Oregon Sample Letter regarding Application for Employer Identification Number

Description

How to fill out Sample Letter Regarding Application For Employer Identification Number?

Selecting the appropriate legal document template can be a challenge. Clearly, there are numerous templates accessible online, but how will you find the legal document you need? Utilize the US Legal Forms website. The platform offers a multitude of templates, including the Oregon Sample Letter for Application for Employer Identification Number, which you can utilize for business and personal purposes. All of the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Oregon Sample Letter for Application for Employer Identification Number. Use your account to review the legal forms you have previously acquired. Navigate to the My documents section of your account and download another copy of the document you require.

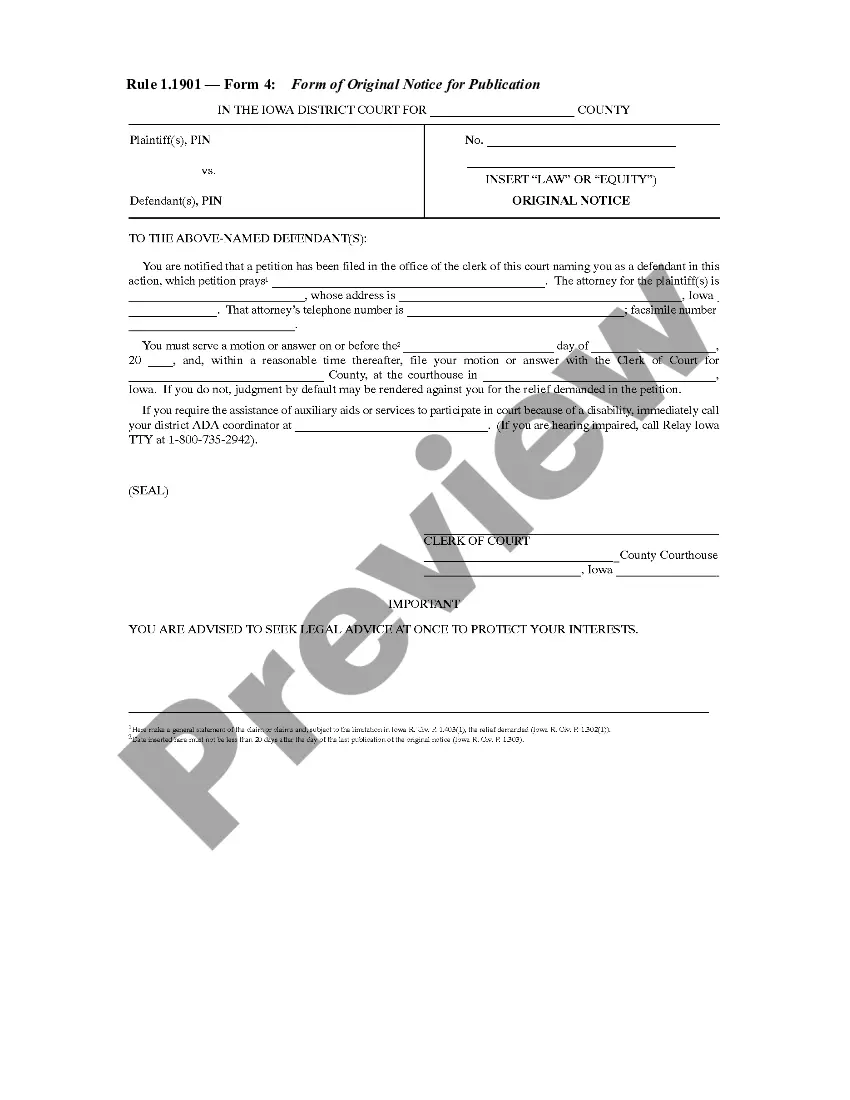

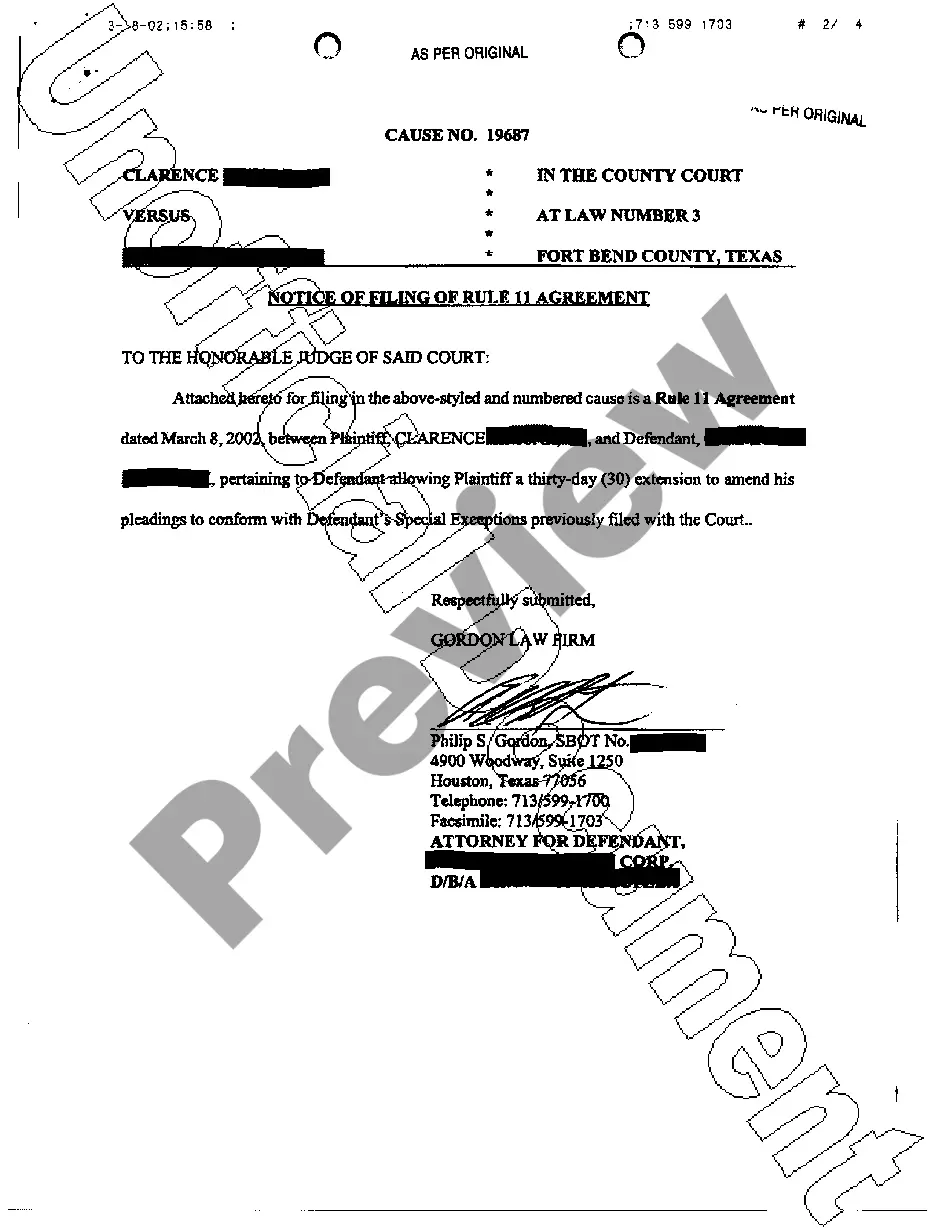

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: First, ensure you have chosen the correct document for your city/region. You can examine the document using the Preview button and read the document description to confirm it is suitable for you. If the document does not meet your needs, use the Search field to find the correct document. Once you are confident that the document is appropriate, click on the Purchase now button to obtain the document. Select the pricing plan you prefer and enter the necessary information. Create your account and pay for your purchase using your PayPal account or Visa or Mastercard. Choose the format and download the legal document template to your device. Finally, complete, modify, and print and sign the received Oregon Sample Letter for Application for Employer Identification Number.

In summary, US Legal Forms provides a comprehensive solution for finding and acquiring legal document templates that suit your requirements.

- US Legal Forms is the largest repository of legal documents where you can find numerous document templates.

- Utilize the service to obtain professionally crafted documents that comply with state requirements.

- The platform ensures that all templates are current and legally sound.

- You can easily manage your documents and access them anytime through your account.

- The site is user-friendly and offers various options for different legal needs.

- With a subscription, you can enjoy unlimited access to a wide range of legal templates.

Form popularity

FAQ

Every LLC in the U.S. should obtain a unique Employer Identification Number (EIN) from the Internal Revenue Service. You'll use it when you open a business bank account, file taxes and pay employees. It's available at no cost from the IRS, or Incfile can get an EIN for you.

The IRS sends out an EIN confirmation letter for every EIN application it processes. This EIN confirmation letter is called CP 575, and the IRS only mails the letter to the mailing address listed on line 4 of the SS-4 application. Unfortunately, you cannot get a copy of the IRS EIN confirmation letter online.

It's much faster online so keep in mind these steps: Visit the IRS website. ... Declare your business entity's legal and tax structure. ... Provide information about the members if your business operates as an LLC. ... Explain your reason for requesting an EIN. ... Identify the responsible party.

Use Form SS-4 to apply for an employer identification number (EIN). An EIN is a 9-digit number (for example, 12-3456789) assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes.

Apply by Mail Ensure that the Form SS-4PDF contains all of the required information. If it is determined that the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type and mailed to the taxpayer.

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories.

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day.

Most businesses need to apply to the Internal Revenue Service for a federal Employer Identification Number (EIN)?. You can apply online through the IRS. For more information: Form SS-4, application for EIN, requires identification of responsible party??