South Dakota Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

Have you ever found yourself in a situation where you need paperwork for business or personal purposes nearly every day.

There are countless legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms offers a wide variety of document templates, such as the South Dakota Nonqualified Defined Benefit Deferred Compensation Agreement, designed to meet state and federal requirements.

Once you find the correct document, click Get now.

Choose the pricing plan you prefer, complete the required information to create your account, and purchase your order using PayPal or a credit card. Select a convenient file format and download your copy. Access all the document templates you’ve purchased in the My documents menu. You can obtain another copy of the South Dakota Nonqualified Defined Benefit Deferred Compensation Agreement at any time if needed. Just click on the desired document to download or print the template. Leverage US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. This service provides professionally crafted legal document templates for a variety of uses. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the South Dakota Nonqualified Defined Benefit Deferred Compensation Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and make sure it is for your correct location/state.

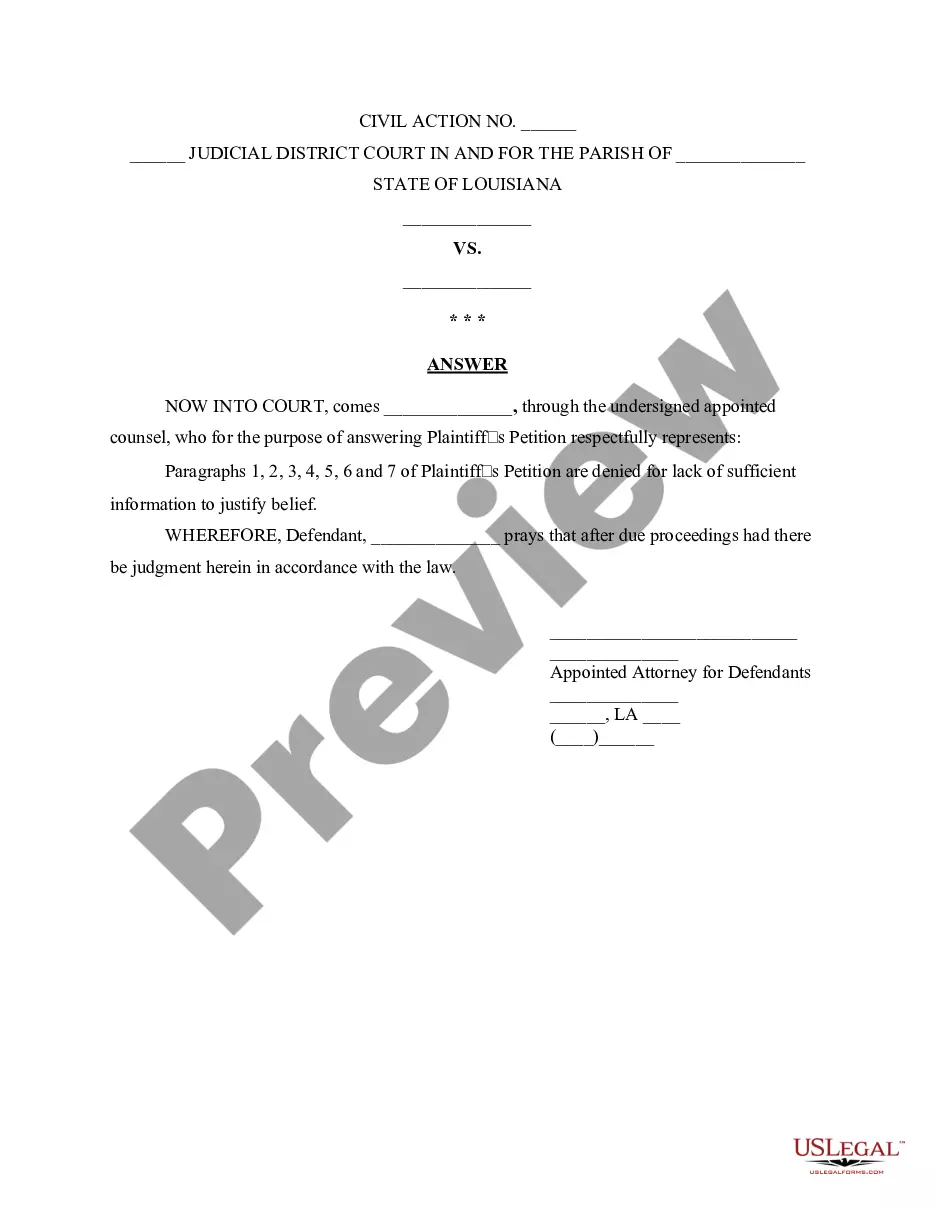

- Use the Preview button to examine the document.

- Review the description to ensure you have selected the right form.

- If the document does not meet your needs, utilize the Search field to find the form that suits your requirements.

Form popularity

FAQ

Yes, deferred compensation can be a form of a defined benefit plan, especially in the context of a South Dakota Nonqualified Defined Benefit Deferred Compensation Agreement. These agreements allow participants to defer part of their income to receive benefits at a later date, often leading to tax advantages and financial planning flexibility. By structuring compensation in this way, you can potentially enhance your retirement savings while managing your current tax obligations. This type of agreement is especially beneficial for high-earning individuals looking to secure their financial future.

Non-qualified plans, such as a South Dakota Nonqualified Defined Benefit Deferred Compensation Agreement, do not need prior IRS approval. Nevertheless, they must adhere to IRS regulations to function properly and deliver advantages to both employers and employees. It is wise to review the guidelines carefully to ensure compliance. Using resources like USLegalForms can simplify this process and help you implement a successful plan.

A South Dakota Nonqualified Defined Benefit Deferred Compensation Agreement does not require formal IRS approval. However, it is essential to ensure the plan complies with IRS guidelines to avoid potential penalties. When structured correctly, these plans provide flexibility for employers and valuable benefits for employees. Consulting with a knowledgeable provider can help you navigate these requirements.

In South Dakota, retirement pensions are not subject to state income tax. This can be advantageous for individuals receiving benefits through a South Dakota Nonqualified Defined Benefit Deferred Compensation Agreement. Not being taxed at the state level allows you to maximize your retirement income, providing you with additional financial security. It is wise to review federal tax implications and consult a tax professional for comprehensive guidance.

The rule of 85 in South Dakota allows certain employees to retire early without facing penalties if their age and years of service total 85. This rule is beneficial for those involved in a South Dakota Nonqualified Defined Benefit Deferred Compensation Agreement, as it provides flexibility in retirement planning. Understanding this rule can help you make informed decisions regarding your retirement options. Always consult with a financial advisor to evaluate how this rule applies to your specific situation.