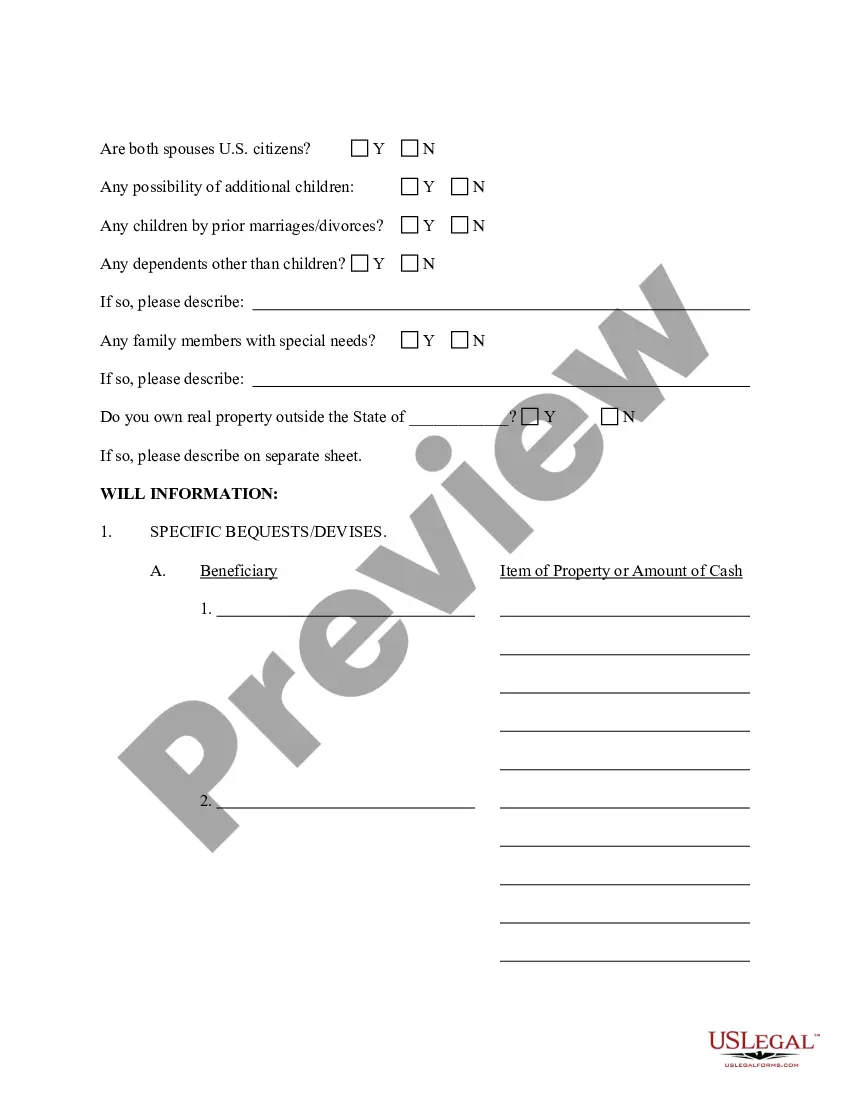

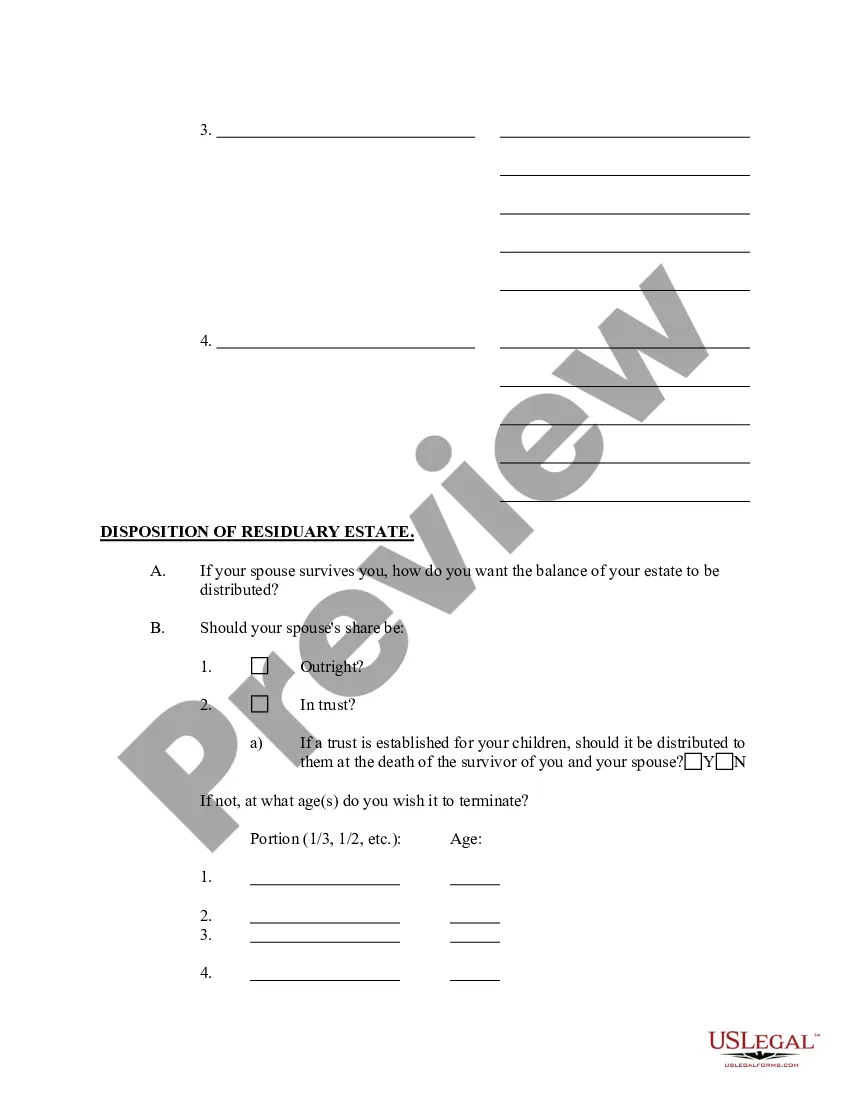

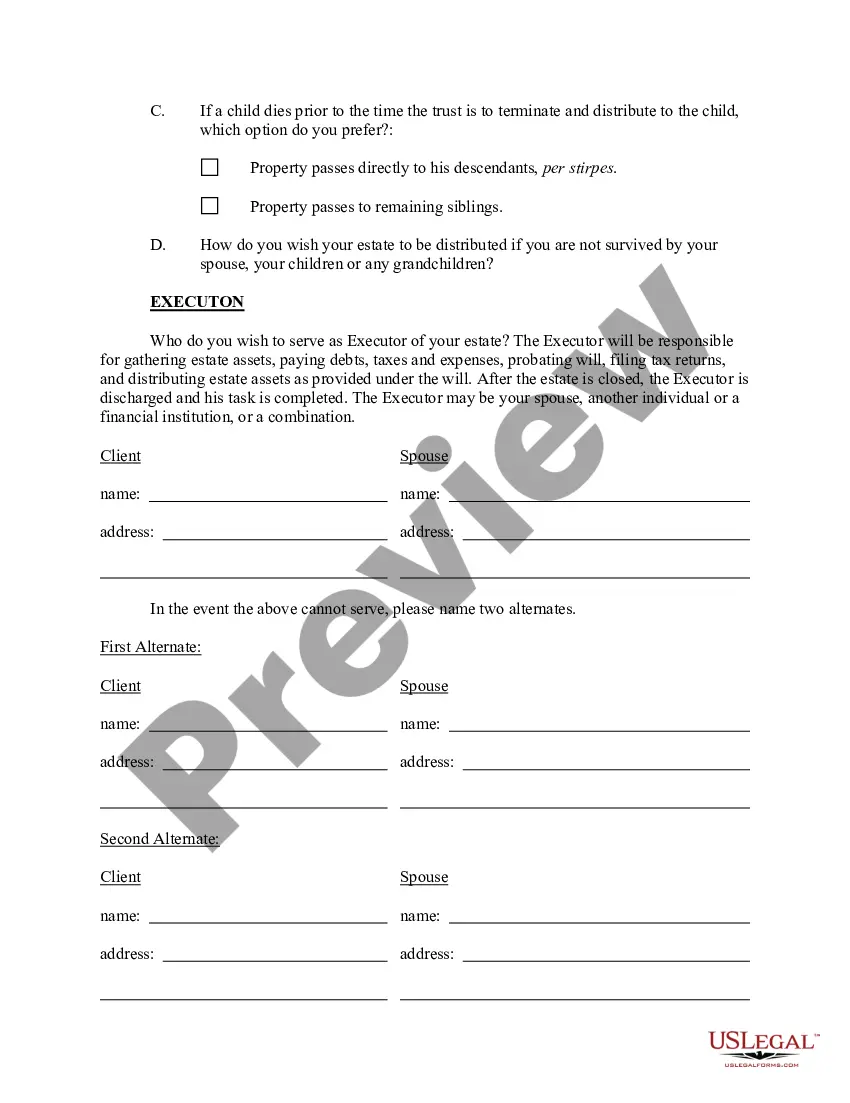

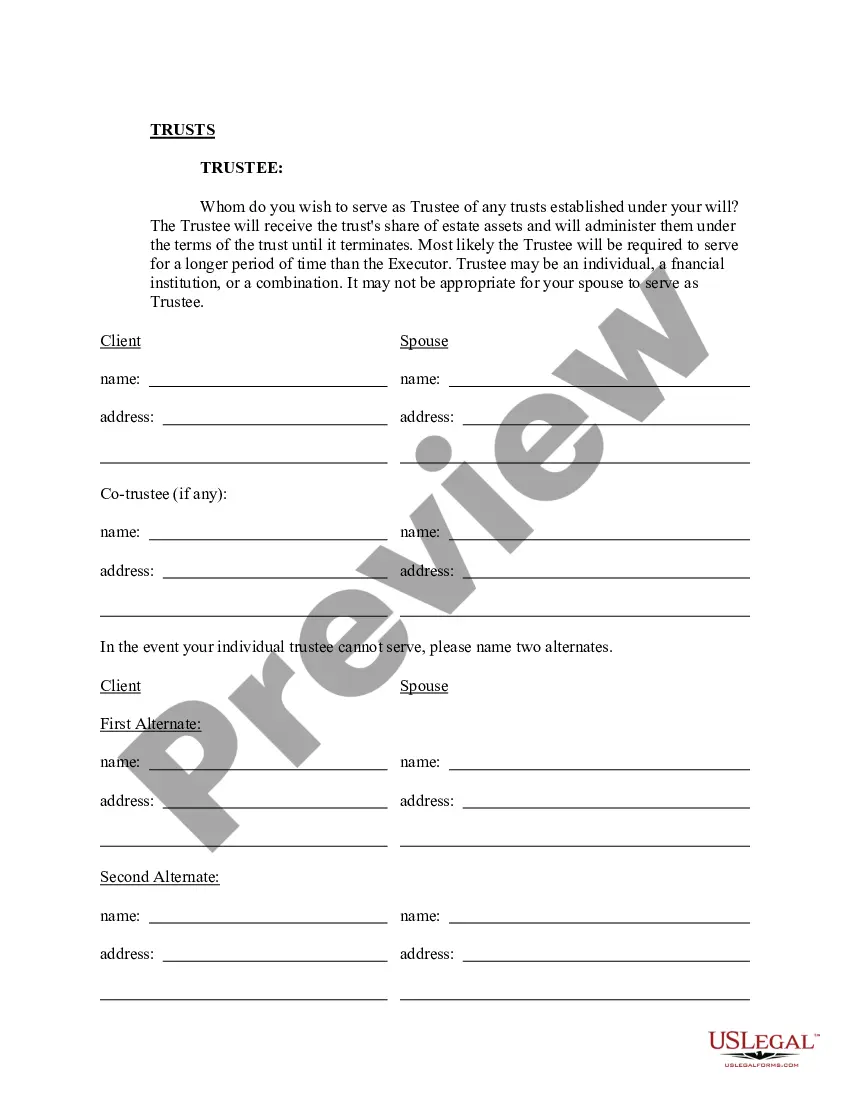

South Dakota Estate Planning Data Sheet

Description

How to fill out Estate Planning Data Sheet?

If you wish to complete, acquire, or produce authorized record templates, use US Legal Forms, the biggest variety of authorized varieties, which can be found on-line. Take advantage of the site`s easy and convenient research to find the files you will need. A variety of templates for organization and individual purposes are sorted by categories and claims, or search phrases. Use US Legal Forms to find the South Dakota Estate Planning Data Sheet in just a handful of mouse clicks.

Should you be currently a US Legal Forms client, log in to your bank account and click the Download key to get the South Dakota Estate Planning Data Sheet. You may also accessibility varieties you previously acquired from the My Forms tab of your respective bank account.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for that appropriate city/land.

- Step 2. Utilize the Preview solution to examine the form`s content material. Don`t overlook to read the description.

- Step 3. Should you be unhappy with all the kind, take advantage of the Search industry towards the top of the display screen to get other variations in the authorized kind web template.

- Step 4. When you have discovered the shape you will need, select the Acquire now key. Opt for the prices prepare you like and add your credentials to register for an bank account.

- Step 5. Process the purchase. You may use your bank card or PayPal bank account to finish the purchase.

- Step 6. Choose the structure in the authorized kind and acquire it on your own gadget.

- Step 7. Total, change and produce or indicator the South Dakota Estate Planning Data Sheet.

Each and every authorized record web template you acquire is yours eternally. You have acces to every single kind you acquired with your acccount. Go through the My Forms section and pick a kind to produce or acquire again.

Remain competitive and acquire, and produce the South Dakota Estate Planning Data Sheet with US Legal Forms. There are millions of skilled and status-certain varieties you can use for your personal organization or individual requirements.

Form popularity

FAQ

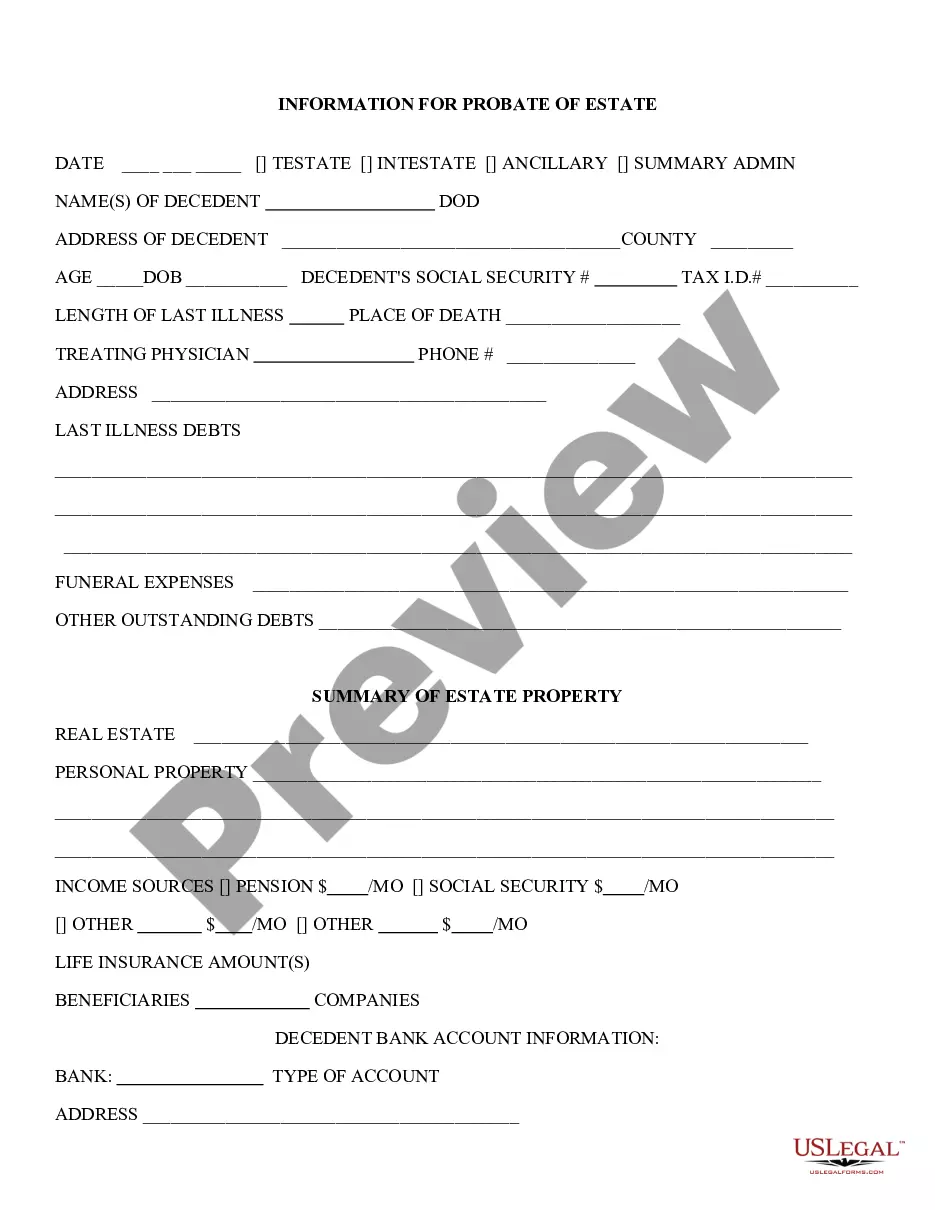

In South Dakota, when a person dies without leaving a will, the surviving spouse is entitled to receive the entire intestate estate unless the decedent was survived by descendants of a prior marriage or other relationship, in which event, the spouse receives $100,000.00 plus half of the remaining estate, plus certain ...

If you die intestate in South Dakota without a spouse but you have children, then your estate goes to your children in equal shares. If you don't have children, then your entire estate goes to your parents, if they are living. If you don't have surviving parents, then your siblings inherit everything.

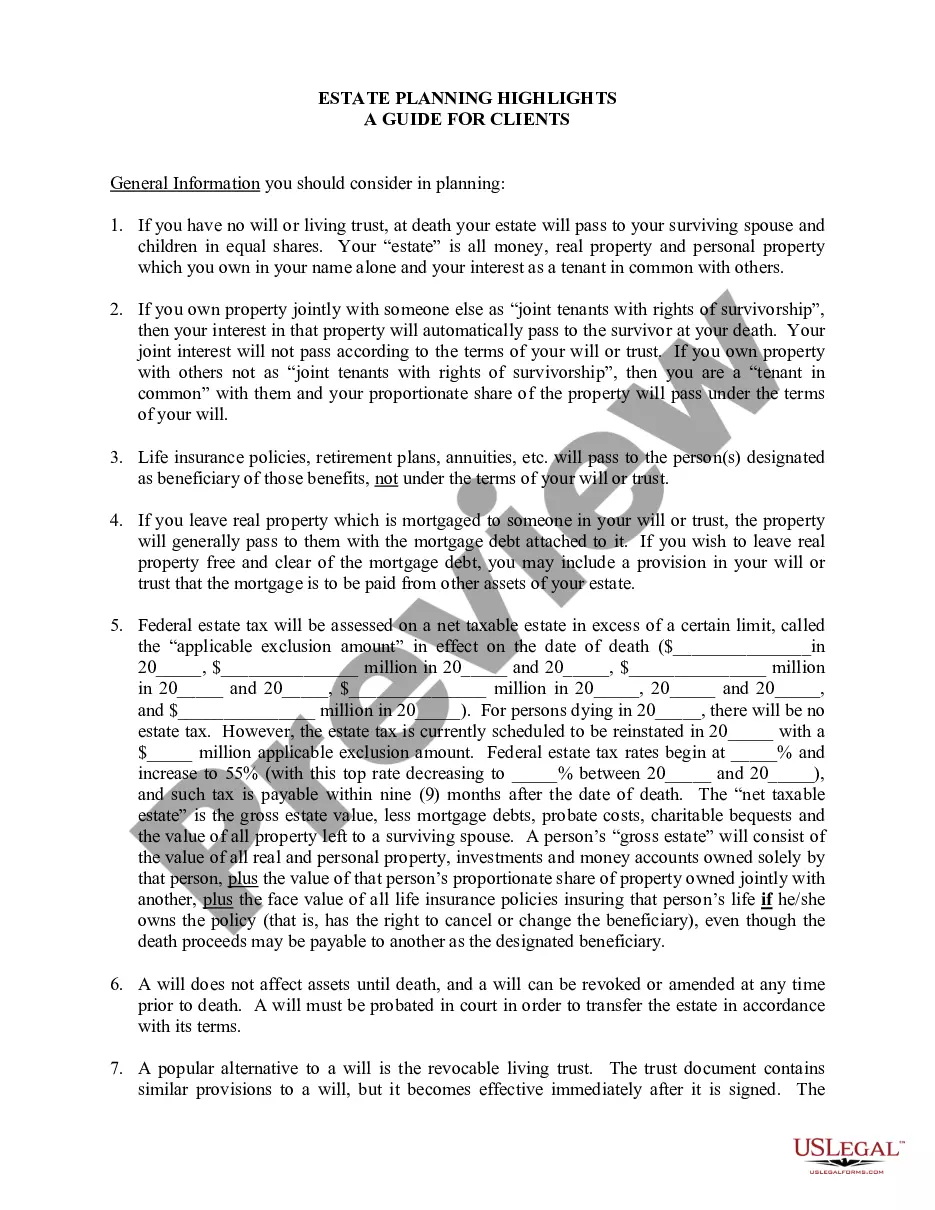

4 essential estate planning documents A will distributes assets upon death. A power of attorney manages finances. Advance care directives manage your health. A living trust is an alternative to a last will.

Inheritance Rights of Adult and Minor Children Unlike a spouse, an adult child generally has no legally protected right to inherit a deceased parent's property under state intestate succession laws.

The Estate Planning Must-Haves. Wills and Trusts. Durable Power of Attorney. Beneficiary Designations. Letter of Intent. Healthcare Power of Attorney. Guardianship Designations. Estate Planning FAQs.

You may be able to avoid probate in South Dakota using any of the following strategies: Establish a Revocable Living Trust. Title property in Joint Tenancy. Create assets/accounts that are TOD or POD (Transfer on Death; Payable on Death)

South Dakota does not have an inheritance tax. Another state's inheritance tax may apply, however, if you receive an inheritance from someone residing in a state that does have an inheritance tax.