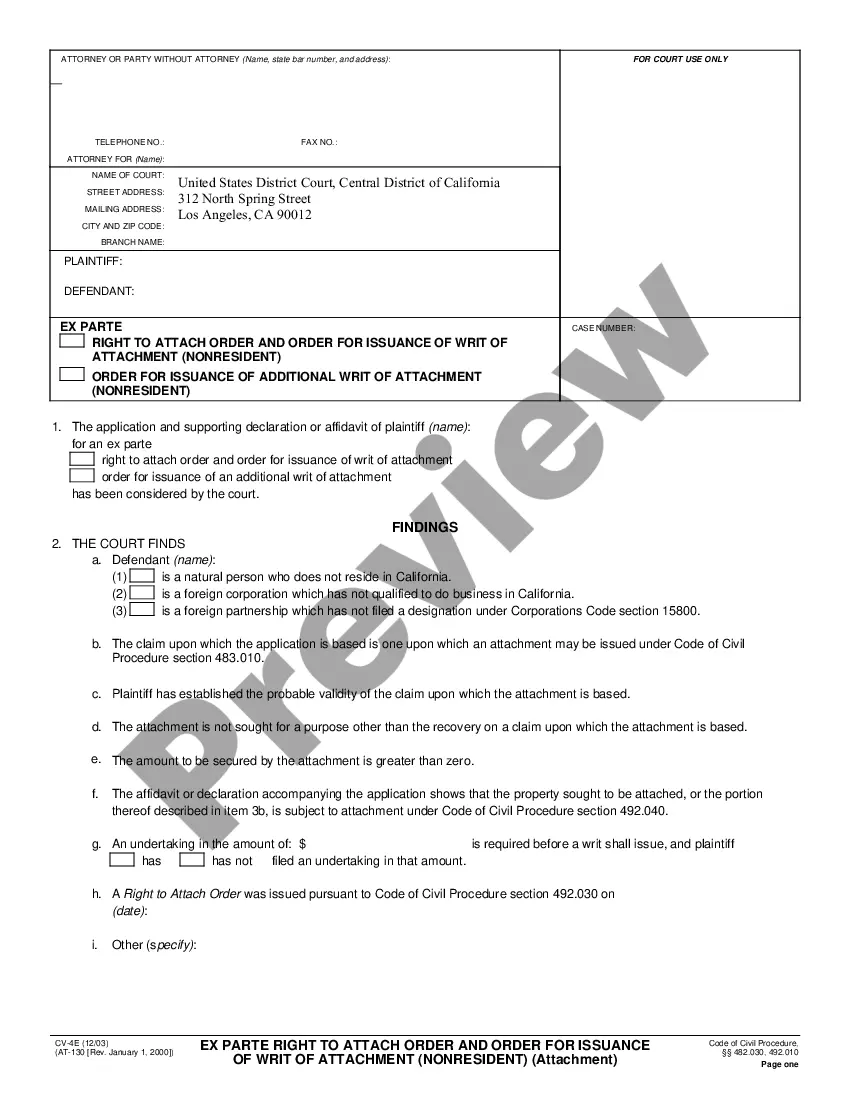

This is the accounting form used in an accounting of a law firm on the complaint of a former partner. It includes assets, liabilities, total liabilities, net assets, and a computation of the former partner's share.

South Carolina Form of Accounting Index

Description

How to fill out Form Of Accounting Index?

Have you ever been in a circumstance where you require documents for either business or specific tasks almost every day.

There is a multitude of legal document templates accessible online, but finding trustworthy ones can be challenging.

US Legal Forms offers thousands of template options, such as the South Carolina Form of Accounting Index, which are tailored to meet federal and state regulations.

Select the pricing plan you prefer, enter the necessary information to create your account, and complete your order using PayPal or a credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you may download the South Carolina Form of Accounting Index template.

- If you do not have an account and wish to utilize US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/state.

- Utilize the Preview button to review the form.

- Check the outline to confirm you have selected the proper form.

- If the form is not what you're looking for, use the Search field to find the form that fits your needs and requirements.

- Once you obtain the correct form, click Acquire now.

Form popularity

FAQ

Residents of South Carolina are required to file a state tax return if their income exceeds certain thresholds set by the state. This includes both individual income and certain business income, as outlined in the South Carolina Form of Accounting Index. If you're unsure whether you need to file, consult resources from uslegalforms to get comprehensive guidance tailored to your situation.

Certain incomes such as Social Security benefits, veterans' benefits, and specific retirement distributions are exempt from South Carolina taxes. To avoid confusion, it is advisable to refer to the South Carolina Form of Accounting Index to categorize your income appropriately. Utilizing platforms like uslegalforms can also help clarify your tax-exempt status efficiently.

To create an account on MyDormway, visit their official website and look for the 'Sign Up' option. You will need to provide basic information, such as your name, email, and possibly your student identification. Completing this process allows you to manage your accommodations seamlessly, thereby optimizing your experience—all of which can be cross-referenced with the South Carolina Form of Accounting Index for any financial matters relating to housing.

Tax-exempt income in South Carolina includes gifts, inheritances, and certain types of insurance benefits. These sources of income do not usually require state income tax payments. Delving deeper into the South Carolina Form of Accounting Index may help you identify what other categories may apply in your situation. To stay informed, refer to the resources available at uslegalforms.

In South Carolina, certain types of income are exempt from state taxation. This includes interest earned on U.S. government securities and some types of retirement income. Understanding the specifics is crucial, especially when referencing the South Carolina Form of Accounting Index for accurate record-keeping. For further assistance, you might want to check resources on uslegalforms.

Yes, South Carolina requires you to file articles of organization to officially create a limited liability company (LLC). This document serves as a foundational legal requirement for LLCs in the state. By filing the articles, you can ensure your business is recognized and compliant with the South Carolina Form of Accounting Index. For more detailed information, consider visiting uslegalforms, which can guide you through the process.

The index in accounting refers to a systematic list or reference that helps locate specific accounts or information within the financial records. It provides a streamlined way to access crucial data quickly. Adopting the South Carolina Form of Accounting Index can significantly enhance the organization of your financial information and improve reporting efficiency.

An example of an index is a financial index, like a stock market index, which measures the value of a section of the stock market. This type of index helps investors gauge the market's performance and trends. In accounting, the South Carolina Form of Accounting Index serves a similar purpose by categorizing financial data effectively.

To become a CPA in South Carolina by 2025, candidates must complete 150 credit hours of education, which includes an accounting degree. Additionally, candidates need to fulfill specific work experience requirements and pass the CPA exam. Keeping up with these standards is crucial as you navigate your career in accounting.

In accounting, an index refers to a systematic arrangement of accounts or data that facilitate easy lookup and retrieval of information. This structure enhances clarity and organization for financial records. Utilizing the South Carolina Form of Accounting Index can streamline accounting processes and improve overall efficiency.