South Dakota Deed and Assignment from individual to A Trust

Description

How to fill out Deed And Assignment From Individual To A Trust?

Are you currently within a place the place you need to have documents for sometimes company or specific purposes nearly every time? There are a lot of authorized record templates available on the Internet, but finding types you can trust is not simple. US Legal Forms offers 1000s of develop templates, like the South Dakota Deed and Assignment from individual to A Trust, that are composed in order to meet federal and state needs.

Should you be previously familiar with US Legal Forms site and possess a merchant account, basically log in. Next, you are able to download the South Dakota Deed and Assignment from individual to A Trust web template.

Unless you offer an account and would like to begin using US Legal Forms, abide by these steps:

- Get the develop you want and ensure it is for your appropriate area/county.

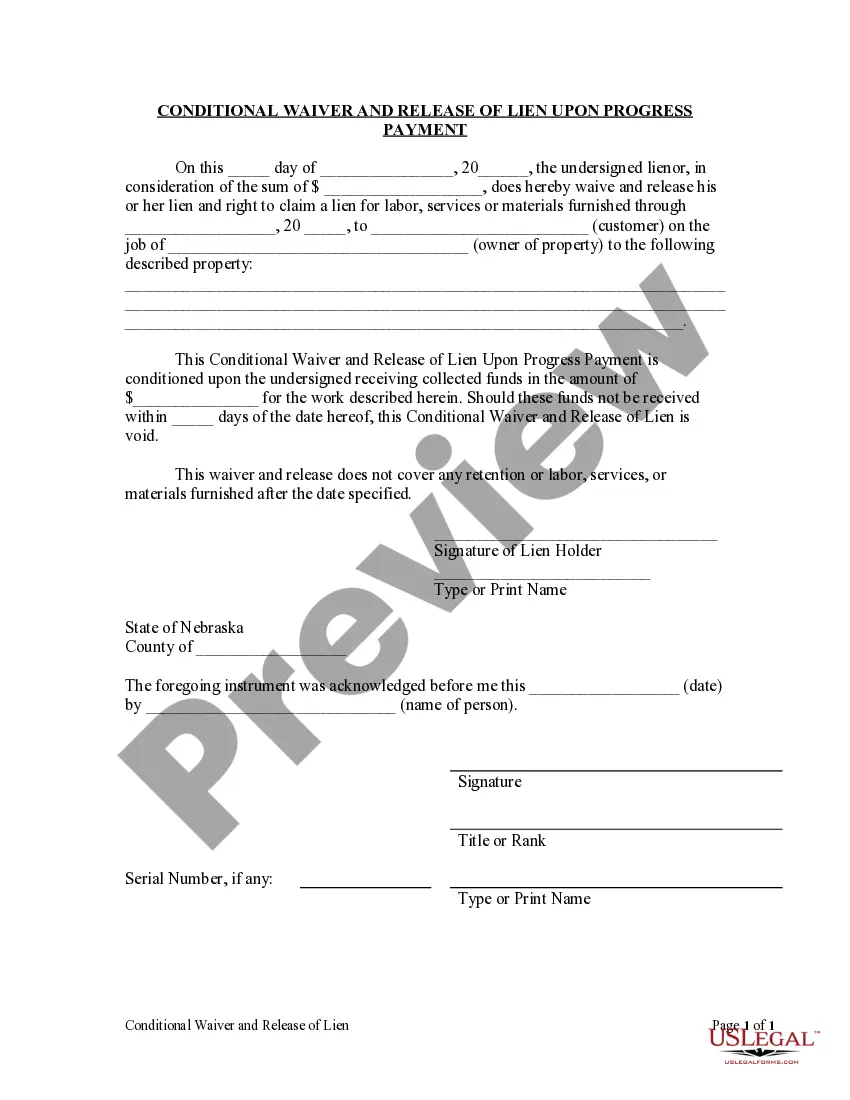

- Take advantage of the Preview option to examine the shape.

- Look at the description to ensure that you have chosen the proper develop.

- When the develop is not what you`re trying to find, take advantage of the Look for field to discover the develop that meets your needs and needs.

- Whenever you discover the appropriate develop, click Get now.

- Choose the costs plan you need, fill out the necessary information and facts to create your money, and pay for the transaction with your PayPal or bank card.

- Choose a handy file format and download your duplicate.

Find all the record templates you might have bought in the My Forms menus. You can aquire a additional duplicate of South Dakota Deed and Assignment from individual to A Trust at any time, if possible. Just click the required develop to download or print out the record web template.

Use US Legal Forms, by far the most comprehensive variety of authorized types, to save lots of time and stay away from blunders. The service offers professionally produced authorized record templates which can be used for a variety of purposes. Make a merchant account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

The Assignment of Property lists every item of trust property that you've indicated doesn't have a title document, plus ones you weren't sure about. It simply says that you're transferring all those items to you as the trustee of your trust. All you need to do is sign it and keep it with your trust document.

The trust will then hold property that will be used to pay the creditor. Thus, the debtor would be the assignor and the person who takes legal title to the property is the assignee. The assignee is also the trustee. The trust document would enumerate the terms of the assignment.

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

An assignment is a gift by the assignor making the assignment to the assignee receiving the assigned interest. Assignments create tax issues for both the assignor and assignee. For example, consider an unmarried father who dies intestate ? without a will or trust ? and is survived by a son and a daughter ? his heirs.

Transferring property out of a trust is the trustee's job. Generally, after the trustor passes away, the trustee notifies the trust's beneficiaries, enacts the trust's conditions and the beneficiaries receive the assets. In addition, the grantor's death makes the trust irrevocable.

A trust is not a legal person, as a corporation is, and therefore it cannot be party to a contract or sign a contract. The trustee is the proper signatory.

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.

A South Dakota deed must include the current owner's original signature. The owner's signature should be dated. A deed transferring real estate owned by two or more owners must include all co-owners' signatures?unless only one owner is transferring an interest.