South Dakota Key Employee Agreement

Description

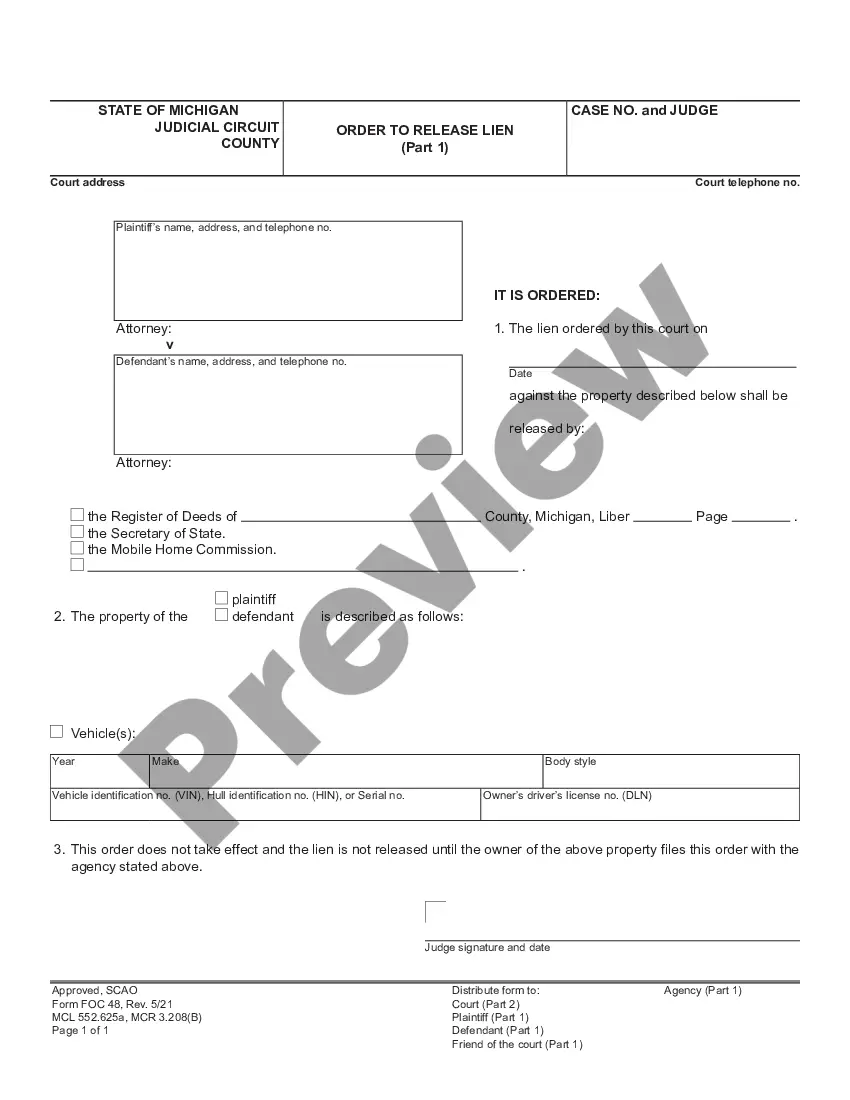

How to fill out Key Employee Agreement?

If you need to full, acquire, or produce authorized file web templates, use US Legal Forms, the largest selection of authorized kinds, which can be found online. Use the site`s simple and easy practical lookup to get the paperwork you need. Various web templates for enterprise and person uses are categorized by categories and states, or search phrases. Use US Legal Forms to get the South Dakota Key Employee Agreement in a handful of mouse clicks.

Should you be presently a US Legal Forms client, log in to your bank account and click the Obtain switch to obtain the South Dakota Key Employee Agreement. You can also accessibility kinds you in the past saved inside the My Forms tab of the bank account.

If you are using US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for that right area/region.

- Step 2. Make use of the Preview solution to look over the form`s content. Never neglect to learn the outline.

- Step 3. Should you be unhappy with the type, take advantage of the Look for industry near the top of the display screen to discover other versions in the authorized type web template.

- Step 4. Once you have located the form you need, go through the Purchase now switch. Choose the costs program you prefer and add your accreditations to register for the bank account.

- Step 5. Process the financial transaction. You can use your charge card or PayPal bank account to complete the financial transaction.

- Step 6. Choose the formatting in the authorized type and acquire it on your system.

- Step 7. Complete, modify and produce or indicator the South Dakota Key Employee Agreement.

Every authorized file web template you get is the one you have for a long time. You may have acces to each type you saved with your acccount. Select the My Forms section and decide on a type to produce or acquire once more.

Contend and acquire, and produce the South Dakota Key Employee Agreement with US Legal Forms. There are thousands of professional and express-certain kinds you may use for the enterprise or person demands.

Form popularity

FAQ

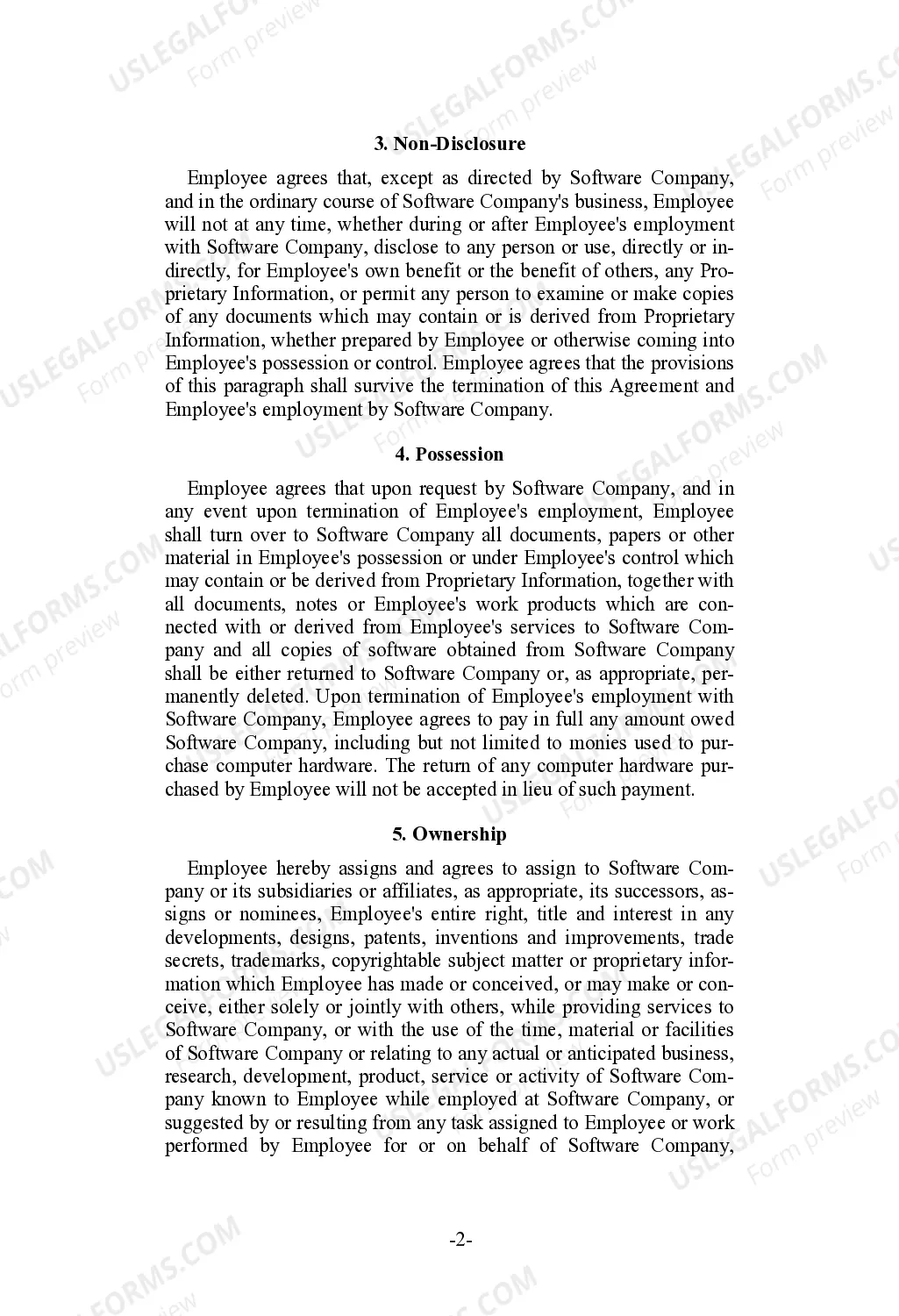

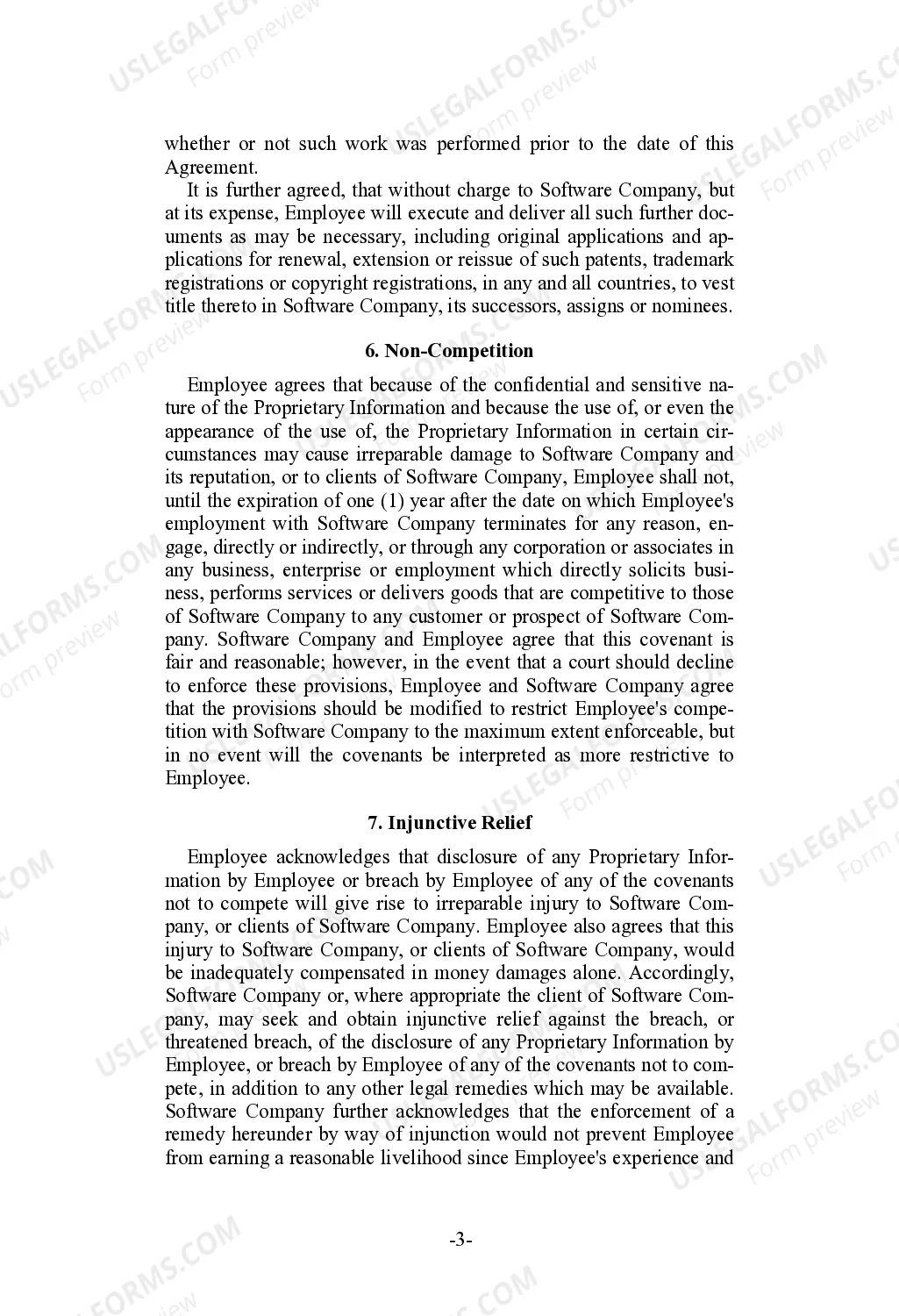

Key Employee Agreement means an agreement entered into between the Company (or an Affiliate) and a Participant that protects confidential information and sets forth other terms and conditions of employment with the Company (or an Affiliate).

A written waiver with employees so employees can skip a meal break if the work shift is six hours or less. Time for meal breaks, but employers are not required to ensure that no work is performed during meal breaks.

Differing from federal law, Minnesota law does require that employees are given breaks. For every four consecutive hours of work performed, employees must be given a break and permitted to use the nearest restroom. Once again, shorter breaks of up to twenty minutes must be paid time for the employee.

Employees may waive their right to a meal period upon agreement with the employer. Employees do not have to be paid for meal periods if they are completely relieved of their duties and the meal period is at least thirty minutes in length.

Payment of accrued, unused vacation on termination is also not addressed by state statutes. Because South Dakota's Legislature and its courts have not provided any information about vacation leave, employers are free to create their own policies regarding vacation leave and PTO payout at termination.

Nonexempt Status - The Fair Labor Standards Act requires that all employees that are not exempt be entitled to overtime pay (compensatory time off - public employers) of at least one-and-one-half times (1 ½) his/her regular rate for hours worked in excess of 40 in any workweek.

Types of Taxes Paid in South Dakota There are no local taxes or state income taxes in South Dakota. In South Dakota, all companies are required to pay State Unemployment Tax Act (SUTA) taxes. The current pay base is $15,000, with rates ranging between 1.2 and 6.0%.

Q: What does the state law require for rest/meal periods? A: South Dakota does not have a law that requires an employer to provide rest breaks or meal periods. This is a matter of employer policy. The Fair Labor Standards Act (federal) also does not require breaks.