South Dakota Specialty Services Contact - Self-Employed

Description

How to fill out Specialty Services Contact - Self-Employed?

Are you presently in a condition where you require documents for either business or personal reasons almost all the time.

There are numerous legal document templates accessible online, but finding ones you can rely on isn't simple.

US Legal Forms offers thousands of form templates, including the South Dakota Specialty Services Contact - Self-Employed, which are designed to comply with state and federal regulations.

You can find all the document templates you have purchased in the My documents menu.

You can download an additional copy of South Dakota Specialty Services Contact - Self-Employed at any time, if needed. Just click the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the South Dakota Specialty Services Contact - Self-Employed template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/county.

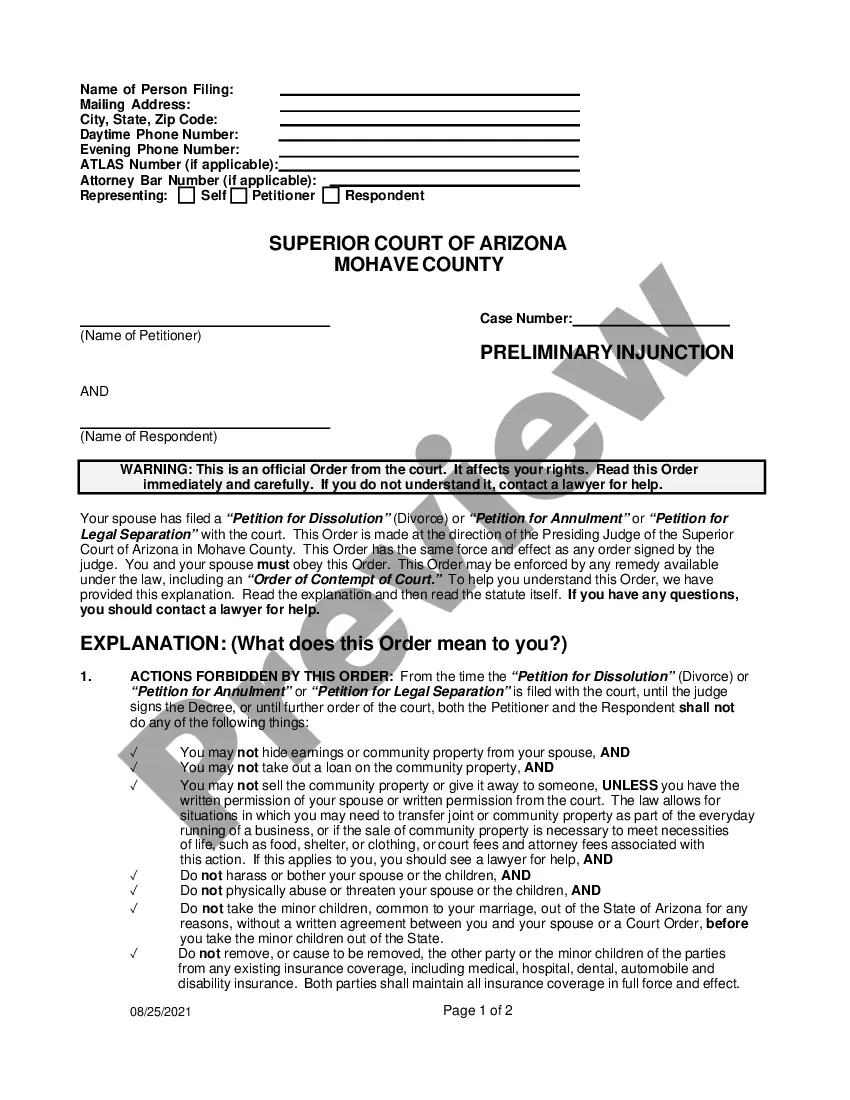

- Use the Review button to evaluate the form.

- Read the description to confirm you have selected the right form.

- If the form isn’t what you are looking for, use the Lookup field to find the document that meets your needs and specifications.

- Once you obtain the correct form, click Get now.

- Choose the pricing plan you prefer, complete the required details to create your account, and pay for your order with your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

Yes, South Dakota offers a favorable environment for starting a business, including a low tax burden and supportive regulations for entrepreneurs. The state has a strong infrastructure and access to various resources for self-employed individuals. By linking with South Dakota Specialty Services Contact - Self-Employed, you can tap into valuable local resources that can help your business flourish.

The number one most profitable business can vary, but many successful self-employed individuals in South Dakota find success in technology services, healthcare consulting, and agricultural services. These sectors often require less overhead and can yield high returns. For a thorough approach to starting your own venture, consider exploring options with South Dakota Specialty Services Contact - Self-Employed.

To contact Medicaid in South Dakota, you can visit the state’s Department of Social Services website. They provide detailed contact information including phone numbers and chat options for immediate assistance. For individuals seeking South Dakota Specialty Services Contact - Self-Employed, knowing how to reach Medicaid can be crucial for accessing healthcare benefits and support.

Agriculture remains the number one industry in South Dakota, significantly influencing the state’s economy. This sector includes farming, ranching, and agribusiness services. If you are considering entering the market as a self-employed individual, understanding this industry can offer great opportunities and insights into the South Dakota Specialty Services Contact - Self-Employed landscape.

You can contact the South Dakota Department of Education (SD DOE) by visiting their official website or calling their main office. They have a dedicated contact page that provides phone numbers and email addresses for specific inquiries. For your South Dakota Specialty Services Contact - Self-Employed needs, ensure you reach out to the appropriate department to get accurate information.

In South Dakota, most services are not subject to sales tax, which makes it appealing for self-employed individuals. However, specific services, such as certain personal services and construction work, may have tax implications. It is crucial to familiarize yourself with the tax laws to ensure compliance. If you need clarification, reaching out to South Dakota Specialty Services Contact - Self-Employed will help you navigate these regulations smoothly.

The most profitable business in South Dakota often varies, but service-oriented businesses tend to thrive due to lower overhead costs. Industries such as agriculture, healthcare, and tourism also show significant potential. Understanding local market demands will help you identify lucrative opportunities. For tailored advice, connecting with South Dakota Specialty Services Contact - Self-Employed can provide you with insights to maximize your business's success.

To start a sole proprietorship in South Dakota, you should choose a business name and ensure it complies with state naming rules. After that, file any necessary licenses or permits based on your business activities. It's also wise to check if your name is available and register it with the state if necessary. For additional guidance on your journey, consider reaching out to South Dakota Specialty Services Contact - Self-Employed for expert assistance.

In South Dakota, the self-employment tax is comprised of both Social Security and Medicare taxes, typically totaling around 15.3%. This tax applies to your net earnings from self-employment, and understanding it is crucial for effective financial planning. For more insights and personalized assistance, reach out to South Dakota Specialty Services Contact - Self-Employed.

Self-employment taxes apply when your net earnings from self-employment exceed a certain threshold, typically $400 per year. This includes income from various sources, including freelance work and small businesses. To ensure compliance and avoid unexpected fees, consider connecting with South Dakota Specialty Services Contact - Self-Employed for a clearer understanding.