South Dakota Restricted Endowment to Educational, Religious, or Charitable Institution

Description

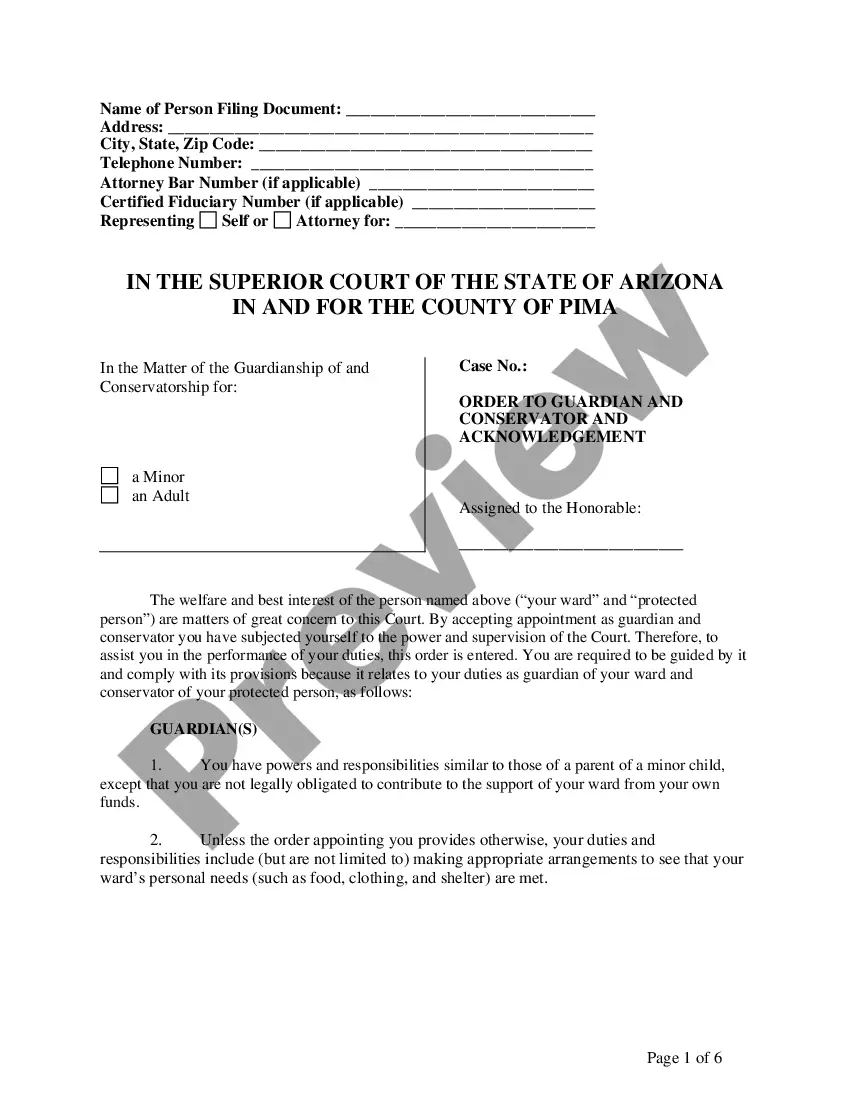

How to fill out Restricted Endowment To Educational, Religious, Or Charitable Institution?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse range of legal form templates that you can download or print.

By using the website, you can find thousands of forms for business and personal needs, organized by categories, states, or keywords.

You can access the latest versions of forms like the South Dakota Limited Endowment to Educational, Religious, or Charitable Institution in just seconds.

If the form doesn’t meet your needs, utilize the Search field at the top of the page to find one that does.

If you're satisfied with the form, confirm your choice by clicking the Get now button. Then, select your preferred pricing plan and provide your details to create an account.

- If you already possess a monthly subscription, Log In and download the South Dakota Limited Endowment to Educational, Religious, or Charitable Institution from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are some simple instructions to help you get started.

- Ensure you have chosen the correct form for your city/state.

- Click the Preview button to review the form's content.

Form popularity

FAQ

A restricted endowment refers to funds that come with conditions set by the donor regarding their usage. These contributions are allocated only for designated purposes, often related to educational, religious, or charitable activities. Organizations managing such endowments must adhere to these restrictions to meet donor intentions and maximize impact. The South Dakota Restricted Endowment to Educational, Religious, or Charitable Institution exemplifies this type of dedicated funding.

Restricted contributions have specific guidelines determining how the funds can be spent, while unrestricted contributions give organizations complete freedom in using the funds. Restricted contributions often support specific projects or initiatives, like a South Dakota Restricted Endowment to Educational, Religious, or Charitable Institution. Understanding these differences helps donors and organizations align their goals and responsibilities clearly.

When a fund is restricted, it means that the donor has placed specific limitations on how the funds can be used. These restrictions often relate to the fund’s intended purpose, such as supporting educational, religious, or charitable projects. Organizations must follow these guidelines to maintain compliance and ensure proper usage. Handling a South Dakota Restricted Endowment to Educational, Religious, or Charitable Institution requires careful attention to these donor-imposed conditions.

The two main types of endowments are restricted and unrestricted endowments. Restricted endowments are dedicated to specific purposes as defined by the donor, such as educational, religious, or charitable institutions. Unrestricted endowments, on the other hand, provide organizations with flexibility in fund allocation. Organizations managing a South Dakota Restricted Endowment to Educational, Religious, or Charitable Institution must adhere to donor restrictions.

The three types of endowments include permanent endowments, term endowments, and quasi-endowments. Permanent endowments are meant to exist indefinitely, while term endowments are established for a specific period. Quasi-endowments allow an organization more flexibility regarding the use of funds. In the context of a South Dakota Restricted Endowment to Educational, Religious, or Charitable Institution, these endowments often support long-term sustainability.

The UPMIFA endowment refers to the management principles set forth by the Uniform Prudent Management of Institutional Funds Act, guiding how institutions handle their endowed funds. This framework encourages prudent investment and spending strategies for these funds, ensuring they continue to serve institutions long-term. The South Dakota Restricted Endowment to Educational, Religious, or Charitable Institution follows these guidelines to maximize the effectiveness of its financial resources.

Endowment refers to a dedicated fund that provides ongoing financial support to an organization or institution. This type of funding is particularly valuable for educational, religious, and charitable institutions, such as those aligned with the South Dakota Restricted Endowment to Educational, Religious, or Charitable Institution. Endowments serve as a financial lifeline, ensuring stability and support for the future.

Factors of UPMIFA include the overall financial needs of the institution, investment return expectations, economic conditions, and the long-term sustainability of the endowed funds. Understanding these factors is essential for trustees managing the South Dakota Restricted Endowment to Educational, Religious, or Charitable Institution. Each factor helps in making informed decisions for optimal fund management.

The tax credit for the North Dakota endowment fund incentivizes donations to eligible endowments, allowing donors to receive significant tax breaks. This credit encourages individuals and businesses to contribute financially to charitable causes. Similarly, the South Dakota Restricted Endowment to Educational, Religious, or Charitable Institution seeks to promote donations through such tax incentives to bolster its funding base.

The North Dakota endowment refers to a set of policies aimed at supporting long-term funding for educational, charitable, and religious institutions within the state. This endowment system mirrors the South Dakota Restricted Endowment to Educational, Religious, or Charitable Institution in its goals of sustainability and impact. Both aim to enhance the viability of essential community services.