In order to preserve the virtue of the lien, as concerns subsequent purchasers or encumbrancers for a valuable consideration without notice thereof, though not as concerns the owner, such lienor, who has not so registered such lienor's contract, is required to file for record in the office of the register of deeds of the county where the premises, or any part affected lies, a sworn statement similar to that set forth in § 66-11-117, and pay the fees. The register shall file, note and record same, as provided in § 66-11-117. Such filing for record is required to be done within ninety (90) days after the building or structure or improvement is demolished, altered and/or completed, as the case may be, or is abandoned and the work not completed, or the contract of the lienor expires or is terminated or the lienor is discharged, prior to which time the lien shall be effective as against such purchasers or encumbrancers without such registration; provided, that the owner shall give thirty (30) days' notice to contractors and to all of those lienors who have filed notice in accordance with § 66-11-145 prior to the owner's transfer of any interest to a subsequent purchaser or encumbrancer for a valuable consideration.

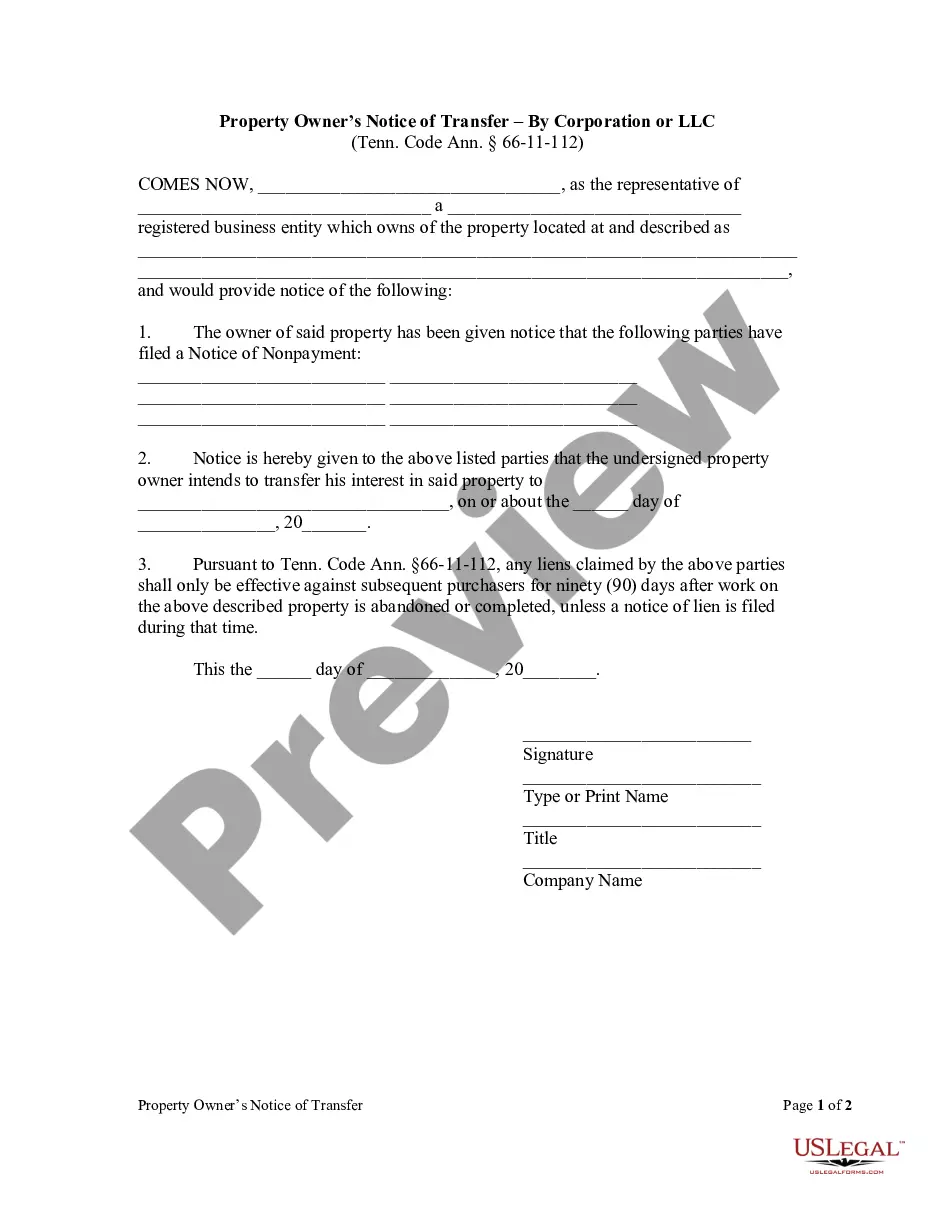

Tennessee Owner's Notice of Transfer by Corporation

Description

How to fill out Tennessee Owner's Notice Of Transfer By Corporation?

Access to top quality Tennessee Owner's Notice of Transfer by Corporation or LLC forms online with US Legal Forms. Steer clear of hours of wasted time looking the internet and lost money on files that aren’t updated. US Legal Forms provides you with a solution to exactly that. Find more than 85,000 state-specific authorized and tax samples you can save and complete in clicks within the Forms library.

To get the example, log in to your account and then click Download. The document is going to be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide below to make getting started easier:

- Find out if the Tennessee Owner's Notice of Transfer by Corporation or LLC you’re looking at is appropriate for your state.

- View the form utilizing the Preview function and read its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay by credit card or PayPal to complete creating an account.

- Pick a preferred format to save the file (.pdf or .docx).

You can now open the Tennessee Owner's Notice of Transfer by Corporation or LLC example and fill it out online or print it and do it by hand. Take into account mailing the file to your legal counsel to make sure everything is filled out properly. If you make a mistake, print out and fill application again (once you’ve registered an account all documents you save is reusable). Make your US Legal Forms account now and get more samples.

Form popularity

FAQ

Probably the most obvious advantage to forming an LLC is protecting your personal assets by limiting the liability to the resources of the business itself. In most cases, the LLC will protect your personal assets from claims against the business, including lawsuits.There is also the tax benefit to an LLC.

LLC ownership can be expressed in two ways: (1) by percentage; and (2) by membership units, which are similar to shares of stock in a corporation. In either case, ownership confers the right to vote and the right to share in profits.

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

An LLC can achieve pass-through taxation status without any of those restrictions. LLCs also offer more income tax choices in how you are taxed. By default, LLCs enjoy pass-through taxation under IRS rules. However, by making an IRS election, you could have your LLC taxed as a C corporation or an S Corporation.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

In an LLC, individuals with an ownership share are called members. In a corporation, they are called shareholders. One of the advantages an LLC has over a corporation is that in many states, a creditor cannot collect a member's dividends, whereas in a corporation dividends can be collected from shareholders.

LLC owners must pay self-employment taxes for all income. S-corp owners may pay less on this tax, provided they pay themselves a "reasonable salary." LLCs can have an unlimited number of members, while S-corps are limited to 100 shareholders.

What is a 'Notice of Determination'? You may have received, from the Office of the Tennessee Secretary of State (TN SOS) a 'Notice of Determination,' if the authorized member(s) of your LLC failed to file an Annual Report on the LLC's behalf (or for some other reason listed in T.C.A. § 48-245-301).

The owners of a limited liability company (LLC) are called members. Each member is an owner of the company; there are no owner shares, as in a corporation. An LLC is formed in a state by filing Articles of Organization or similar document in some states.