South Dakota Invoice Template for Farmer

Description

How to fill out Invoice Template For Farmer?

It is feasible to spend numerous hours online searching for the legal document template that complies with the federal and state requirements you will need.

US Legal Forms offers a vast array of legal templates that have been reviewed by experts.

You can obtain or create the South Dakota Invoice Template for Farmer through the services.

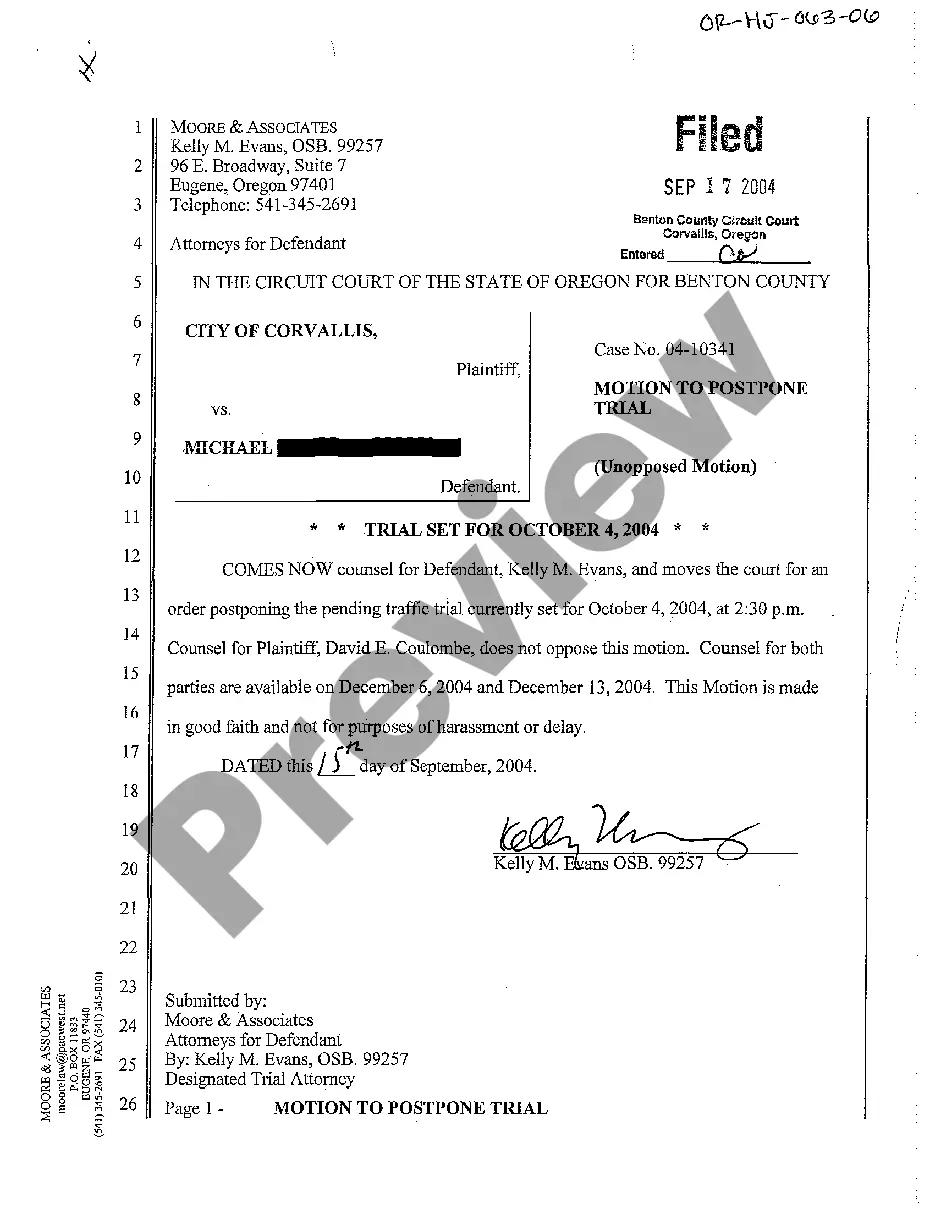

If available, utilize the Preview button to review the document template as well. If you want to get another version of the document, use the Search field to find the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you can sign in and then click the Acquire button.

- Once logged in, you can fill out, edit, create, or sign the South Dakota Invoice Template for Farmer.

- Every legal document template you purchase is yours permanently.

- To get an additional copy of a bought form, navigate to the My documents section and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Review the form description to confirm you have selected the proper document.

Form popularity

FAQ

To draft an invoice, start with your company's name and logo at the top, followed by the client's information. List the services provided or products sold, including individual prices and totals. Don’t forget to add payment terms, due dates, and invoice number for tracking. A structured South Dakota Invoice Template for Farmer can enhance your drafting process by providing all necessary sections.

When creating an invoice for a construction company, include all relevant project details, such as project name, location, and duration. Itemize labor costs, materials used, and any other charges incurred. You may also want to specify payment milestones. Using a South Dakota Invoice Template for Farmer designed for agricultural projects can help ensure clarity and professionalism.

Drafting an invoice involves several key steps. Start by labeling it as an 'Invoice' and including your details, the client's information, and an itemized list of your services or products. Make sure to calculate taxes, if applicable, and provide a total amount due. A South Dakota Invoice Template for Farmer can provide a structured format to follow, making this task easier.

To write a simple invoice, begin by including your business name and contact information at the top. Next, add the customer's details, followed by a list of goods or services supplied, along with their prices. Finally, ensure to incorporate the payment terms and the due date. Utilizing a South Dakota Invoice Template for Farmer can streamline this process significantly.

For tax purposes, the IRS considers a farm to be any operation that produces agricultural products, regardless of size, but generally, 10 acres can suffice for designation. Farmers must report income from these acres and can benefit from specific tax treatments. Utilizing a South Dakota Invoice Template for Farmer is beneficial for keeping accurate financial records, which is crucial during tax season. This ensures farmers maintain their eligibility for deductions and credits on their agricultural income.

In South Dakota, the definition of a farm varies, but generally, a minimum of 10 acres is often considered a farming operation. This can include land used for crop production, livestock grazing, or other agricultural activities. Having a South Dakota Invoice Template for Farmer allows you to document transactions related to these acres, making it easier to manage your farm's financial records. Understanding this definition helps farmers navigate regulations and eligibility for various programs.

Yes, there are various tax breaks available for farmers in South Dakota. These can include deductions on property taxes, exemptions on certain purchases, and credits for fuel used in farming operations. By utilizing a South Dakota Invoice Template for Farmer, you can easily track expenses and maximize your potential savings. Staying informed about the latest tax incentives can help farmers significantly reduce their taxable income.

Farmers can obtain tax-exempt status by properly applying for sales tax exemptions on eligible purchases related to farming. To qualify, farmers must provide documentation and a valid South Dakota Invoice Template for Farmer that demonstrates their agricultural use. It's essential to understand the specific forms required by the South Dakota Department of Revenue to ensure compliance. By having an invoice template, farmers can simplify the process and maintain accurate records.

Farmers can be tax exempt under specific conditions, including exemptions for sales tax on equipment or inputs used directly in farming activities. Different regulations apply, and it's crucial to consult with a tax professional. A South Dakota Invoice Template for Farmer can help maintain comprehensive records to ensure compliance.

Farmers typically file taxes using IRS Form 1040 Schedule F, which focuses on farm income and expenses. It's important for farmers to keep detailed records of both income and expenditures throughout the year. A South Dakota Invoice Template for Farmer aids in this record-keeping process, making tax filing more manageable.