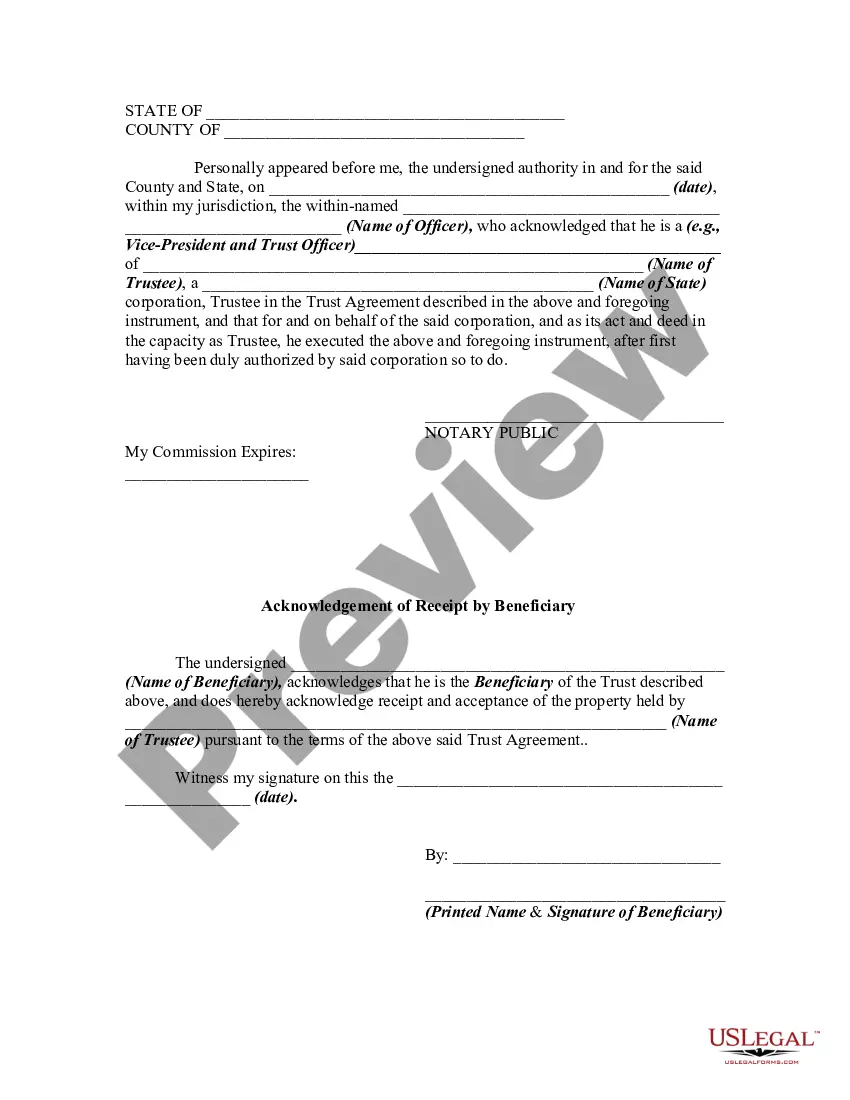

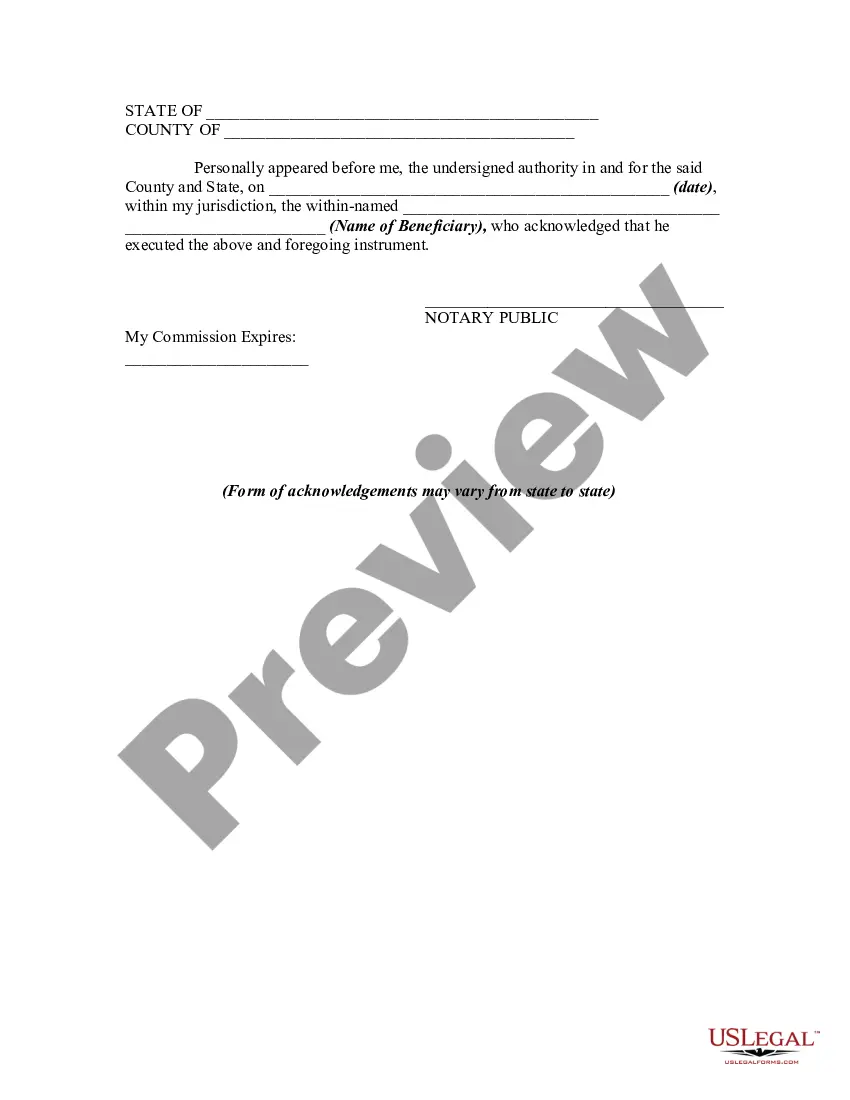

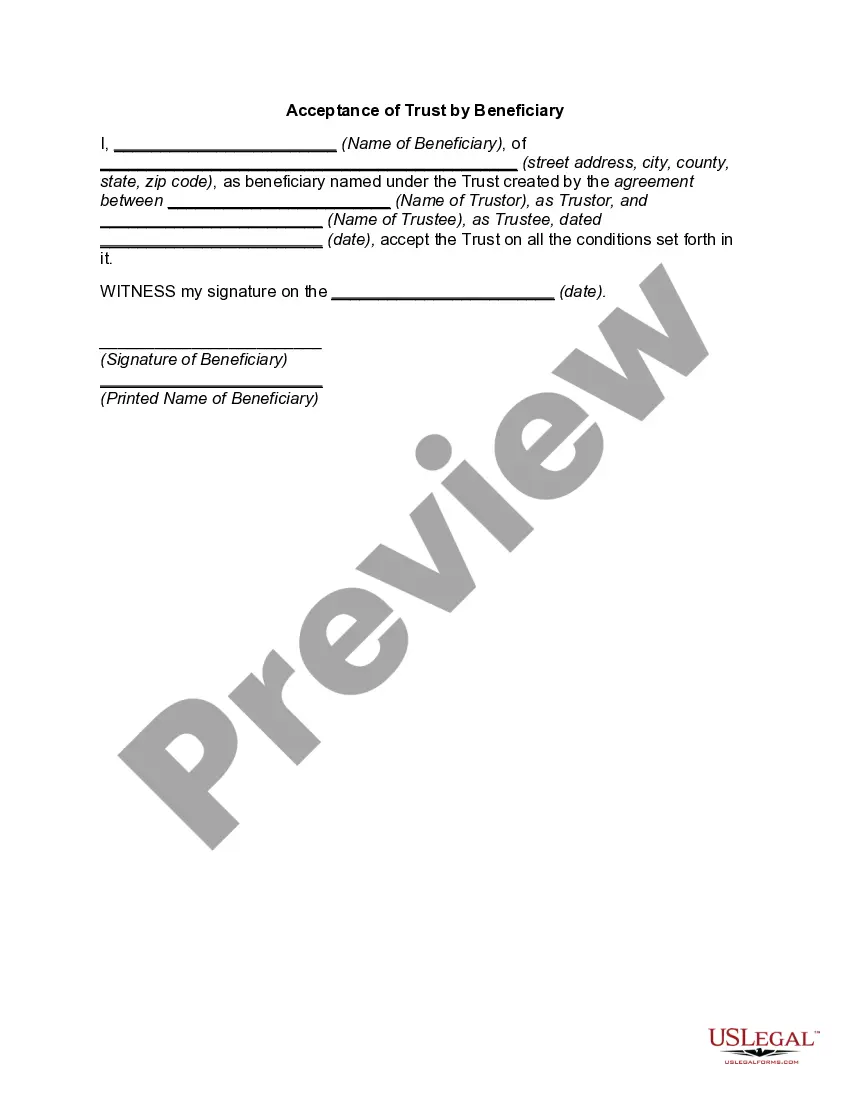

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary

Description

How to fill out Release By Trustee To Beneficiary And Receipt From Beneficiary?

Are you presently in a position where you frequently require documents for either business or personal purposes.

There are numerous approved form templates accessible online, but finding reliable types can be challenging.

US Legal Forms provides thousands of document templates, such as the South Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary, that are designed to comply with state and federal regulations.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of South Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary at any time, if needed. Simply choose the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the South Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct state/region.

- Utilize the Review feature to review the form.

- Examine the description to confirm that you have selected the appropriate document.

- If the form is not what you are looking for, use the Search section to find the form that fits your needs and requirements.

- Once you find the correct form, click Get now.

- Choose the subscription plan you want, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- Select a suitable document format and download your copy.

Form popularity

FAQ

A trustee can remove a beneficiary through a formal process that often involves creating a South Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary. This document outlines the trustee's decision to release the beneficiary from the trust, ensuring clarity and legal compliance. It's essential to follow state laws and the trust’s terms to avoid potential disputes. For effective management of this process, consider using the US Legal Forms platform, which offers tailored documents and guidance to simplify these transactions.

A receipt and release of trustee is a formal acknowledgment from the beneficiaries confirming they have received their distributions and agree to the terms set out by the trustee. This document usually references the South Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary, solidifying the agreement that beneficiaries will not pursue further claims. Using resources such as US Legal Forms can help ensure that this document is completed accurately.

A release from beneficiaries is a legal document wherein beneficiaries relinquish their rights to challenge or dispute the distribution of trust assets. This document may include the South Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary, offering a legally binding agreement that facilitates smooth asset distribution. It is beneficial for both trustees and beneficiaries, reducing potential conflict.

The letter of release of inheritance is a formal document that beneficiaries sign, indicating they accept their inherited shares of the estate. It commonly includes the South Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary to clarify that beneficiaries waive any future claims regarding the inheritance received. This process promotes clarity among parties and helps safeguard the trustee against disputes.

A letter of release to beneficiaries is a document that confirms the beneficiaries' agreement to accept their share of the trust's assets. This letter often includes the South Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary, ensuring that the trustee receives acknowledgment from the beneficiaries. This document is crucial for formalizing the distribution process and ensuring that beneficiaries understand their rights and responsibilities.

To write a trust fund distribution letter, start by addressing the beneficiaries and stating the purpose of the letter clearly. Include specific distribution amounts, timeline, and any required actions, such as signing the South Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary. Utilizing templates from platforms like US Legal Forms can make this process simpler and help ensure that all legal requirements are met.

Getting releases signed by beneficiaries is essential because it protects the trustee from future claims regarding the distribution of assets. When beneficiaries sign the South Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary, they relinquish any right to contest the distribution, which provides legal peace of mind for all parties involved. This step also ensures transparency and maintains trust among beneficiaries and the trustee.

A letter to beneficiaries typically includes the details of the trust, the distribution amounts, and specific instructions. It clearly communicates the duties of the trustee, outlines the expected actions from the beneficiaries, and emphasizes the importance of the South Dakota Release by Trustee to Beneficiary and Receipt from Beneficiary as part of the distribution process. By using a template from US Legal Forms, you can create a professional and effective letter that covers all necessary aspects.

Transferring assets from a trust to a beneficiary involves a legal process that typically requires a Release by Trustee to Beneficiary and Receipt from Beneficiary. The trustee must formally approve the distribution and document the transfer. This process not only ensures transparency but also protects the rights of all parties involved. Utilizing resources from platforms like uslegalforms can simplify this process and provide essential documentation.

Distributions from a trust can indeed be taxable to beneficiaries, but it largely depends on the type of trust and the specific circumstances. In South Dakota, a Release by Trustee to Beneficiary and Receipt from Beneficiary outlines the details of these distributions. It is essential for beneficiaries to understand their tax obligations, which may vary based on the nature of the assets received. For clarity, consider consulting a tax professional or an estate planning attorney.