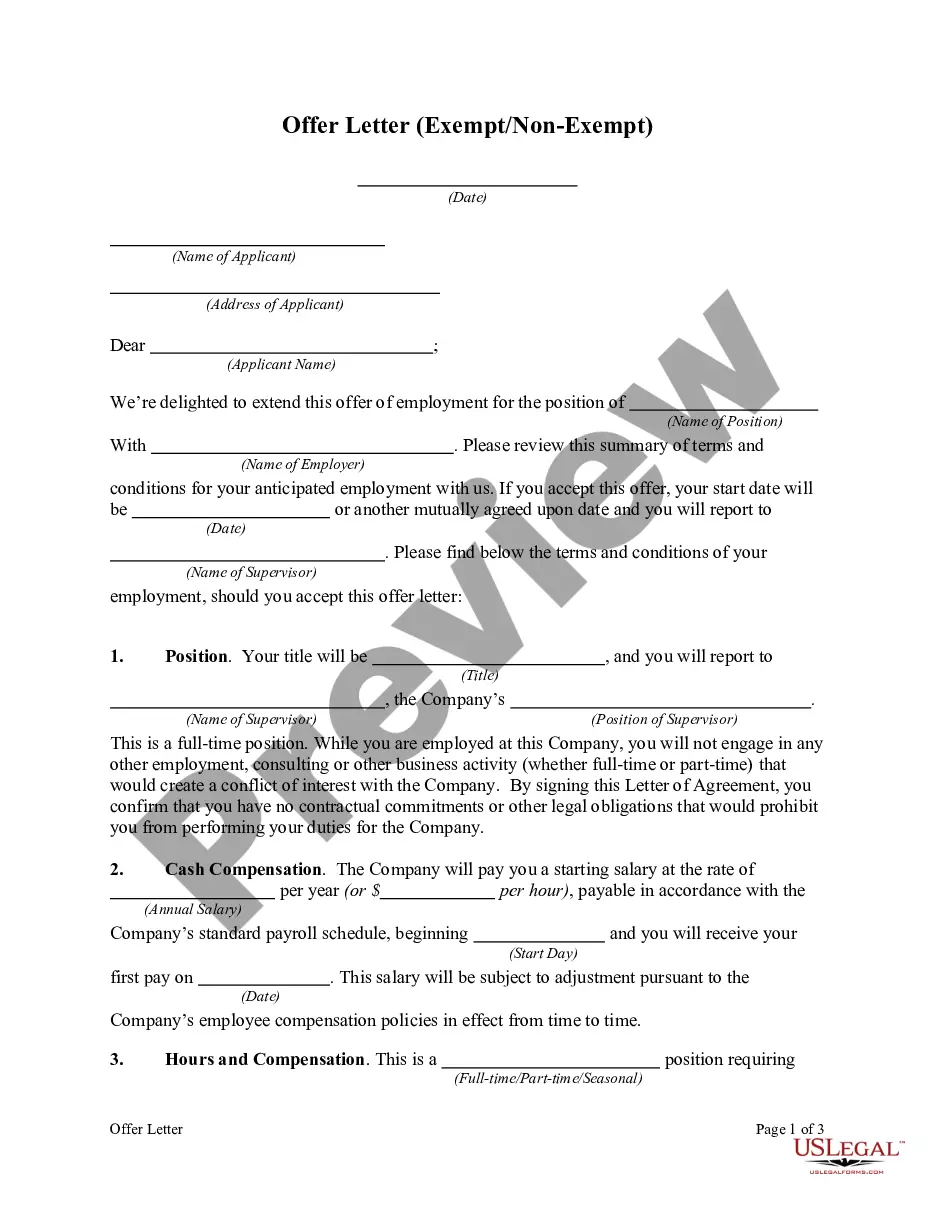

South Dakota Job Offer Letter - Exempt or Nonexempt Position

Description

How to fill out Job Offer Letter - Exempt Or Nonexempt Position?

You might spend hours online seeking the appropriate legal document template that meets the state and federal standards you need. US Legal Forms offers a multitude of legal forms that can be reviewed by experts.

You can download or print the South Dakota Job Offer Letter - Exempt or Nonexempt Position from their service.

If you already possess a US Legal Forms account, you can Log In and select the Download option. Subsequently, you can complete, modify, print, or sign the South Dakota Job Offer Letter - Exempt or Nonexempt Position. Each legal document template you purchase is yours permanently. To obtain another copy of the purchased form, navigate to the My documents tab and click the corresponding option.

Select the format of your document and download it to your device. Make any necessary changes to the file. You can complete, modify, sign, and print the South Dakota Job Offer Letter - Exempt or Nonexempt Position. Download and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice. Review the form description to confirm you have chosen the correct form.

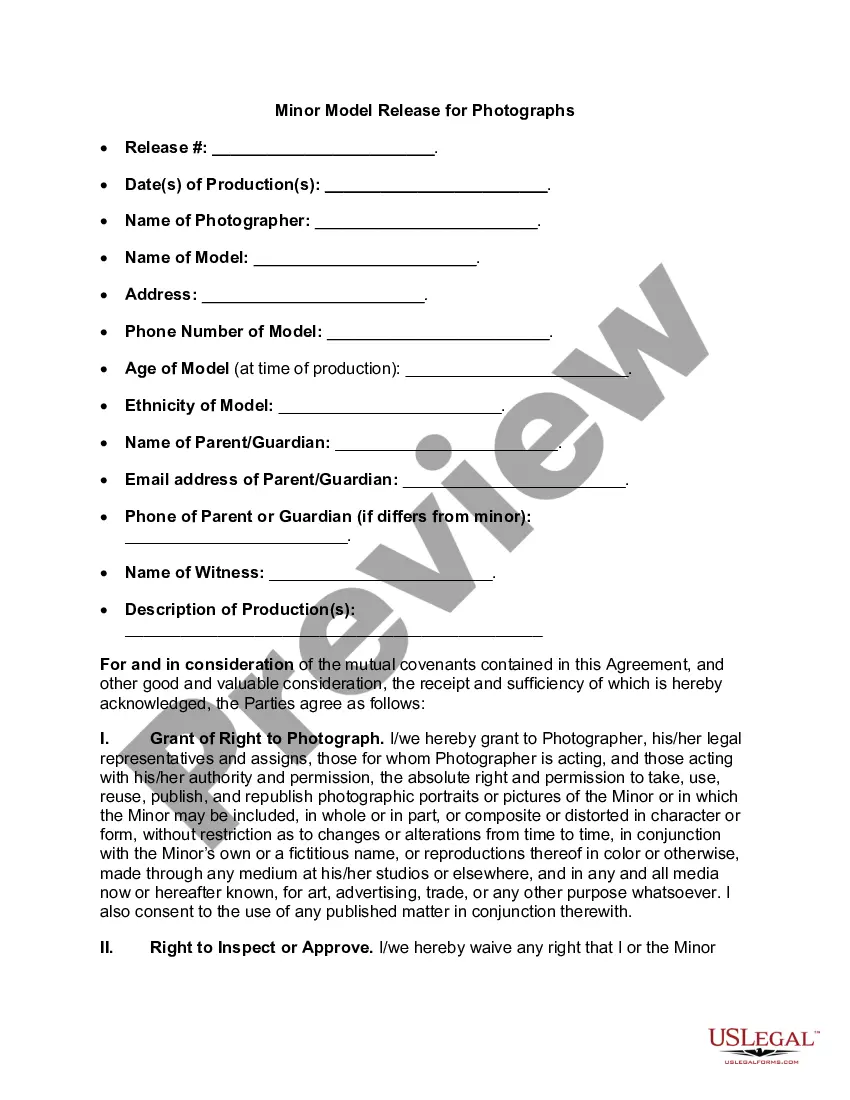

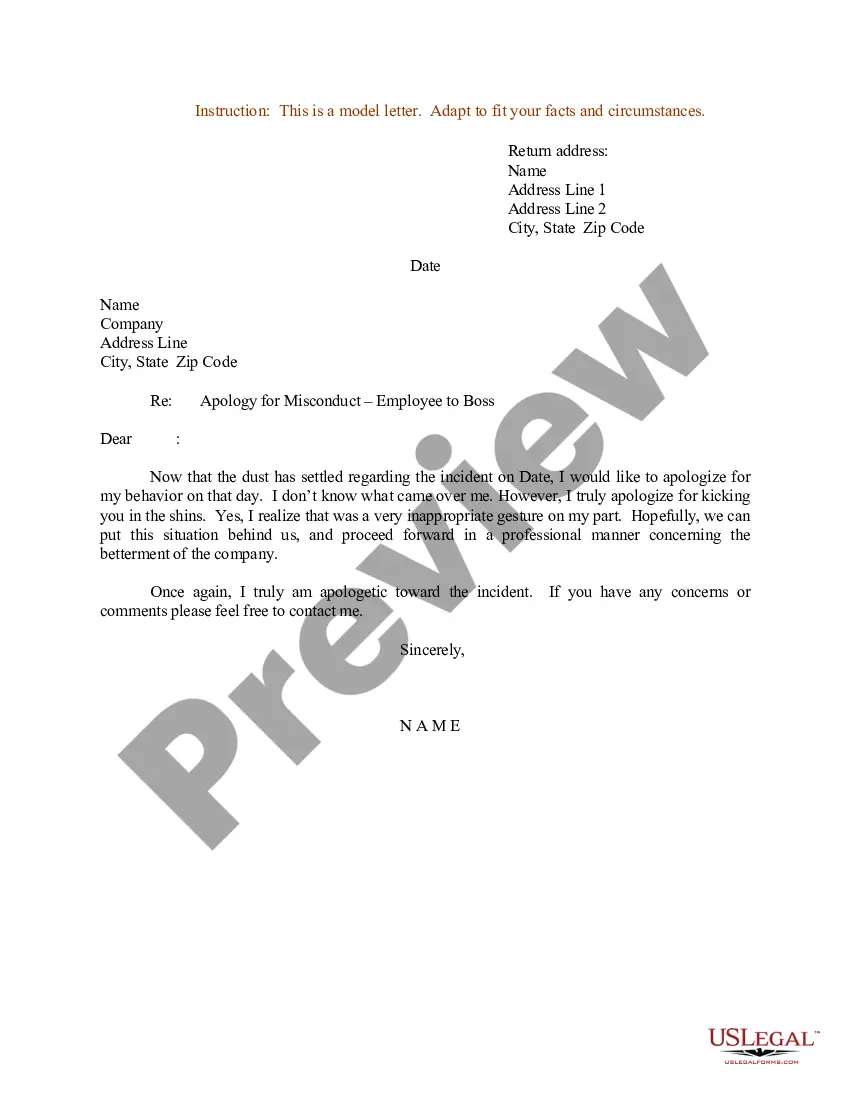

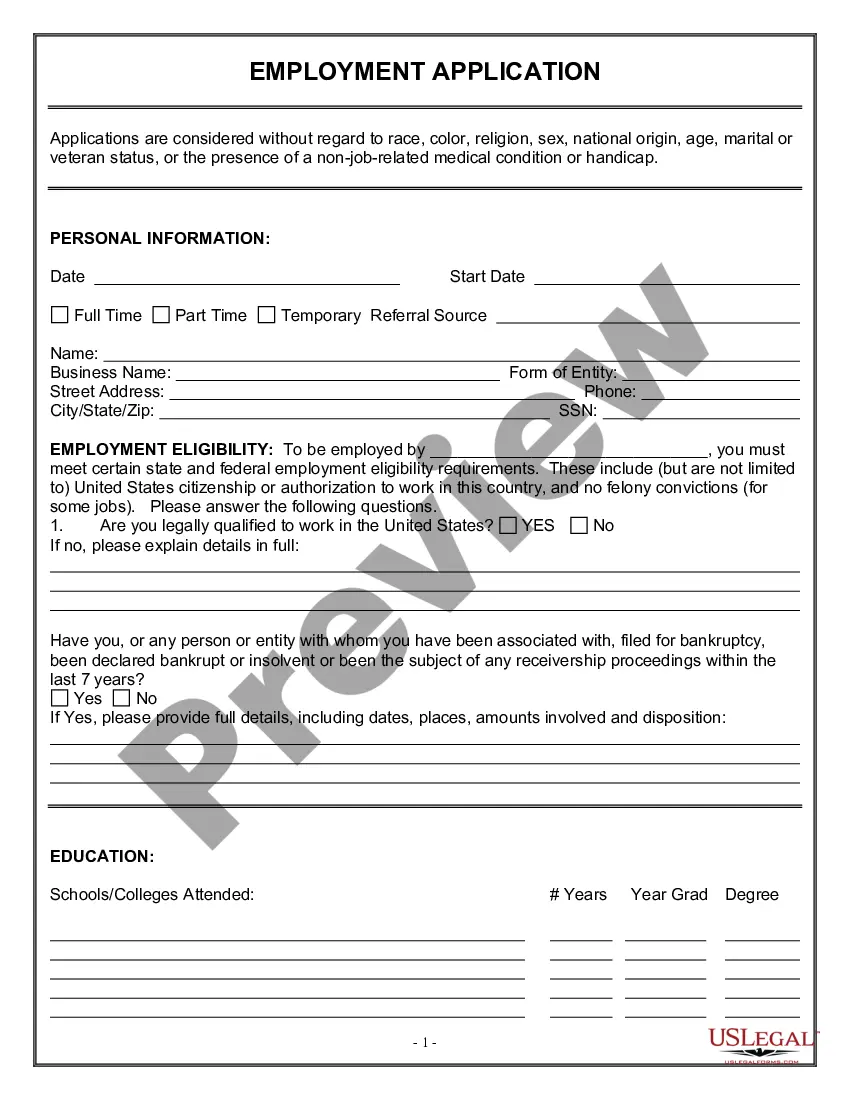

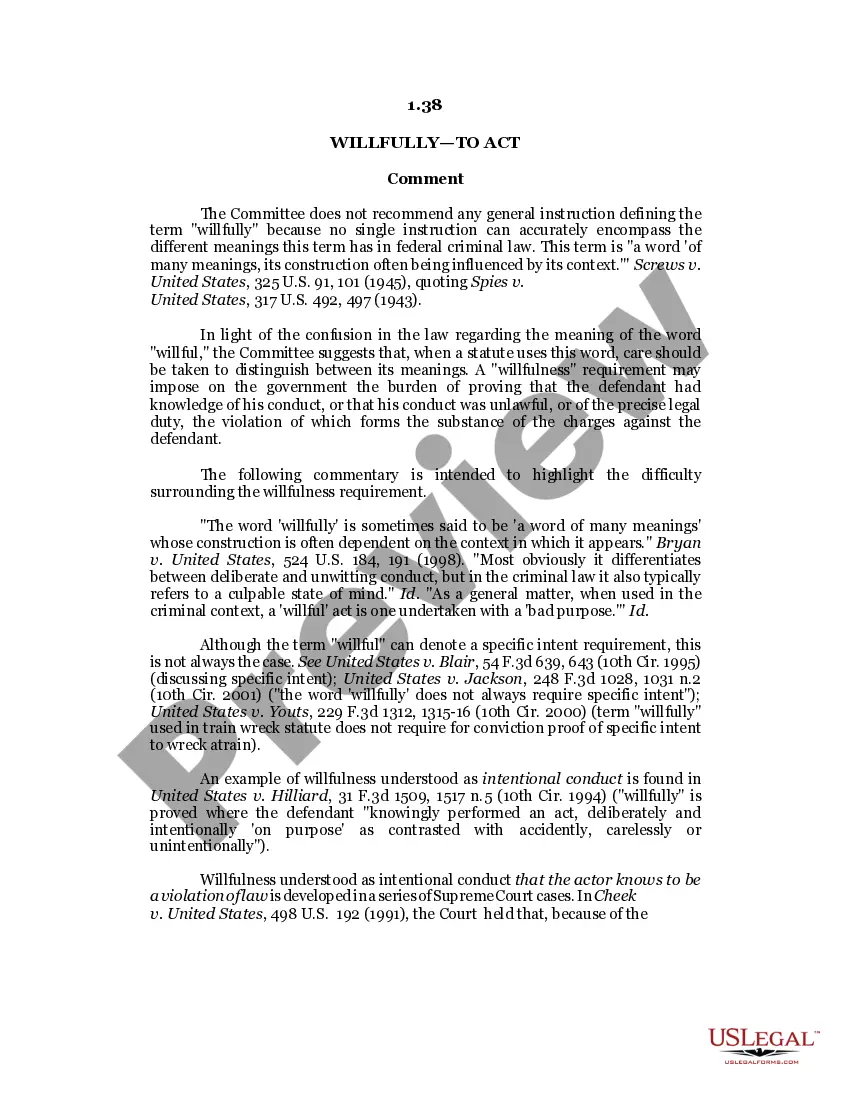

- If available, use the Preview option to review the document template as well.

- To acquire another version of your form, use the Search area to locate the template that fits your needs.

- Once you have found the template you wish to acquire, click Get now to proceed.

- Choose the pricing plan you desire, enter your details, and register for an account on US Legal Forms.

- Complete the transaction. You can utilize your Visa, Mastercard, or PayPal account to pay for the legal form.

Form popularity

FAQ

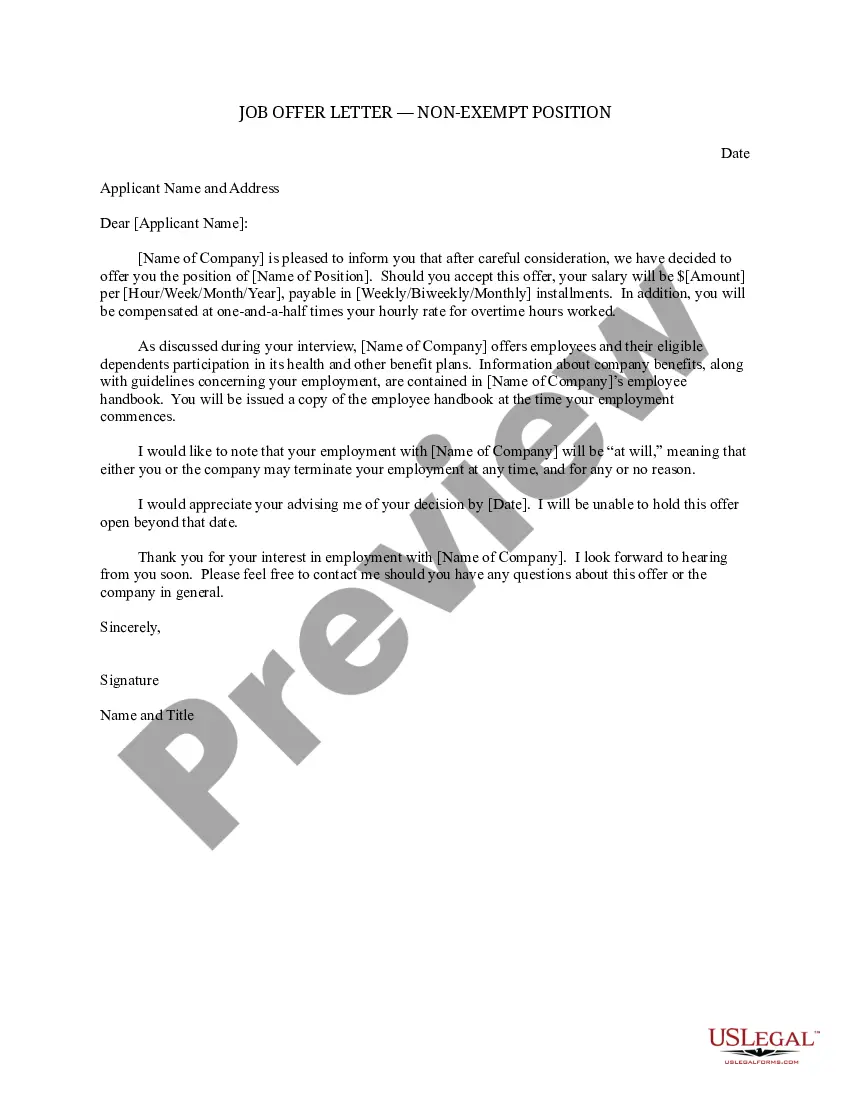

An offer letter for a non-exempt employee outlines the terms of employment, including job title, salary, work hours, and overtime eligibility. This document serves as formal communication that clarifies both the employer’s and the employee’s expectations. When you receive a South Dakota Job Offer Letter - Exempt or Nonexempt Position, make sure to review these details to ensure they align with your needs.

Key Takeaways. An exempt employee is an employee who does not receive overtime pay or qualify for minimum wage. Exempt employees are paid a salary rather than by the hour, and their work is executive or professional in nature.

Exempt positions are excluded from minimum wage, overtime regulations, and other rights and protections afforded nonexempt workers. Employers must pay a salary rather than an hourly wage for a position for it to be exempt.

Exempt employees must be paid on a salary basis, as discussed above. Nonexempt employees may be paid on a salary basis for a fixed number of hours or under the fluctuating workweek method. Salaried nonexempt employees must still receive overtime in accordance with federal and state laws.

What does non-exempt mean? If employees are non-exempt, it means they are entitled to minimum wage and overtime pay when they work more than 40 hours per week.

Exempt or Nonexempt.Employees whose jobs are governed by the FLSA are either "exempt" or "nonexempt." Nonexempt employees are entitled to overtime pay. Exempt employees are not.

Exempt employees must be paid on a salary basis, as discussed above. Nonexempt employees may be paid on a salary basis for a fixed number of hours or under the fluctuating workweek method. Salaried nonexempt employees must still receive overtime in accordance with federal and state laws.

Unfortunately, your boss is correct. An written offer of employment does not constitue a legal contrat unless it guaranteed your employment in some way (i.e. your compensation, etc.) for a specified period of time. Further, without a written employment contract, you are an "at will" worker.

Under the FLSA, exempt workers qualify for time and a half, their normal hourly wage plus half that wage, when they work overtime. Workers who volunteer for overtime or have mandatory overtime can benefit significantly from their status as non-exempt employees, as they can make a large amount of money in overtime pay.

What does non-exempt mean? If employees are non-exempt, it means they are entitled to minimum wage and overtime pay when they work more than 40 hours per week.