An heirship affidavit is used to state the heirs of a deceased person. It is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidavit to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate. The affidavit of heirship must also be signed by a notary public.

South Dakota Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate

Description

How to fill out Affidavit Of Heirship, Next Of Kin Or Descent - Decedent Died Intestate?

Are you in a circumstance where you require documents for either corporate or personal purposes almost every business day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides a vast collection of document templates, such as the South Dakota Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate, which are designed to meet state and federal requirements.

Utilize US Legal Forms, the most comprehensive collection of legal documents, to save time and avoid mistakes.

The platform offers professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can access the South Dakota Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and ensure it is suitable for the correct town/county.

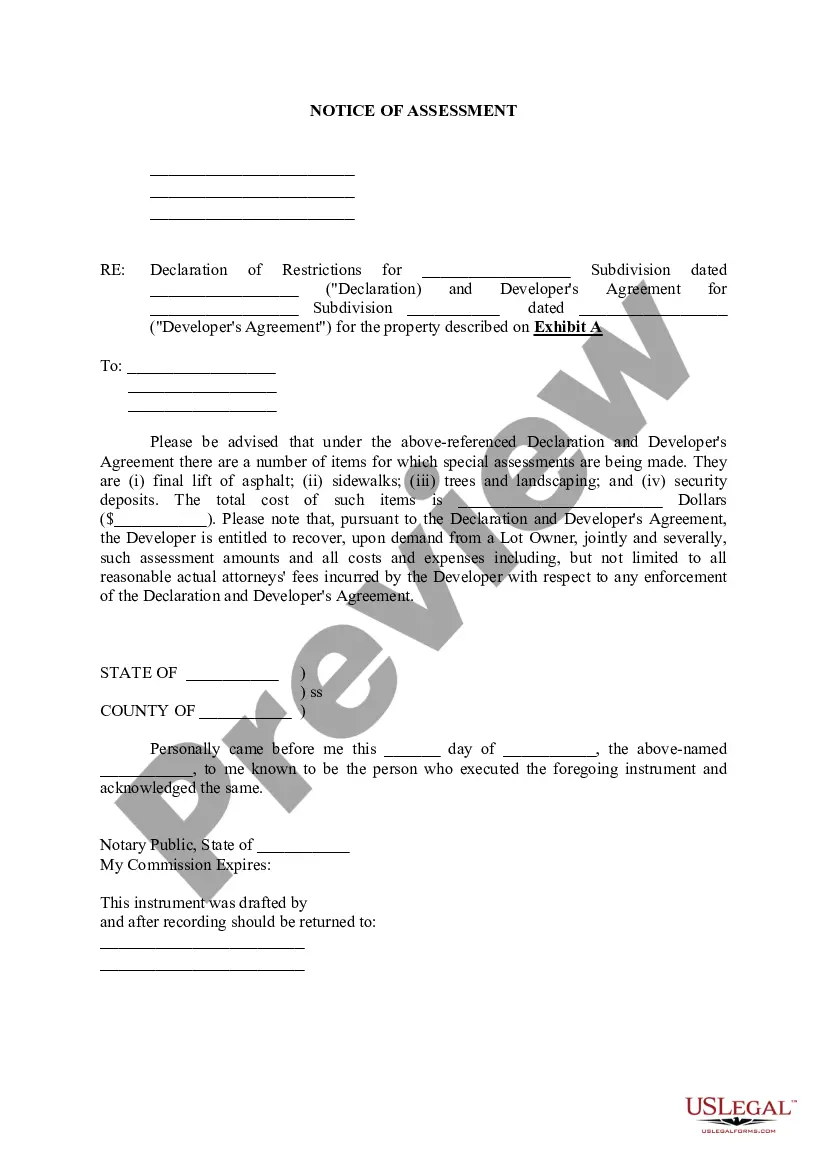

- Utilize the Review button to examine the document.

- Check the description to confirm you have selected the right template.

- If the document is not what you are seeking, use the Research section to locate a form that fits your needs and requirements.

- Once you find the correct form, click Buy now.

- Choose the pricing plan you want, complete the required information for payment, and pay for your order using PayPal or credit card.

- Select a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents section.

- You can obtain another copy of the South Dakota Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate at any time if necessary. Just select the desired form to download or print the document template.

Form popularity

FAQ

Yes, an affidavit of death generally needs to be notarized to be legally binding. Notarization provides an official verification of the identities of the signers and ensures that the document complies with state laws. When handling a South Dakota Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate, be sure to have the affidavit notarized to avoid potential disputes regarding validity.

In New York, an affidavit of heirship must be signed by the surviving heirs who can verify their relationship to the deceased. This document serves as proof of heirship and establishes the rights of the heirs to the estate. It is important to note that while this affidavit is valuable in New York, the process may differ slightly from the South Dakota Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate.

In South Dakota, intestate succession dictates how the estate of a deceased person is divided when there is no will. Typically, the surviving spouse inherits half of the estate, while the remaining half goes to the children. If there are no children, the estate may pass to parents, siblings, or further relatives, guided by the rules stated in the South Dakota Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate.

Filling out an affidavit of next of kin involves providing information about the deceased and their familial relationships. Begin by listing the full name and address of the deceased, followed by the names and relationships of the next of kin. It is important to ensure your details reflect the facts accurately, as this affidavit serves to support any claims to the estate under South Dakota Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate.

In South Dakota, the surviving heirs typically file the affidavit of heirship. This document helps establish who inherits the decedent's assets when they die without a will. Therefore, it is essential for heirs to understand their rights under the South Dakota Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate to facilitate the transfer of property.

To fill out a South Dakota Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate, begin by gathering necessary details about the deceased, such as their full name, date of death, and last known address. Next, provide information about the heirs, including their names, relationships to the deceased, and contact information. Ensure you complete all sections clearly and accurately, as any mistakes could delay the process.

When someone dies without a will in South Dakota, the state laws govern how their assets are distributed. This process is known as intestate succession. Generally, the deceased's assets will be distributed to their next of kin, which may include spouses, children, and parents. To formalize the transfer of these assets, heirs may need to complete a South Dakota Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate, which can simplify the process of proving their relationship to the deceased.

The next of kin in South Dakota generally refers to the closest living relatives of the decedent. This can include the spouse, children, parents, siblings, and even more remote relatives if necessary. Determining the next of kin is important for legal proceedings, including handling the South Dakota Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate, ensuring a smooth transition of assets.

An intestate estate in South Dakota is divided according to the state's intestacy laws. If the decedent has a spouse and children, the spouse shares the estate with the children. If there are no children, the spouse receives the entire estate. This division is key in any South Dakota Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate.

In South Dakota, the first in line for inheritance is typically the decedent's surviving spouse and children. If there are no children, the spouse inherits everything. This clear hierarchy ensures that loved ones receive what they are entitled to under intestate laws. Utilizing the South Dakota Affidavit of Heirship, Next of Kin or Descent - Decedent Died Intestate can simplify the process for those involved.