South Dakota Escrow Agreement for Sale of Real Property with regard to Deposit of Earnest Money

Description

How to fill out Escrow Agreement For Sale Of Real Property With Regard To Deposit Of Earnest Money?

You can spend hours online searching for the legal document template that meets the federal and state specifications you will need.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

It is possible to obtain or create the South Dakota Escrow Agreement for Sale of Real Property pertaining to Deposit of Earnest Money from their services.

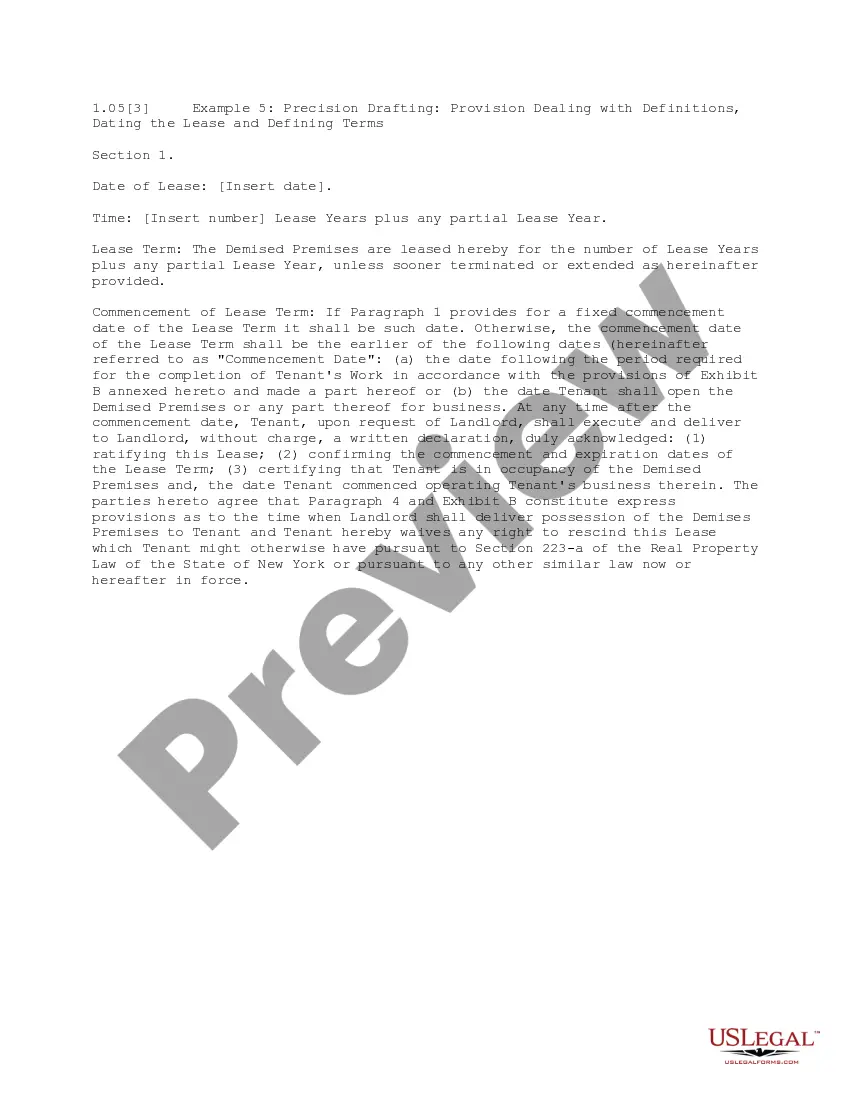

If available, utilize the Preview option to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Obtain option.

- Then, you can complete, edit, create, or sign the South Dakota Escrow Agreement for Sale of Real Property regarding Deposit of Earnest Money.

- Every legal document template you acquire is yours permanently.

- To access another copy of any obtained form, go to the My documents section and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your region/city of choice.

- Review the form description to confirm that you have selected the appropriate form.

Form popularity

FAQ

Earnest money is a deposit made to a seller that represents a buyer's good faith to buy a home. The money gives the buyer extra time to get financing and conduct the title search, property appraisal, and inspections before closing.

Earnest money is always returned to the buyer if the seller terminates the deal. While the buyer and seller can negotiate the earnest money deposit, it often ranges between 1% and 2% of the home's purchase price, depending on the market.

The earnest money can be held in escrow during the contract period by a title company, lawyer, bank, or brokerwhatever is specified in the contract. Most U.S. jurisdictions require that when a buyer timely and properly drops out of a contract, the money be returned within a brief period of time, say, 48 hours.

In an escrow agreement, one partyusually a depositordeposits funds or an asset with the escrow agent until the time that the contract is fulfilled. Once the contractual conditions are met, the escrow agent will deliver the funds or other assets to the beneficiary.

The deposit is paid to the seller on exchange of contracts as part payment of the purchase price. A request for a deposit over 10% should be questioned as it may not be legally enforceable because it amounts to a penalty on the buyer.

If an agent is managing the sale, the buyer pays the deposit to that agent. The agent will hold the deposit in their trust account until the settlement date, or transfer it to a conveyancer's or legal practitioner's trust account. If an agent is not managing the sale: the buyer pays the deposit directly to you.

Earnest money refers to the deposit paid by a buyer to a seller, reflecting the good faith of a buyer in purchasing a home. The money buys more time to the buyer before closing the deal to arrange for funding and perform the hunt for names, property valuation, and inspections.

It is a general rule that the buyer has to pay a deposit for the property. If the buyer fails to pay the deposit, the seller may not proceed with the sale of the property. This is to protect the interest of the seller, as when the buyer agrees to purchase a property, it has to be taken off the market.

Contracts need to involve an exchange of something valuable, referred to in legal terms as consideration. In the case of a real estate contract, that consideration would be the title (from the seller) and an earnest money deposit (from the buyer). Without that consideration, the contract is unenforceable.

Earnest money protects the seller if the buyer backs out. It's typically around 1 3% of the sale price and is held in an escrow account until the deal is complete. The exact amount depends on what's customary in your market.