South Dakota Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

Description

How to fill out Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

Selecting the appropriate legal document format can pose a challenge. Naturally, there are numerous online templates accessible, but how do you acquire the specific legal document you need.

Utilize the US Legal Forms website. This service provides a vast array of templates, including the South Dakota Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust, suitable for both business and personal purposes. All forms are vetted by experts and adhere to federal and state regulations.

If you are already registered, Log In to your account and click the Acquire button to locate the South Dakota Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust. Use your account to browse the legal documents you have previously purchased. Navigate to the My documents section of your account to download another copy of the document you require.

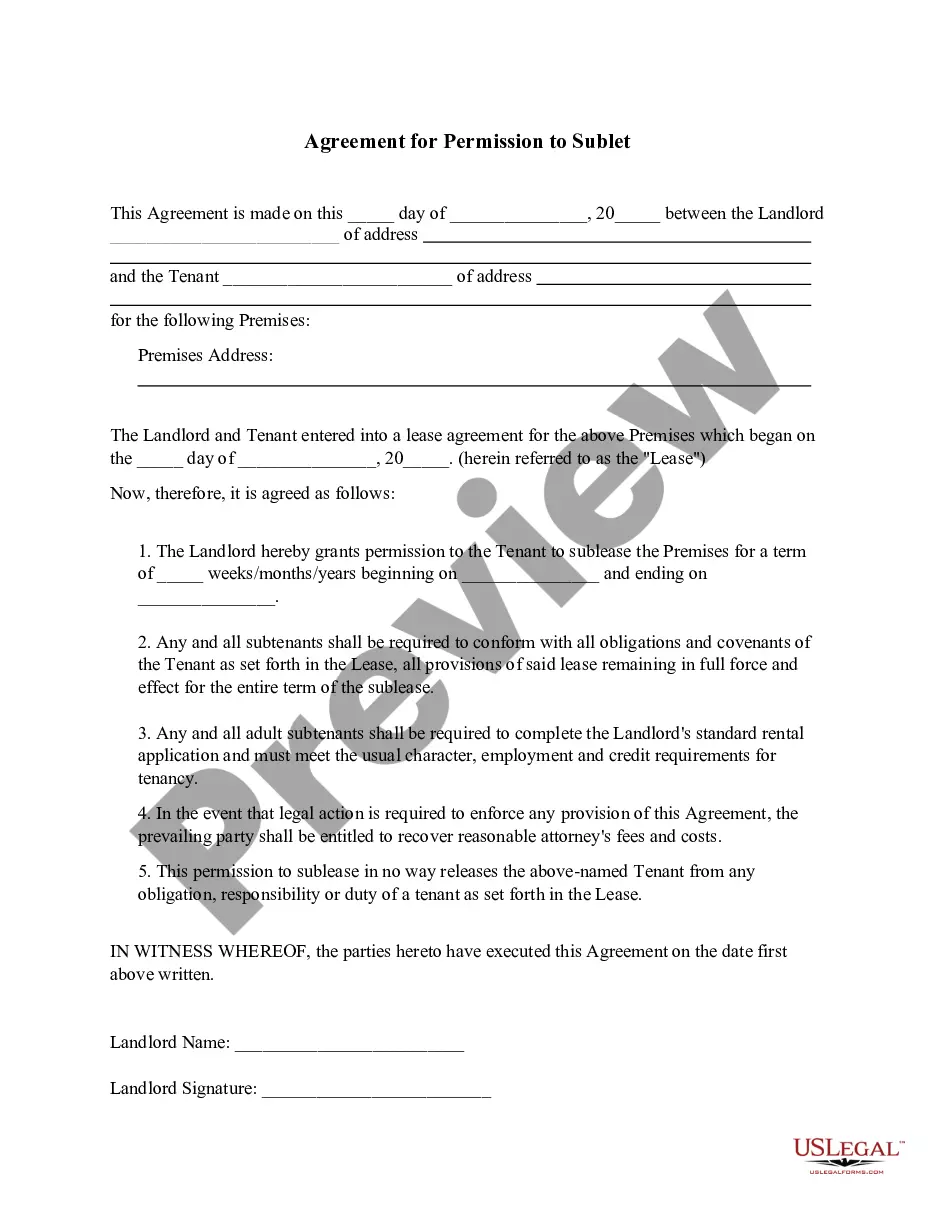

Complete, edit, print, and sign the acquired South Dakota Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust. US Legal Forms is the largest repository of legal documents where you can find numerous document templates. Leverage the service to obtain professionally crafted forms that comply with state requirements.

- If you are a new user of US Legal Forms, here are some simple steps for you to follow.

- First, ensure that you have chosen the correct form for your city/state. You can review the form using the Review button and read the form description to verify it meets your needs.

- If the form does not fulfill your criteria, take advantage of the Search field to find the appropriate document.

- Once you are convinced that the form is suitable, click the Get now button to obtain the document.

- Select the pricing plan you wish and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the download format and retrieve the legal document format onto your device.

Form popularity

FAQ

In other words, if the grantor (or a non-adverse party) has the power to revoke any part of a trust and reclaim the trust assets, then the grantor will be taxed on the trust income.

Putting the life insurance policy in the trust can remove it from the grantor's personal assets. As an irrevocable trust, once the life insurance is owned by the trust, you can't take it back.

A grantor trust can, in a given case, be either revocable or irrevocable, although most types of grantor trusts involve an irrevocable trust. Certain types of trusts (such, as for example, a revocable trust) are disregarded not only for income tax purposes but also for federal estate and gift tax purposes.

A GRAT is an irrevocable trust that allows the trust's creator known as the grantor to direct certain assets into a temporary trust and freeze its value, removing additional appreciation from the grantor's estate and giving it to heirs with minimal estate or gift tax liability.

Even an irrevocable trust can be revoked with a court order. A court may execute an order that permits the dissolution of a life insurance trust if changes in trust or tax laws or in the grantor's family situation make the life insurance trust no longer serve its original purpose.

As the Trustor of a trust, once your trust has become irrevocable, you cannot transfer assets into and out of your trust as you wish. Instead, you will need the permission of each of the beneficiaries in the trust to transfer an asset out of the trust.

A grantor retained annuity trust, better known as a GRAT, is an irrevocable trust that pays an annuity amount to the grantor for a set period of years, after which the remainder passes to or for the benefit of children or others.

One easy way to terminate a life insurance trust, the grantor to stops making the premium payments, known as gifts, to the trust. If the grantor stops making payments to the trust, then the policy will lapse. This causes the purpose of the trust to be eliminated.

Grantor Retained Income Trust, DefinitionA GRIT is a type of irrevocable trust, meaning the transfer of assets is permanent and can't be reversed.

A grantor retained annuity trust is a type of irrevocable gifting trust that allows a grantor or trustmaker to potentially pass a significant amount of wealth to the next generation with little or no gift tax cost. GRATs are established for a specific number of years.