South Dakota General Partnership for Business

Description

How to fill out General Partnership For Business?

Have you experienced a circumstance where you require documents for both business or personal reasons nearly every day.

There are numerous legal document templates available online, but locating ones you can rely on is challenging.

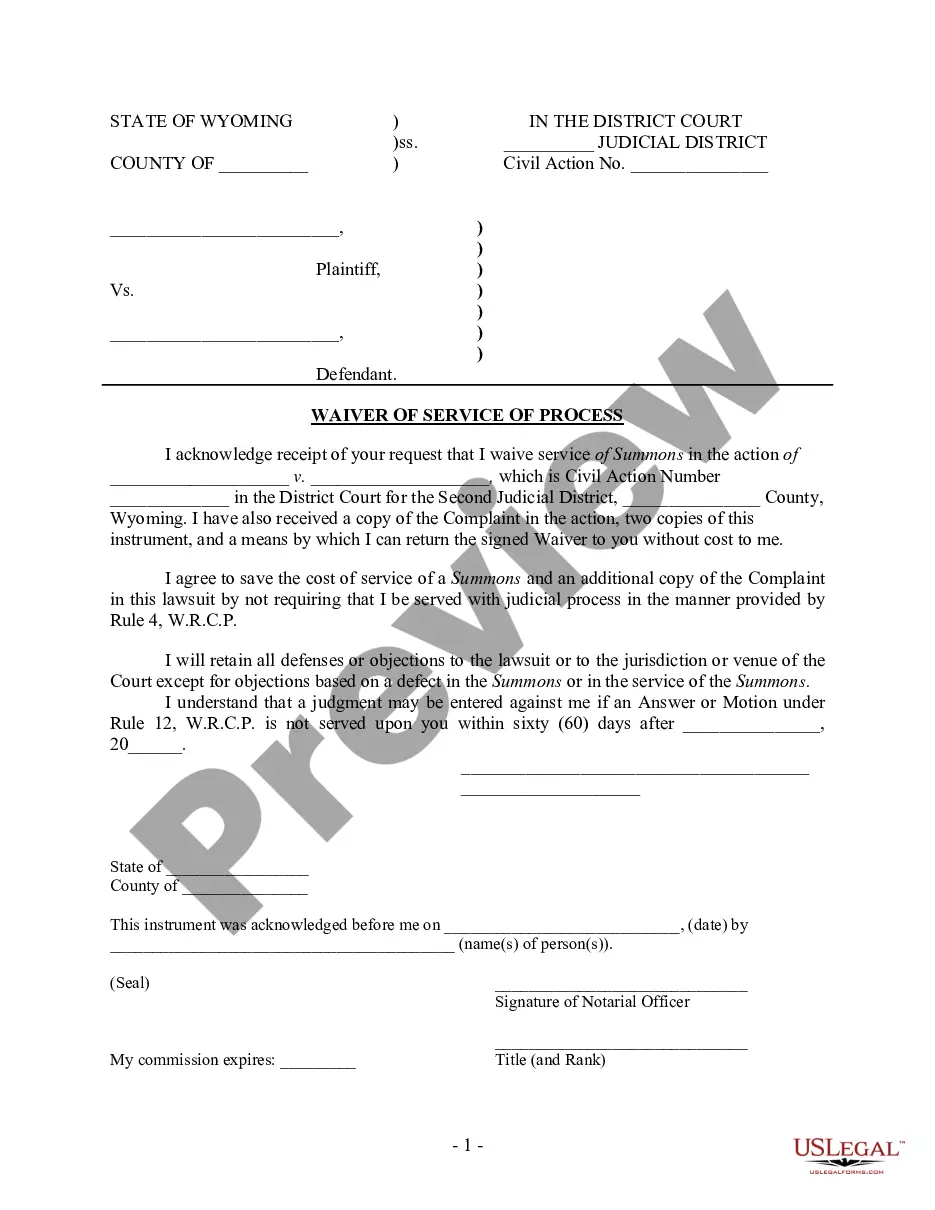

US Legal Forms offers thousands of form templates, such as the South Dakota General Partnership for Business, which are designed to meet state and federal requirements.

If you find the correct form, click on Purchase now.

Select a pricing plan you prefer, fill in the required information to create your account, and pay for the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- Afterward, you can download the South Dakota General Partnership for Business template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/county.

- Use the Review button to scrutinize the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to find the template that meets your needs and requirements.

Form popularity

FAQ

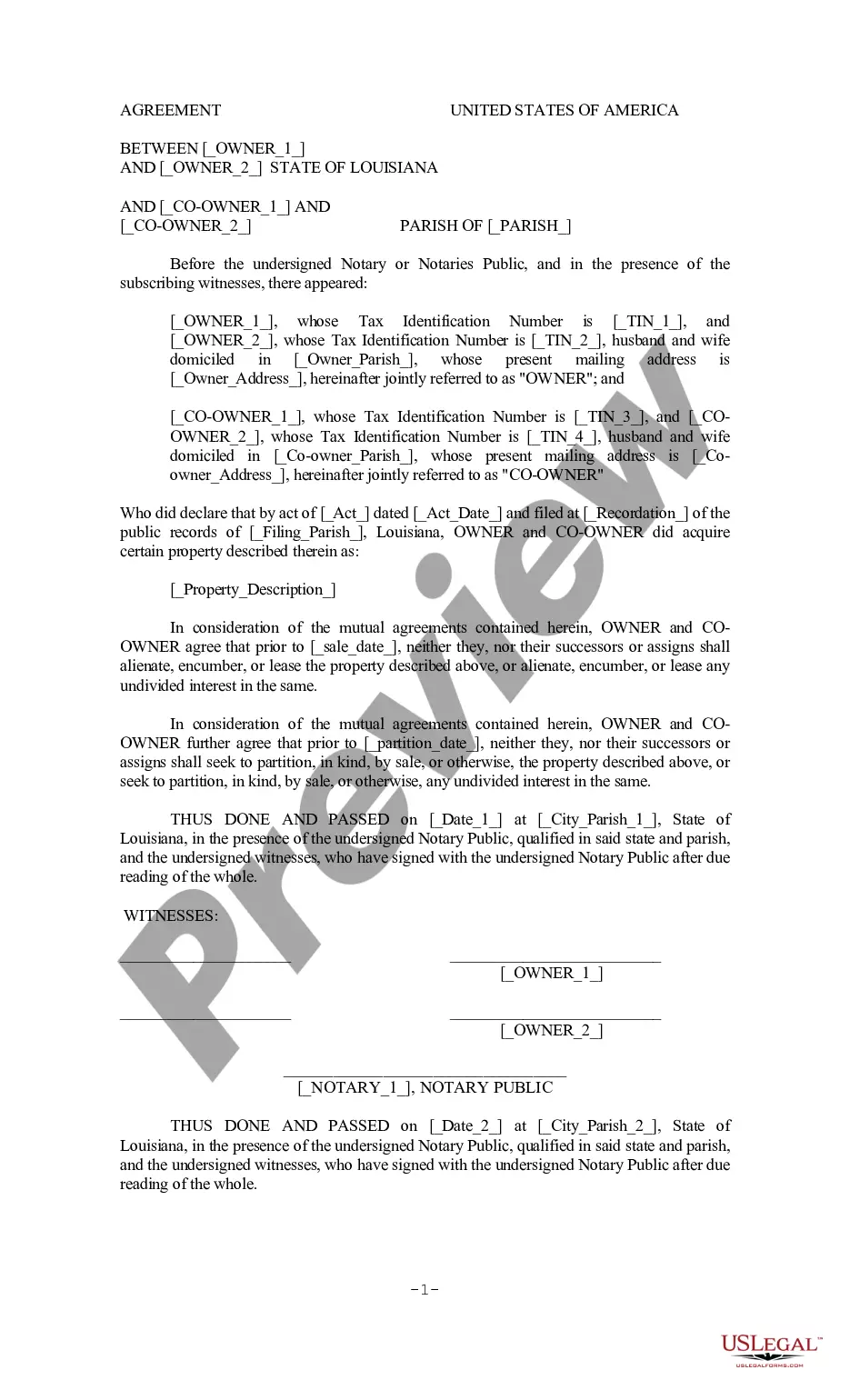

To have a general partnership, two conditions must be true: The company must have two or more owners. All partners must agree to have unlimited personal responsibility for any debts or legal liabilities the partnership might incur.

It's a partnership where all partners have responsibility for the business and unlimited liability for business debts. This means that each general partner shares both the benefits and the obligations of the business.

In general, an LLC offers better liability protection and more tax flexibility than a partnership. But the type of business you're in, the management structure, and your state's laws may tip the scales toward partnership.

Not only did Ben and Jerry decide to switch from a partnership to a corporation, but they also decided to sell shares of stock to the public (and thus become a public corporation).

Generally, any business arrangement in which two or more parties are jointly liable for the assets, profits, and financial obligations of a firm is referred to as a general partnership.

What Is The Major Characteristic Of Partnership? As stated in the partnership agreement between the partners, a partnership has four key features: a shared risk and reward; two of which may differ; sharing the growth, expansion, and profit risks with each other.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.

For example, let's say that Dottie and Dave decide to open a clothing store. They decide to name the store D.D.'s Duds. Dottie and Dave don't need to do anything special in order to form a general partnership. Once Dottie and Dave agree to form the business, it's automatically considered to be a general partnership.

A general partnership must satisfy the following conditions: The partnership must minimally include two people. All partners must agree to any liability that their partnership may incur. The partnership should ideally be memorialized in a formal written partnership agreement, though oral agreements are valid.

As per definition, a partnership business consists of at least two people that combine resources, and they agree to share losses and profits. Law firms, physician groups, real estate investment firms, and accounting companies are examples of partnership businesses.