South Dakota Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

How to fill out Employment Agreement With Nonqualified Retirement Plan Funded With Life Insurance?

If you require thorough, acquire, or print legal document templates, utilize US Legal Forms, the finest assortment of legal forms, available online.

Take advantage of the website's straightforward and convenient search to retrieve the documents you require.

An array of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Use US Legal Forms to get the South Dakota Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the South Dakota Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

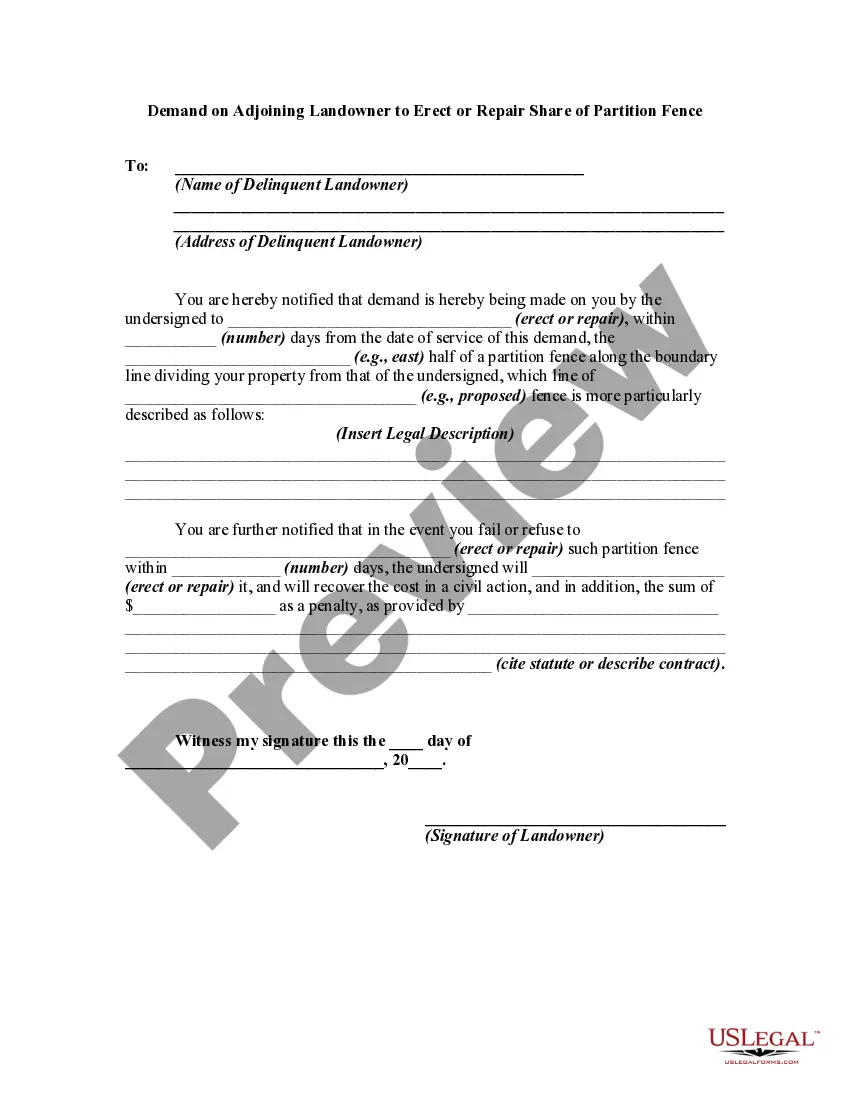

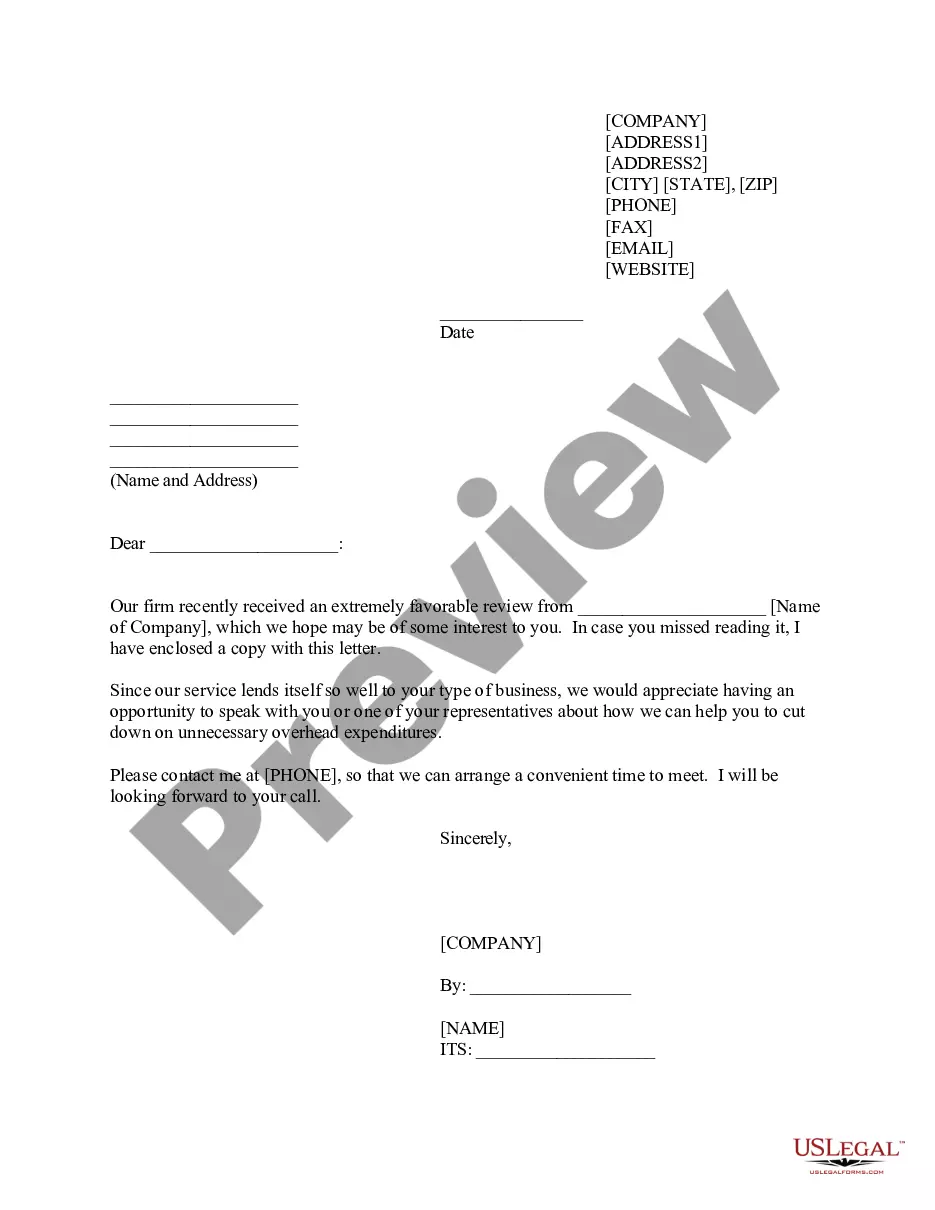

- Step 2. Utilize the Preview option to review the form's content. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

An unfunded deferred compensation plan, representing the employers unsecured promise to pay the employee a future benefit, does not result in current taxable income to the employee. Income is not recognized for tax purposes until the funds are available for immediate distribution.

SDRS benefits are based on the member's final average compensation, the member's years of credited service, and a benefit multiplier. Retirement benefits are payable for member's lifetime. Surviving spouse benefits are also available.

Examples of nonqualified plans are deferred compensation plans, supplemental executive retirement plans, split-dollar arrangements and other similar arrangements. Contributions to a deferred compensation plan will reduce an employee's gross income, but there's no rollover option upon termination of employment.

When it comes to retirement, ASRS members are vested from the date their first contribution is received. Members may keep their funds on account with ASRS until they meet their normal retirement criteria, at which point they can retire, even with only 1 month of service.

The full retirement age is 66 if you were born from 1943 to 1954. The full retirement age increases gradually if you were born from 1955 to 1960 until it reaches 67. For anyone born 1960 or later, full retirement benefits are payable at age 67.

Life insurance generally provides the most cost-effective method of informally funding a deferred compensation plan, as long as the executive participant is insurable.

A nonqualified deferred compensation (NQDC) plan is an arrangement between an employer and employee that defers the receipt of currently earned compensation. A NQDC plan doesn't need to comply with the discrimination and administrative rules that govern qualified plans, such as Section 401 of the Internal Revenue Code.

What's Included in the Offer? While the specifics vary, the heart of an early retirement package is invariably a severance payment comprising weeks, months, or even years of wages. That sum may be sweetened by such additions as paid insurance and outplacement services to aid your transition to a new job.

qualified deferred compensation plan is a binding contract between an employer and an employee where the employer agrees to pay the employee at a later time. Specifically, the employer makes an unsecured promise to pay an employee's future benefits, subject to the specific terms of the contract.

If you retire at 20 years service you get 40% of your final base pay. If you retire at 30 years service you get 60% of your final base pay. You can either get your full retirement when eligible or opt to get a lump-sum benefit at retirement.