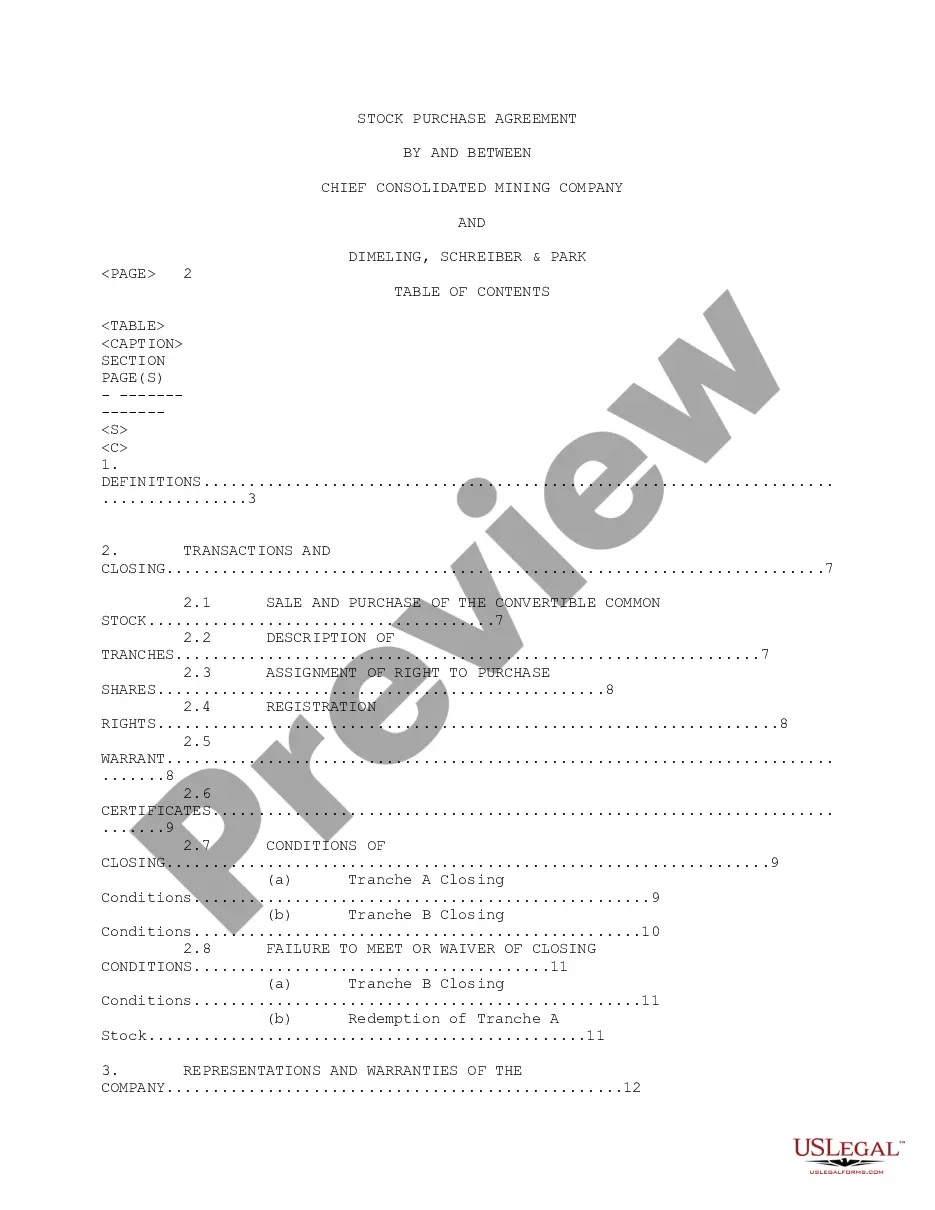

South Dakota Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers

Description

How to fill out Stock Option Plan Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options To Executive Officers?

You can devote time on the Internet looking for the legal file design that fits the state and federal requirements you will need. US Legal Forms gives 1000s of legal forms which are analyzed by specialists. It is possible to obtain or print out the South Dakota Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers from our assistance.

If you already possess a US Legal Forms account, you can log in and click the Obtain switch. After that, you can total, modify, print out, or sign the South Dakota Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers. Every single legal file design you buy is yours eternally. To acquire yet another duplicate of any bought form, visit the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms internet site initially, keep to the simple recommendations listed below:

- First, make certain you have chosen the correct file design for the region/metropolis of your liking. Read the form outline to make sure you have picked the correct form. If available, use the Preview switch to search with the file design at the same time.

- If you want to find yet another edition of your form, use the Look for area to obtain the design that fits your needs and requirements.

- Once you have discovered the design you desire, click Get now to proceed.

- Find the prices strategy you desire, type in your references, and register for a free account on US Legal Forms.

- Full the financial transaction. You should use your bank card or PayPal account to cover the legal form.

- Find the file format of your file and obtain it to your gadget.

- Make changes to your file if needed. You can total, modify and sign and print out South Dakota Stock Option Plan which provides for grant of Incentive Stock Options and Nonqualified Stock Options to executive officers.

Obtain and print out 1000s of file themes while using US Legal Forms Internet site, which offers the most important collection of legal forms. Use skilled and state-distinct themes to tackle your business or specific needs.

Form popularity

FAQ

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.

Summary of ISO vs. NSO Differences Incentive Stock Options (ISOs)Non-Qualified Stock Options (NSOs)Eligible RecipientsEmployees onlyAny service provider (e.g. employees, advisors, consultants, directors)Tax at GrantNo tax eventNo tax event10 more rows

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

Incentive stock options (ISOs) are a form of equity compensation that allows you to buy company shares for a specific exercise price. ISOs are a type of stock option?they are not actual shares of stock; you must exercise (buy) your options to become a shareholder.

Non-qualified Stock Options (NSOs) are stock options that, when exercised, result in ordinary income under US tax laws on the difference, calculated on the exercise date, between the exercise price and the fair market value of the underlying shares.

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.