This License applies to any original work of authorship whose owner has placed the

following notice immediately following the copyright notice for the Original Work:

Licensed under the Open Software License version 2.0.

South Dakota Open Software License

Description

How to fill out Open Software License?

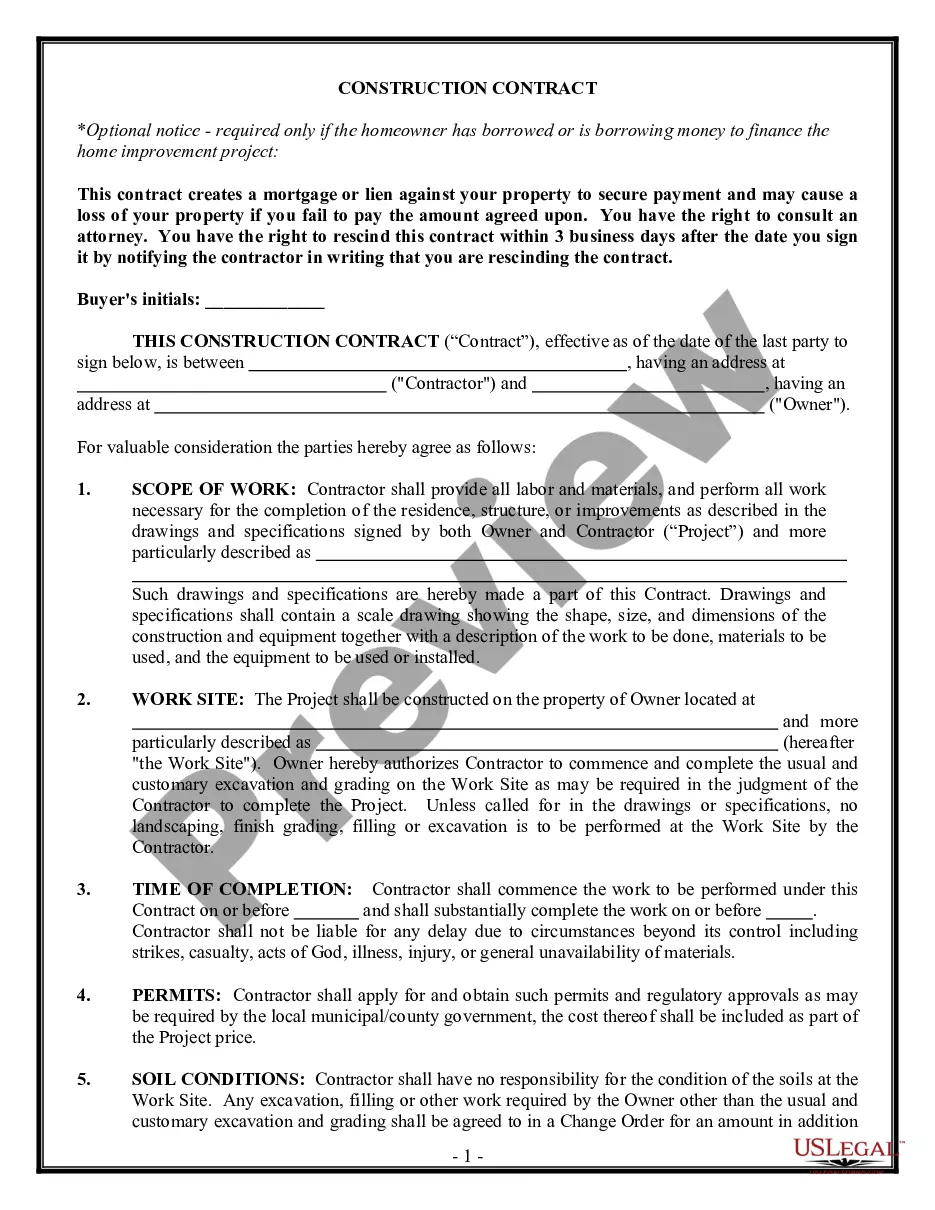

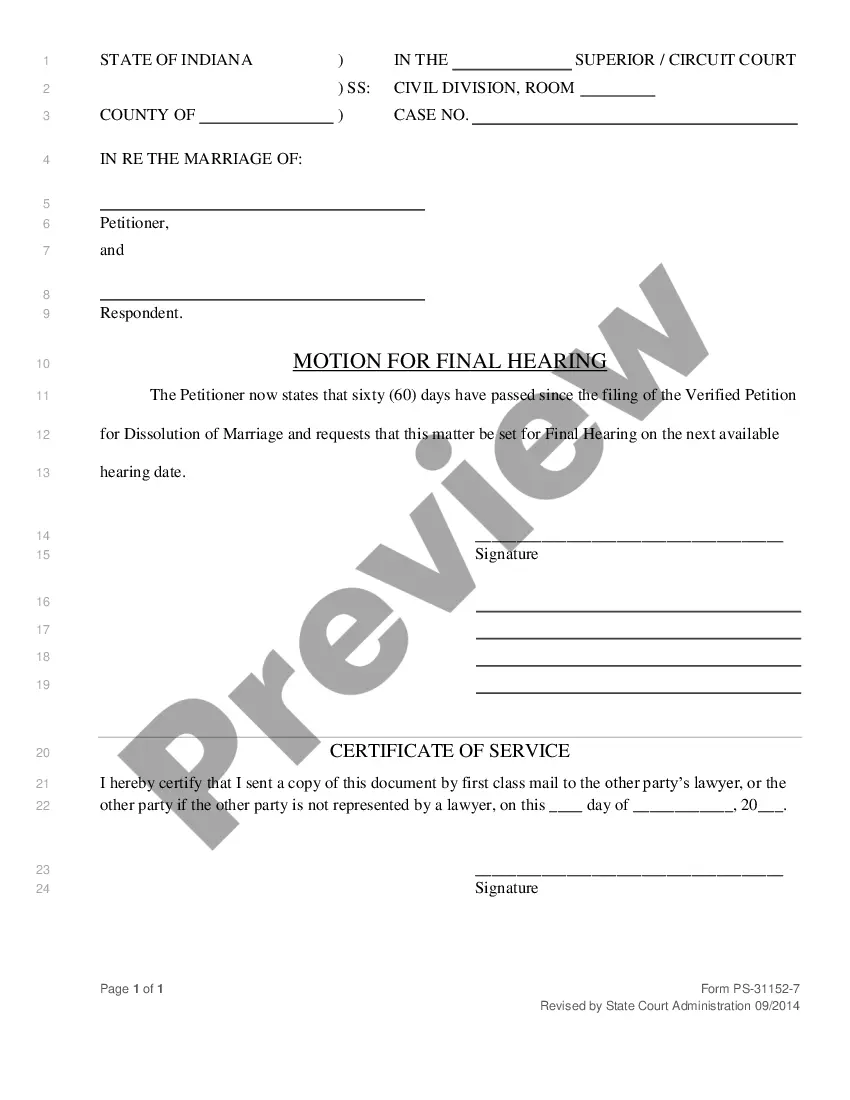

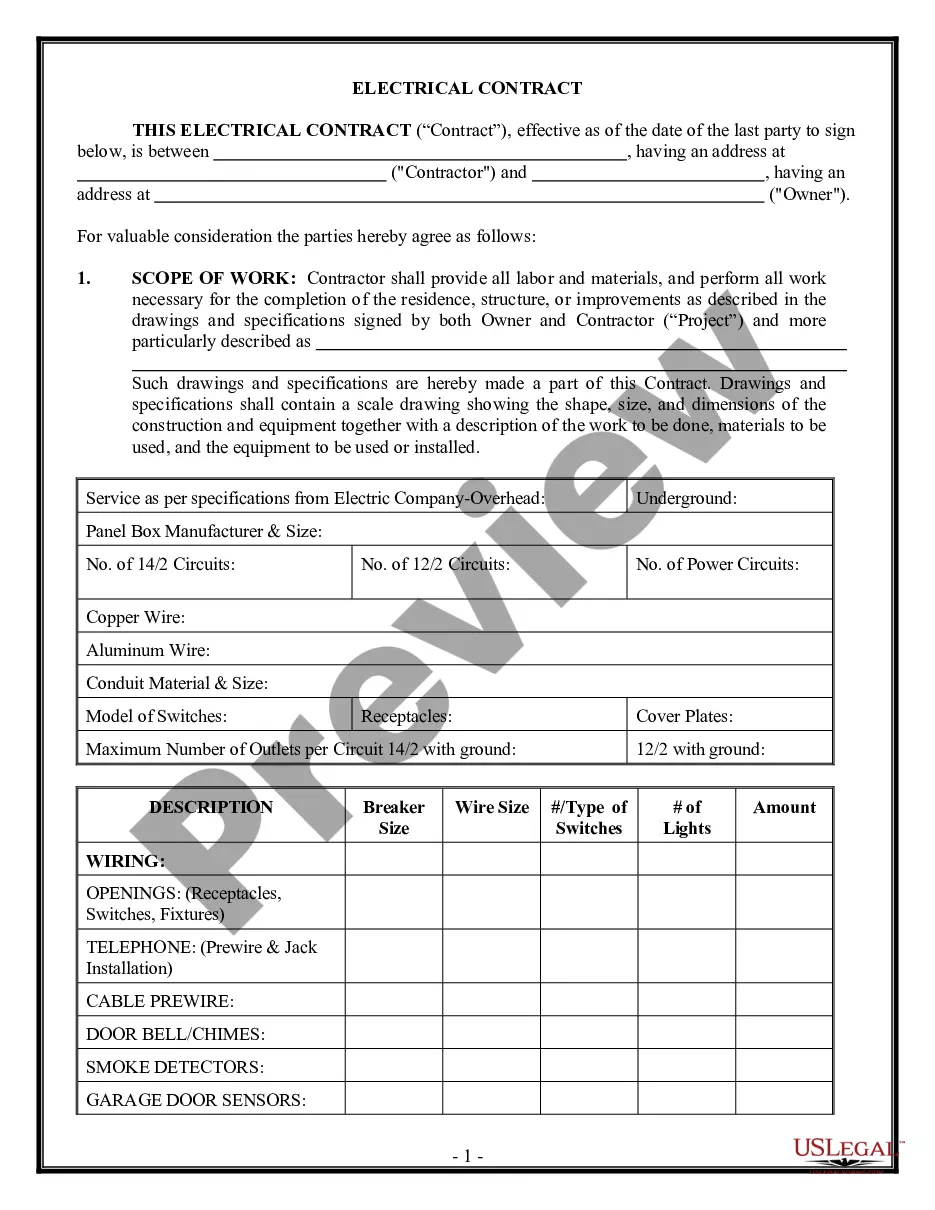

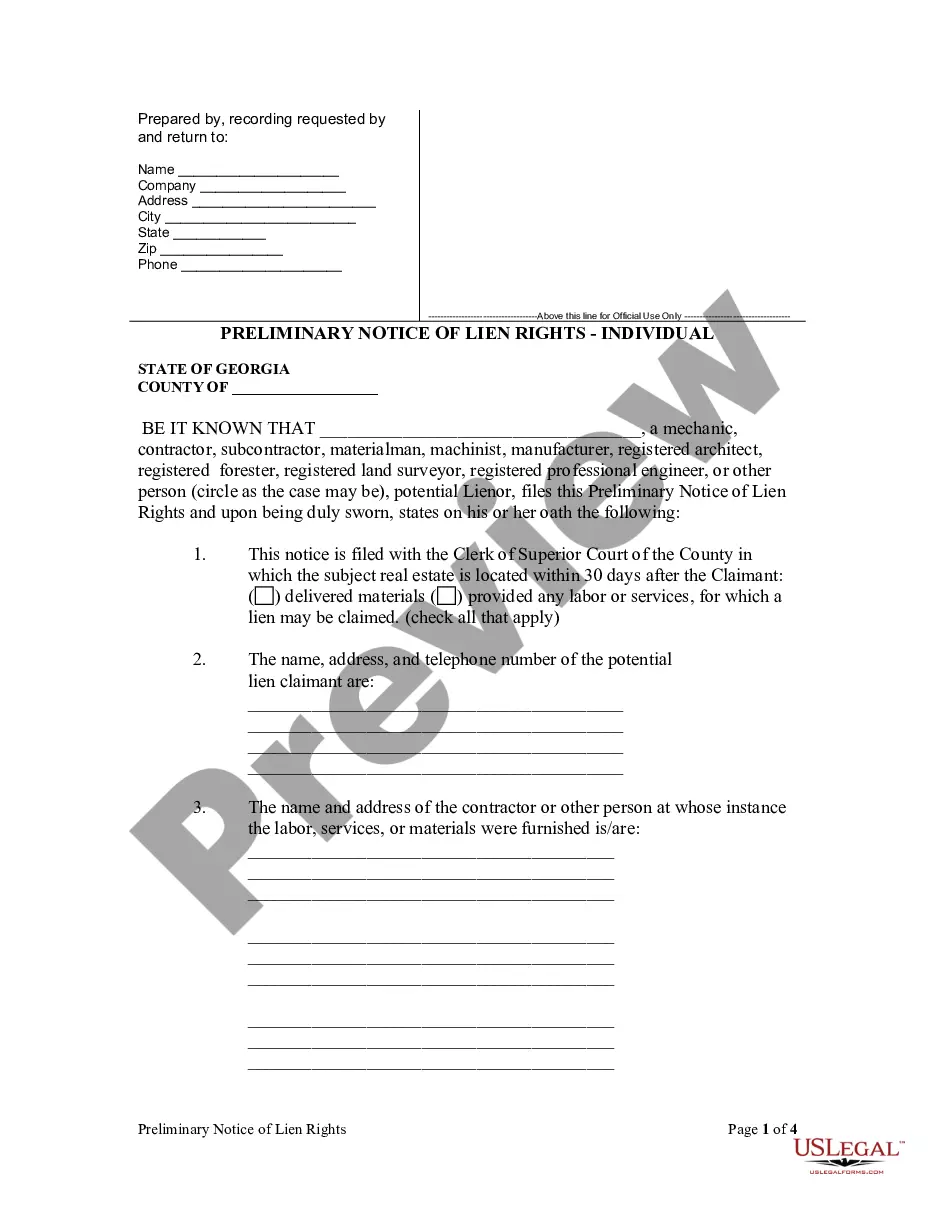

You can spend numerous hours online seeking the legal document template that meets the state and federal requirements you desire.

US Legal Forms offers a vast collection of legal forms that can be assessed by professionals.

You can actually download or print the South Dakota Open Software License from the platform.

Review the form description to confirm that you have picked the right form. If available, utilize the Preview option to review the document template as well.

- If you possess a US Legal Forms account, you may Log In and click on the Download option.

- Subsequently, you may complete, modify, print, or sign the South Dakota Open Software License.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of the purchased form, head to the My documents tab and select the appropriate option.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your desired region/city.

Form popularity

FAQ

Information Needed to Complete ApplicationFull Legal Name as is or will be registered in South Dakota.The Responsible Party's legal name (an individual who will be responsible for communication regarding tax matters) and their Social Security Number.Contact Email and Phone Number of the Responsible Party.More items...

All applicants must submit completed fingerprint cards with their application to the South Dakota Commission on Gaming. The cards must be obtained from the South Dakota Commission on Gaming, Deadwood office at (605) 578-3074.

North Dakota SaaS is non-taxable in North Dakota.

Certificate of Good Standing: You can obtain a South Dakota certificate of good standing by ordering through the Secretary of State and paying the $20 fee.

Traditional Goods or Services South Dakota is unique in the fact that almost all services are taxable. The only major service that is exempt from being taxed is construction.

In other words, Software-as-a-Service as a cloud-computing program that is only accessed remotely without delivery of a tangible media and does not include the user taking possession of the program is not subject to sales or use tax.

South Dakota also imposes sales taxes on fees paid to access a database or network as well as software, programs or computer systems in the cloud. Much like the cloud computing and SaaS tax ramifications, prewritten software that's electronically delivered is taxable in South Dakota.

Local business licenses: In addition to state or federal licenses where applicable, almost all businesses will need a license from the local government (city or county) to lawfully operate within their jurisdictions. These local licenses are typically very easy to obtain and require paying a fee.

Better known as SaaS, these products are cloud-based software products, accessed online by customers. The definition of SaaS sometimes falls in the gray area of digital service. South Dakota does tax SaaS products, but check the website to confirm that the definition firmly applies to your service.

There is no general business license in South Dakota. However, before you begin to operate your business, you will need to obtain a State of South Dakota Tax License issued by the Department of Revenue and Regulations. There are also other specialty licensing, tax and permit requirements that may also be needed.