If you want to complete, acquire, or print legitimate papers web templates, use US Legal Forms, the largest collection of legitimate varieties, that can be found on the Internet. Use the site`s simple and easy convenient research to find the papers you will need. Various web templates for organization and person reasons are categorized by categories and claims, or key phrases. Use US Legal Forms to find the South Dakota Agreement By Heirs to Substitute New Note for Note of Decedent within a few mouse clicks.

Should you be previously a US Legal Forms client, log in to your accounts and click the Down load option to obtain the South Dakota Agreement By Heirs to Substitute New Note for Note of Decedent. You may also gain access to varieties you formerly delivered electronically in the My Forms tab of your respective accounts.

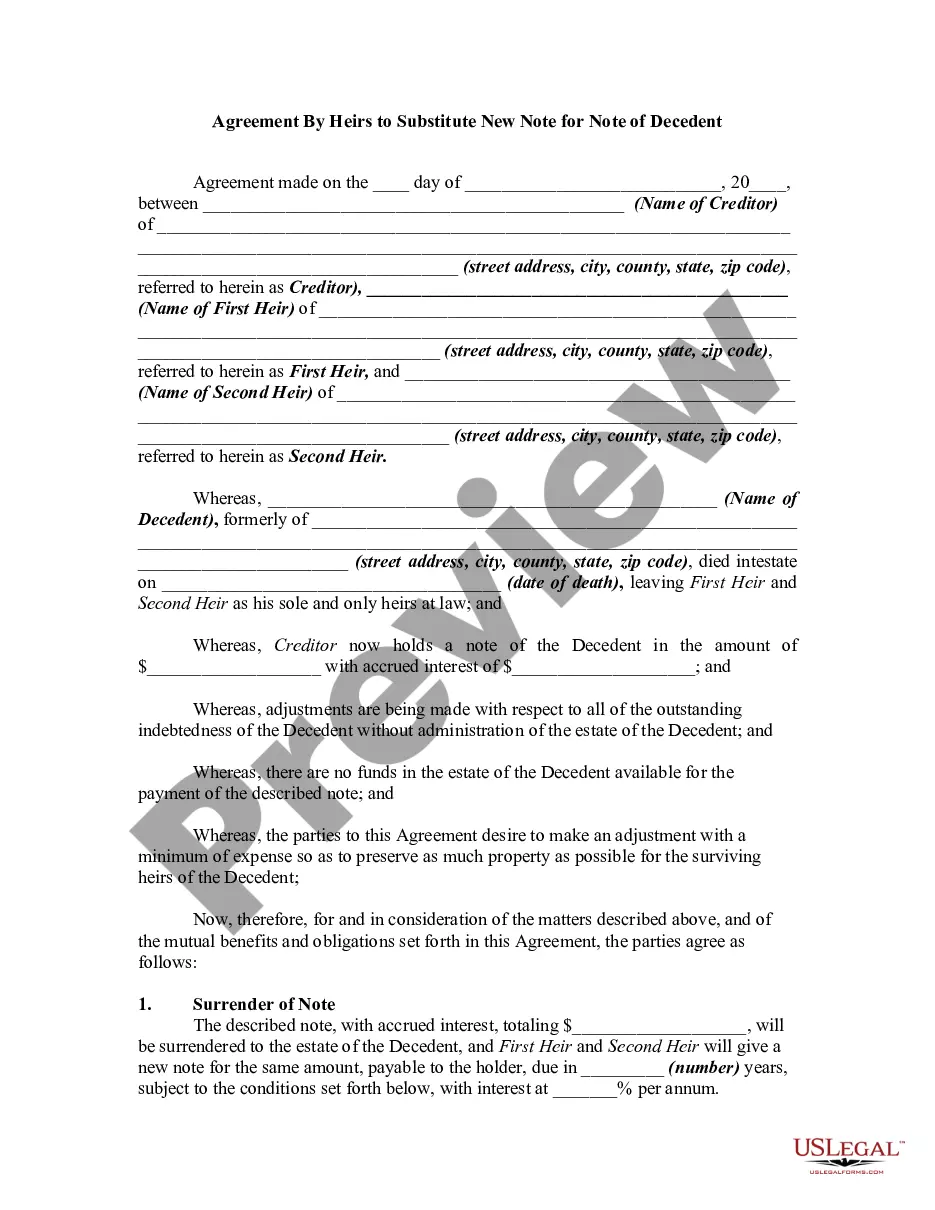

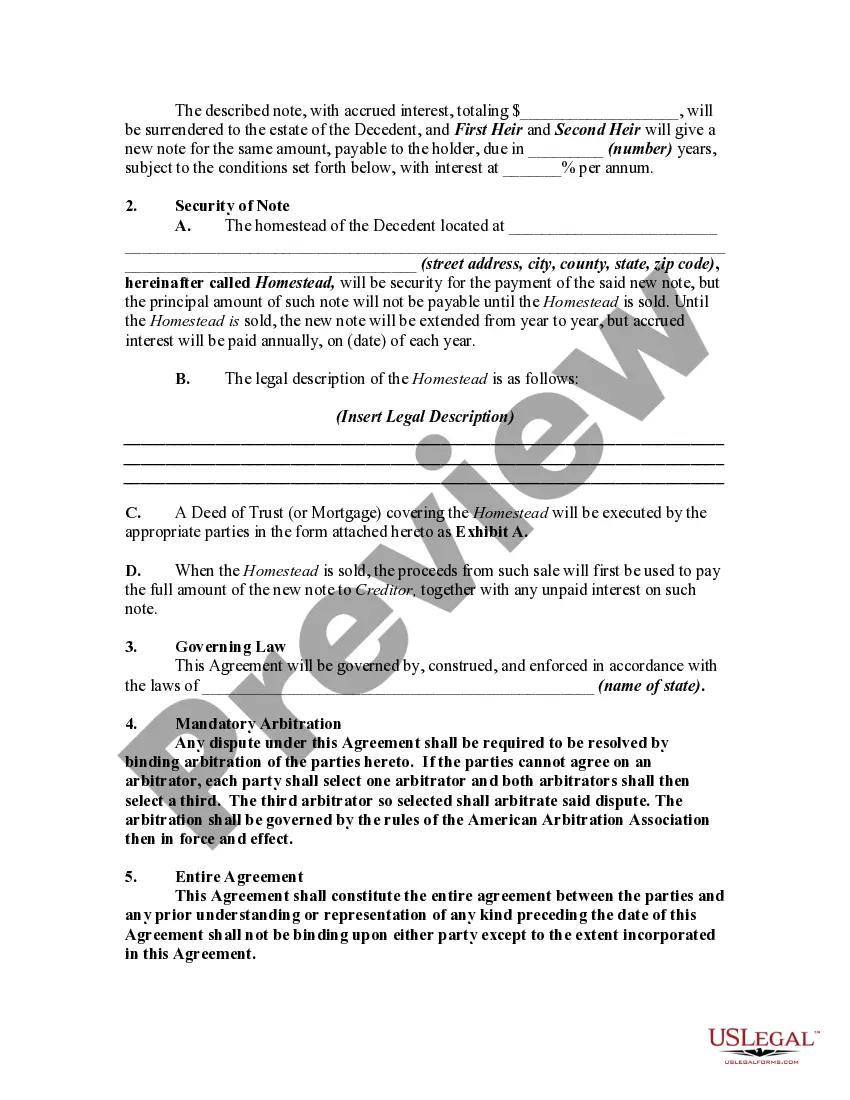

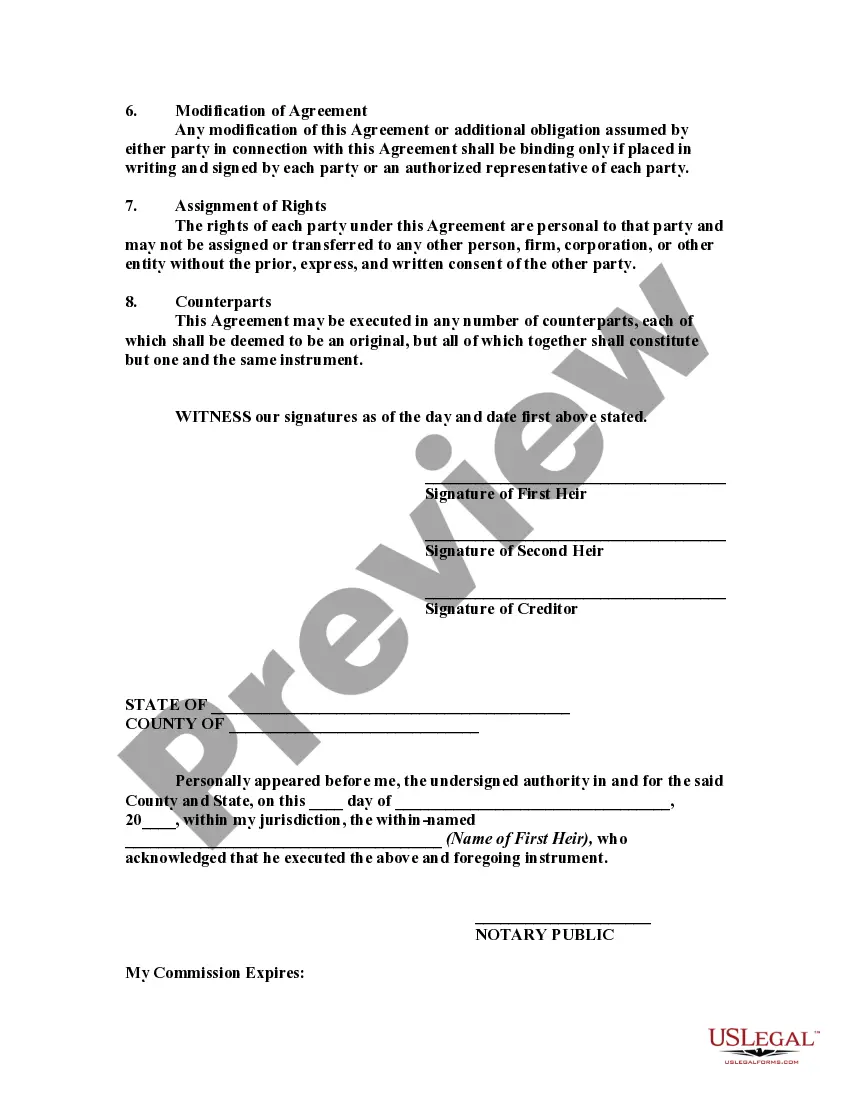

If you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for that correct town/country.

- Step 2. Take advantage of the Review solution to check out the form`s information. Never neglect to read through the information.

- Step 3. Should you be not satisfied together with the kind, utilize the Search area towards the top of the screen to get other variations from the legitimate kind template.

- Step 4. When you have located the form you will need, select the Buy now option. Choose the rates strategy you prefer and put your credentials to register on an accounts.

- Step 5. Approach the transaction. You can use your charge card or PayPal accounts to perform the transaction.

- Step 6. Pick the formatting from the legitimate kind and acquire it on your own gadget.

- Step 7. Full, modify and print or indicator the South Dakota Agreement By Heirs to Substitute New Note for Note of Decedent.

Every single legitimate papers template you buy is yours forever. You may have acces to every single kind you delivered electronically with your acccount. Go through the My Forms area and pick a kind to print or acquire yet again.

Remain competitive and acquire, and print the South Dakota Agreement By Heirs to Substitute New Note for Note of Decedent with US Legal Forms. There are millions of skilled and condition-particular varieties you may use for your organization or person requirements.