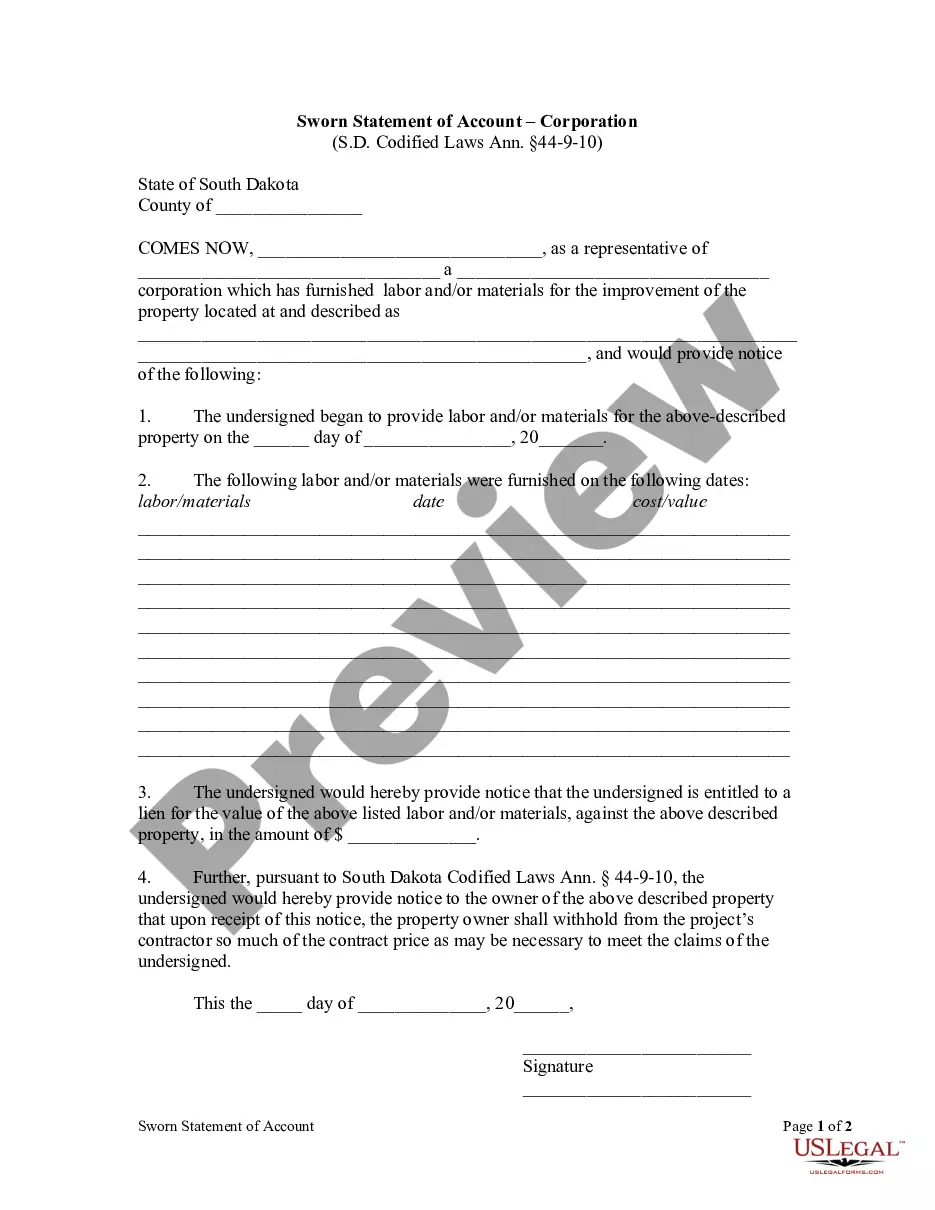

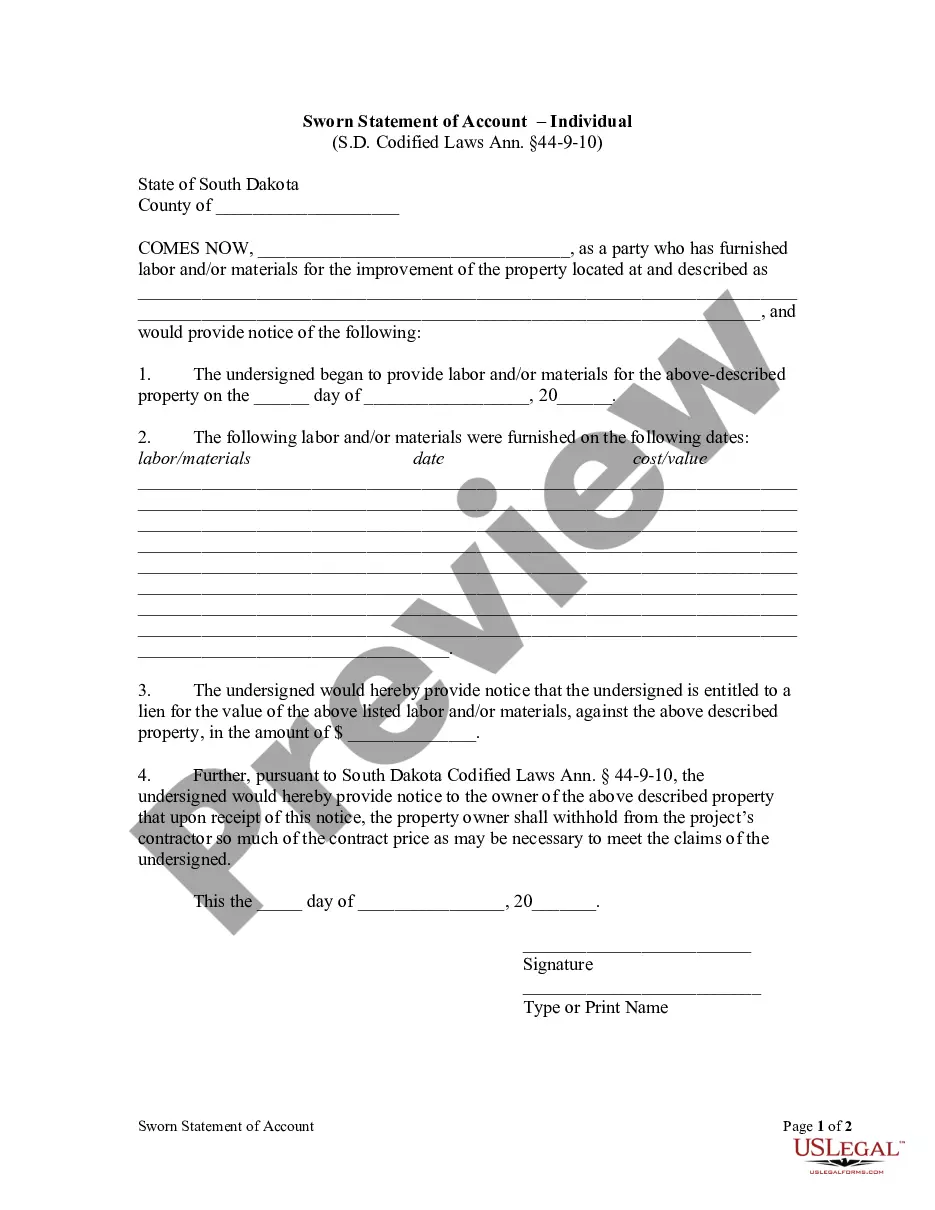

Any person furnishing any of the items for which a lien may be claimed under the provisions of § 44-9-1 under a contract, either express or implied between the owner of the property or his duly authorized agent or representative, and any contractor working upon or about such property may serve upon the owner, or his duly authorized agent or representative at any time, a sworn account and notice of his claim showing the items and amounts and the dates that the same were furnished, and thereupon the owner shall withhold from his contractor so much of the contract price as may be necessary to meet the claims of persons who have served such accounts and notices.

South Dakota Statement of Account by Corporation

Description

How to fill out South Dakota Statement Of Account By Corporation?

Creating papers isn't the most uncomplicated job, especially for people who rarely work with legal paperwork. That's why we recommend using accurate South Dakota Statement of Account by Corporation or LLC templates made by skilled lawyers. It gives you the ability to prevent problems when in court or working with official institutions. Find the documents you need on our site for high-quality forms and accurate explanations.

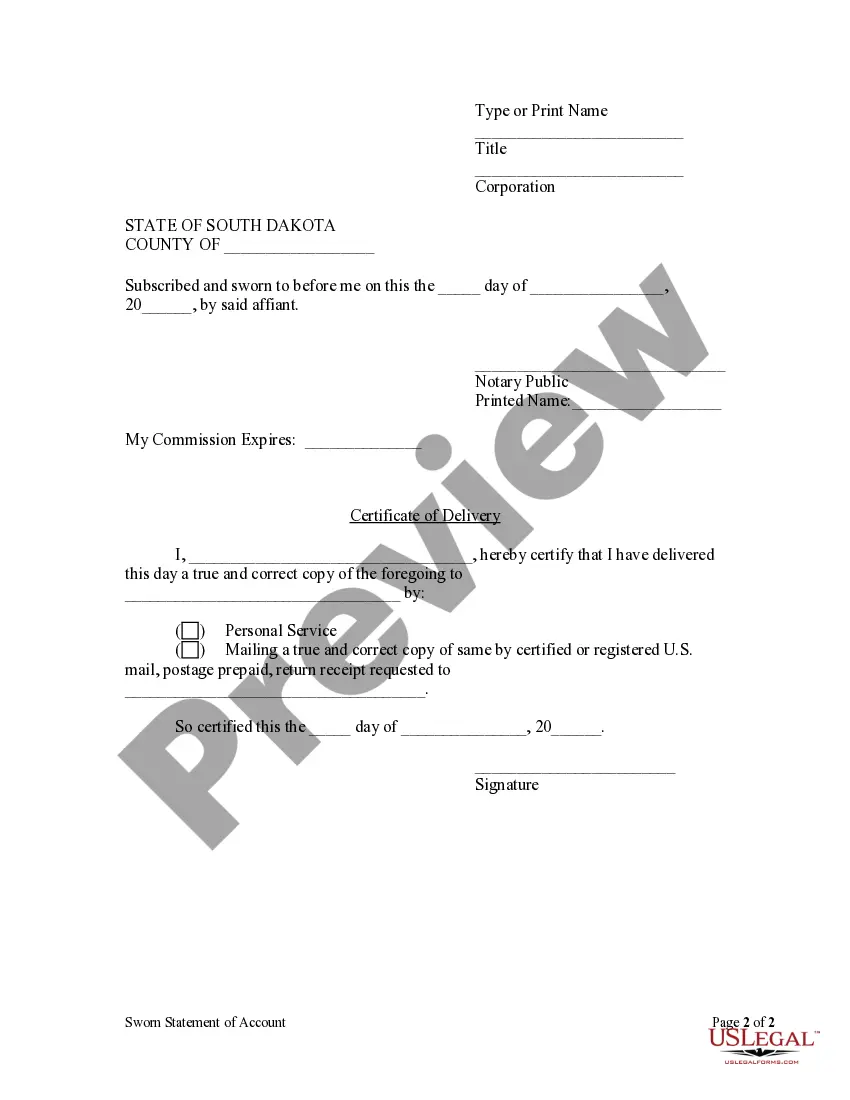

If you’re a user having a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will automatically appear on the template webpage. After getting the sample, it will be stored in the My Forms menu.

Customers without an activated subscription can easily create an account. Make use of this short step-by-step guide to get your South Dakota Statement of Account by Corporation or LLC:

- Ensure that file you found is eligible for use in the state it is necessary in.

- Verify the file. Make use of the Preview feature or read its description (if available).

- Buy Now if this sample is the thing you need or return to the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

After doing these easy steps, you can fill out the form in a preferred editor. Check the filled in data and consider requesting a legal representative to examine your South Dakota Statement of Account by Corporation or LLC for correctness. With US Legal Forms, everything becomes easier. Give it a try now!

Form popularity

FAQ

LLCs are not corporations and do not use articles of incorporation. Instead, LLCs form by filing articles of organization.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Obtain an EIN. File Annual Reports.

Not every state requires annual reports.

Annual reports became a regulatory requirement for public companies following the stock market crash of 1929, when lawmakers mandated standardized corporate financial reporting. The intent of the required annual report is to provide public disclosure of a company's operating and financial activities over the past year.

Business Licenses The state of South Dakota doesn't have a general business license; however, many cities require a business license in order to operate. Sales Tax License Businesses selling products and certain services will need to register for a Sales Tax License with the South Dakota Department of Revenue.

If you've incorporated as a business As an LLC, LLP, S-Corp or C-Corp, you must file an annual report, normally with your state's Secretary of State. This applies no matter how big or small your business is. Typically, sole proprietors and partnerships do not have to file an annual report.

STEP 1: Name your South Dakota LLC. STEP 2: Choose a South Dakota Registered Agent. STEP 3: File the South Dakota LLC Articles of Organization. STEP 4: Create Your South Dakota LLC Operating Agreement. STEP 5: Get an EIN for Your South Dakota LLC.

Key Things to Know About Annual Reports Currently, all states, except Ohio, require some sort of annual report filing. Specific filing requirements and deadlines vary by state. Some states also require an initial report when first starting a business.

After a certain amount of time past the due date, if the report still isn't filed, the jurisdiction will revoke your company's good standing or put it into a forfeited status.Most states require the past due annual report as well as an additional certificate of reinstatement and more fees.