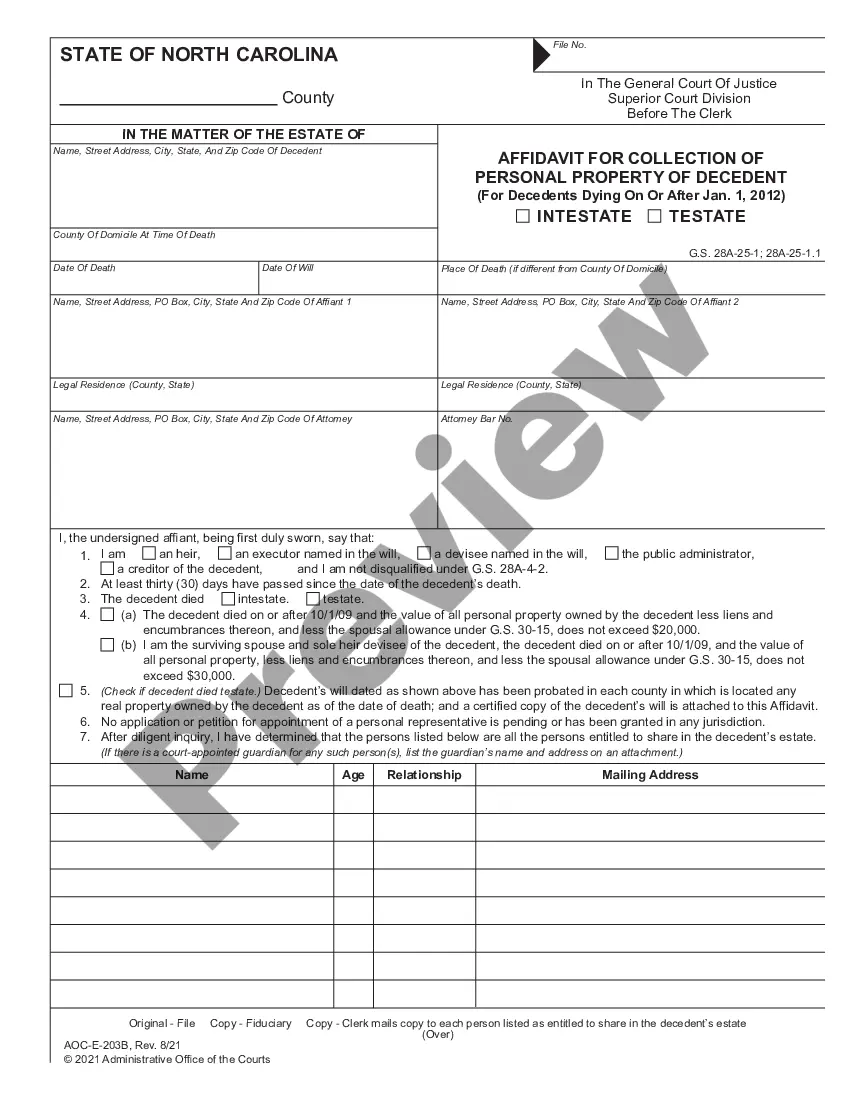

An heirship affidavit is used to state the heirs of a deceased person. It is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidavit to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate. The affidavit of heirship must also be signed by a notary public.

South Dakota Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Made By Someone Well-Acquainted with Decedent - Decedent having Spouse and Children at Death

Description

How to fill out Affidavit Of Heirship, Next Of Kin Or Descent - Heirship Affidavit Made By Someone Well-Acquainted With Decedent - Decedent Having Spouse And Children At Death?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal document templates that you can download or create.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords.

You can find the latest forms such as the South Dakota Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Created By Someone Familiar with Decedent - Decedent with Spouse and Children at Death within minutes.

If the form does not meet your needs, utilize the Search field at the top of the page to find one that does.

Once you are satisfied with the form, finalize your selection by clicking the Buy now button. Then, choose the payment plan you prefer and provide your information to register for the account.

- If you already have an account, Log In and download the South Dakota Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Created By Someone Familiar with Decedent - Decedent with Spouse and Children at Death from the US Legal Forms library.

- The Get button will appear on each form you view.

- You can access all previously saved forms in the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/region. Click the Preview button to check the form's content.

- Review the form details to confirm that you have chosen the correct form.

Form popularity

FAQ

Filling out an affidavit of death and heirship involves several key steps. First, provide the full name and date of death of the decedent, alongside their key details. Next, document the names and relationships of the heirs, ensuring that you highlight any surviving spouse and children. This process is crucial for the South Dakota Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Made By Someone Well-Acquainted with Decedent - Decedent having Spouse and Children at Death, and using a platform like uslegalforms can simplify this experience.

When filling in next of kin, specify the full names of the decedent's immediate family, including their spouse and children. Include additional details such as addresses, dates of birth, and the nature of each relationship. This information is essential for clarity and accuracy and forms a crucial part of the South Dakota Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Made By Someone Well-Acquainted with Decedent - Decedent having Spouse and Children at Death.

Documenting next of kin requires gathering pertinent details that showcase the relationship to the decedent. Start with the names and birth dates of all immediate family members, such as the spouse and children. Collect any additional supporting documents, like birth certificates or marriage licenses, to provide proof of relationships. Utilizing the South Dakota Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Made By Someone Well-Acquainted with Decedent - Decedent having Spouse and Children at Death will also help establish this documentation.

When writing a next of kin affidavit, begin by identifying yourself and your relationship to the decedent. Clearly state the decedent's name and relevant details, such as their date of birth and death. List all immediate family members, including spouse and children, to establish the heirship. It is crucial that this document adheres to the guidelines surrounding the South Dakota Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Made By Someone Well-Acquainted with Decedent - Decedent having Spouse and Children at Death.

To fill out an affidavit example effectively, start by clearly stating the purpose at the top. Include the full names and addresses of the decedent and the affiant. In the sections following, detail the relationship between the affiant and the decedent, specifically noting any spouse and children involved. Ensure all information is accurate and truthful, as the South Dakota Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Made By Someone Well-Acquainted with Decedent - Decedent having Spouse and Children at Death must be reliable.

An affidavit of heirship should be filled out by someone who has personal knowledge of the decedent’s family and the circumstances surrounding their estate. This person often includes relatives or close friends who can truthfully identify heirs and their relationships to the decedent. Utilizing the South Dakota Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Made By Someone Well-Acquainted with Decedent - Decedent having Spouse and Children at Death can clarify this important process.

To fill out a proof of heirship affidavit, start by collecting necessary documents that confirm your relationship to the decedent. The affidavit must clearly state the relationship, any relevant facts, and should be signed by someone well-acquainted with the decedent. Using the South Dakota Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Made By Someone Well-Acquainted with Decedent - Decedent having Spouse and Children at Death will help ensure you meet legal requirements effectively.

Filling out an affidavit of heirship form requires gathering relevant information about the decedent and the heirs. You will need to provide personal details such as names, relationships to the decedent, and any important dates. Utilize the South Dakota Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Made By Someone Well-Acquainted with Decedent - Decedent having Spouse and Children at Death template from USLegalForms to simplify this process and ensure accuracy.

In South Dakota, a notary public can notarize an affidavit of heirship. This official verifies the identity of the signer and witnesses the signing of the document, ensuring its legality. It is crucial to have a credible notary involved, especially when completing the South Dakota Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Made By Someone Well-Acquainted with Decedent - Decedent having Spouse and Children at Death.

To prove you are an heir, you typically need to provide documentation that establishes your relationship to the decedent. This may include birth certificates, marriage certificates, or other legal documents that trace your lineage. The South Dakota Affidavit of Heirship, Next of Kin or Descent - Heirship Affidavit Made By Someone Well-Acquainted with Decedent - Decedent having Spouse and Children at Death can serve as a valuable tool in identifying the rightful heirs.