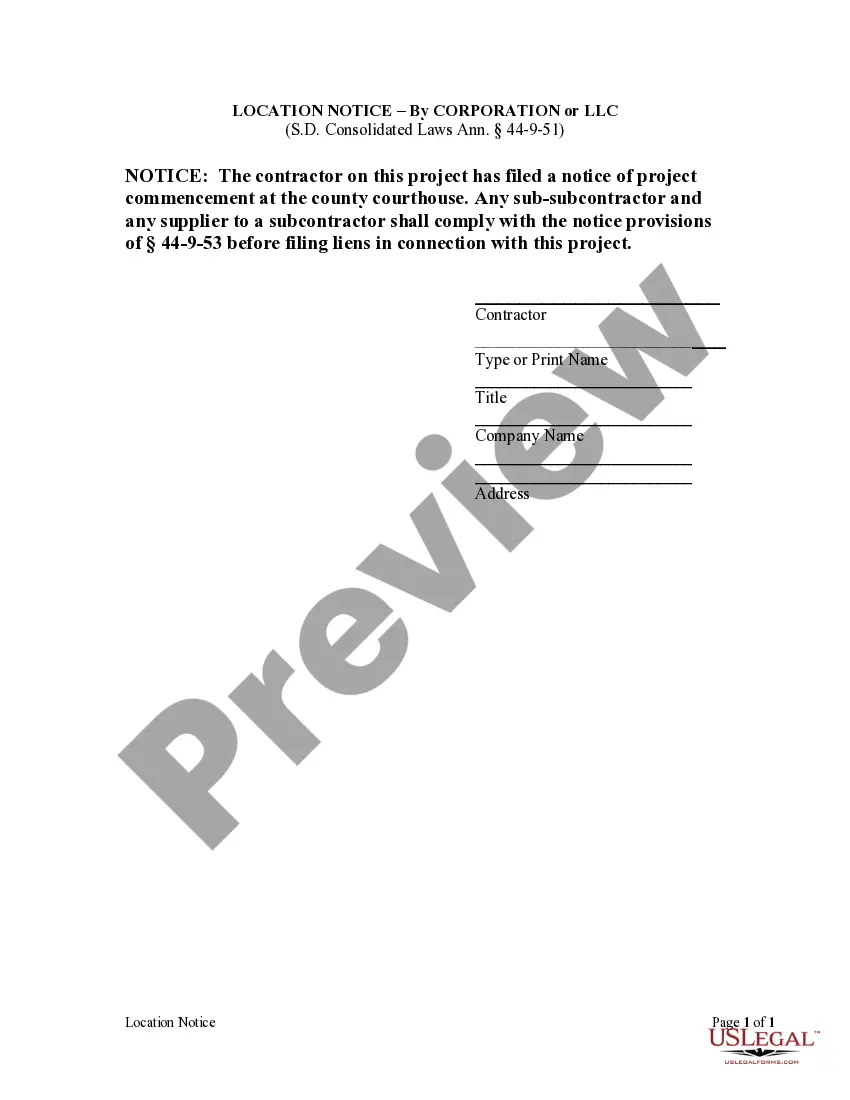

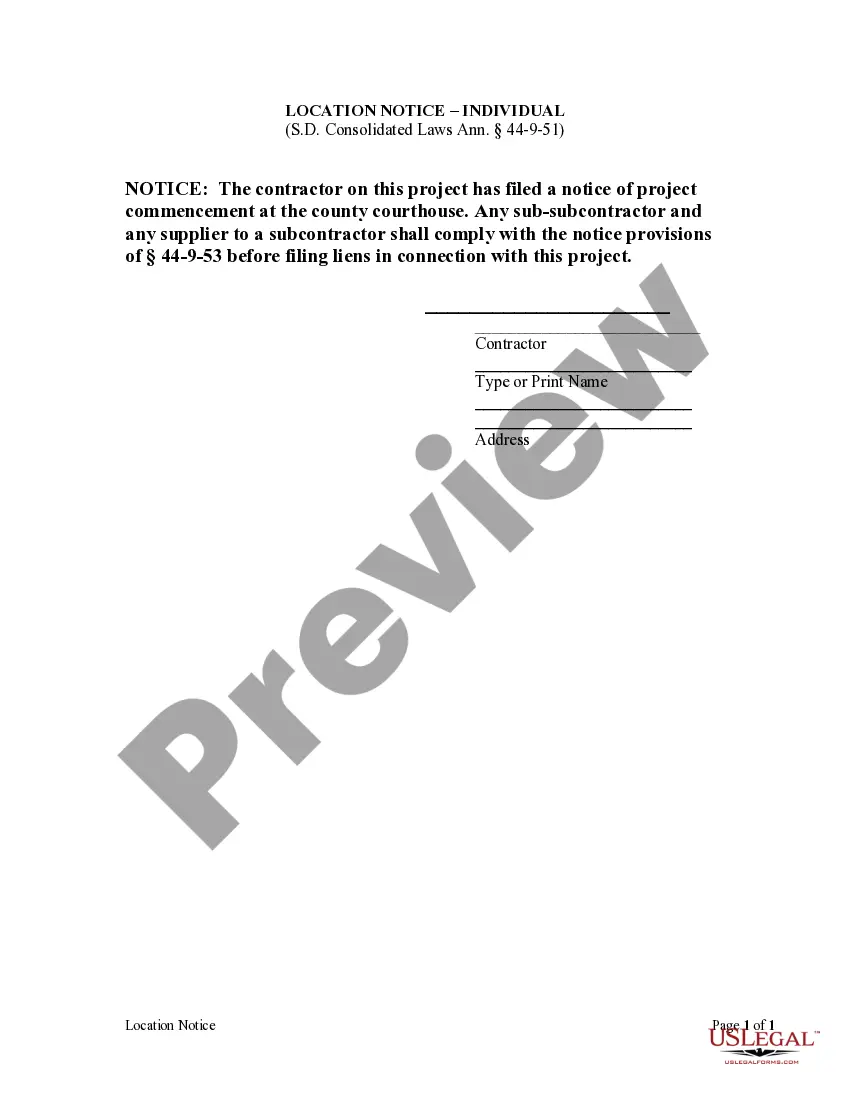

Any person filing a notice of project commencement shall post the name and address of the contractor and location notice at the job site. The location notice shall contain the following statement: The contractor on this project has filed a notice of project commencement at the county courthouse. Any sub-subcontractor and any supplier to a subcontractor shall comply with the notice provisions of ?§ 44-9-53 before filing liens in connection with this project.

South Dakota Location Notice - Individual

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out South Dakota Location Notice - Individual?

Creating papers isn't the most easy job, especially for those who almost never work with legal paperwork. That's why we advise utilizing correct South Dakota Location Notice - Individual templates made by skilled attorneys. It gives you the ability to prevent difficulties when in court or working with formal institutions. Find the files you need on our website for top-quality forms and correct explanations.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will automatically appear on the file webpage. After getting the sample, it will be stored in the My Forms menu.

Customers with no an active subscription can quickly get an account. Use this short step-by-step help guide to get your South Dakota Location Notice - Individual:

- Make sure that the sample you found is eligible for use in the state it’s required in.

- Confirm the document. Utilize the Preview option or read its description (if available).

- Buy Now if this form is what you need or go back to the Search field to find a different one.

- Choose a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after doing these straightforward steps, you are able to fill out the sample in an appropriate editor. Double-check completed info and consider requesting a legal representative to examine your South Dakota Location Notice - Individual for correctness. With US Legal Forms, everything becomes easier. Try it out now!

Form popularity

FAQ

A California resident includes an individual who is either (1) in California for other than a temporary or transitory purpose, or (2) domiciled in California, but outside California for a temporary or transitory purpose. Cal. Rev. & Tax.

Research suggests that, on average, families need an income of about twice the federal poverty threshold to meet their most basic needs. Children living in families with incomes below this level$48,678 for a family of four with two children in 2016are referred to as low income.

On a statewide basis, South Dakota does not levy a personal income tax. The state's sales tax is also among the lowest in the country. However, the average effective property tax rate in South Dakota is above the national average.

To establish domicile in South Dakota you need to stay at least one night in a campground, RV park, hotel or motel (not a state park since they don't provide receipts).

A completed Residency Affidavit. A receipt from a South Dakota hotel/motel, campground or RV park to prove one night of stay within the last year. The receipt must include your name and South Dakota address. One document, no more than one year old, proving your personal mailbox (PMB) service address.

Since South Dakota does not collect an income tax on individuals, you are not required to file a SD State Income Tax Return. However, you may need to prepare and efile a Federal Income Tax Return.

Establishing SD residency is easy. With only 24 hours of actually being in the state, you can become a resident for at least five years before you'll need to renew your driver's license again.

South Dakota Tax Facts, Information Description:South Dakota has no personal income tax code. Description:South Dakota's sales tax rate is 4.5%. There may be additional sales and use taxes at the local level. Description:South Dakota has a "cider tax." The imposed tax is $0.28 per gallon of cider sold.

Find a new place to live in the new state. Establish domicile. Change your mailing address and forward your mail. Change your address with utility providers. Change IRS address. Register to vote. Get a new driver's license. File taxes in your new state.