South Dakota Monthly Retirement Planning

Description

How to fill out Monthly Retirement Planning?

If you need to complete, acquire, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s straightforward and convenient search tool to locate the documents you require.

Numerous templates for business and personal use are categorized by type and state, or keywords.

Every legal document template you purchase is yours permanently. You can access any form you saved in your account.

Go to the My documents section to select a form to print or download again. Stay proactive and acquire and print the South Dakota Monthly Retirement Planning using US Legal Forms. There are various professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to obtain the South Dakota Monthly Retirement Planning with a few clicks.

- If you are already a user of US Legal Forms, Log In to your account and click the Download button to access the South Dakota Monthly Retirement Planning.

- You can also view forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

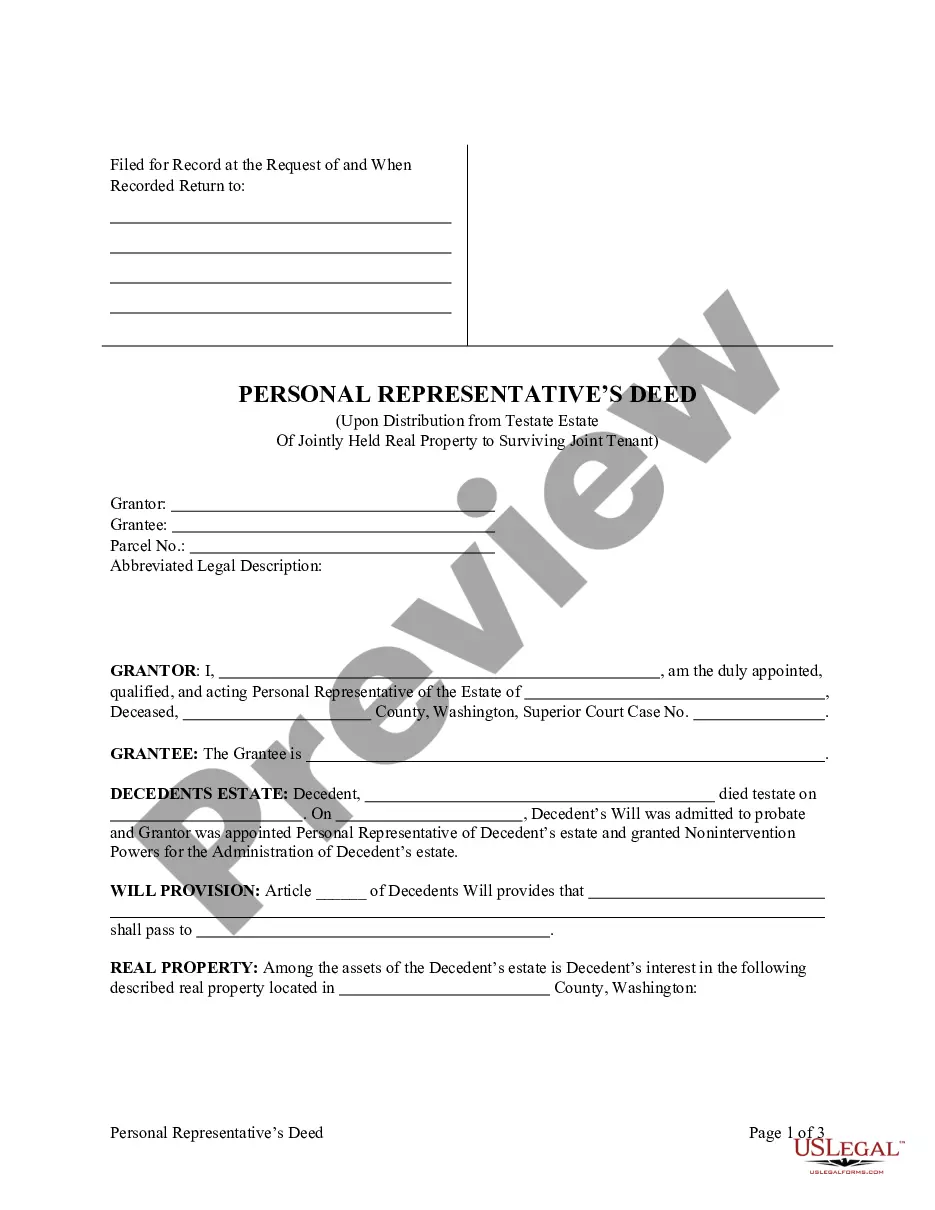

- Step 2. Use the Preview feature to review the form’s details. Make sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the payment option you prefer and provide your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize your purchase.

- Step 6. Retrieve the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the South Dakota Monthly Retirement Planning.

Form popularity

FAQ

Normal retirement age is 65 with three years of service. Early retirement age is 55 with three years of service with unreduced benefits upon attaining Rule of 85 (age plus service equals or exceeds 85). Early retirement reduction with less than 20 years of service is 3% per year.

So can you retire at 55 and collect Social Security? The answer, unfortunately, is no. The earliest age to begin drawing Social Security retirement benefits is 62.

The minimum retirement age is 50, 52, or 55 years depending on the retirement formula associated to the service credit on your account. Your monthly benefit may or may not increase if you wait to retire.

What's Included in the Offer? While the specifics vary, the heart of an early retirement package is invariably a severance payment comprising weeks, months, or even years of wages. That sum may be sweetened by such additions as paid insurance and outplacement services to aid your transition to a new job.

If you retire at 20 years service you get 40% of your final base pay. If you retire at 30 years service you get 60% of your final base pay. You can either get your full retirement when eligible or opt to get a lump-sum benefit at retirement.

SDRS benefits are based on the member's final average compensation, the member's years of credited service, and a benefit multiplier. Retirement benefits are payable for member's lifetime. Surviving spouse benefits are also available.

The South Dakota Retirement System is a 401(a) defined benefit public retirement plan operated for the sole benefit of its members and beneficiaries. Elements key to the system are the Board of Trustees, the Retirement Laws Committee of the Legislature, the SDRS staff, and the State Investment Council.

The California Public Employees Retirement System (CalPERS) offers a defined benefit retirement plan. It provides benefits based on members years of service, age, and final compensation.