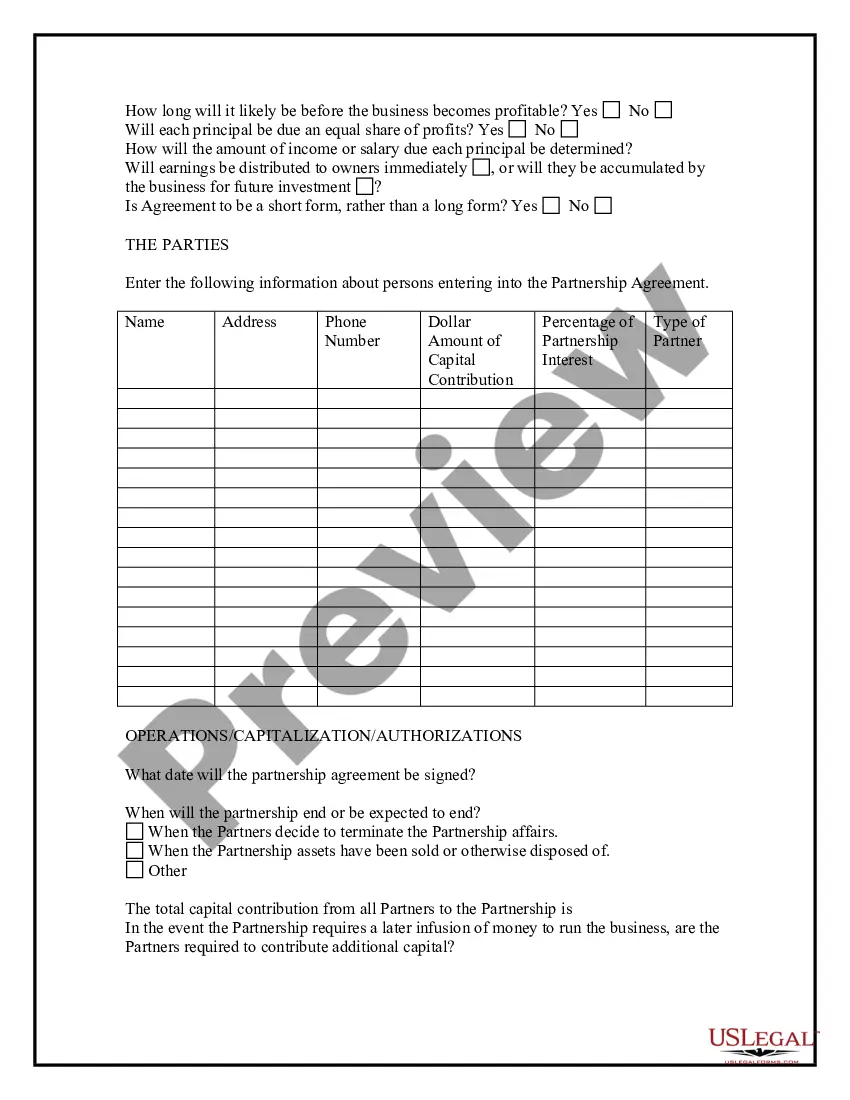

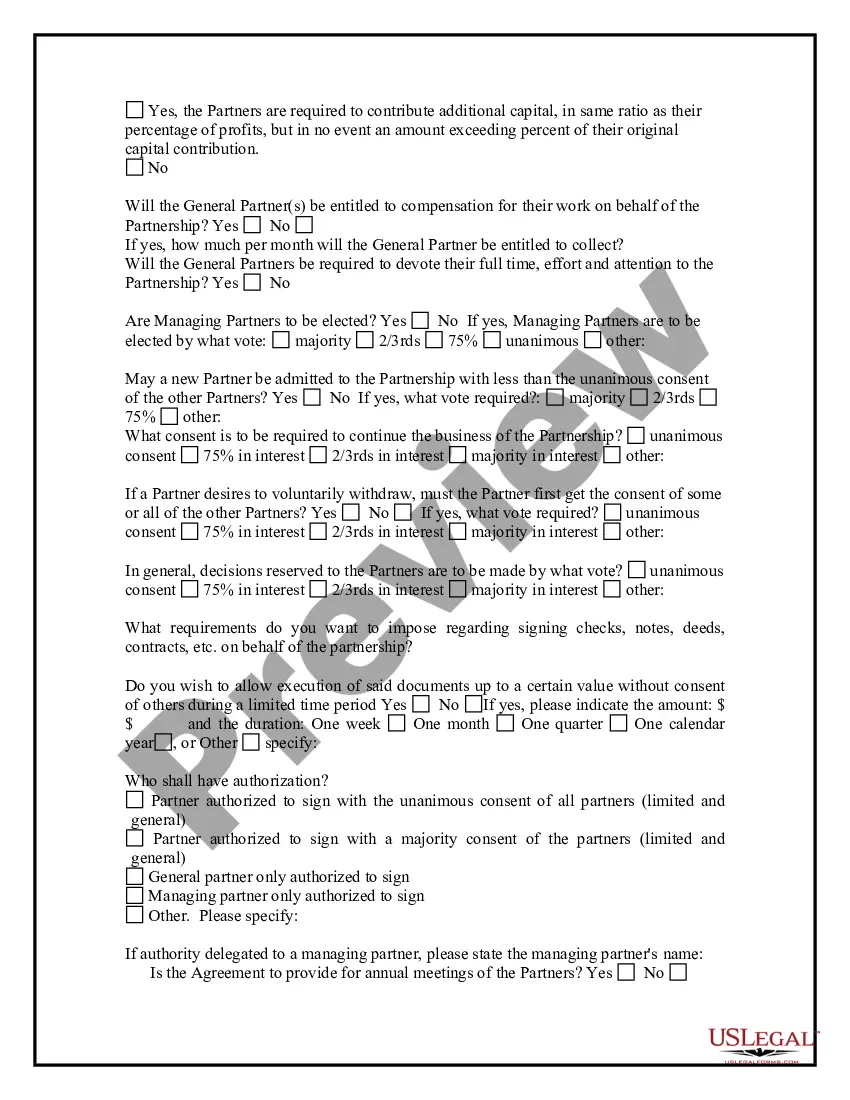

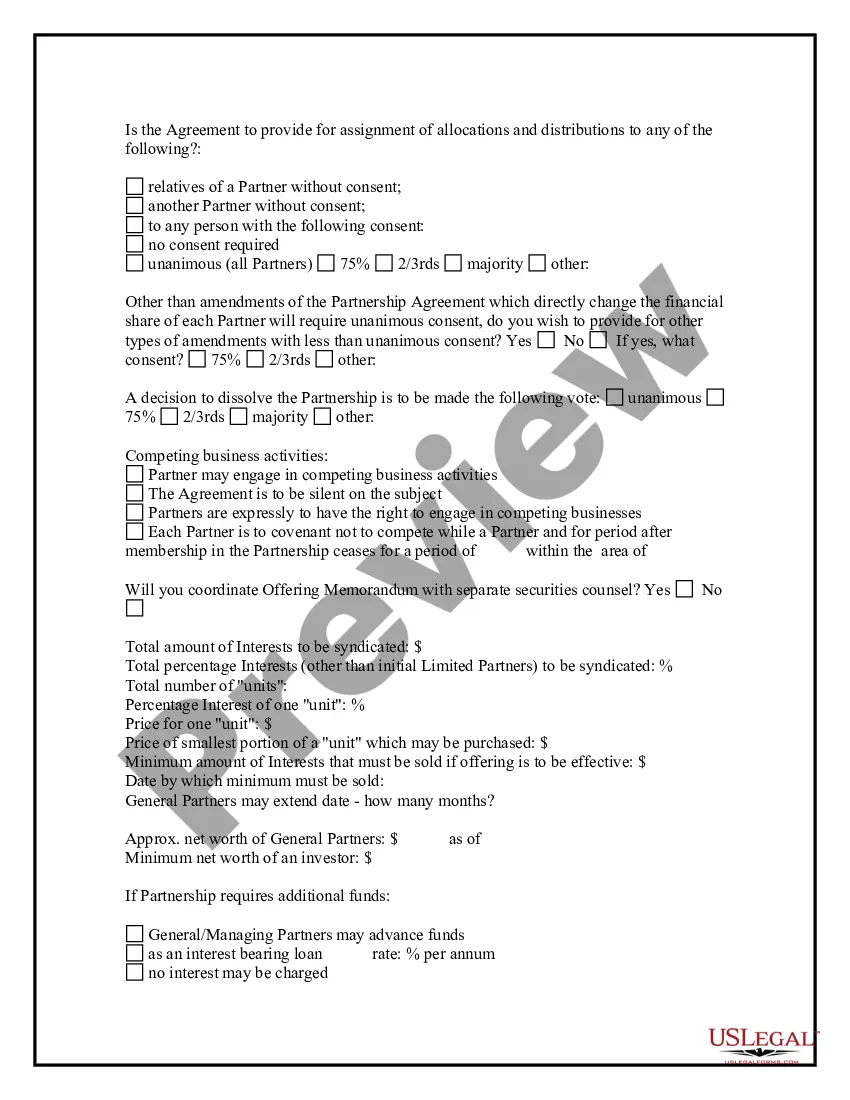

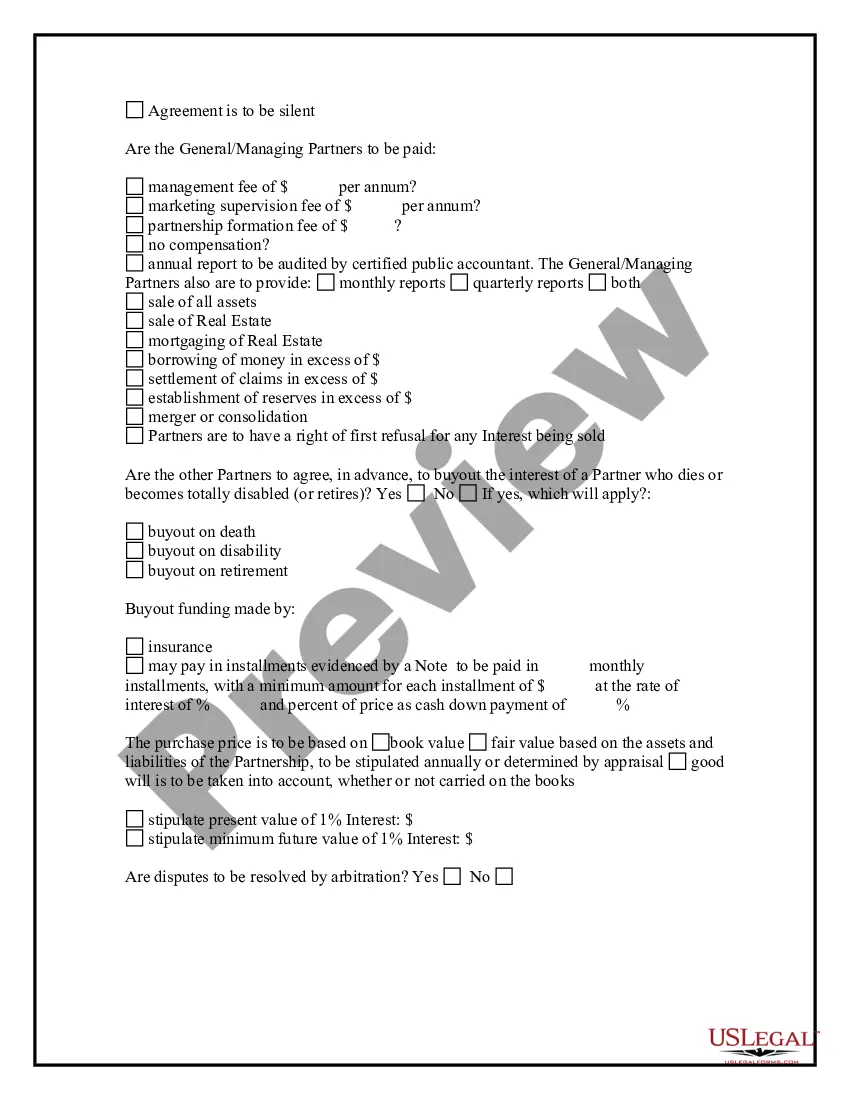

South Carolina Partnership Formation Questionnaire

Description

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

How to fill out Partnership Formation Questionnaire?

It is feasible to dedicate time online trying to discover the valid document template that meets the federal and state criteria you need. US Legal Forms provides thousands of valid forms that are assessed by experts.

You can download or print the South Carolina Partnership Formation Questionnaire from our service. If you already have a US Legal Forms account, you can Log In and then click the Acquire option. After that, you can complete, modify, print, or sign the South Carolina Partnership Formation Questionnaire. Every valid document template you purchase belongs to you indefinitely.

To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding option. If you are using the US Legal Forms website for the first time, follow the simple instructions below: Initially, ensure that you have selected the correct document template for the area/region of your choice. Review the form description to confirm you have chosen the appropriate form. If available, use the Preview option to review the document template as well.

- To find another version of the form, use the Search field to locate the template that fulfills your needs and requirements.

- Once you have found the template you desire, click Buy now to proceed.

- Select the pricing plan you want, enter your details, and register for a free account on US Legal Forms.

- Complete the purchase. You can use your credit card or PayPal account to pay for the valid form.

- Choose the format of the document and download it to your device.

- Make changes to your document if necessary. You can complete, modify, sign, and print the South Carolina Partnership Formation Questionnaire.

- Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest collection of valid forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

South Carolina does not automatically grant extensions for partnerships. However, partners may request an extension by filing the appropriate forms before the due date. Utilizing the South Carolina Partnership Formation Questionnaire can help you understand the filing requirements and deadlines, ensuring you stay compliant and avoid penalties.

A partnership becomes legal when it is established through a formal agreement that outlines the roles, responsibilities, and profit-sharing among partners. Additionally, adhering to state regulations, such as completing the South Carolina Partnership Formation Questionnaire, helps solidify the partnership's legal standing. This legal framework protects all partners involved.

To register a business as a partnership in South Carolina, you must file the appropriate registration documents with the Secretary of State. Completing the South Carolina Partnership Formation Questionnaire can guide you through this process. This ensures you provide all necessary information for a successful registration.

You can obtain South Carolina tax forms online through the South Carolina Department of Revenue's website. Additionally, many local libraries and government offices have physical copies available. For partnerships, filling out the correct forms alongside the South Carolina Partnership Formation Questionnaire is crucial for tax compliance.

To legalize a partnership in South Carolina, you need to draft a partnership agreement, obtain necessary licenses, and file your business name with the state. Additionally, completing the South Carolina Partnership Formation Questionnaire can simplify the process. This questionnaire outlines essential details required for legal recognition, ensuring you comply with state regulations.

The four main types of business partnerships include general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type has its own structure and liability implications. Understanding these distinctions is important for anyone filling out the South Carolina Partnership Formation Questionnaire. It helps you choose the right partnership type based on your business needs.

To set up a legal partnership in South Carolina, you need to follow specific steps, including drafting a partnership agreement and registering your business with the state. Utilizing the South Carolina Partnership Formation Questionnaire can simplify this process by providing a structured approach to the required documentation. Additionally, consulting with legal experts or platforms like uslegalforms can ensure that you meet all legal obligations efficiently.

In South Carolina, the annual report for businesses is often referred to as the 'Annual Franchise Tax and Report.' This form must be filed to maintain good standing with the state. Completing the South Carolina Partnership Formation Questionnaire can provide you with the necessary insights and requirements for filing your annual report correctly. Ensuring timely submissions will help you avoid penalties and keep your business in compliance.

South Carolina offers a favorable environment for forming an LLC. The state features a business-friendly climate, reasonable fees, and a straightforward registration process. Additionally, using the South Carolina Partnership Formation Questionnaire can guide you through the necessary steps to establish your LLC efficiently. Many entrepreneurs find that the benefits of forming an LLC in South Carolina outweigh the complexities.

Yes, South Carolina aligns with federal regulations regarding partnership tax extensions. This means that if you file for an extension at the federal level, South Carolina will typically honor that extension for state taxes as well. However, it’s crucial to ensure that you complete the South Carolina Partnership Formation Questionnaire accurately to avoid any issues. Staying informed about state-specific requirements can help you manage your partnership effectively.