South Dakota Promissory Note - Balloon Note

Description

How to fill out Promissory Note - Balloon Note?

It is feasible to spend numerous hours online searching for the legal document format that meets both state and federal standards you require.

US Legal Forms offers an extensive collection of legal forms that can be assessed by experts.

It is easy to obtain or create the South Dakota Promissory Note - Balloon Note from the service.

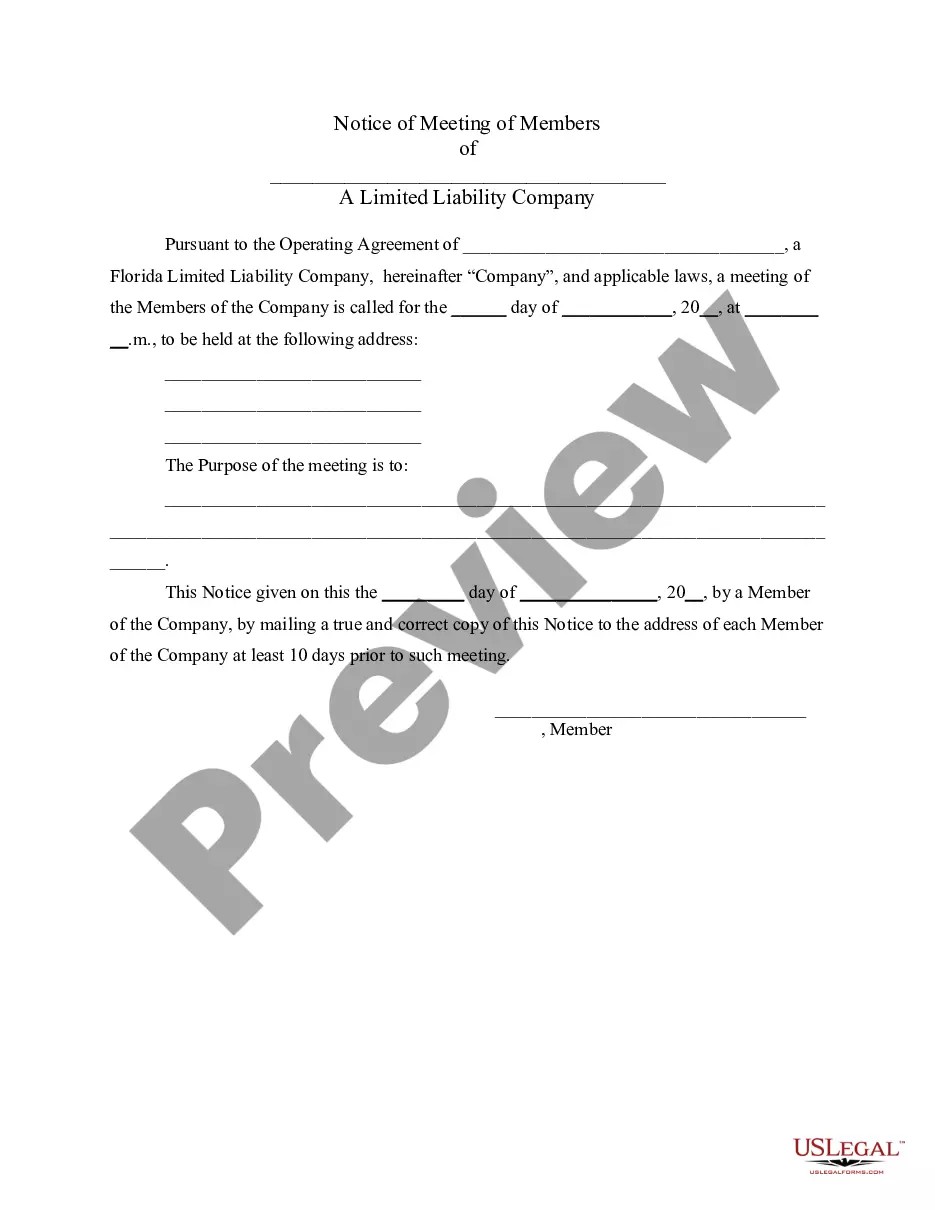

If available, utilize the Preview key to view the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire key.

- After that, you can complete, modify, create, or sign the South Dakota Promissory Note - Balloon Note.

- Each legal document format you obtain is yours permanently.

- To retrieve another copy of a purchased document, access the My documents tab and click the relevant key.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- Initially, ensure that you have selected the correct document format for the area of your preference.

- Review the document description to confirm you have chosen the right document.

Form popularity

FAQ

Yes, a South Dakota Promissory Note - Balloon Note can go on your public record if it is recorded with the county. This recording makes the document accessible to the public, providing transparency about your debt obligations. It is crucial to understand that having a recorded note may affect your credit and financial standing. For reliable information on how this impacts your records, check out USLegalForms.

When reporting a South Dakota Promissory Note - Balloon Note on your taxes, it is essential to document any interest earned as income. You must also state the principal amount when applicable. Additionally, consider any applicable deductions on related expenses. For precise guidance, you might want to consult tax professionals or utilize resources available on USLegalForms.

You should file a South Dakota Promissory Note - Balloon Note with the appropriate local authorities, typically at the county recorder’s office. This process ensures that your agreement is legally binding and acknowledged. Filing official documents helps protect your rights and interests. If you need assistance, consider using USLegalForms for detailed filing instructions tailored to your needs.

To record a South Dakota Promissory Note - Balloon Note, you should contact your local county clerk's office. Recording the note helps establish its validity and creates a public record. Once you file it there, anyone can access the information, which offers you legal protection. Using a platform like USLegalForms simplifies this process, guiding you through the necessary steps.

Filling out a South Dakota Promissory Note - Balloon Note involves several key steps. Start with the date, then add the names of the lender and borrower, followed by the principal amount and interest rate. Clearly outline the payment schedule, including any balloon payments. Ensure that each party signs the document to validate the agreement, making the process straightforward and clear.

The format of a South Dakota Promissory Note - Balloon Note typically includes the date, the names of the lender and borrower, the principal amount, the interest rate, and the payment schedule. You will also find a section for signatures, indicating agreement by both parties. Following a structured format ensures clarity, making it easier for both the lender and borrower to understand their obligations.

Typically, a balloon payment would represent a percentage of the purchase price of the vehicle. For example, for a car costing R300 000, a 20 % balloon payment would work out at R60 000. This would be paid in one lump sum at the end of the contract period for example 60 months or five years after purchase.

What Is a Balloon Loan. A balloon loan is a type of loan that does not fully amortize over its term. Since it is not fully amortized, a balloon payment is required at the end of the term to repay the remaining principal balance of the loan.

To write a promissory note for a personal loan, you will need to include the names of both parties, the principal balance, the APR, and any fees that are part of the agreement. The promissory note should also clearly explain what will happen if the borrower pays late or does not pay the loan back at all.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.