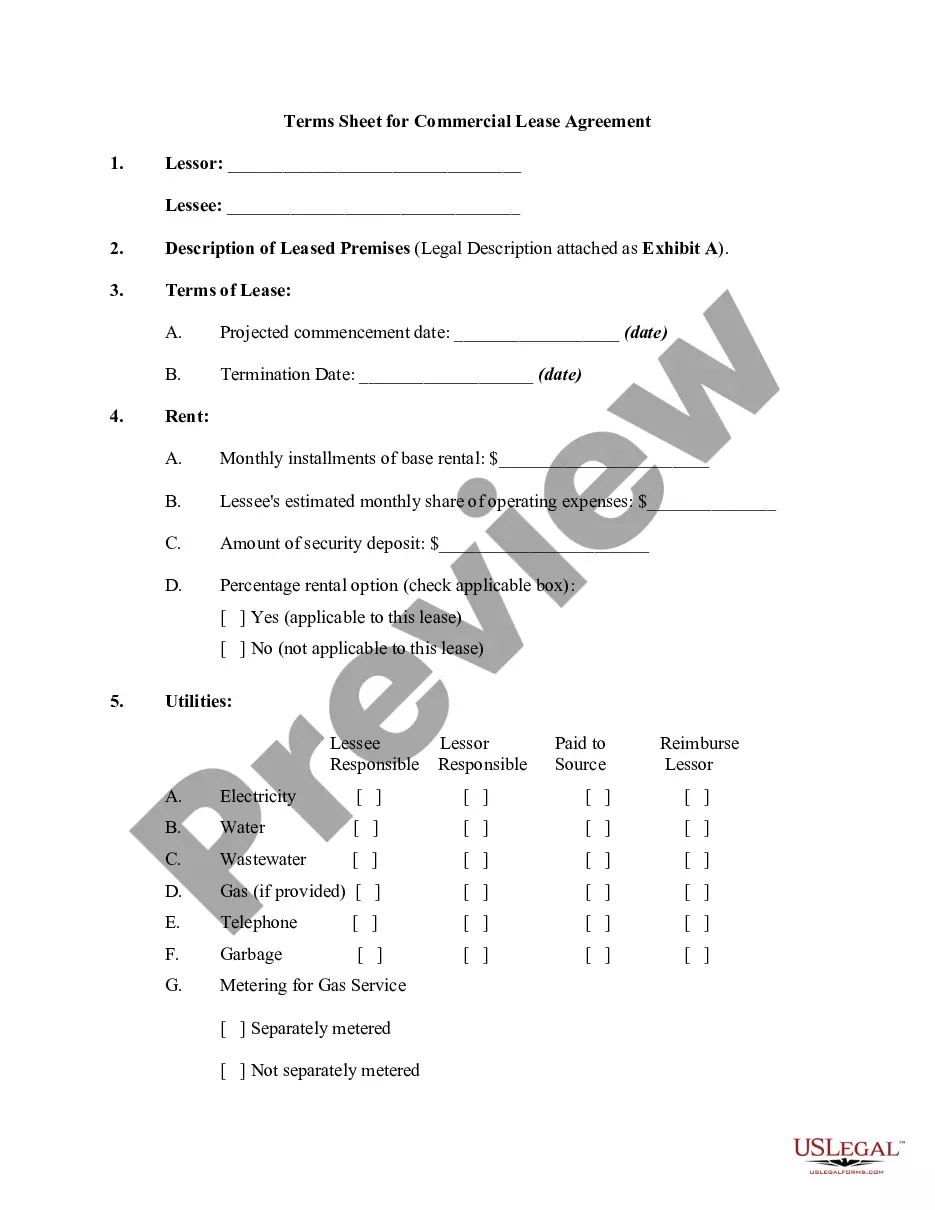

This office lease form states and lists the terms for the Demised Premises. It describes the number of lease years plus any partial lease year as well as the commencement of the lease term.

Arkansas Precision Drafting Provision Dealing with Definitions Dating the Lease and Defining Terms

Description

How to fill out Precision Drafting Provision Dealing With Definitions Dating The Lease And Defining Terms?

Finding the right lawful papers format can be a battle. Needless to say, there are tons of web templates available on the Internet, but how do you find the lawful develop you want? Utilize the US Legal Forms web site. The assistance offers thousands of web templates, like the Arkansas Precision Drafting Provision Dealing with Definitions Dating the Lease and Defining Terms, which can be used for organization and private requires. All the kinds are examined by professionals and meet state and federal demands.

When you are previously signed up, log in in your account and click on the Obtain option to have the Arkansas Precision Drafting Provision Dealing with Definitions Dating the Lease and Defining Terms. Make use of account to check throughout the lawful kinds you may have acquired in the past. Visit the My Forms tab of the account and obtain one more duplicate from the papers you want.

When you are a new customer of US Legal Forms, allow me to share basic guidelines that you should comply with:

- Initially, make sure you have chosen the right develop for your city/state. You can look over the form using the Preview option and browse the form information to make sure it is the right one for you.

- In case the develop fails to meet your expectations, take advantage of the Seach field to find the right develop.

- Once you are sure that the form is suitable, click the Purchase now option to have the develop.

- Select the prices program you would like and enter in the necessary details. Create your account and buy the transaction making use of your PayPal account or charge card.

- Opt for the file file format and download the lawful papers format in your device.

- Comprehensive, edit and print out and indicator the received Arkansas Precision Drafting Provision Dealing with Definitions Dating the Lease and Defining Terms.

US Legal Forms will be the most significant local library of lawful kinds where you can see various papers web templates. Utilize the company to download appropriately-created papers that comply with condition demands.

Form popularity

FAQ

Tax-exempt customers Some customers are exempt from paying sales tax under Arkansas law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Any materials used in the performance of non-taxable services, including initial installation in new construction, are not taxed to the customer; however, the business must self-assess, report, and pay sales tax as a withdrawal from inventory (stock) on the purchase price of the materials.

Arkansas imposes a tax based on the gross receipts from sales. Sales of tangible personal property or services to contractors and sales to consumers or users are generally subject to the gross receipts tax.

?Sale? includes the lease or rental of tangible personal property. Taxable services include sales of gas, water, electricity, most solid waste disposal, telephone and prepaid telecommunications and repair services. Repair and replacement parts for manufacturing machinery are generally taxable.

What is one important difference between a sublease and a lease assignment? In an assignment, responsibility for the original lease is transferred completely to the assignee. In a sublease, the original tenant retains primary responsibility for performance of the original lease contract.

The state Use Tax rate is the same as the Sales Tax rate, 6.500%. In addition, you are required to remit the city and/or county tax where the items are first delivered in Arkansas. A list of tax rates for cities and counties may be obtained from the Sales Tax and Use Tax Section or downloaded from our website.

The Arkansas gross receipts tax is a tax imposed upon the sale of tangible personal property and not the property itself. Thus, when a sale of tangible personal property occurs in Arkansas, a taxable event has occurred and the tax should be collected and remitted.

Verbal and Written Agreements California's Statute of Frauds requires a lease to be in writing if it either: 1. has a term longer than one year; or 2. has a term less than one year which expires more than one year after the agreement is reached.