Illinois Sample Letter regarding Bill

Description

How to fill out Sample Letter Regarding Bill?

Are you currently in a circumstance where you need to have documents for either business or personal purposes every day.

There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers a vast array of form templates, such as the Illinois Sample Letter concerning Bill, which are designed to meet federal and state requirements.

Once you find the appropriate form, click on Get now.

Choose the pricing plan you want, fill out the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Illinois Sample Letter concerning Bill template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

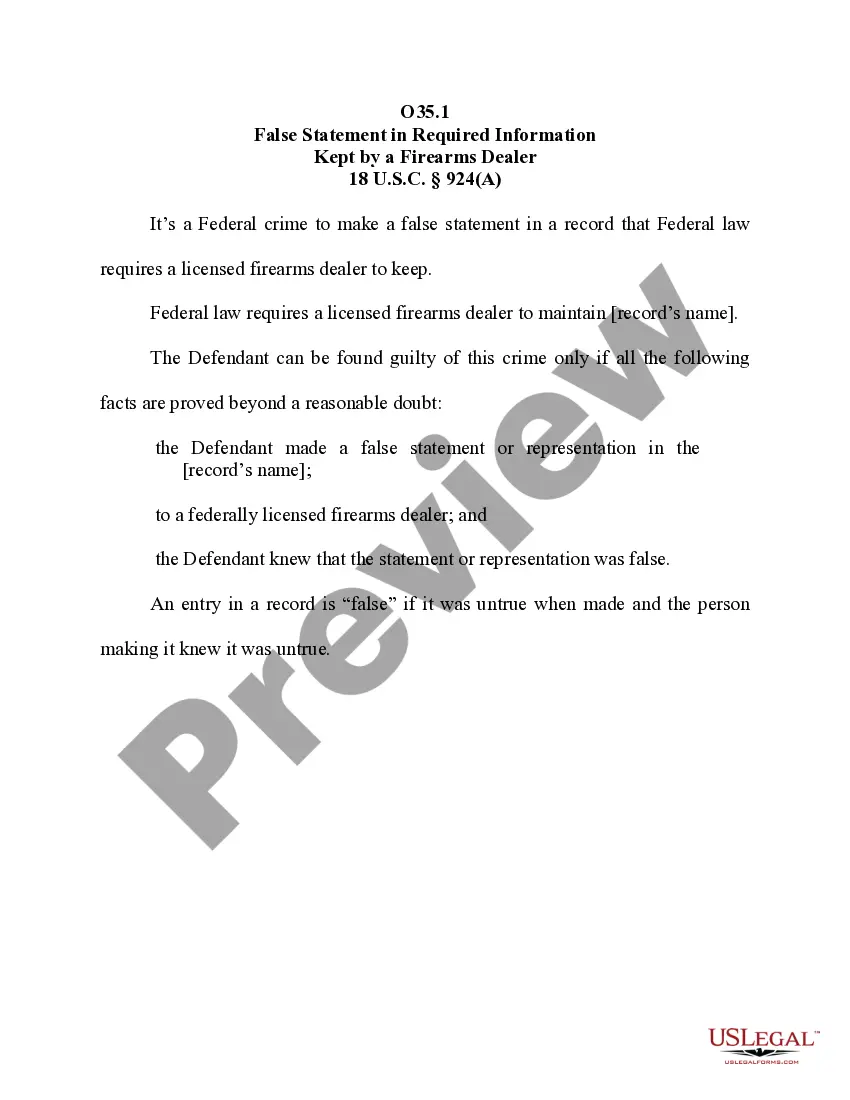

- Use the Preview button to review the form.

- Read the description to ensure you have selected the right form.

- If the form is not what you’re looking for, use the Search field to find the form that fits your needs.

Form popularity

FAQ

This Notice of Proposed Tax Liability is basically Illinois' written notice to you that you have been under audit and the audit is complete. This is the auditor's proposal of changes. What do those changes mean? They mean that Illinois has made a determination of whether your company owes additional tax.

If you owe money to a federal agency and you did not pay it on time, you have a delinquent debt. You will receive a letter first from the agency to whom you owe the debt. If you do not pay the agency, the debt then goes to Treasury and we send you a letter about that debt.

Official Communication: When the IRS sends a certified letter, it means that the information in the letter is significant and requires your attention. It could be related to matters like tax audits, overdue tax payments, or other issues that require your response or action.

What is a notice or letter? The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

Paper checks will arrive by mail in a white envelope from the U.S. Department of the Treasury.

Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes any steps the taxpayer needs to take. A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return.

The Illinois Department of Revenue (IDOR) sends letters and notices to request additional information and support for information you report on your tax return, or to inform you of a change made to your return, balance due or overpayment amount.

The IRS is a bureau of the Department of the Treasury and one of the world's most efficient tax administrators. In fiscal year 2020, the IRS collected almost $3.5 trillion in revenue and processed more than 240 million tax returns.