A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of the transfer of ownership of stock by a separate instrument.

South Dakota Bill of Sale and Assignment of Stock by Separate Instrument

Description

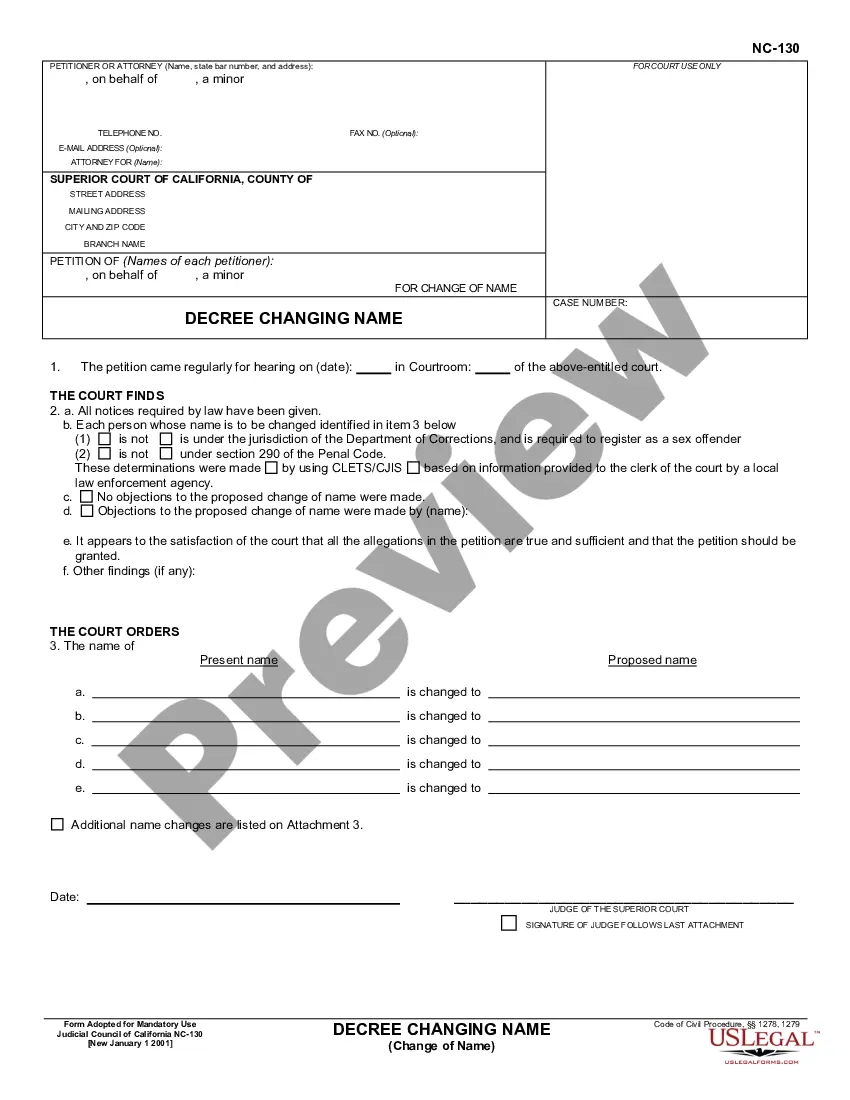

How to fill out Bill Of Sale And Assignment Of Stock By Separate Instrument?

Finding the appropriate legitimate document template can be challenging.

Certainly, there are numerous templates accessible online, but how do you locate the authentic version you require.

Utilize the US Legal Forms website.

First, ensure you have selected the correct form for your city/county. You can review the form using the Review button and read the form description to confirm it is the right one for you.

- The service provides thousands of templates, including the South Dakota Bill of Sale and Assignment of Stock by Separate Instrument, suitable for both business and personal purposes.

- All the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, sign in to your account and click the Download button to access the South Dakota Bill of Sale and Assignment of Stock by Separate Instrument.

- Use your account to browse through the legitimate forms you have previously purchased.

- Visit the My documents tab in your account to obtain another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

Form popularity

FAQ

In South Dakota, to create a trust, you need a clear intention, a legal purpose, and identifiable beneficiaries. The trust document should outline the terms, along with a trustee who will manage the assets according to those terms. Establishing a trust can be a beneficial strategy for estate planning. It’s good to consult legal resources or professionals if you're considering this approach, including tips on how tools like the South Dakota Bill of Sale and Assignment of Stock by Separate Instrument can fit into your estate planning.

In South Dakota, individuals may qualify for a property tax exemption at the age of 65. However, this exemption is subject to certain income and asset limits. It's wise to consult the relevant guidelines or seek guidance to ensure you meet the criteria. This can help you save on costs related to property ownership, alongside understanding tools like the South Dakota Bill of Sale and Assignment of Stock by Separate Instrument.

To print a seller's permit in South Dakota, you first need to apply through the South Dakota Department of Revenue. Once your application is approved, you can access your permit through the online portal provided by the department. After logging in, locate your permit and select the print option. If you require assistance with the process, you might find it useful to consult the South Dakota Bill of Sale and Assignment of Stock by Separate Instrument, which outlines essential documentation for your transactions.

You can sell a car without a title in South Dakota, but it involves specific protocols. A South Dakota Bill of Sale and Assignment of Stock by Separate Instrument can facilitate the process, but be prepared to prove ownership through other means. It is wise to discuss your situation with legal experts or utilize dedicated services that specialize in these transactions for clarity and security.

Selling a car without a title in South Dakota can lead to legal complications. While it is technically not illegal, it does pose risks for both the seller and the buyer. To protect both parties, it is advisable to use a South Dakota Bill of Sale and Assignment of Stock by Separate Instrument to document the sale and ensure compliance with state laws.

Registering a car in South Dakota without a title can be challenging, but it is possible under certain conditions. If you can provide adequate proof of ownership, such as a South Dakota Bill of Sale and Assignment of Stock by Separate Instrument, you may be able to register the vehicle. It is important to consult local regulations and possibly seek assistance from a professional service.

The salvage title law in South Dakota applies to vehicles that have been declared a total loss by an insurance company. Under this law, a vehicle must obtain a salvage title before it can be repaired and re-registered. Knowing the implications of salvage title vehicles is crucial, especially when using a South Dakota Bill of Sale and Assignment of Stock by Separate Instrument for any transactions involving such vehicles.

Codified law 43-4-38 in South Dakota addresses the requirements for transferring ownership of personal property. This law outlines the necessary documentation, including the South Dakota Bill of Sale and Assignment of Stock by Separate Instrument. It is essential for individuals to understand this law to ensure a smooth and legally compliant transaction.

Yes, South Dakota is considered a non title holding state. This means that a title is not required for certain types of property transactions. However, for vehicle transactions, a South Dakota Bill of Sale and Assignment of Stock by Separate Instrument are typically necessary to document the sale and transfer of ownership.

To privately sell a vehicle in South Dakota, ensure you have the title ready and create a bill of sale for the transaction. The South Dakota Bill of Sale and Assignment of Stock by Separate Instrument will help document the details of the sale and protect both you and the buyer. Lastly, remember to notify the DMV of the sale to transfer ownership correctly.