South Dakota Stock Option and Award Plan

Description

How to fill out Stock Option And Award Plan?

It is feasible to invest hours online trying to locate the official document template that aligns with the federal and state requirements you need.

US Legal Forms offers a multitude of official templates that are reviewed by specialists.

You can easily download or print the South Dakota Stock Option and Award Plan from the service.

If available, utilize the Review button to browse through the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Obtain button.

- Following that, you can complete, edit, print, or sign the South Dakota Stock Option and Award Plan.

- Every official document template you purchase becomes your property for an indefinite period.

- To obtain another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the county/city of your choice.

- Read the form details to confirm that you have selected the right one.

Form popularity

FAQ

From the employee's standpoint, a stock option grant is an opportunity to purchase stock in the company for which they work. Typically, the grant price is set as the market price at the time the grant is offered.

With a stock award, you receive the company's stocks as compensation. Depending on the type of stock, you may have to wait for a certain period before you can fully own it. A stock option, on the other hand, only gives you the right to buy the company's stocks in the future at a certain price.

Stock options are an employee benefit that grants employees the right to buy shares of the company at a set price after a certain period of time. Employees and employers agree ahead of time on how many shares they can purchase and how long the vesting period will be before they can buy the stock.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

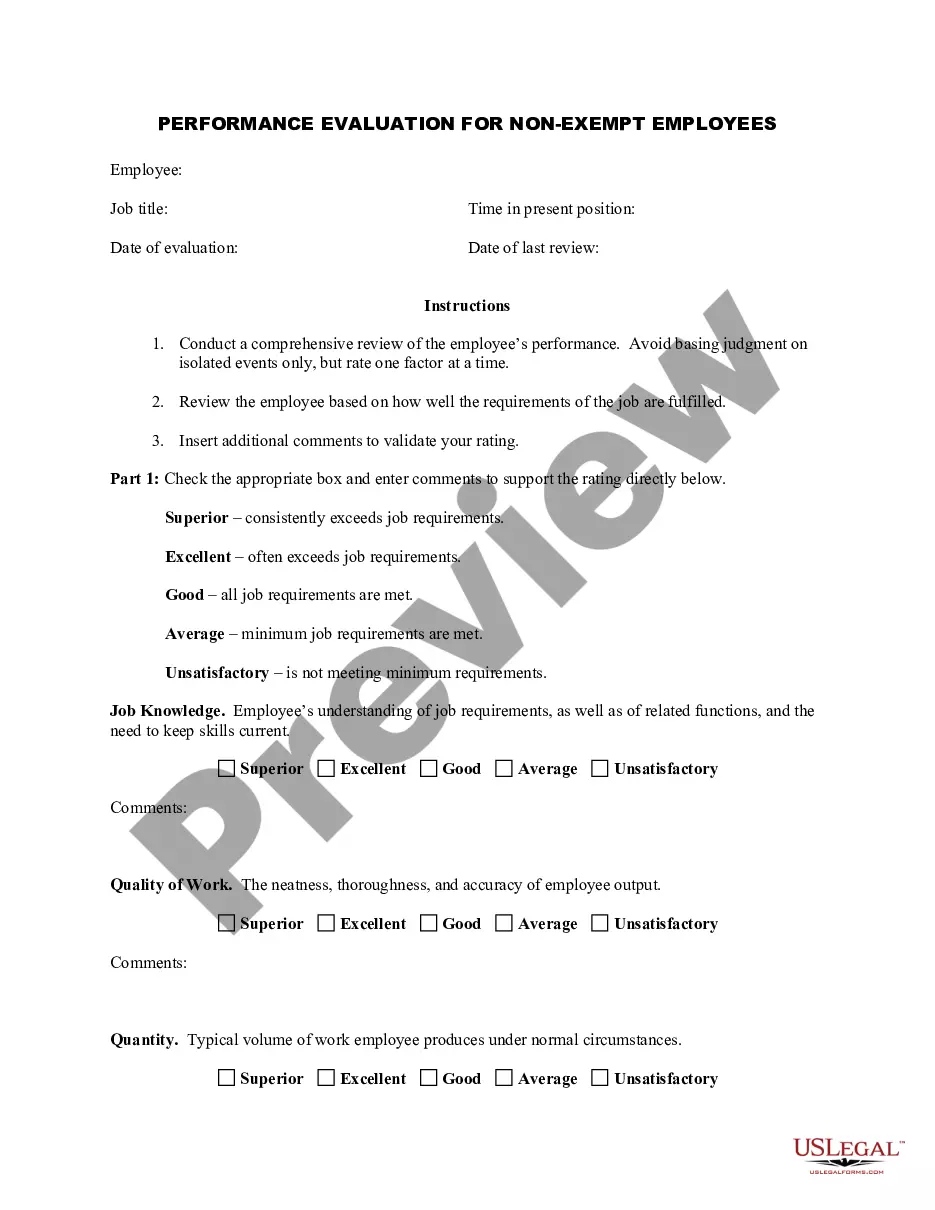

Compensation may also be used as a reward for exceptional job performance. Examples of such plans include: bonuses, commissions, stock, profit sharing, gain sharing.

Stock options are usually granted for a specific period (option term) and must be exercised within that period. A common option term is 10 years, after which, the option expires. While time-based vesting remains popular, companies are increasingly granting equity that vests upon meeting certain performance criteria.

Accordingly, stock option plans and stock purchase plans are not covered by ERISA .

Exercising a stock option means purchasing the issuer's common stock at the price set by the option (grant price), regardless of the stock's price at the time you exercise the option.

An employee stock option is the right given to you by your employer to buy ("exercise") a certain number of shares of company stock at a pre-set price (the "grant," "strike" or "exercise" price) over a certain period of time (the "exercise period").

For example, a stock option is for 100 shares of the underlying stock. Assume a trader buys one call option contract on ABC stock with a strike price of $25. He pays $150 for the option. On the option's expiration date, ABC stock shares are selling for $35.