South Dakota Aging of Accounts Receivable

Description

How to fill out Aging Of Accounts Receivable?

US Legal Forms - one of the largest repositories of legal templates in the United States - offers a diverse selection of legal document types that you can download or print. By utilizing the site, you will find numerous forms for business and personal purposes, organized by categories, states, or keywords.

You can quickly access the latest versions of documents such as the South Dakota Aging of Accounts Receivable.

If you possess a membership, Log In and download the South Dakota Aging of Accounts Receivable from the US Legal Forms library. The Download button will appear on every document you view. You can find all previously acquired forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form onto your device. Make modifications. Fill out, edit, print, and sign the downloaded South Dakota Aging of Accounts Receivable. Every template added to your account has no expiration date and is yours forever. Therefore, if you need to download or print another copy, simply visit the My documents section and click on the form you require. Access the South Dakota Aging of Accounts Receivable with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize a wide range of professional and state-specific templates that cater to your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some simple steps to get you started.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to evaluate the form's content.

- Refer to the form summary to confirm you have the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose the payment plan you want and provide your details to register for an account.

Form popularity

FAQ

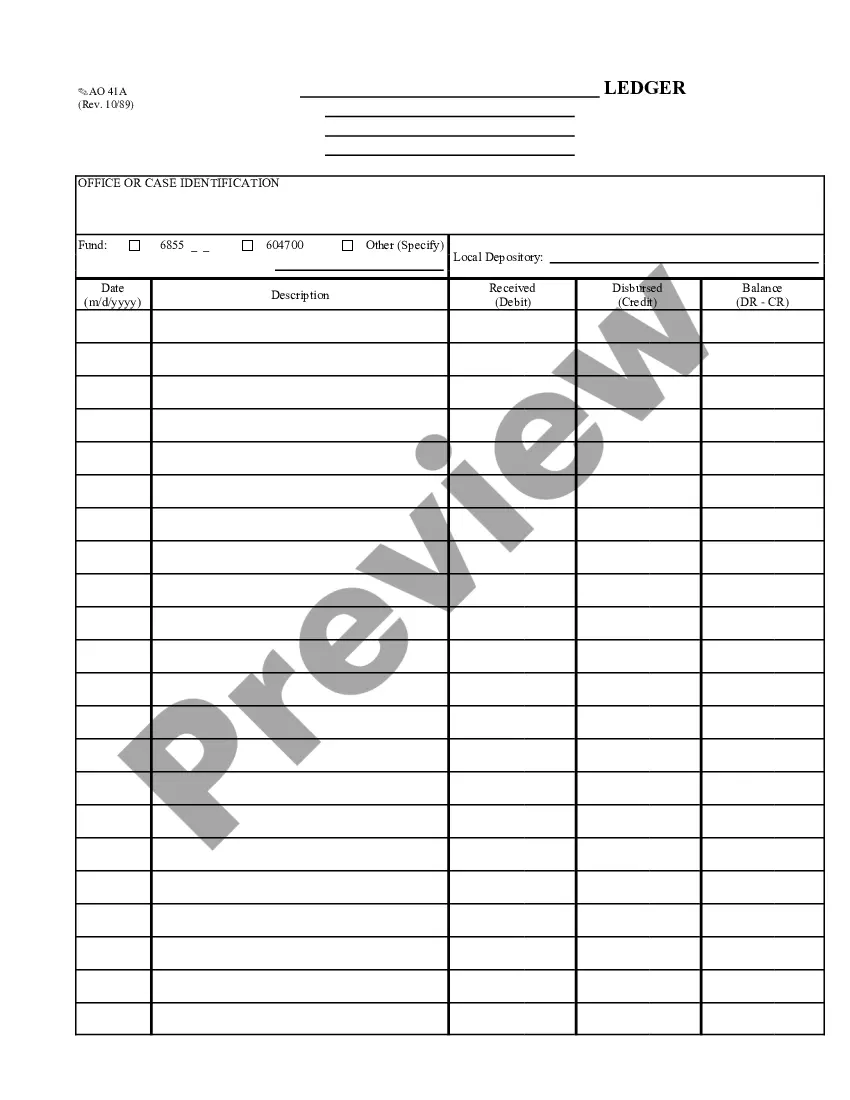

To write an accounts receivable aging report, start by compiling all outstanding invoices. Then, categorize these by their due dates into various aging buckets like current, 30 days overdue, or 60 days overdue. This process not only streamlines your analysis but also helps you optimize your South Dakota Aging of Accounts Receivable management, ensuring timely collections.

To report accounts receivable aging in QuickBooks, navigate to the Reports section and select 'Accounts Receivable Aging Summary.' Once there, you can customize your report to show specific time intervals. This report allows you to efficiently manage your South Dakota Aging of Accounts Receivable and helps you identify overdue invoices quickly.

To write an aging report, you first need to gather all outstanding invoices and organize them by their due dates. Next, categorize these invoices into time intervals, such as current, 30 days past due, and 60 days past due. This structure provides clarity and helps you analyze your South Dakota Aging of Accounts Receivable, making it easier for you to follow up with clients.

The formula for aging accounts receivable involves categorizing invoices based on their due dates. You calculate the aging of each invoice and then group them into buckets, such as current, 1-30 days overdue, 31-60 days overdue, and so on. Understanding the formula allows you to assess how quickly you collect payments and manage your South Dakota Aging of Accounts Receivable effectively.

To age trade receivables, first list all customer invoices along with their issue dates. Next, categorize these invoices by aging intervals to create a clear view of your South Dakota Aging of Accounts Receivable. This categorized information can guide your collection tactics, allowing you to focus on those accounts that are overdue and enhance your financial stability.

Calculating the age of accounts receivable involves determining the difference between the invoice date and the current date. This method allows you to classify each receivable as current or overdue, directly reflecting your South Dakota Aging of Accounts Receivable. Implementing this calculation regularly can reveal trends in payment delays and help inform your collection strategies.

To calculate the aging of receivables, start by organizing your accounts receivable by invoice date. Then, categorize the invoices based on how long they have been outstanding, typically into ranges like 0-30 days, 31-60 days, and so on. This process helps you visualize the South Dakota Aging of Accounts Receivable, allowing you to manage collection efforts effectively. You can use accounting software for more efficient tracking.

Accounts receivable aging should ideally be performed regularly, such as monthly or quarterly, to ensure that you stay on top of outstanding invoices. Frequent aging reports help you recognize trends and address overdue accounts promptly. Using the South Dakota Aging of Accounts Receivable can greatly assist in optimizing your collection efforts and financial strategy.

The aging table of accounts receivables is a visual representation that lists all accounts due, alongside how long they have been outstanding. This table helps you quickly assess the state of your accounts and to pinpoint overdue invoices. By implementing the South Dakota Aging of Accounts Receivable, you can streamline your financial processes and ensure timely payments from customers.

Total gross receipts generally include all revenues from sales, services, and other business transactions before any deductions for refunds or allowances. In the context of South Dakota Aging of Accounts Receivable, understanding what is included helps in assessing your business's financial performance. Ensure you categorize your revenue correctly to maintain accuracy in your records.