Indiana Sample Letter for Dormant Letter

Description

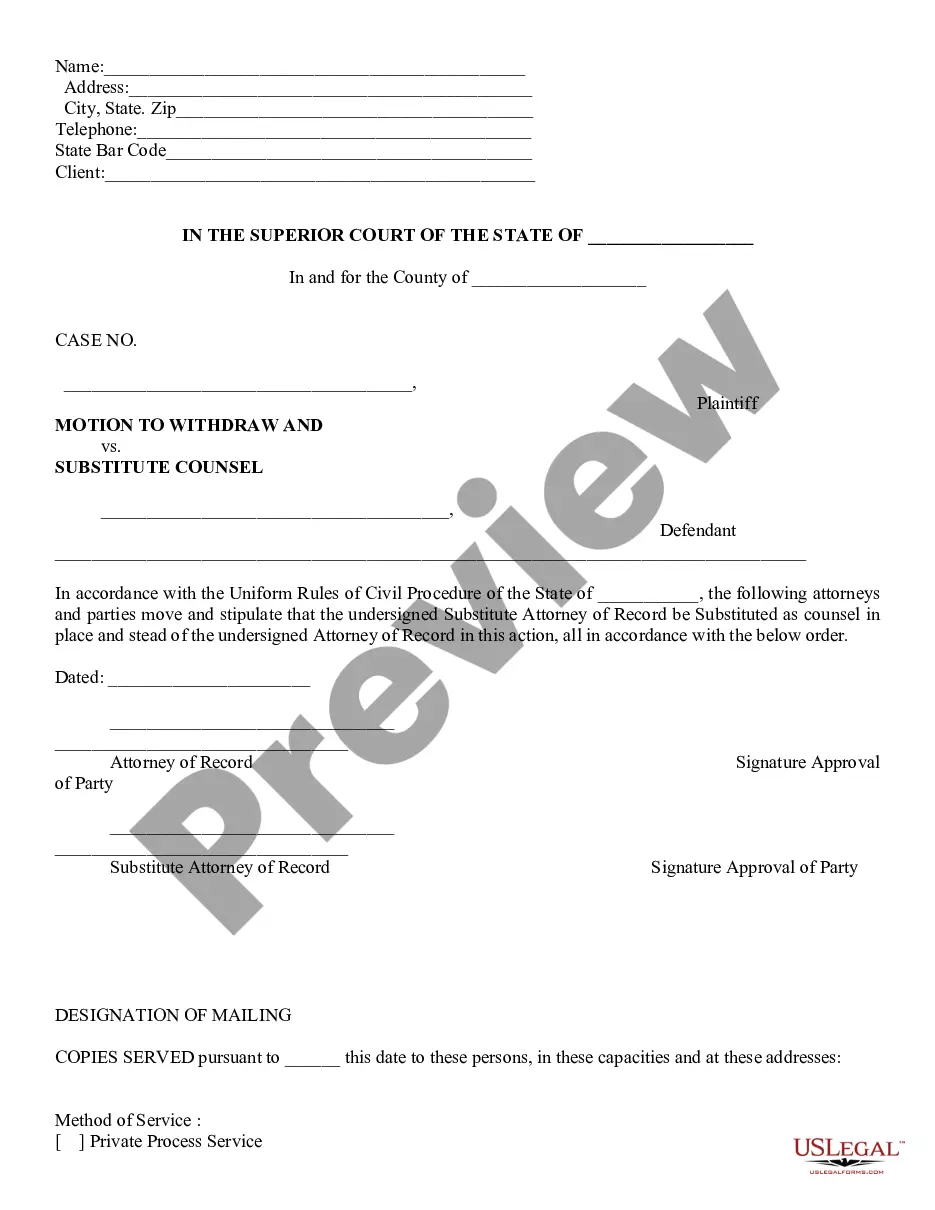

How to fill out Sample Letter For Dormant Letter?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal template forms that you can download or print.

By using the website, you can discover thousands of forms for both business and personal needs, categorized by types, states, or keywords.

You can find the most recent forms such as the Indiana Sample Letter for Dormant Letter within minutes.

Read the form details to make sure you have chosen the correct form.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you already hold a subscription, Log In and download Indiana Sample Letter for Dormant Letter from the US Legal Forms library.

- The Download button will be available on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are straightforward steps to begin.

- Ensure you have selected the appropriate form for your city/region.

- Click the Preview button to review the form's content.

Form popularity

FAQ

Dormant accounts should display no recent transactions, reflecting inactivity over an extended timeframe. Often, these accounts will have a note indicating their status, and they may incur fees if not managed properly. If you need to reactivate or inquire about a dormant account, an Indiana Sample Letter for Dormant Letter can serve as an effective tool to communicate with your financial institution and provide the necessary details for reactivation.

An example of dormant can be a bank account that has not had any activity for a significant period. When an account becomes dormant, it typically means that the owner has not made any deposits or withdrawals for a specific length of time, often set by the institution. To formalize your intent regarding such accounts, you might consider using an Indiana Sample Letter for Dormant Letter, which provides a clear communication method to your bank.

Writing an account reactivation letter involves a few key elements. Start with your account information and a clear statement requesting reactivation. Consider using the Indiana Sample Letter for Dormant Letter as a guide to structure your letter effectively and include any required verification details. Ensure that your tone remains courteous while specific in your request, helping the receiving institution to process your reactivation smoothly.

To write a dormant account letter, begin by clearly stating your intent to reactivate the account. Include your account details, such as the account number and any relevant identification information. Referencing the Indiana Sample Letter for Dormant Letter can provide you with a helpful format and wording to follow. It’s important to express your request politely and include any necessary supporting documentation to expedite the process.

When writing a letter for a dormant account, begin with your personal details, including your name, address, and account number. Clearly state your request to reactivate the account, citing the Indiana Sample Letter for Dormant Letter as a solid reference. Ensure to maintain a professional tone while being direct and concise about your needs. Using uslegalforms can provide you with a structured letter template to streamline this process.

A dormant account generally refers to a bank account that has had no activity for a specific period, typically one year. For instance, if you have a savings account where no deposits or withdrawals have occurred for over 12 months, it may be classified as dormant. This status can impact how your account is managed, so understanding this aspect is crucial. The Indiana Sample Letter for Dormant Letter can help you reactivate such accounts.

To fill out the dormant form properly, start by gathering all necessary information about your account. The Indiana Sample Letter for Dormant Letter often requires your account details, such as the account number and contact information. Follow the guidelines provided with the form to ensure accuracy. Utilizing uslegalforms can simplify this process, as they offer templates that guide you through each step effectively.

To request reactivation of your bank account, draft a clear and concise letter addressed to your bank’s customer service team. State your intent to reactivate the account and provide relevant details like account number and identification. You can benefit from using the Indiana Sample Letter for Dormant Letter as a roadmap to ensure all necessary information is included in your request. This helps facilitate a quicker response from your bank.

Writing a letter to reopen your bank account should start with your personal information and the specific bank’s address. Clearly indicate that you wish to reopen the account, mentioning any prior account details. Referencing an Indiana Sample Letter for Dormant Letter will provide a solid framework for your request. Be sure to include any additional information the bank might need to process your request.

To activate a dormant account, you typically need to provide a valid form of identification, such as a driver’s license or passport. Additionally, you might need proof of address, like a utility bill. Check with your bank’s policy as there can be variations, so using an Indiana Sample Letter for Dormant Letter may guide you through the required steps effectively.