South Dakota Exempt Survey

Description

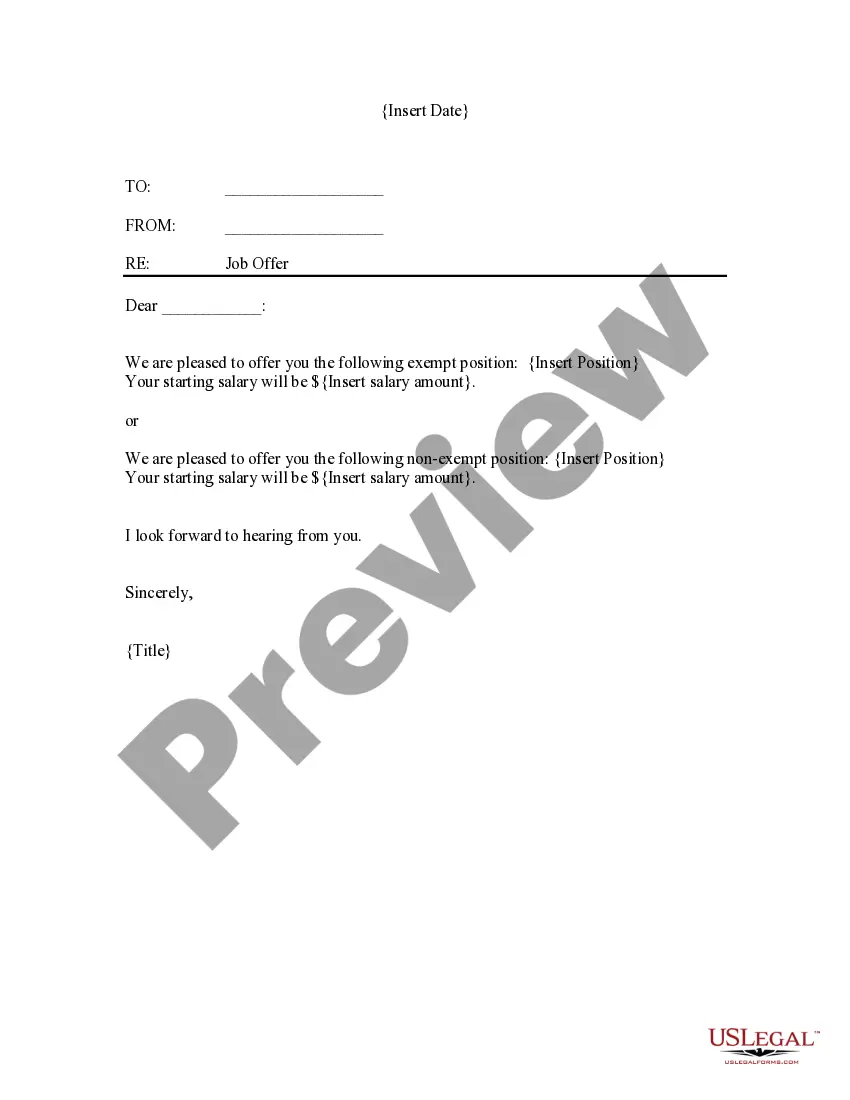

How to fill out Exempt Survey?

If you want to compile, save, or print authentic document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the site's straightforward and user-friendly search function to find the documents you need. Various templates for business and personal use are categorized by type and state, or by keywords.

Utilize US Legal Forms to acquire the South Dakota Exempt Survey in just a few clicks.

Each legal document template you purchase is yours permanently. You have access to every form you acquired in your account. Visit the My documents section and select a form to print or download again.

Be proactive and download, and print the South Dakota Exempt Survey with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and then click the Download button to receive the South Dakota Exempt Survey.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

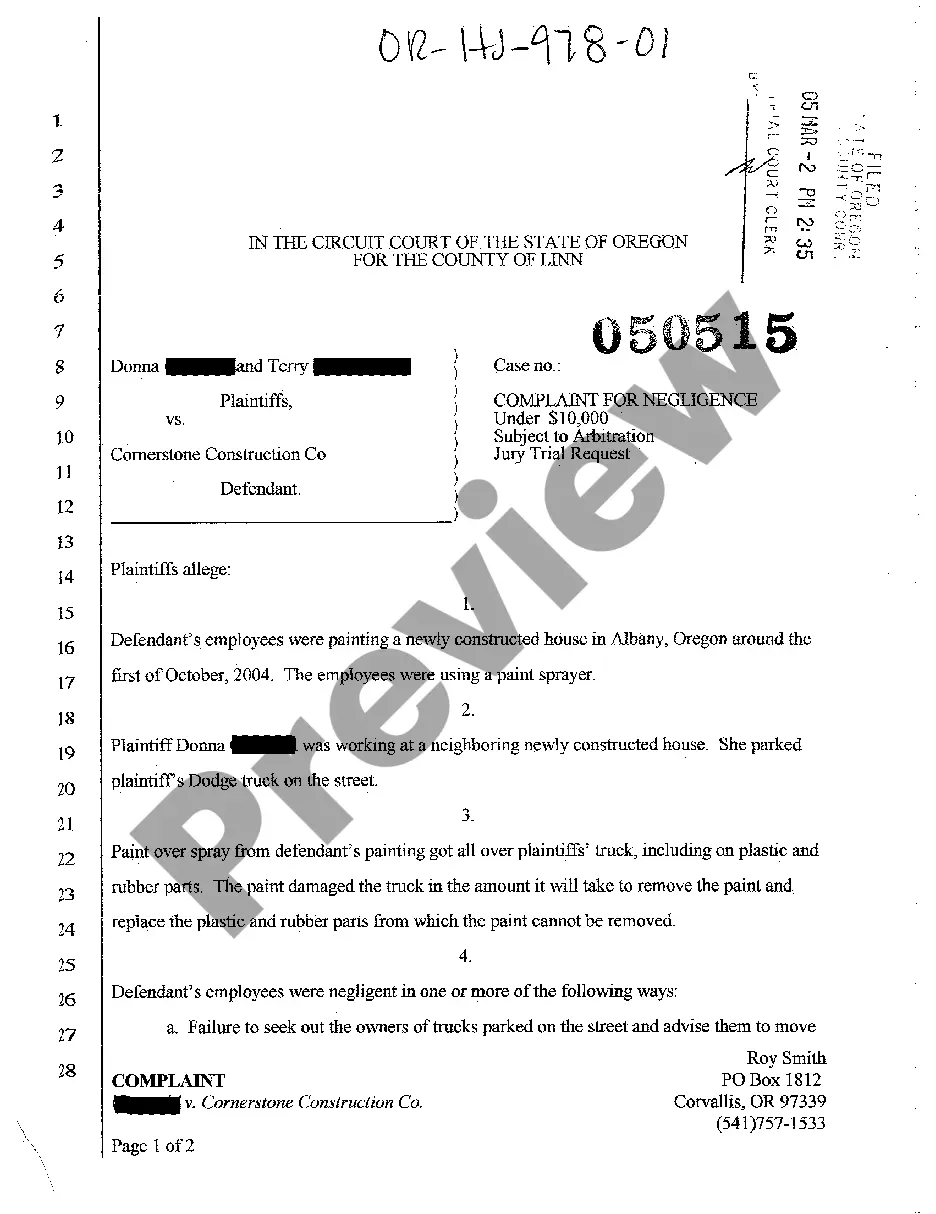

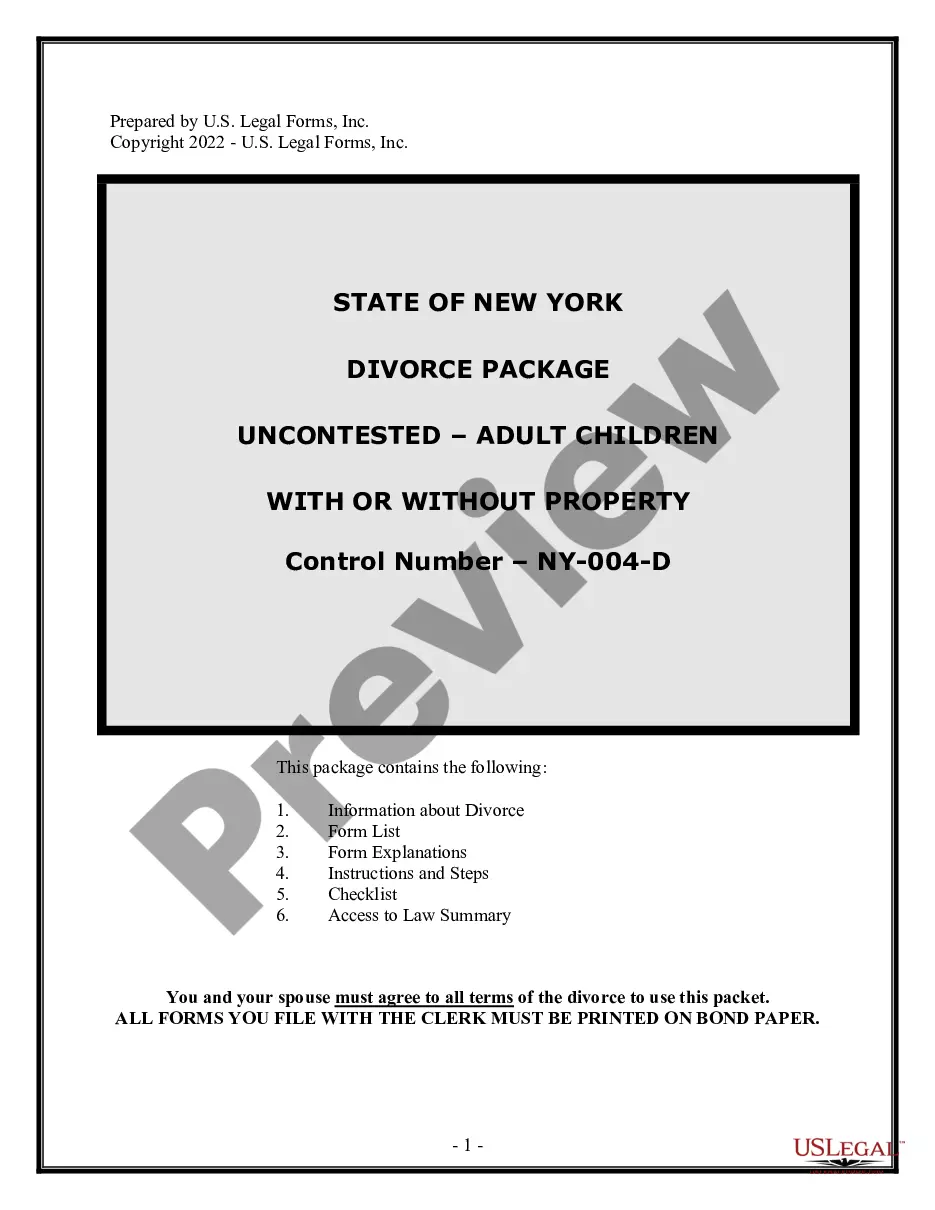

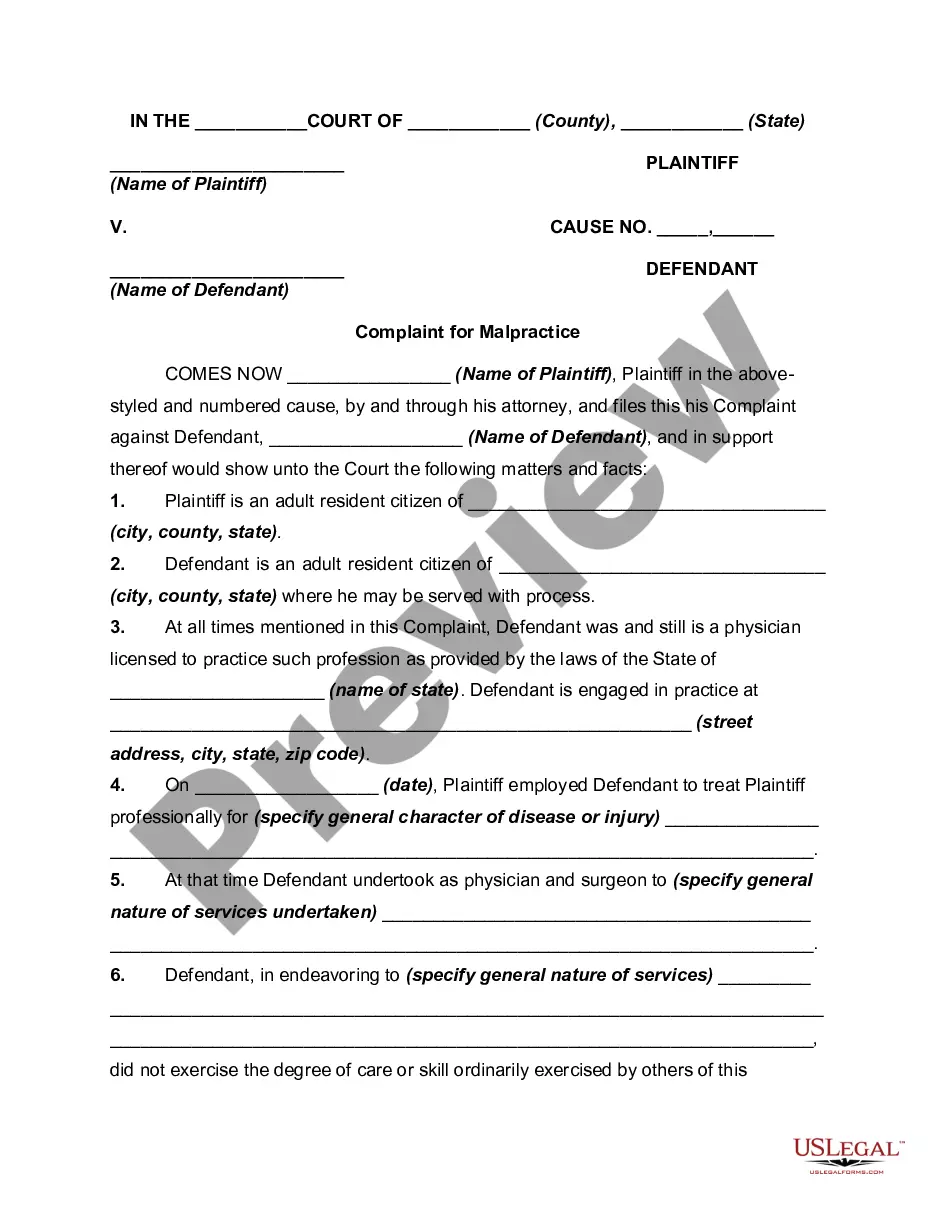

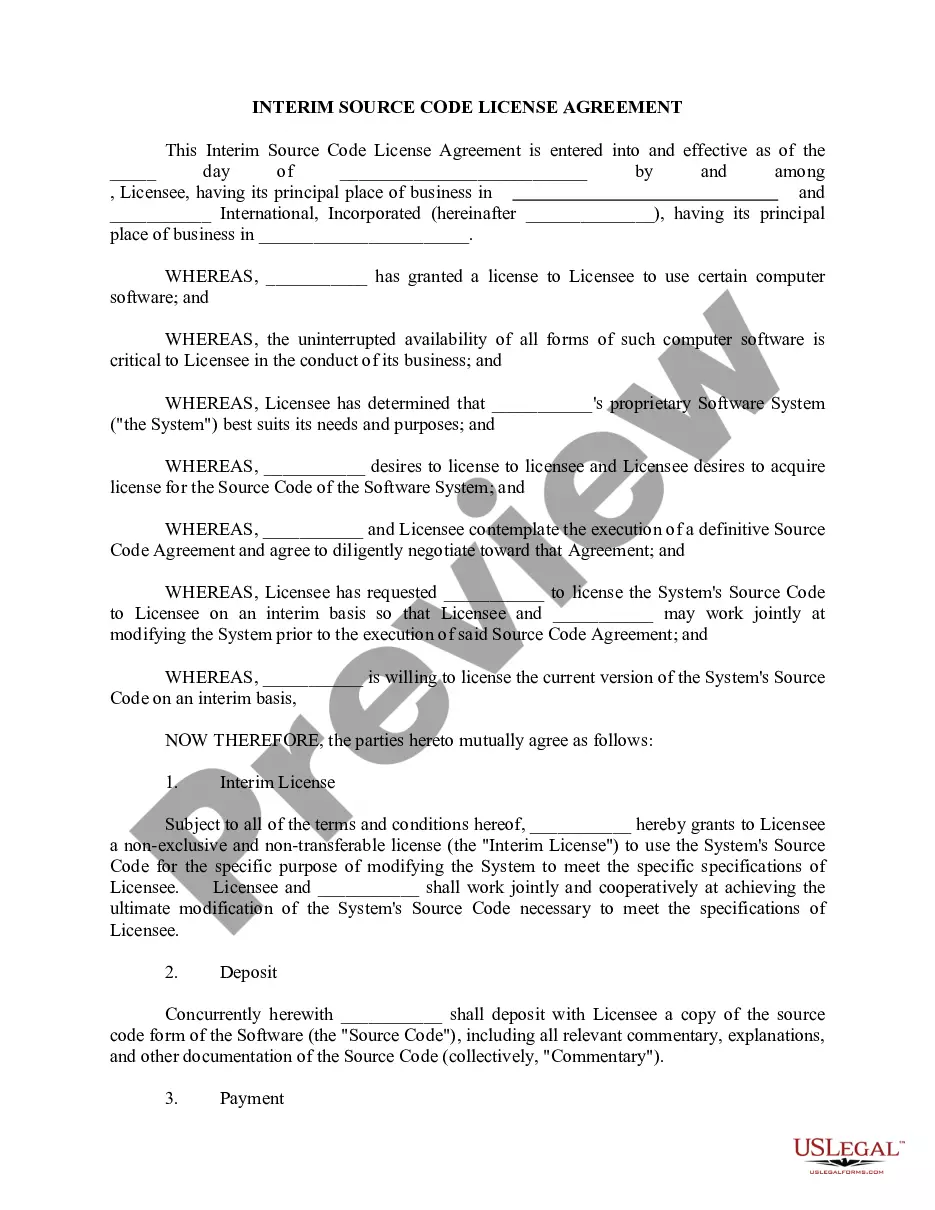

- Step 2. Use the Review function to examine the form's details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative forms in the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the South Dakota Exempt Survey.

Form popularity

FAQ

An exemption certificate is the form presented by an exempt organization or individual to the seller when making a tax-exempt purchase. Exemptions are based on the customer making the purchase and always require documentation. Different purchasers may be granted exemptions under a state's statutes.

Tax-exempt refers to income or transactions that are free from tax at the federal, state, or local level. The reporting of tax-free items may be on a taxpayer's individual or business tax return and shown for informational purposes only. The tax-exempt article is not part of any tax calculations.

What is South Dakota's Sales Tax Rate? The South Dakota sales tax and use tax rates are 4.5%.

14-Any motor vehicle sold or transferred which is eleven or more model years old and which is sold or transferred for $2,500 or less and any boat which is eleven or more model years old and which is sold or transferred for $2,500 or less.

For an organization to receive tax-exempt status, it must satisfy all IRS requirements. Generally, these are organizations that don't operate for profit and provide valuable services to the community such as a charity.

On a statewide basis, South Dakota does not levy a personal income tax. The state's sales tax is also among the lowest in the country. However, the average effective property tax rate in South Dakota is above the national average.

Traditional Goods or Services Goods that are subject to sales tax in South Dakota include physical property, like furniture, home appliances, and motor vehicles. The purchase of prescription medication and gasoline are tax-exempt. South Dakota is unique in the fact that almost all services are taxable.

An official document that gives someone special permission not to do or pay something: a medical/tax exemption certificate.

South Dakota Property Taxes Across the state, the average effective property tax rate is 1.22%.

Eligibility for Certificate of Exemption They can instead apply for a Certificate of Exemption, which is issued free of charge. However, as residents not residing in Hong Kong are not required to register for Hong Kong identity cards, they are not required to apply for the Certificate of Exemption.