South Dakota Agreement with Sales Representative to Sell Advertising and Related Services

Description

How to fill out Agreement With Sales Representative To Sell Advertising And Related Services?

Are you in a situation where you will require documents for both corporate or individual activities nearly every day.

There are numerous legal form templates accessible online, but finding forms you can trust is not easy.

US Legal Forms provides a vast selection of document templates, including the South Dakota Agreement with Sales Representative to Market Advertising and Related Services, designed to comply with federal and state regulations.

Once you find the right form, click on Get now.

Choose the pricing plan you want, fill in the required details to create your account, and pay for your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Dakota Agreement with Sales Representative to Market Advertising and Related Services template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Look for the form you need and ensure it is for the correct city/state.

- Utilize the Review button to check the form.

- Read the details to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the document that meets your requirements.

Form popularity

FAQ

In South Dakota, most advertising services are generally considered taxable. However, there may be exceptions based on the medium or type of advertising. If you plan to create a South Dakota Agreement with Sales Representative to Sell Advertising and Related Services, it is imperative to identify any applicable tax implications to avoid unexpected costs.

To calculate sales tax in South Dakota, multiply the taxable amount by the applicable sales tax rate, which is generally 4.5%. Additional local taxes may apply in certain areas, so always check for local rates. Understanding this calculation is crucial when drafting a South Dakota Agreement with Sales Representative to Sell Advertising and Related Services, ensuring compliance and accuracy.

South Dakota does not impose sales tax on certain services and goods. Notably, services related to healthcare and certain educational services are exempt. This knowledge is vital when forming a South Dakota Agreement with Sales Representative to Sell Advertising and Related Services, ensuring that you navigate the taxable landscape effectively.

In South Dakota, certain items are exempt from sales tax. These include specific agricultural products, prescription medications, and certain food items sold for home consumption. When creating a South Dakota Agreement with Sales Representative to Sell Advertising and Related Services, it is essential to understand these exemptions as they may impact your overall sales strategy.

In South Dakota, advertisements are generally subject to sales tax. Therefore, if you enter into a South Dakota Agreement with Sales Representative to Sell Advertising and Related Services, including sales tax in your budget is crucial. The current rate is 4.5%, but be mindful of local taxes that may apply. Understanding these tax obligations can assist you in planning more effectively and ensuring your advertising efforts are financially sound.

In South Dakota, verbal contracts can be binding, but they come with risks. Establishing a South Dakota Agreement with Sales Representative to Sell Advertising and Related Services in writing is always advisable. Written agreements provide clear evidence of the terms, making it easier to enforce them if disputes arise. Thus, securing a written document is an excellent way to protect your interests.

In South Dakota, legal services are generally exempt from sales tax. However, it’s wise to review your specific circumstances. For instance, if your South Dakota Agreement with Sales Representative to Sell Advertising and Related Services involves other taxable services, you might encounter tax implications. Consulting with a tax professional can help clarify any concerns.

Drafting a sales contract involves outlining the key elements such as the parties, product or service description, terms of sale, payment details, and any contingencies. It’s important to use clear and concise language to avoid misunderstandings. Utilizing a platform like uslegalforms can simplify this process, ensuring you create a robust South Dakota Agreement with Sales Representative to Sell Advertising and Related Services that protects your interests.

In South Dakota, sales tax applies to several goods and services, including certain professional services. Depending on the service type, the tax rate may vary, and it is essential to check with the South Dakota Department of Revenue for specific details. When engaging in a South Dakota Agreement with Sales Representative to Sell Advertising and Related Services, understanding the sales tax implications is vital for compliance.

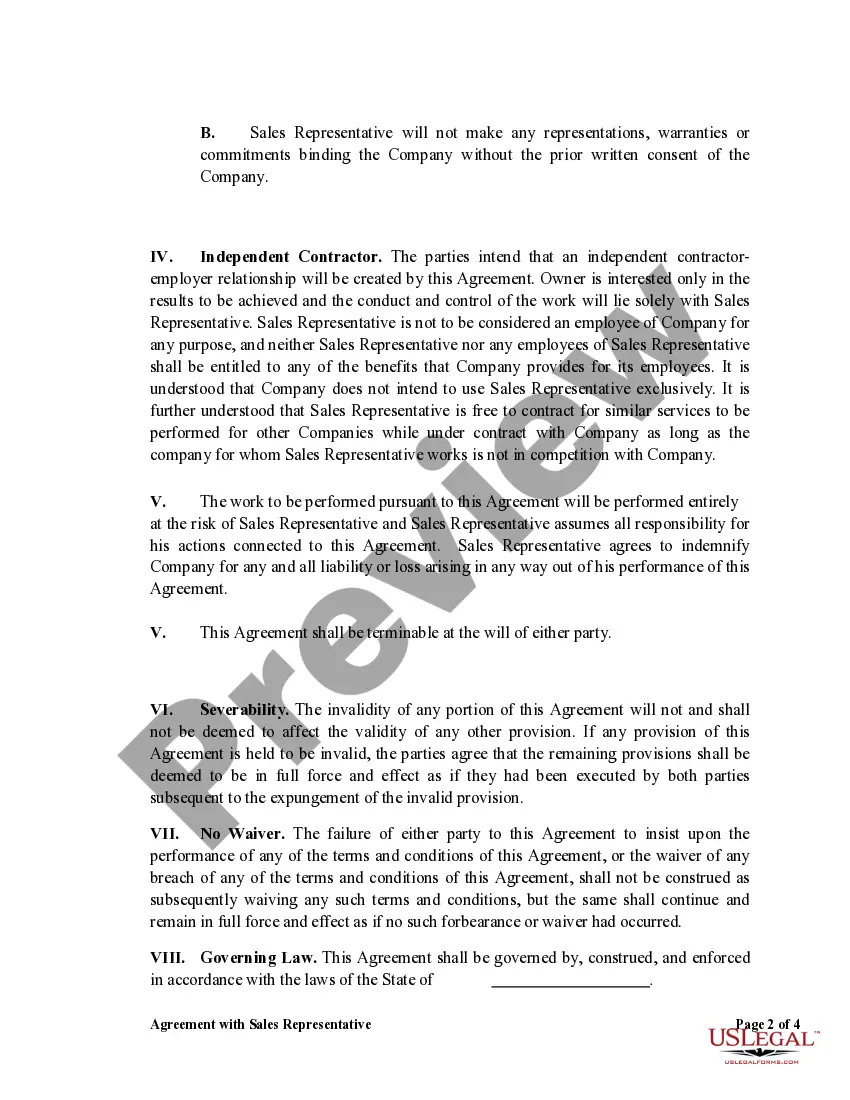

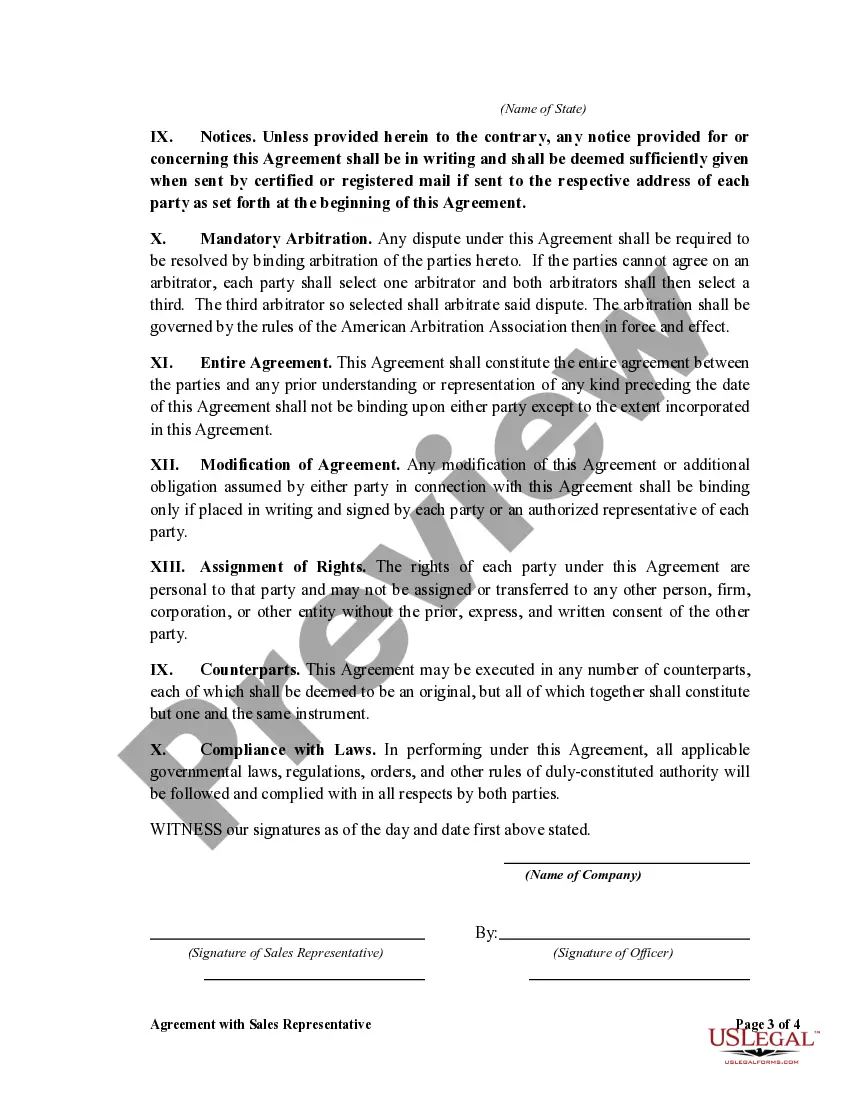

A sales representative agreement is a legal document outlining the relationship between a salesperson and a company. It details the rights and responsibilities of both parties, including territory, commission structure, and duration of the agreement. For those in South Dakota, establishing a thorough South Dakota Agreement with Sales Representative to Sell Advertising and Related Services is crucial for clarity and adherence to state regulations.