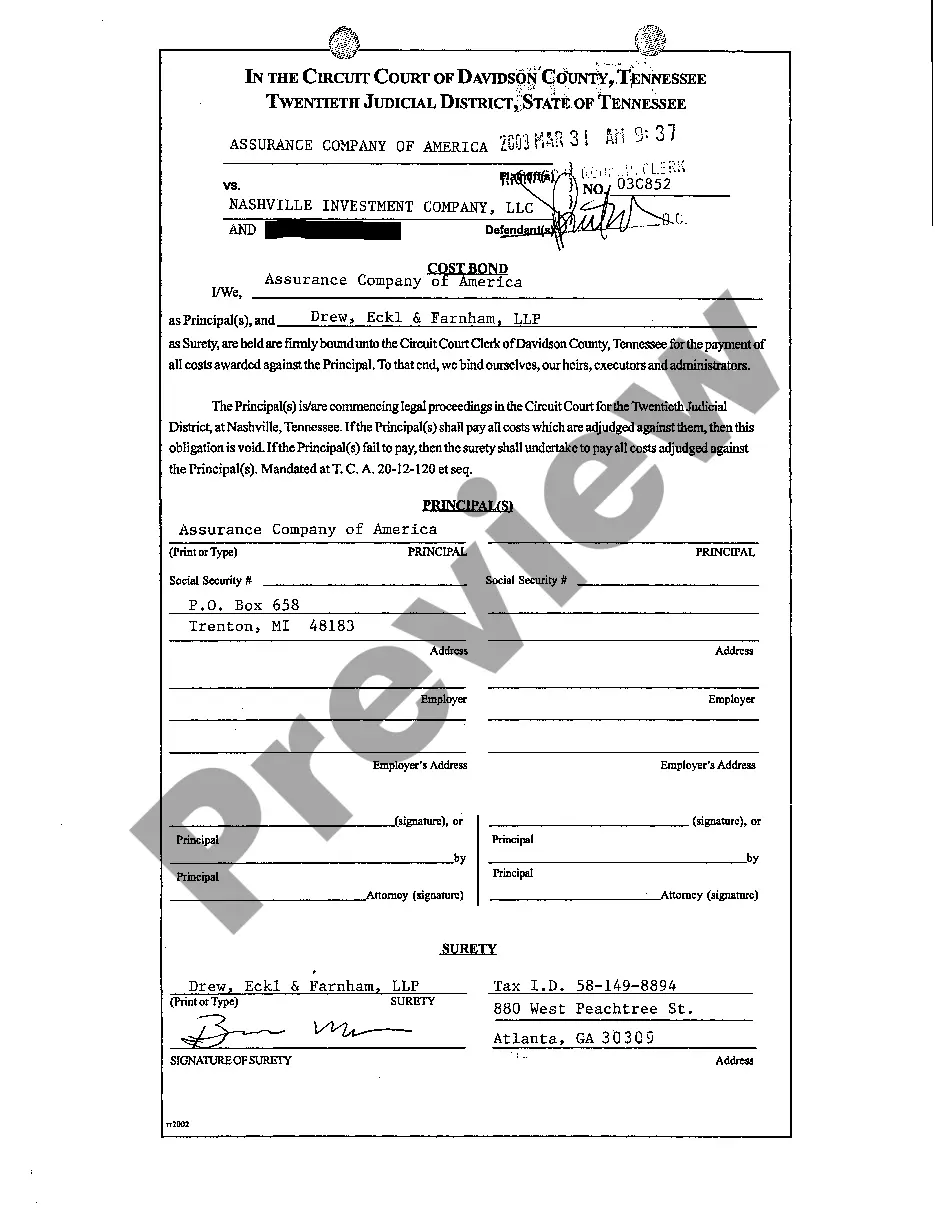

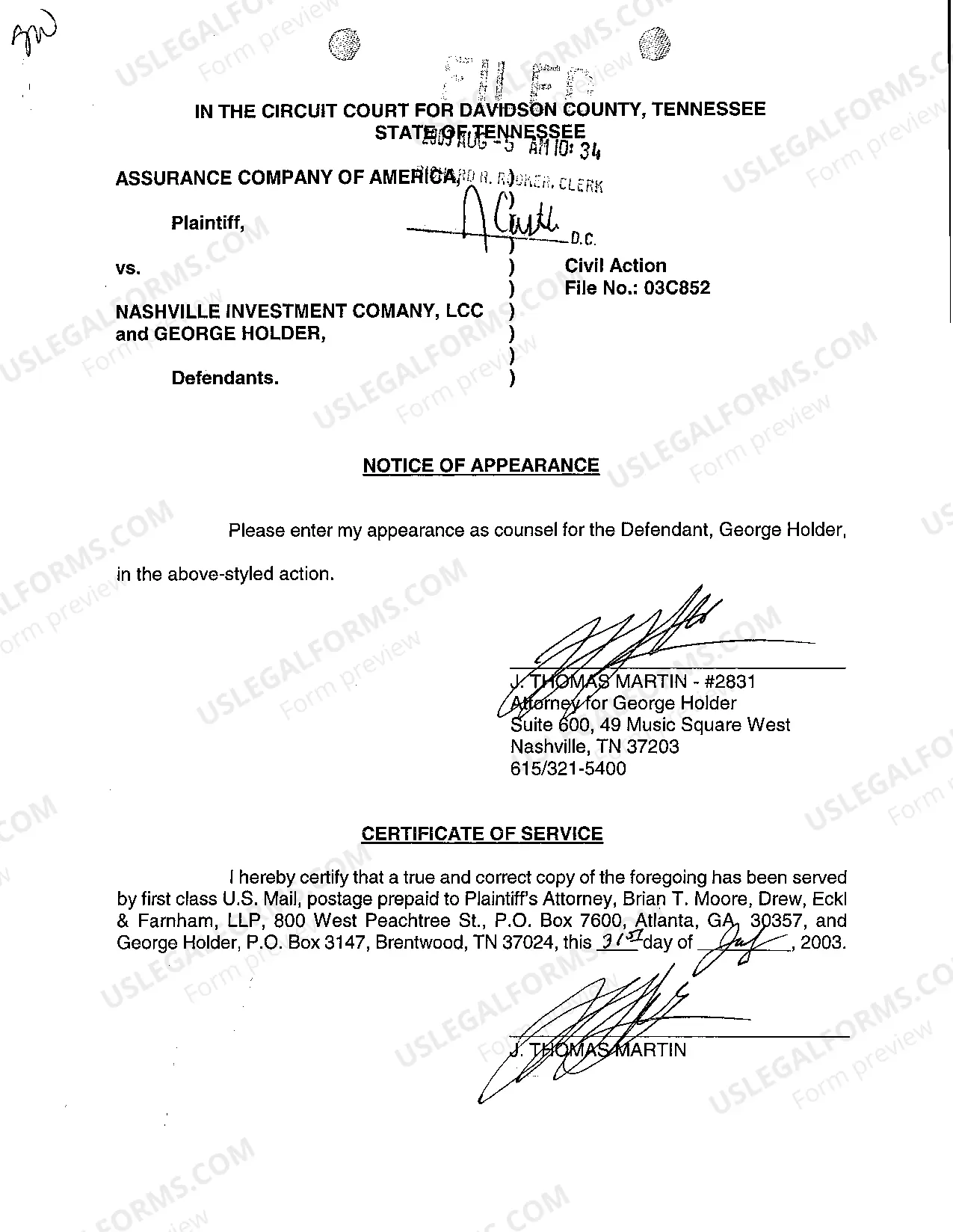

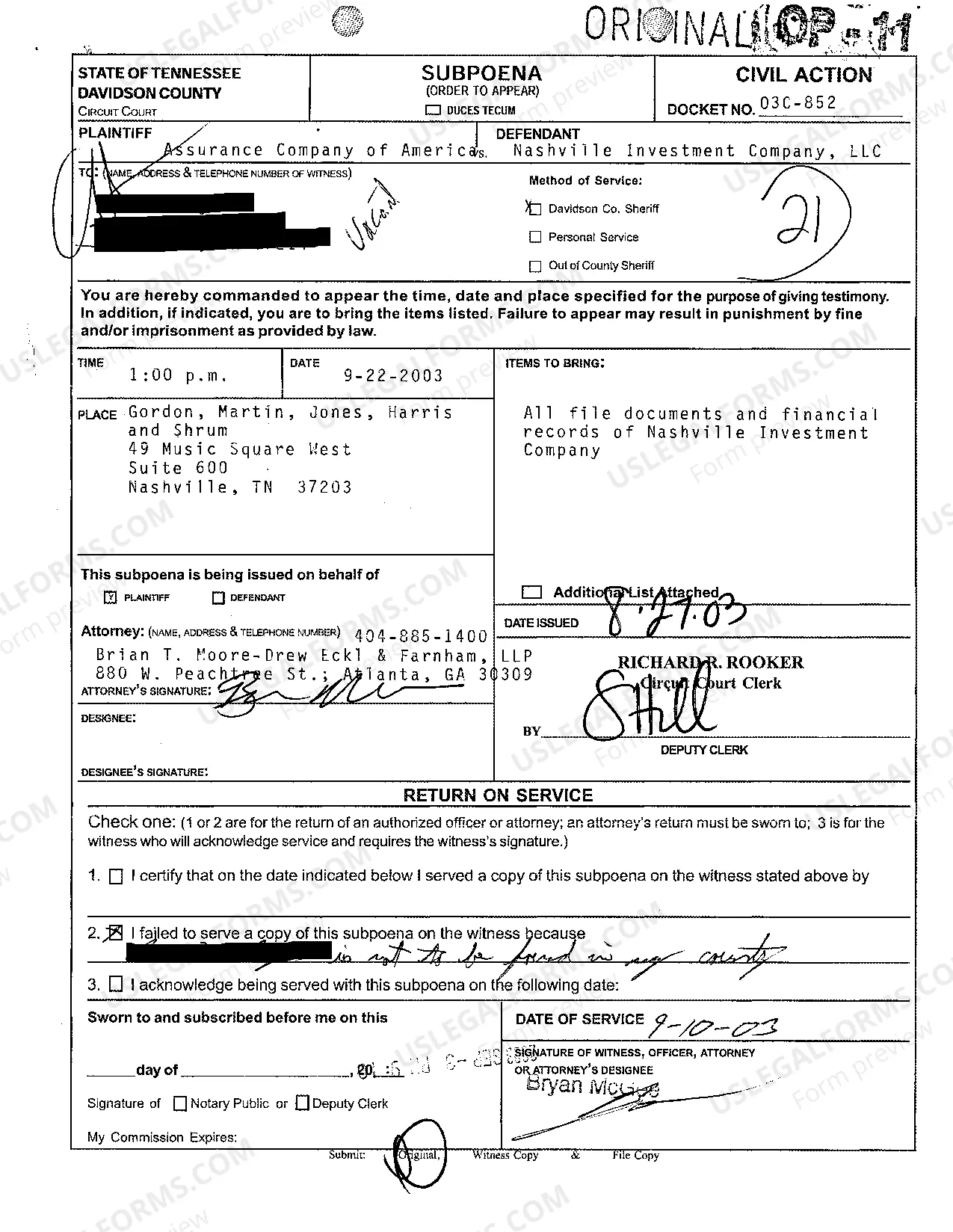

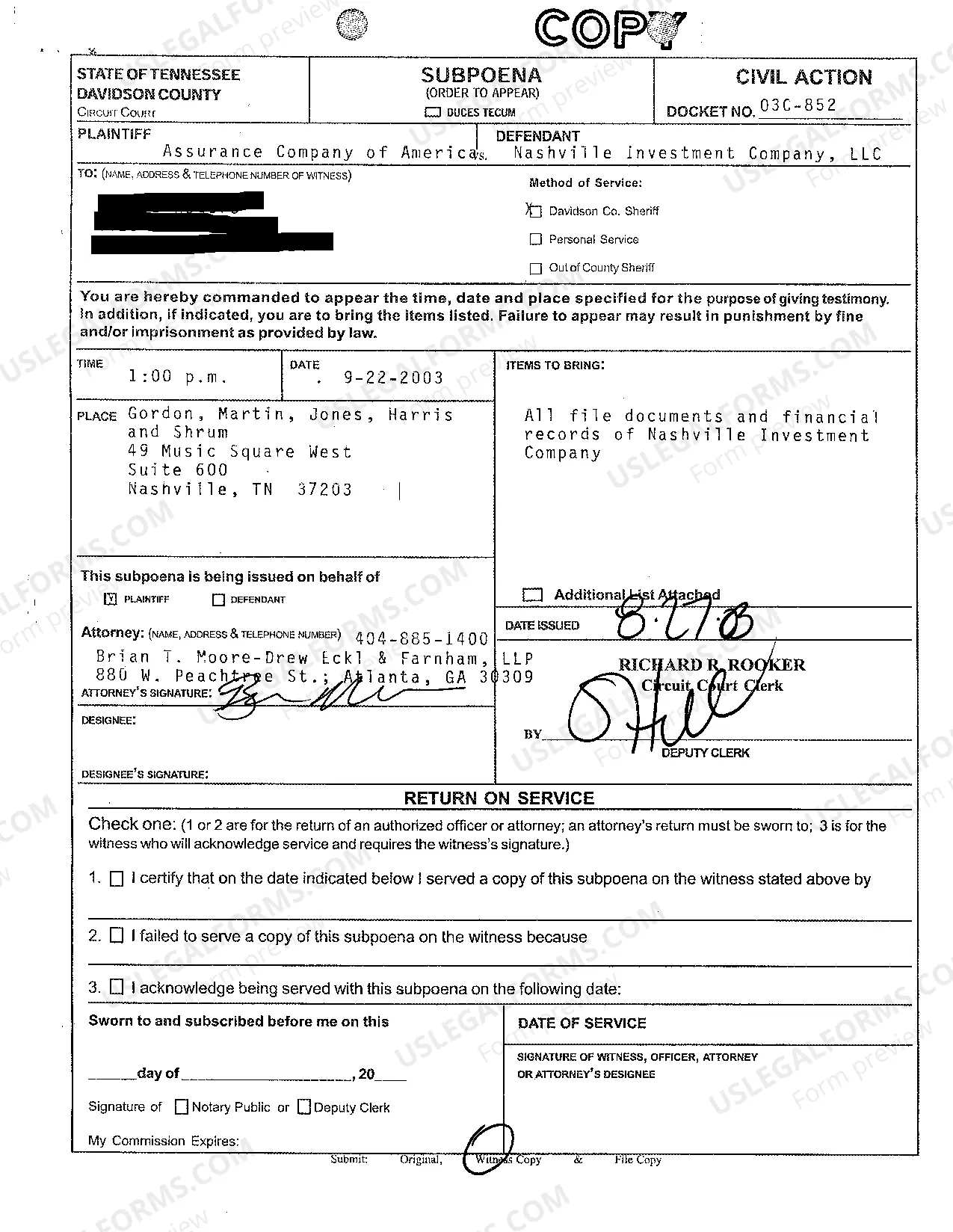

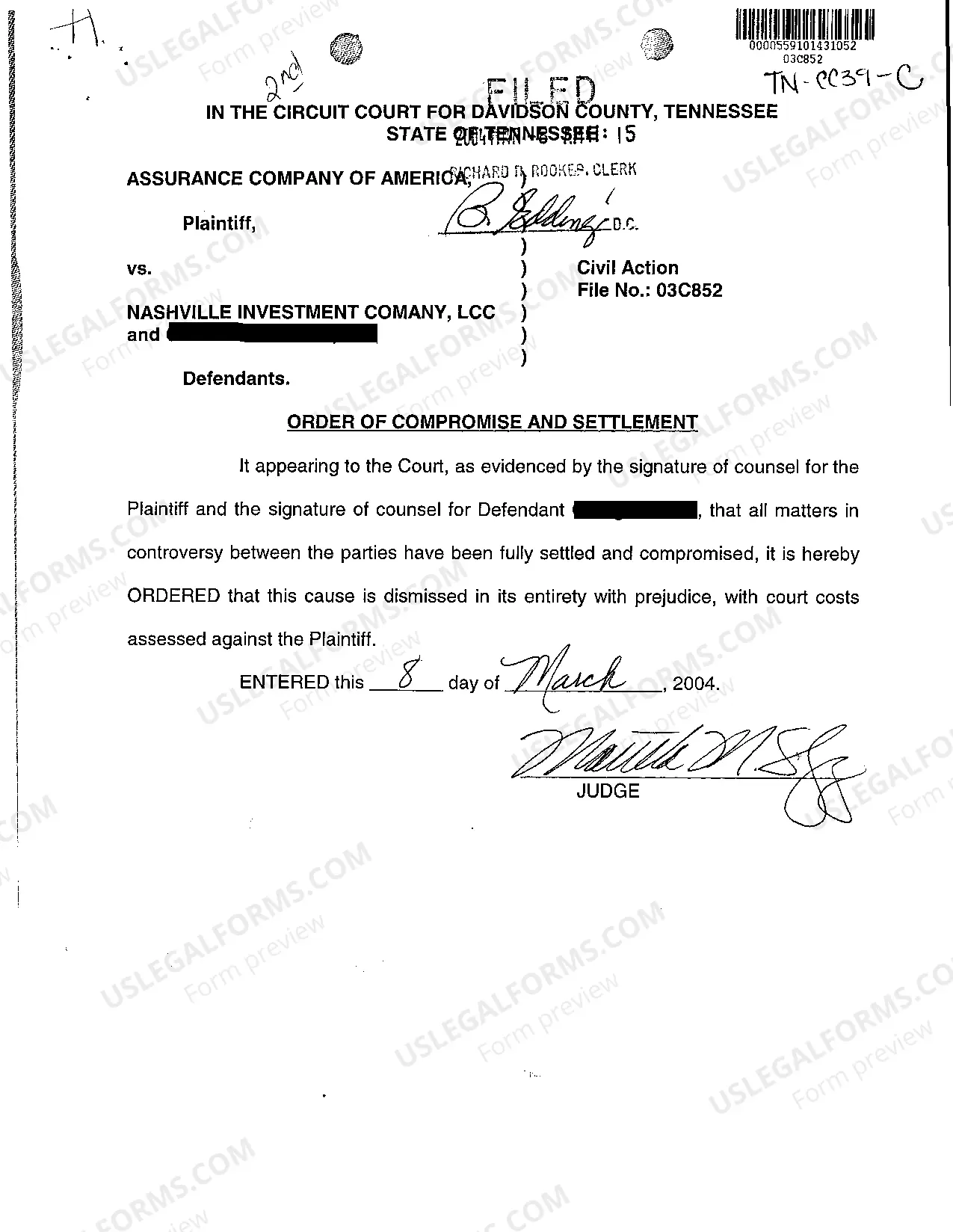

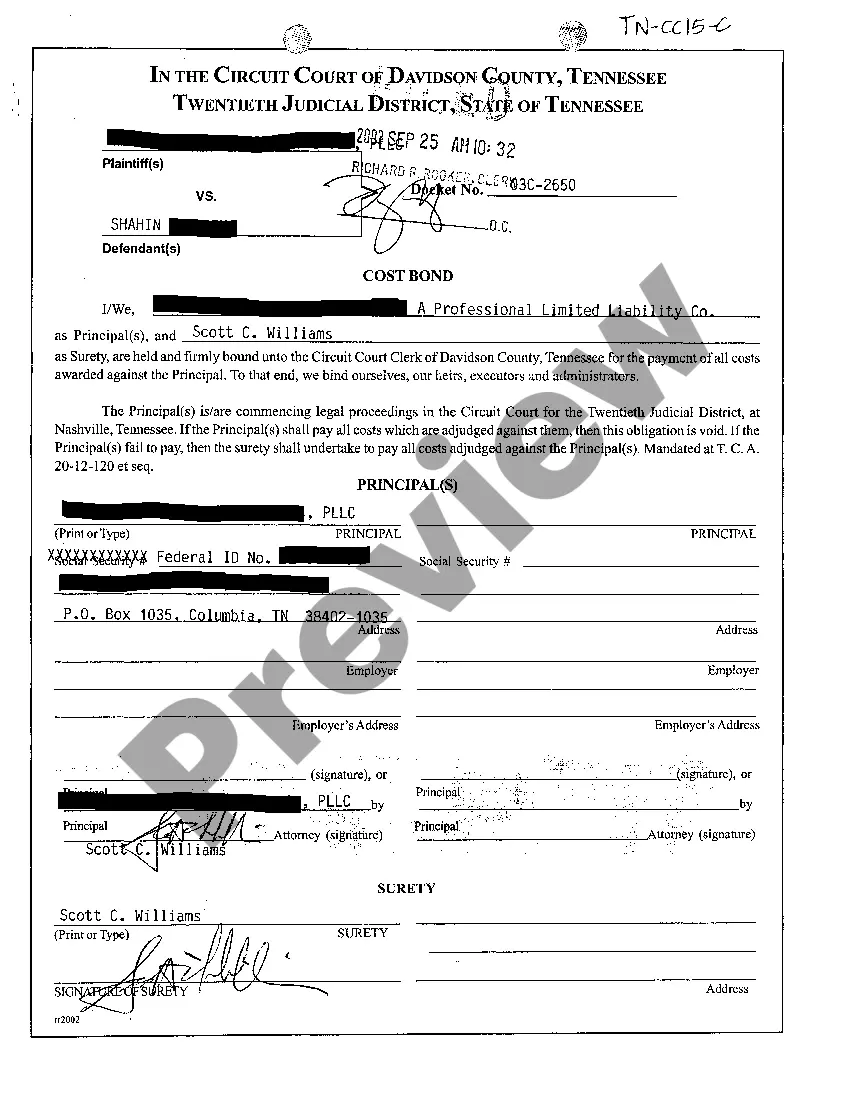

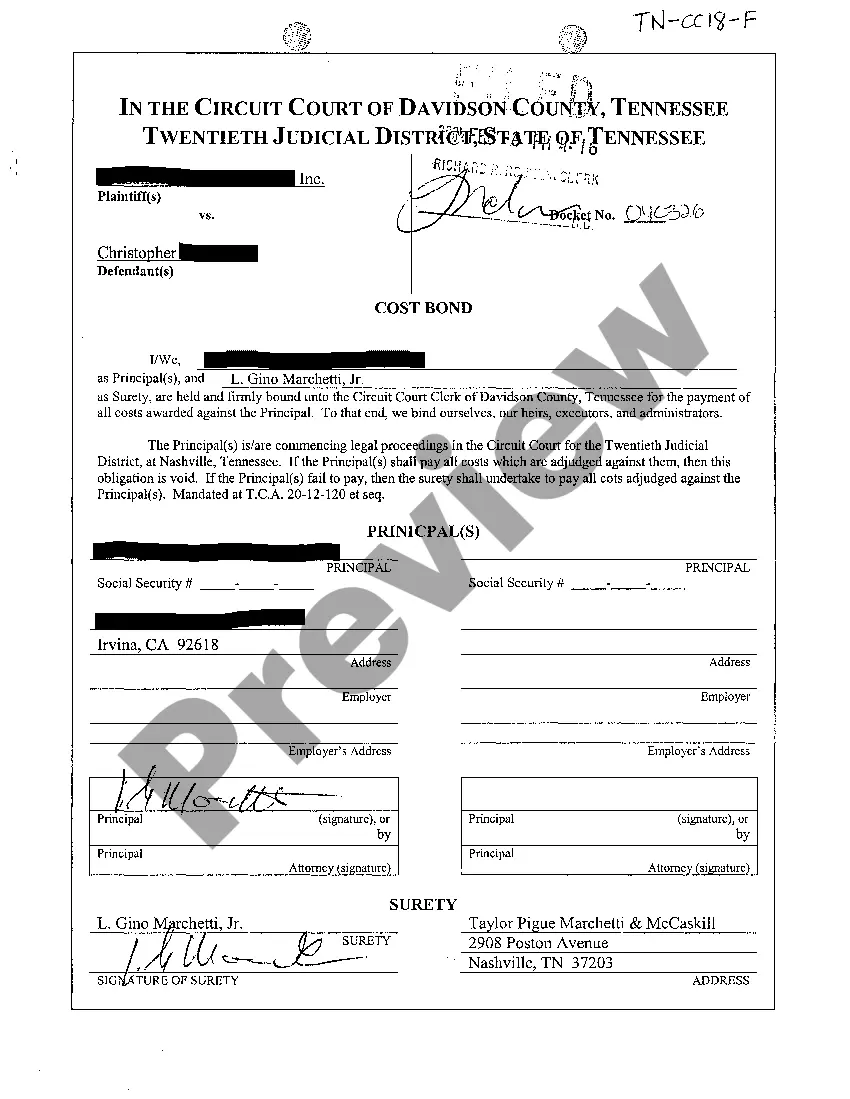

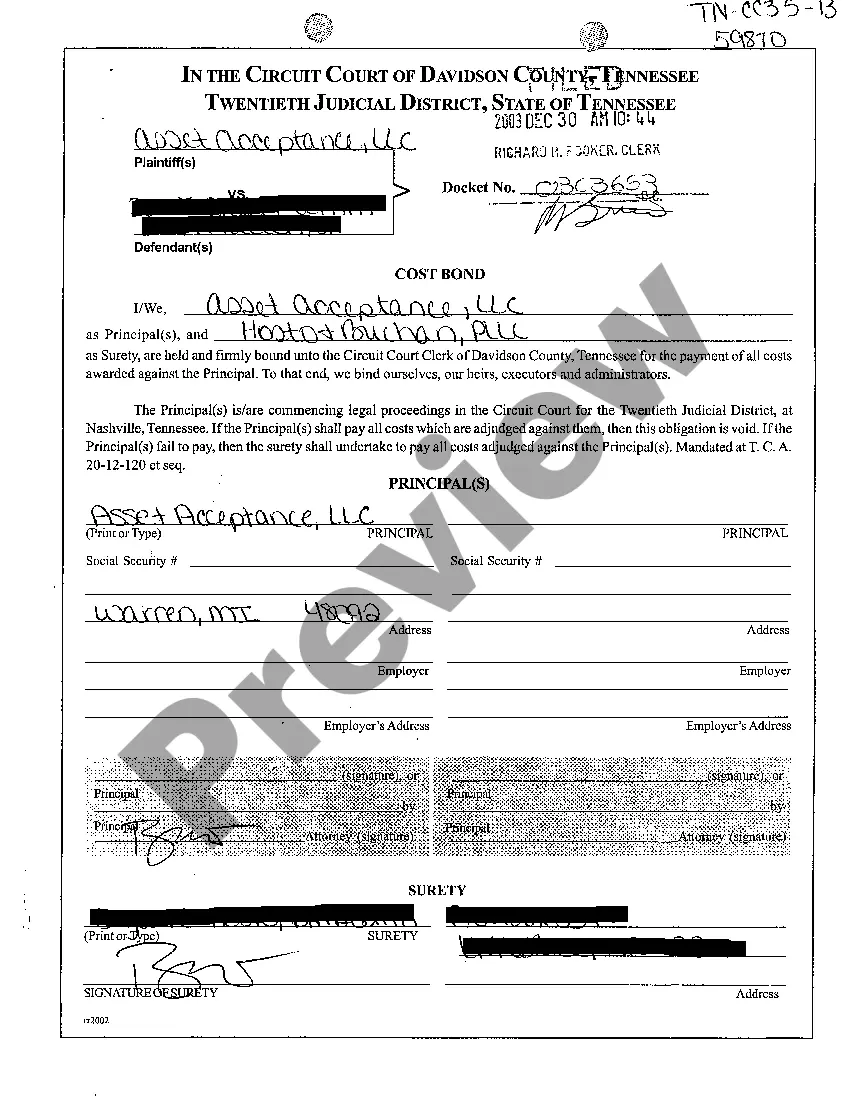

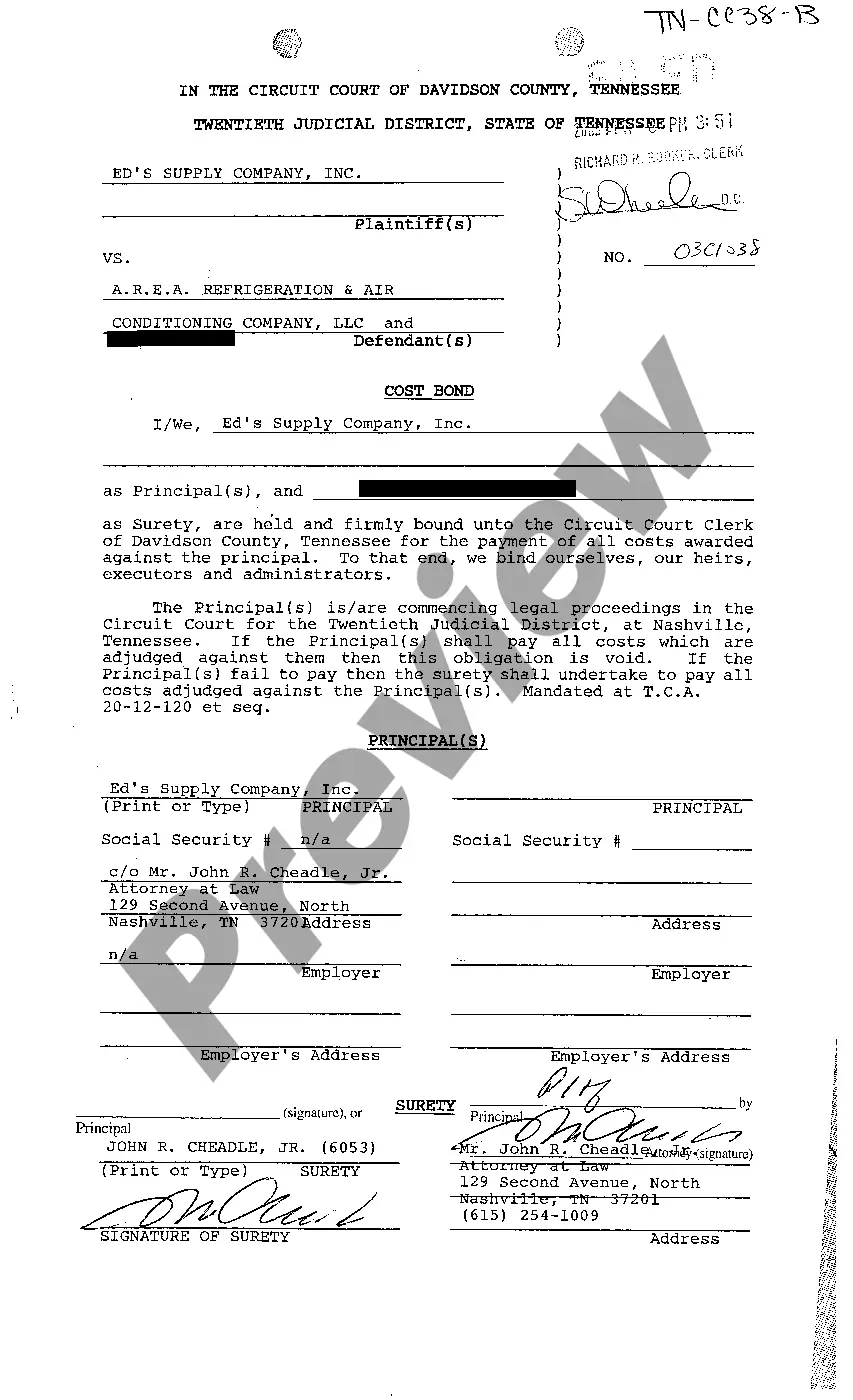

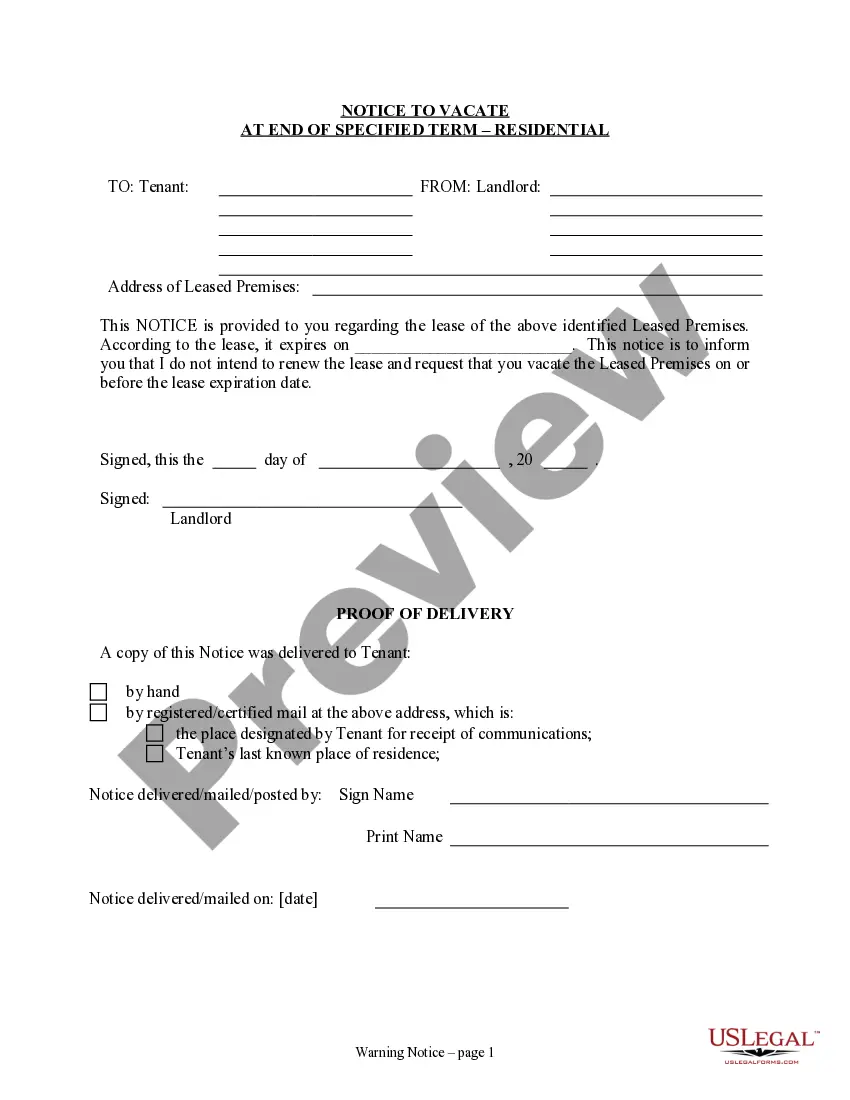

How to fill out Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal?

Get access to top quality Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal templates online with US Legal Forms. Avoid hours of misused time looking the internet and lost money on forms that aren’t updated. US Legal Forms offers you a solution to just that. Get around 85,000 state-specific legal and tax samples that you could download and fill out in clicks within the Forms library.

To get the sample, log in to your account and click Download. The document is going to be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide below to make getting started simpler:

- Verify that the Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal you’re looking at is appropriate for your state.

- See the sample using the Preview option and read its description.

- Check out the subscription page by simply clicking Buy Now.

- Choose the subscription plan to continue on to sign up.

- Pay out by credit card or PayPal to complete creating an account.

- Choose a favored file format to save the file (.pdf or .docx).

Now you can open up the Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal template and fill it out online or print it and do it by hand. Take into account giving the file to your legal counsel to make certain everything is completed properly. If you make a error, print and fill application again (once you’ve made an account every document you save is reusable). Create your US Legal Forms account now and get a lot more forms.