Tennessee Warranty Deed from Individual to a Trust

Definition and meaning

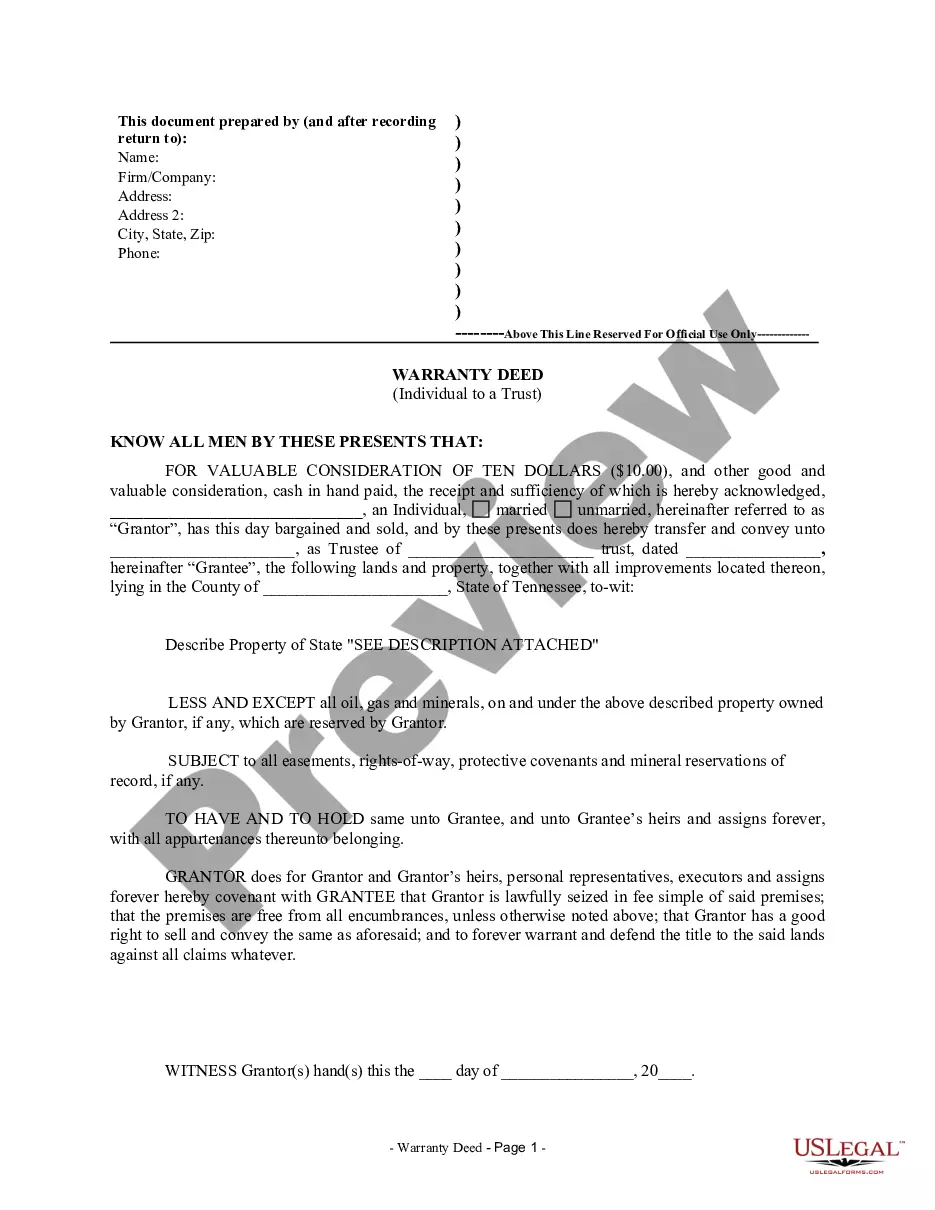

A Tennessee Warranty Deed from Individual to a Trust is a legal document that facilitates the transfer of property ownership from an individual (the Grantor) to a trust (the Grantee). This type of deed ensures that the Grantor holds the legal title to the property and covenants that they have the right to transfer it. The trust then manages the property on behalf of its beneficiaries, making this deed a critical instrument in estate planning.

How to complete a form

To complete a Tennessee Warranty Deed from Individual to a Trust, follow these steps:

- Fill in the name and address of the Grantor.

- Insert the name of the Trustee and the trust they represent.

- Provide a detailed description of the property being transferred.

- Note any reservations or encumbrances related to the property.

- Have the Grantor date and sign the document in the presence of a notary public.

Ensure all information is accurate to avoid complications.

Who should use this form

This form is suitable for individuals in Tennessee who wish to transfer ownership of their property into a trust. It is ideal for those involved in estate planning, especially if they want to manage assets for their beneficiaries' benefit. Users should consider using this form if they are:

- Planning for future ownership of property.

- Looking to avoid probate for their estate.

- Seeking to manage property through a trust structure.

Key components of the form

The Tennessee Warranty Deed from Individual to a Trust contains several essential components:

- Grantor Information: Name and marital status of the individual transferring the property.

- Grantee Information: Name of the Trustee and the trust name.

- Property Description: A detailed account of the property being transferred.

- Covenants: Assurances from the Grantor regarding their ownership and rights to the property.

- Notary Acknowledgment: Verification of the Grantor's identity and signature.

What to expect during notarization or witnessing

When notarizing the Tennessee Warranty Deed, the Grantor will need to present the signed document to a notary public. The notary will:

- Verify the identity of the Grantor.

- Confirm that the Grantor signed the document willingly.

- Affix their seal and signature, solidifying the legal standing of the document.

It's important to ensure that the notary is licensed in Tennessee and that the signing occurs in their presence.

Form popularity

FAQ

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

Take the signed and notarized quitclaim deed to your county recorder's office to complete the transfer of title into your revocable trust. Check in two to four weeks to ensure it has been recorded. Include the address of the property on the asset list addendum attached to your trust.

Obtain a California grant deed from a local office supply store or your county recorder's office. Complete the top line of the deed. Indicate the grantee on the second line. Enter the trustees' names and addresses.

A trustee deed offers no such warranties about the title.

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.

To transfer real estate (also called real property) into your living trust, you must prepare and sign a new deed, transferring ownership. You can usually fill out a new deed yourself.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.