South Dakota Material Return Record

Description

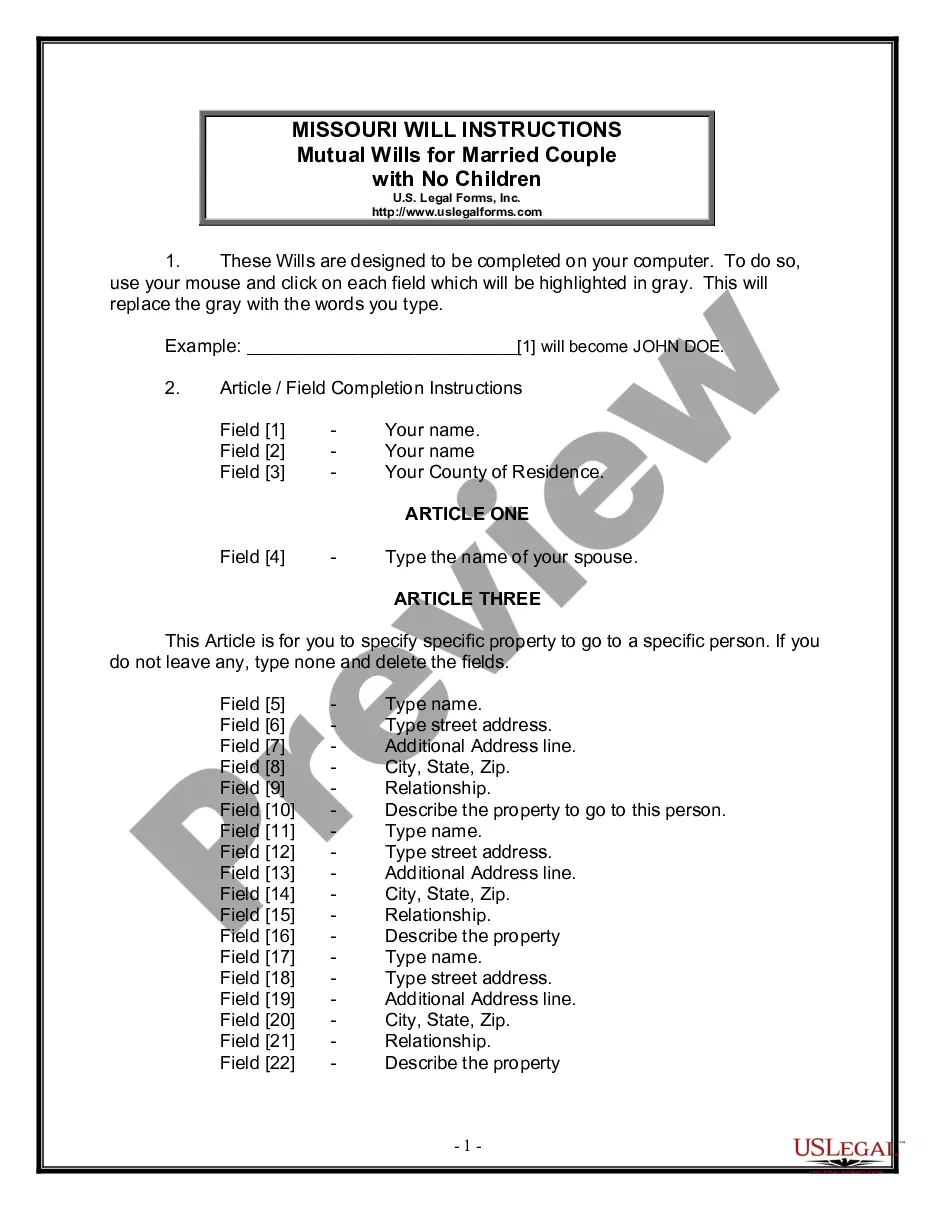

How to fill out Material Return Record?

You can devote numerous hours online trying to locate the legal document template that fits your state and federal requirements.

US Legal Forms offers a vast selection of legal forms that are vetted by experts.

You have the option to download or print the South Dakota Material Return Document from the service.

First, ensure that you have chosen the correct document template for the specific state/city of your preference. Review the form details to confirm you have selected the appropriate form. If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can sign in and click on the Download button.

- Next, you can fill out, modify, print, or sign the South Dakota Material Return Document.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of the form you bought, go to the My documents section and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions below.

Form popularity

FAQ

A 2% contractor's excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects. The work must be for the utility company and the prime contractor must receive payment directly from the utility company to be taxed under SDCL 10-46B.

Filing a federal return Many states will require you to file state taxes if you're also required to file federal taxes. Having income over a threshold In some states, you'll only need to file if your income is above a certain threshold. This amount will vary state-by-state and can also vary by your filing status.

Sellers must keep exemption certificates in their records for three years. If the purchaser doesn02bct provide the seller with a properly completed exemption certificate, the seller must collect sales tax. An exemption certificate may be issued for a single purchase or as a blanket certificate.

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent.

Since South Dakota does not collect an income tax on individuals, you are not required to file a SD State Income Tax Return. However, you may need to prepare and efile a Federal Income Tax Return.

A 2% contractor's excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects. The work must be for the utility company and the prime contractor must receive payment directly from the utility company to be taxed under SDCL 10-46B.

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming don't have income tax. If you're a resident of one of these states, you don't need to file a return in that state.

Note: South Dakota doesn't have income tax, so that's why I'm using sales tax. No, excise taxes are not deductible as sales tax; however, some state excise tax is deductible as personal property tax on Schedule A, itemized deductions, in place of car registration fees.

Since South Dakota does not collect an income tax on individuals, you are not required to file a SD State Income Tax Return. However, you may need to prepare and efile a Federal Income Tax Return.

Sales tax applies to almost anything you purchase while excise tax only applies to specific goods and services. Sales tax is typically applied as a percentage of the sales price while excise tax is usually applied at a per unit rate.