A disclaimer deed is a deed in which a spouse disclaims any interest in the real property acquired by the other spouse. A mortgage company often asks a borrower to sign a disclaimer deed so that his spouse not having her name on the loan, cannot claim any interest in the property.

South Dakota Disclaimer Deed

Description

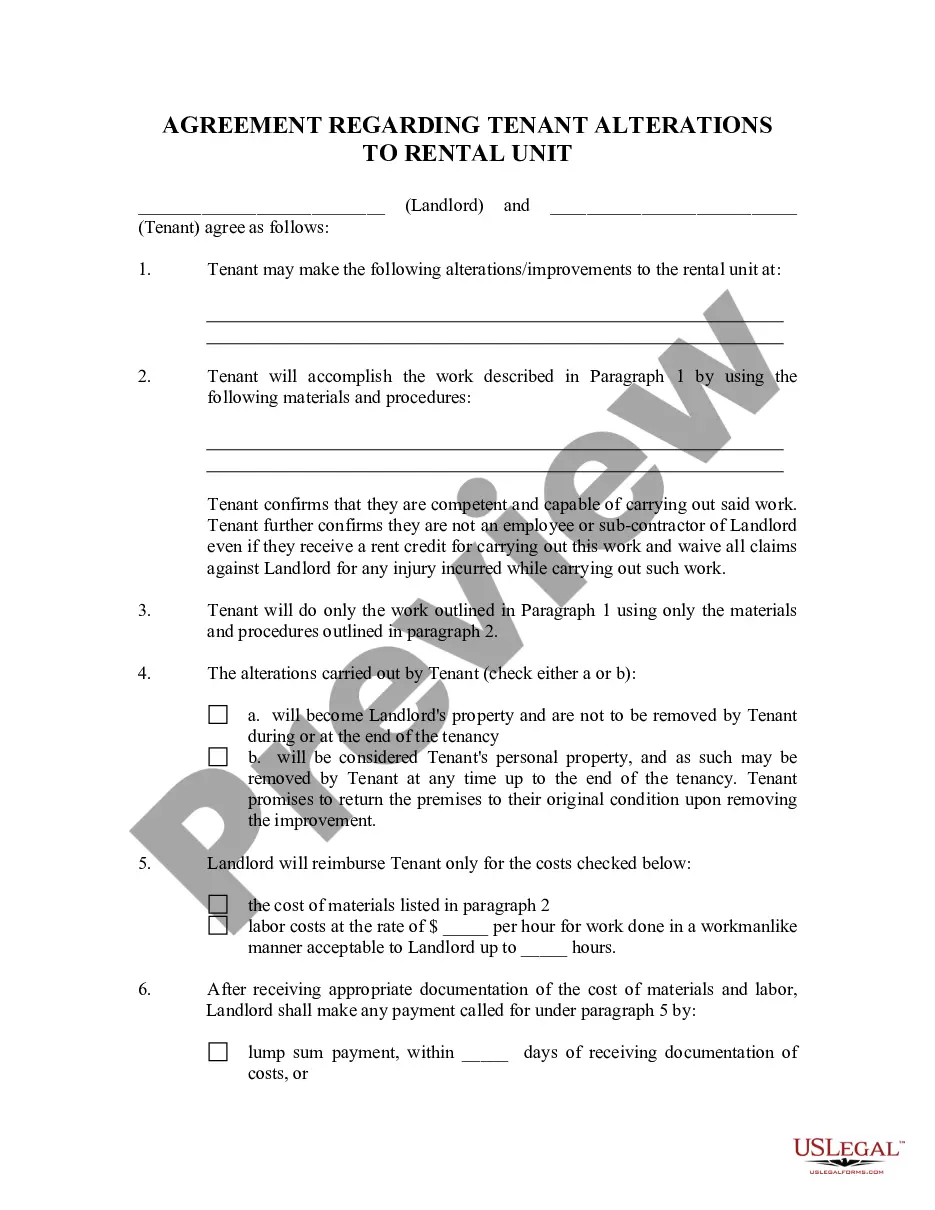

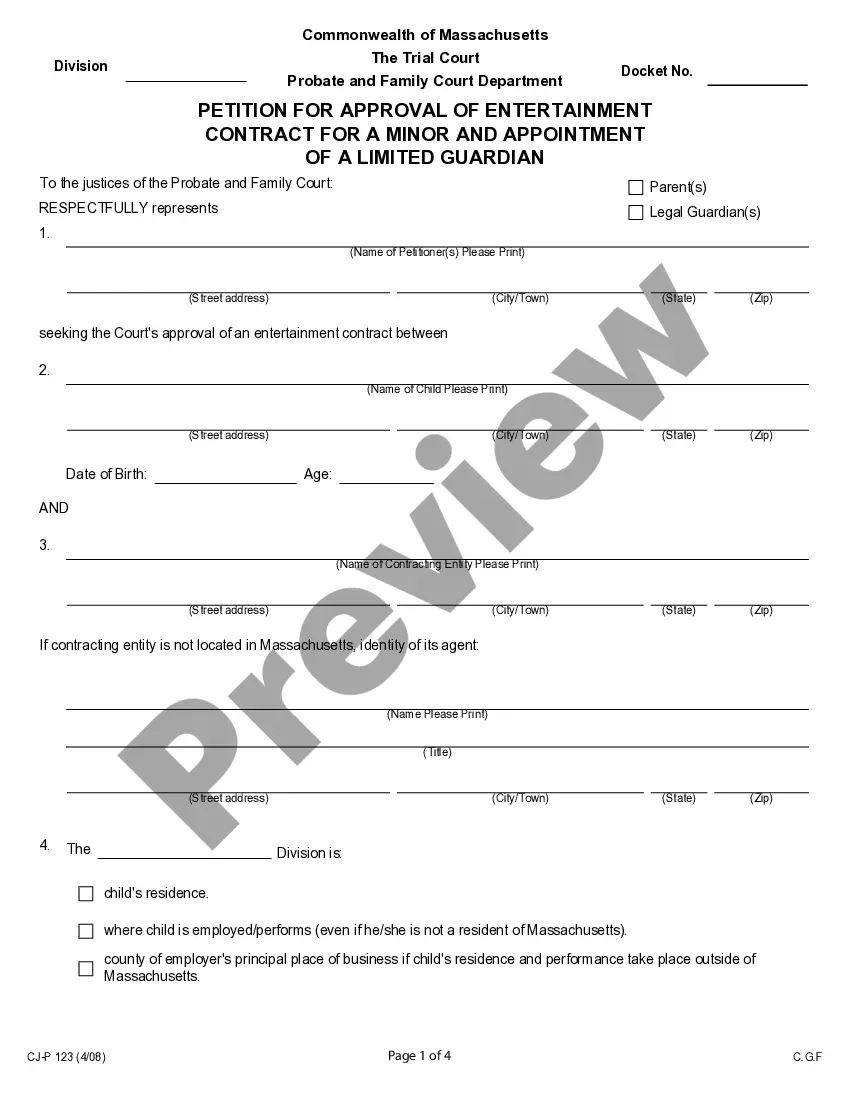

How to fill out Disclaimer Deed?

If you need to aggregate, retrieve, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search feature to locate the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to acquire the South Dakota Disclaimer Deed in just a few clicks.

Every legal document template you purchase is yours indefinitely. You will have access to every form you downloaded within your account. Go to the My documents section and select a form to print or download again.

Stay proactive and download, and print the South Dakota Disclaimer Deed with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms member, sign in to your account and click the Download button to access the South Dakota Disclaimer Deed.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct jurisdiction.

- Step 2. Utilize the Review option to examine the form’s content. Remember to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Get now button. Choose your preferred payment plan and enter your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the South Dakota Disclaimer Deed.

Form popularity

FAQ

The 22-42-5 law in South Dakota addresses the legal framework for a Disclaimer Deed. This law allows property owners to transfer property without admitting to any debts or obligations associated with that property. In essence, it protects the grantor from liability while ensuring the transfer is legally recognized. If you need assistance with drafting or understanding a South Dakota Disclaimer Deed, consider exploring the resources available at US Legal Forms.

The 43 4 38 law in South Dakota pertains to the rules surrounding the transfer of real property and outlines specific procedures for deeds, including disclaimer deeds. This law ensures that property transfers are conducted fairly and in accordance with state regulations. Understanding this law can provide clarity on how a South Dakota Disclaimer Deed operates within the broader legal framework.

Common mistakes with quitclaim deeds include failing to properly execute the document or not including all necessary parties. Additionally, not recording the deed with the appropriate county office can lead to ownership disputes. Utilizing a South Dakota Disclaimer Deed instead, when applicable, can help clarify ownership and prevent misunderstandings in property transfers.

Yes, South Dakota does allow for a Transfer on Death Deed, which enables property owners to designate beneficiaries who will receive the property upon their death. This type of deed is a useful estate planning tool that simplifies the transfer process and avoids probate. It complements the South Dakota Disclaimer Deed by offering another method to manage property succession.

Individuals may choose to disclaim property for various reasons, such as avoiding debt, managing tax implications, or simply not wanting the property. A South Dakota Disclaimer Deed can streamline the process by allowing the individual to relinquish their interest without the need for complicated legal proceedings. This option can lead to a smoother estate settlement.

In an estate context, a South Dakota Disclaimer Deed allows heirs to formally decline their inheritance. This can be beneficial if the property carries debts or responsibilities that the heir does not want to assume. By disclaiming, the property can pass directly to the next eligible beneficiary without complications.

A South Dakota Disclaimer Deed effectively removes a person's claim to a property. When executed, this deed prevents the disclaimed interest from being part of the estate or transferred to others. It serves to clarify ownership and can help avoid disputes among heirs regarding property rights.

The purpose of a disclaimer is to enable individuals to avoid unwanted responsibilities or liabilities associated with a property. For example, if you inherit a property that requires significant upkeep or has outstanding debts, a South Dakota Disclaimer Deed allows you to refuse your interest. This helps in simplifying estate matters and ensures that the property can be transferred smoothly to the next beneficiary.

A South Dakota Disclaimer Deed is a legal document that allows a person to refuse or disclaim their interest in a property. This deed is often used in estate planning or when someone inherits property they do not wish to keep. By executing this deed, the individual formally relinquishes any rights to the property, ensuring that it passes to another party.