In this form, the Buyer is assuming the indebtedness on a loan used to purchase a vehicle. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Dakota Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness

Description

How to fill out Conditional Sales Agreement Of Automobile Between Individuals And Assumption Of Outstanding Indebtedness?

Have you ever found yourself in a scenario where you consistently require documents for either business or personal purposes.

There is a multitude of legal document templates accessible on the web, but finding trustworthy ones can be challenging.

US Legal Forms offers an extensive array of template forms, including the South Dakota Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, designed to comply with both federal and state regulations.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can acquire an additional copy of the South Dakota Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness whenever needed. Simply click on the required form to download or print the document template.

Utilize US Legal Forms, one of the largest selections of legal documents, to save time and reduce errors. The service provides professionally crafted legal document templates suitable for a variety of purposes. Create your account on US Legal Forms and start making your life simpler.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the South Dakota Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- 1. Locate the form you need and ensure it is for the correct city/region.

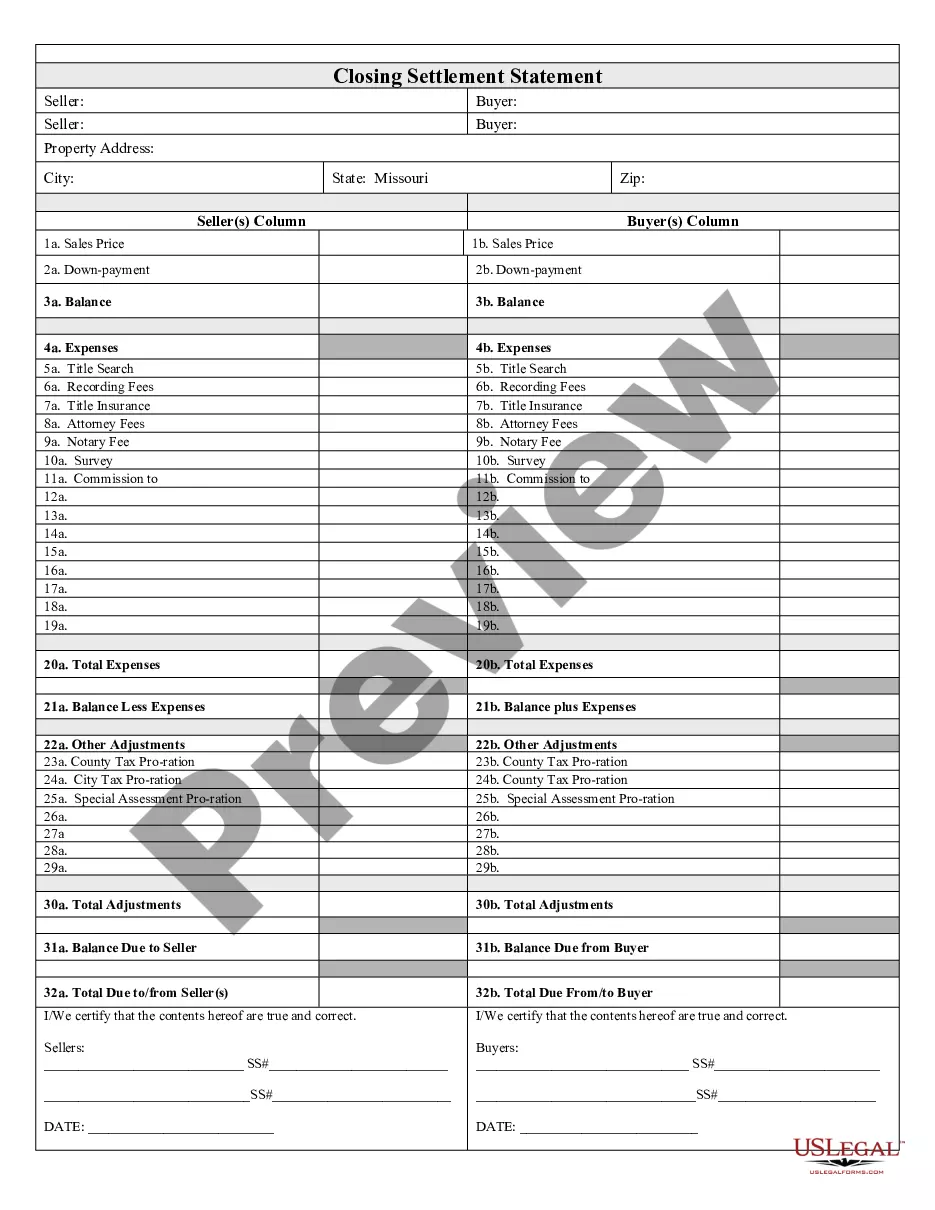

- 2. Utilize the Preview feature to review the form.

- 3. Read the description to confirm that you have selected the right form.

- 4. If the form isn't what you're looking for, use the Search box to find the form that suits your needs.

- 5. Once you have the correct form, click Buy now.

- 6. Choose the payment plan you wish, enter the required information to create your account, and purchase your order using PayPal or your credit card.

Form popularity

FAQ

To register a vehicle in South Dakota as a non-resident, you first need proof of ownership, which can be established with a bill of sale. Ensure that you have a completed application for vehicle title and registration and submit any necessary fees. Utilizing the South Dakota Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness can help clarify ownership if you're buying from a seller in the state. Consider using uslegalforms for templates and guidance throughout the process.

Creating a bill of sale for a vehicle without a title can seem challenging. However, you can draft a document that includes key details such as the vehicle's make, model, year, and VIN. Additionally, include a declaration stating the sale is valid despite the missing title. Incorporate the South Dakota Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness to formalize the transaction.

Acquiring a title for a car without one can be challenging, but it’s possible. First, you may need to provide evidence of ownership, such as a bill of sale or a completed South Dakota Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness. Contact the DMV for guidance on the specific steps and forms required in your case, as policies can vary by state and situation.

Creating your own bill of sale is straightforward. Start by including essential details such as the buyer's and seller's names, addresses, the vehicle's make and model, and the sale amount. It's beneficial to incorporate elements of the South Dakota Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness for clarity on any associated debts. This document helps both parties understand their responsibilities in the sale.

The West Virginia Department of Motor Vehicles (DMV) does not explicitly require a bill of sale for automobile transactions. However, it is highly recommended to create a bill of sale to document the agreement between individuals. This document can serve as proof of sale, especially if you utilize the South Dakota Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness. It helps clarify any details regarding the condition of the vehicle and outstanding debts.

Debts in South Dakota are generally considered uncollectible after six years, which aligns with the state’s statute of limitations. This timeframe varies depending on the nature of the debt, so it's crucial to verify specifics in your situation. If you are negotiating terms in a South Dakota Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, keeping this timeline in mind can help inform your decisions.

South Dakota has specific laws that govern slow-moving vehicles, especially those traveling less than 25 miles per hour. Such vehicles must display a slow-moving vehicle emblem to ensure visibility and safety. When purchasing a vehicle through a South Dakota Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, consider these regulations to stay compliant and safe on the roads.

In South Dakota, a debt becomes uncollectible after the six-year statute of limitations expires. This time frame applies to many types of debts, including those arising from conditional sales agreements. When engaging in a South Dakota Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, be aware of these limits to assert your rights effectively.

A debt collector can typically initiate a lawsuit within the statute of limitations period, which is six years in South Dakota. After this period, the collector may lose the ability to collect on the debt through legal action. Knowing this timeline is vital when dealing with agreements like the South Dakota Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness.

South Dakota does not have a specific right to cure law applicable to all debts. However, certain consumer protection statutes may offer some recourse for borrowers. If you're negotiating a South Dakota Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, it's beneficial to understand any available rights and options.