South Dakota Disability Services Contract - Self-Employed

Description

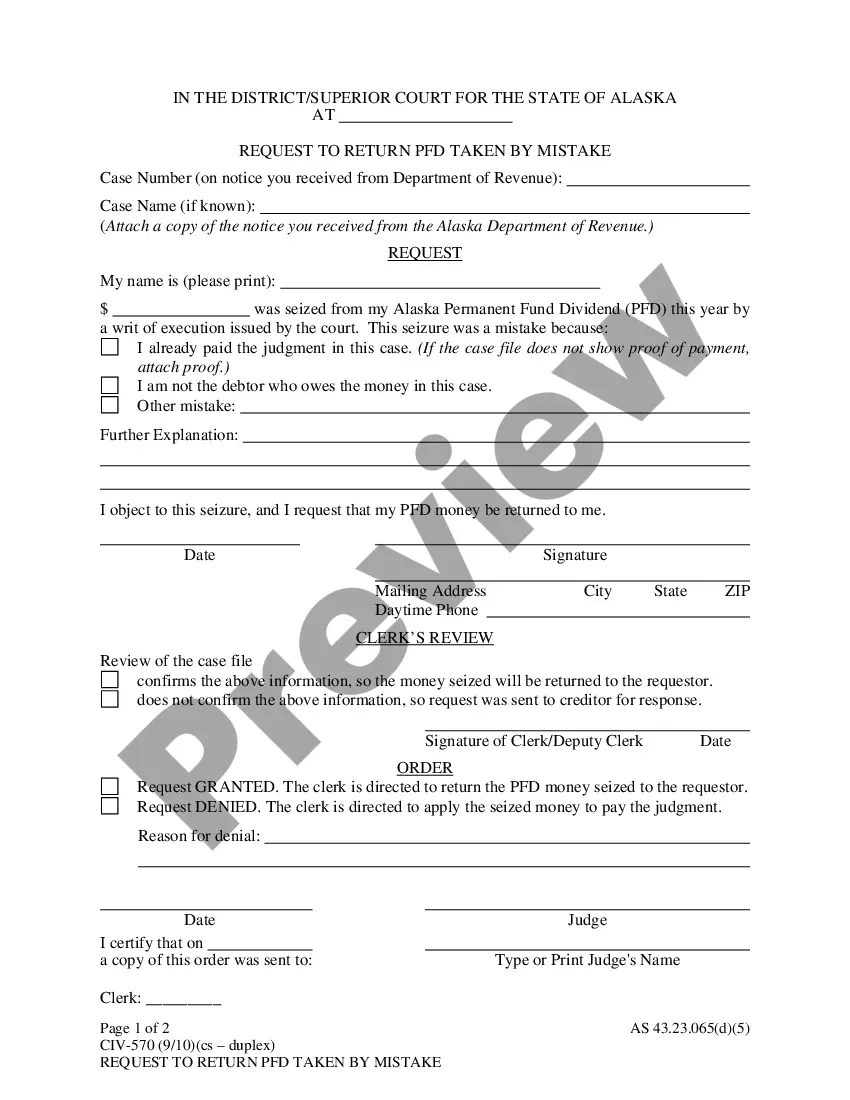

How to fill out Disability Services Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a variety of legal document formats that you can download or print. By utilizing the site, you can discover thousands of templates for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of documents such as the South Dakota Disability Services Contract - Self-Employed in just seconds. If you have a subscription, Log In and download the South Dakota Disability Services Contract - Self-Employed from the US Legal Forms library. The Download button will appear on each document you view. You can access all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are some simple steps to get started: Ensure you have selected the correct document for your locality/region. Click the Preview button to review the content of the form. Check the form description to confirm that you have chosen the right document. If the form does not meet your needs, use the Search bar at the top of the page to find one that does. When you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the payment option you prefer and provide your details to create an account.

- Process the transaction. Use a credit card or PayPal account to complete the payment.

- Choose the format and download the document to your device.

- Make edits. Fill out, modify, print, and sign the downloaded South Dakota Disability Services Contract - Self-Employed.

- Every template you added to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply navigate to the My documents section and click on the document you need.

- Access the South Dakota Disability Services Contract - Self-Employed with US Legal Forms, one of the most extensive libraries of legal document formats.

- Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

Yes, the Americans with Disabilities Act (ADA) does apply to independent contractors, ensuring they are protected against discrimination. This law mandates reasonable accommodations in certain situations. Understanding your rights under the ADA and the South Dakota Disability Services Contract - Self-Employed can empower you to advocate for yourself and secure a fair working environment.

Self-employed individuals can indeed qualify for disability benefits if they have contributed to Social Security. To access these benefits, you must provide sufficient documentation of your work history and income. The South Dakota Disability Services Contract - Self-Employed offers resources to assist you in preparing your application and increasing your chances of approval.

Yes, independent contractors can collect disability benefits, provided they meet specific eligibility criteria. It is essential to contribute to Social Security through self-employment taxes to qualify for these benefits. By obtaining a South Dakota Disability Services Contract - Self-Employed, you can navigate the complexities of the application process and secure the support you need.

Yes, you can claim a disability allowance if you are self-employed. The South Dakota Disability Services Contract - Self-Employed allows for this, provided you meet the necessary criteria. It’s important to gather all relevant financial documents and medical records to support your claim. Using platforms like uslegalforms can help simplify the application process and ensure your claim is filed correctly.

Disability benefits for self-employed individuals operate under specific guidelines. When you apply, the South Dakota Disability Services Contract - Self-Employed evaluates your income and work history. You’ll need to demonstrate how your disability impacts your ability to work. This process ensures that you receive the most accurate assessment and appropriate support.

Yes, self-employed individuals can qualify for disability benefits. The South Dakota Disability Services Contract - Self-Employed includes provisions for those who work for themselves. You need to provide adequate documentation of your income and the nature of your disability. This ensures that your application is processed fairly and efficiently.

Short-term disability insurance in South Dakota provides income replacement for a limited time if you become unable to work due to a medical condition. Typically, this coverage begins after a waiting period of a few weeks and lasts for a few months. If you are self-employed, you may want to explore options that align with your South Dakota Disability Services Contract - Self-Employed to secure adequate coverage. Utilizing platforms like uslegalforms can help you find the right policy and navigate the application process smoothly.

Disability insurance can be a valuable investment for self-employed individuals, offering financial protection in case of illness or injury. It helps ensure that you can continue to meet your financial obligations during challenging times. Exploring options through the South Dakota Disability Services Contract - Self-Employed can help you determine the right coverage for your needs.

Yes, independent contractors can collect disability benefits, provided they meet the necessary requirements. It's essential to understand how your work status influences your eligibility for SSDI. The South Dakota Disability Services Contract - Self-Employed can assist you in navigating the complexities of your application process.

The easiest disabilities to get approved for typically include conditions that are well-documented and medically recognized. Examples may include certain mental health disorders or specific physical disabilities. To enhance your chances of approval, consider using the South Dakota Disability Services Contract - Self-Employed for expert guidance on preparing your application.