Illinois Sample Letter for Dormant Letter

Description

How to fill out Sample Letter For Dormant Letter?

Locating the appropriate legal document format can be a challenge.

Of course, there are numerous templates accessible online, but how do you identify the legal form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Illinois Sample Letter for Dormant Letter, which can be utilized for both business and personal purposes.

You can view the form using the Review button and examine the form outline to confirm it is suitable for your needs.

- All of the forms are verified by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Illinois Sample Letter for Dormant Letter.

- Use your account to review the legal documents you have previously purchased.

- Navigate to the My documents tab of your account and acquire another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure that you have selected the correct form for your city/region.

Form popularity

FAQ

You can generally leave a bank account dormant for a maximum of three years in Illinois before it is classified as dormant by the bank. However, this can vary based on your bank's policies. After this period, be aware that fees may apply or your funds could be sent to the state. It's wise to monitor your account to avoid these outcomes.

The dormancy period for bank accounts in Illinois is typically three years. After this period, if there has been no activity, the account may be classified as dormant. It's crucial to be aware of this timeline to keep your account active and avoid potential fees. Regularly checking your account can help you maintain its status.

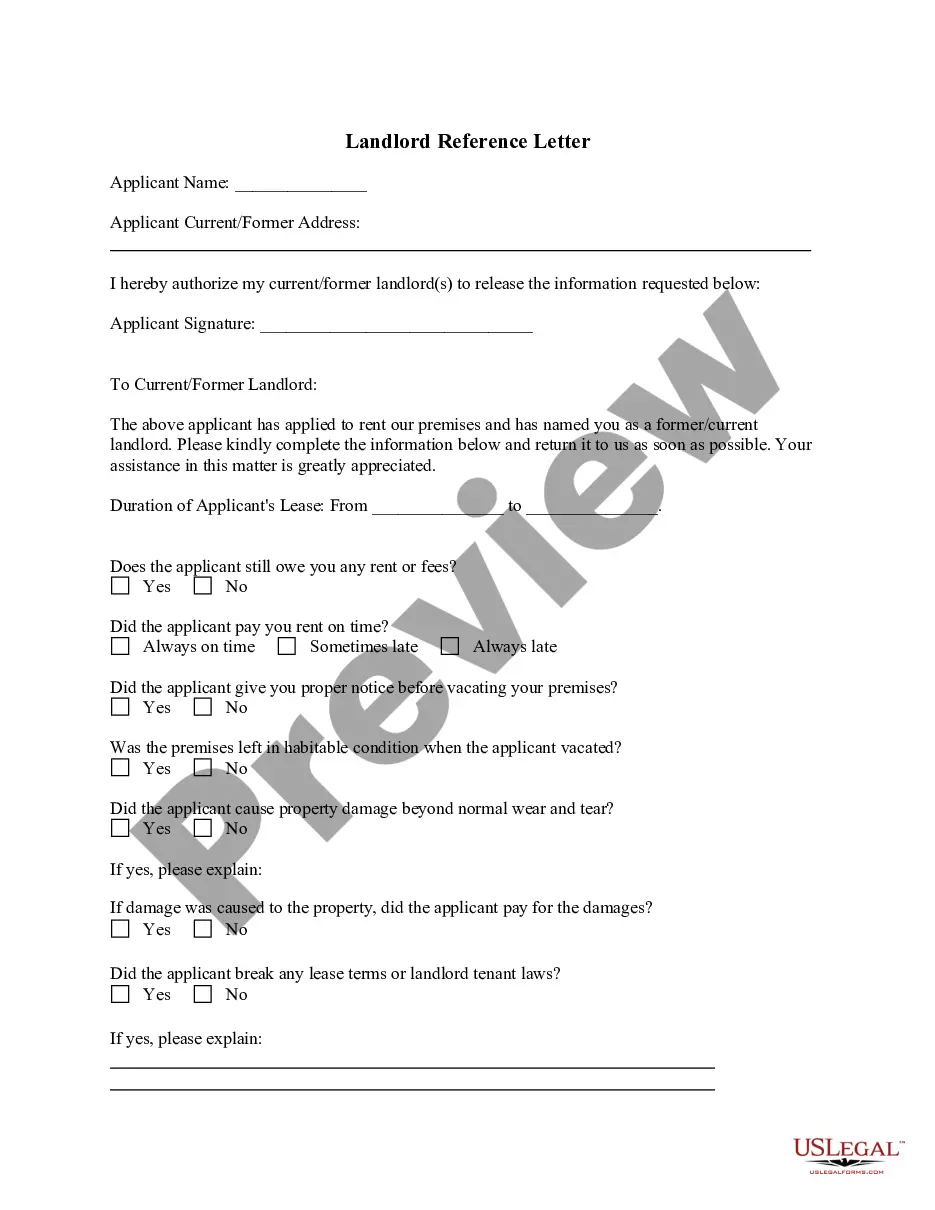

To fill out a dormant account form, you first need to gather your personal and account information. Write your name, address, account number, and any other required details accurately. Most importantly, indicate your intention for the account’s status, whether you plan to keep it dormant or reactivate it. A well-completed form facilitates smooth processing by the bank.

In general, banks define dormant accounts based on inactivity over a certain duration. Regulations can vary from state to state. In Illinois, banks typically consider accounts dormant if there are no transactions for a period of three years. Understanding these regulations helps you navigate your finances better and keep your account in good standing.

Writing an Illinois Sample Letter for Dormant Letter starts with addressing the bank clearly. Include your account number and personal details so they can locate your information easily. State clearly that you want to declare the account dormant and provide a request to take necessary actions to prevent any future charges. This letter ensures that you communicate your intentions effectively to the bank.

Declaring a dormant company involves submitting a notice to your state’s business filing office. You should affirm that the company has had no significant transactions during the specified period. Be sure to include all required information like the company name and registration number. Utilizing an Illinois Sample Letter for Dormant Letter may help you craft a precise declaration and ensure compliance with state regulations.

To write an account reactivation letter, start by addressing the financial institution or service provider. Clearly state your intention to reactivate your dormant account, providing any necessary account details for their reference. Additionally, include a polite request for confirmation upon reactivation. Using an Illinois Sample Letter for Dormant Letter can simplify this process, ensuring you cover all essential points.

Writing a letter for a dormant account requires clarity and precision. Start by including your account details and clearly state your intentions, whether you wish to reactivate the account or inquire about its status. It's beneficial to use an Illinois Sample Letter for Dormant Letter as a template, as this can guide you through the important elements and ensure your request is processed efficiently.

A dormant account is typically a financial account that has not had any activity for a specified period, usually between six to twelve months. Examples include checking or savings accounts where no deposits or withdrawals have occurred. Understanding dormant accounts is crucial because they might incur fees or be subject to state regulations. You may refer to an Illinois Sample Letter for Dormant Letter to formally address any concerns related to a dormant account.