South Dakota Advertising Services Agreement

Description

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

How to fill out Advertising Services Agreement?

Are you currently in a circumstance where you require documents for either professional or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding those you can trust is not easy.

US Legal Forms provides thousands of form templates, including the South Dakota Advertising Services Agreement, which are created to meet federal and state requirements.

Once you find the correct form, click Get now.

Select the pricing plan you prefer, fill in the required details to set up your account, and pay for your order using PayPal, Visa, or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the South Dakota Advertising Services Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Choose the form you need and ensure it is for the correct city/region.

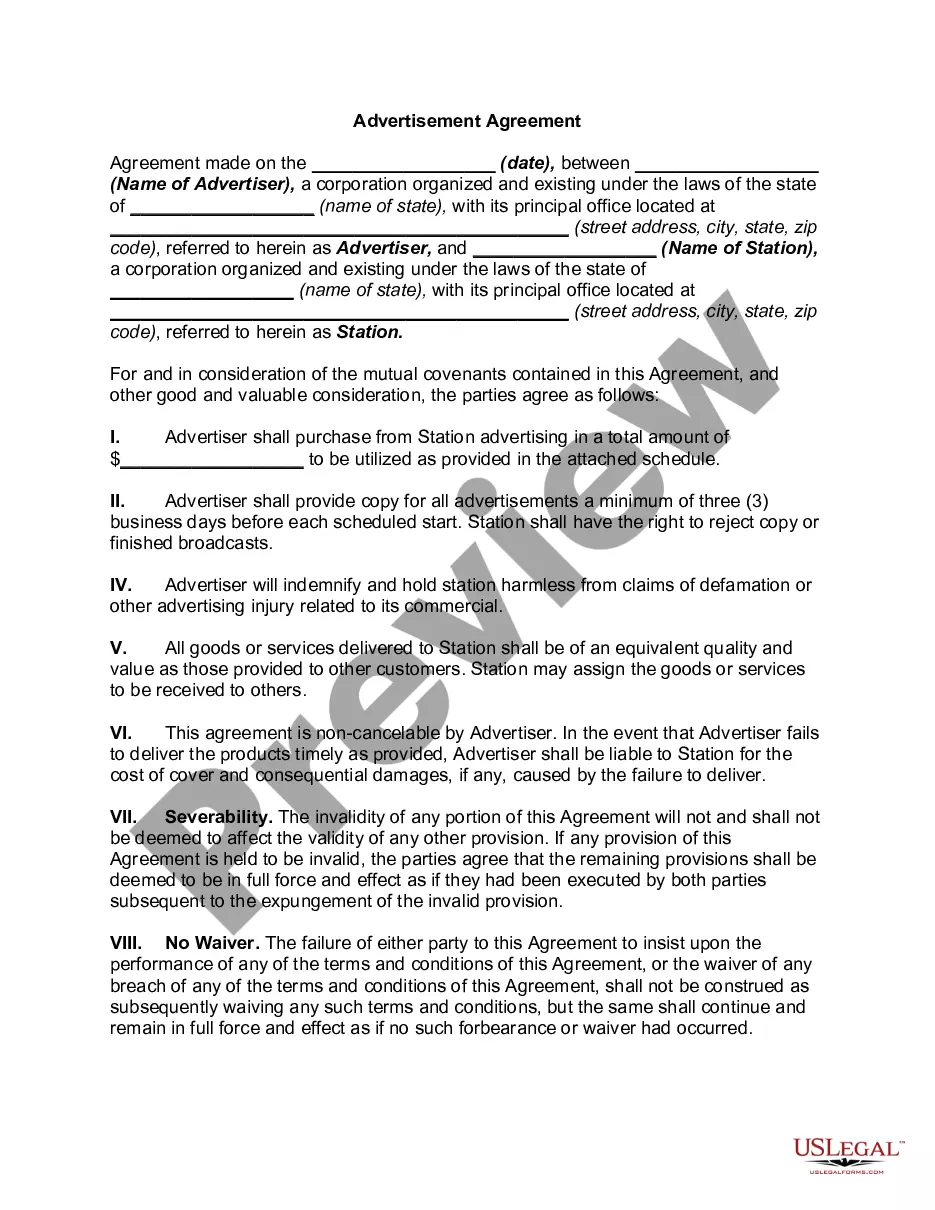

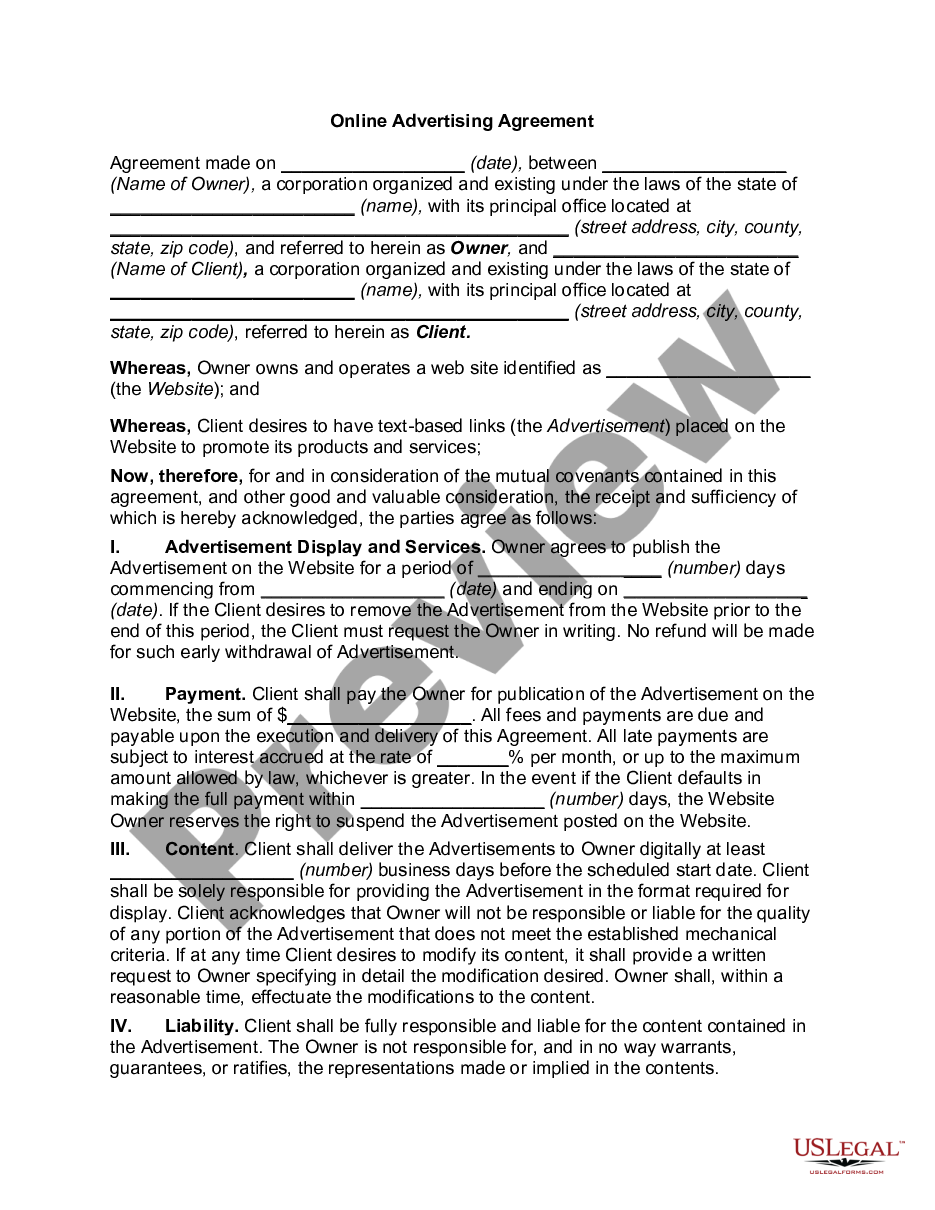

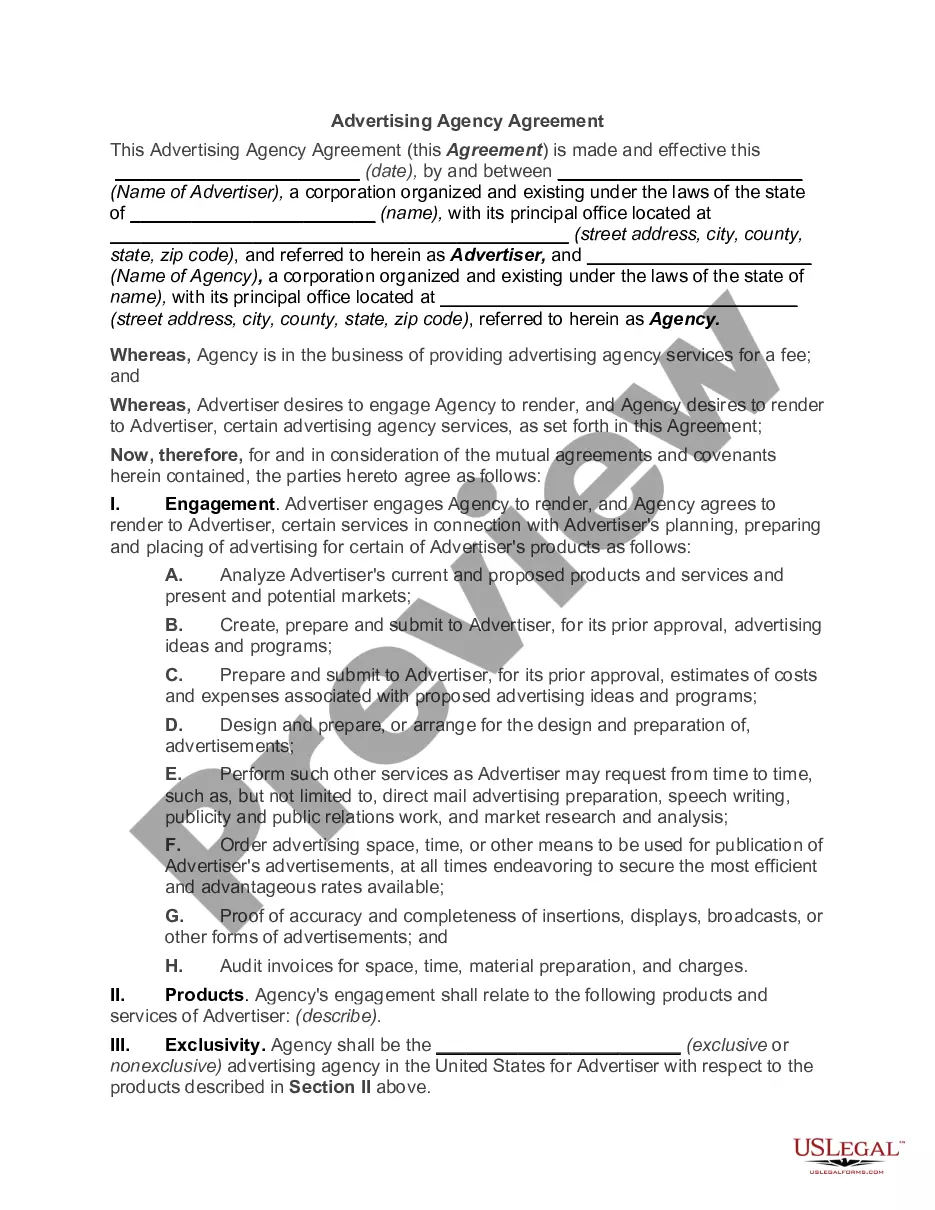

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the appropriate form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

While you do not necessarily need an LLC to start a marketing agency, forming one is often beneficial in South Dakota. An LLC can protect your personal assets from business liabilities and provide tax advantages. Most importantly, reviewing a South Dakota Advertising Services Agreement can clarify the legal requirements you need to meet, allowing you to start your agency on a solid foundation.

Starting an advertising company requires a mix of creativity and business acumen. You will need a well-defined business plan, necessary licenses, and a South Dakota Advertising Services Agreement to operate legally. Furthermore, consider investing in essential tools such as design software, online marketing platforms, and a reliable website to attract clients and showcase your services.

To get into an advertising company, start by developing your skills in marketing, communication, and design. Networking is crucial; attend industry events and connect with established professionals. Many companies also value internships, so consider applying for such opportunities. A solid understanding of the South Dakota Advertising Services Agreement can also give you an edge, as it shows your commitment to legal and ethical advertising practices.

To obtain a South Dakota sales tax permit, you need to apply through the Department of Revenue. You can complete the process online and provide the necessary information regarding your business, including details from your South Dakota Advertising Services Agreement. Once approved, you will receive your permit, allowing you to collect sales tax.

Generally, professional services, such as legal and medical services, are not taxable in South Dakota. However, if those services relate to advertising, the tax implications may differ. Reviewing your South Dakota Advertising Services Agreement with a tax professional can help clarify your obligations.

Yes, advertising services can be subject to sales tax in South Dakota. However, specific exemptions may apply depending on the nature of the services provided. It is essential to understand how your South Dakota Advertising Services Agreement fits into the tax landscape to ensure compliance.

A sales tax license and an EIN are not the same. A sales tax license is necessary for collecting sales tax on sales in South Dakota, while an EIN, or Employer Identification Number, is needed for tax reporting purposes and hiring employees. When engaging in a South Dakota Advertising Services Agreement, having both may be essential for compliance.

To file an annual report for your LLC in South Dakota, you must complete the report form available on the Secretary of State’s website. Include all relevant information about your business, such as your South Dakota Advertising Services Agreement details. This process usually has a deadline of the end of the anniversary month of your LLC formation.

Getting a tax ID number in South Dakota involves applying through the IRS. You can apply online, by mail, or by fax. When you submit your application, ensure that your South Dakota Advertising Services Agreement information is correctly included to avoid any processing delays.

To apply for a South Dakota sales tax license, visit the South Dakota Department of Revenue's website. You can complete the application online, which requires details about your business, including your South Dakota Advertising Services Agreement specifics. After submitting the application, you'll receive your license typically within a few business days.