South Dakota Personal Monthly Budget Worksheet

Description

How to fill out Personal Monthly Budget Worksheet?

Have you ever been in a situation where you require documents for either professional or personal purposes almost every day.

There are countless legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of template forms, like the South Dakota Personal Monthly Budget Worksheet, which are designed to comply with federal and state regulations.

Choose a convenient file format and download your copy.

View all the document templates you have purchased in the My documents section. You can obtain an additional copy of the South Dakota Personal Monthly Budget Worksheet at any time, if needed. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Dakota Personal Monthly Budget Worksheet template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Use the Preview button to review the form.

- Read the description to make sure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the right form, click Acquire now.

- Select the pricing plan you want, fill in the necessary information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

Form popularity

FAQ

The 3 P's of budgeting refer to Prioritization, Planning, and Performance evaluation. First, prioritize your essential expenses to ensure your needs are met. Following this, use the South Dakota Personal Monthly Budget Worksheet for planning your monthly goals, and finally, review your financial performance to see where you can improve.

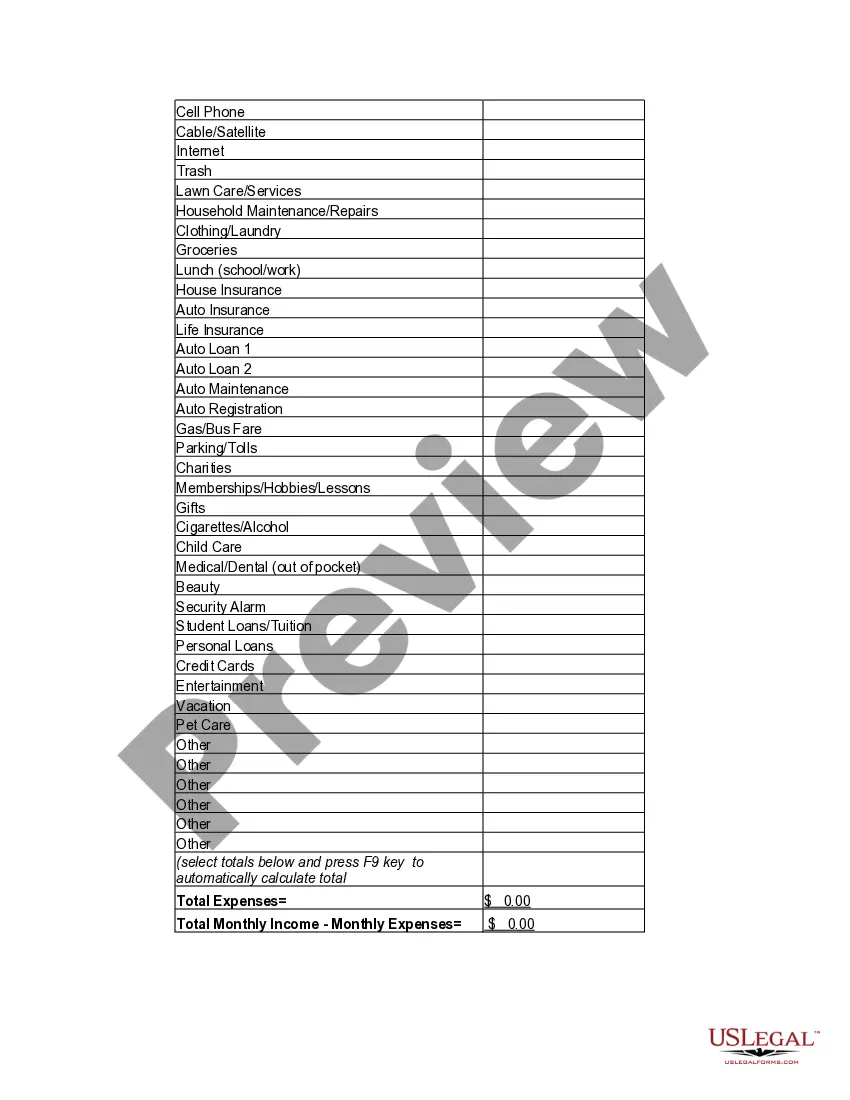

Writing a monthly budget example starts with detailing your expected income and expenses. You might set up a table format, showing the income streams on one side and expense categories on the other. Using the South Dakota Personal Monthly Budget Worksheet, you can visualize your financial situation, helping you to manage your resources effectively.

Filling out a monthly budget sheet involves entering your estimated income at the top, followed by your anticipated expenses. Use the South Dakota Personal Monthly Budget Worksheet to allocate amounts to specific categories like savings or debt repayment. Review your entries periodically to ensure you stay on track and make adjustments as needed.

To record a monthly budget, start by listing your income sources, such as salaries or other earnings. Next, create a list of all your expenses, including housing, utilities, groceries, and entertainment. The South Dakota Personal Monthly Budget Worksheet can help you categorize these entries clearly, making it easier to track your finances throughout the month.

Yes, Excel offers a variety of personal budget templates that you can customize for your needs. The South Dakota Personal Monthly Budget Worksheet can be enhanced with Excel's features, allowing for easy calculations and tracking. By using an Excel template, you can visually manage your finances and make informed decisions regarding your spending habits.

The 50 20 30 budget rule is a simple method to allocate your income. According to this rule, allocate 50% for necessities, 20% for savings, and 30% for wants. Using the South Dakota Personal Monthly Budget Worksheet can help you categorize and adhere to this guideline effectively, promoting a balanced approach to spending.

Creating a personal monthly budget involves assessing your income and listing all expenditures in the South Dakota Personal Monthly Budget Worksheet. Begin by calculating your total income, then itemize your expenses, ensuring you differentiate between essential and discretionary spending. Regularly review and adjust your budget to reflect any changes in your financial situation, allowing for better financial management.

To set up a personal budget spreadsheet using the South Dakota Personal Monthly Budget Worksheet, start by listing your monthly income sources. Next, categorize your expenses into fixed and variable sections. Fill in the corresponding amounts, ensuring that your total expenses do not exceed your income. This structured approach simplifies tracking your financial health.

A good monthly personal budget is one that balances your income with your needs, wants, and savings. It should reflect your lifestyle while ensuring you are prepared for unexpected expenses. The 50/30/20 rule offers a clear structure for creating this budget. For optimal organization, consider using a South Dakota Personal Monthly Budget Worksheet to fine-tune your financial plan and ensure it works for you.

The 50/30/20 rule budget is a financial planning strategy that divides your after-tax income into three categories: needs, wants, and savings. This rule encourages you to prioritize essential expenditures, enjoy personal spending, and save for future goals. Implementing this budget can lead to improved financial stability. A South Dakota Personal Monthly Budget Worksheet helps you keep track of these categories with ease.