South Carolina Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

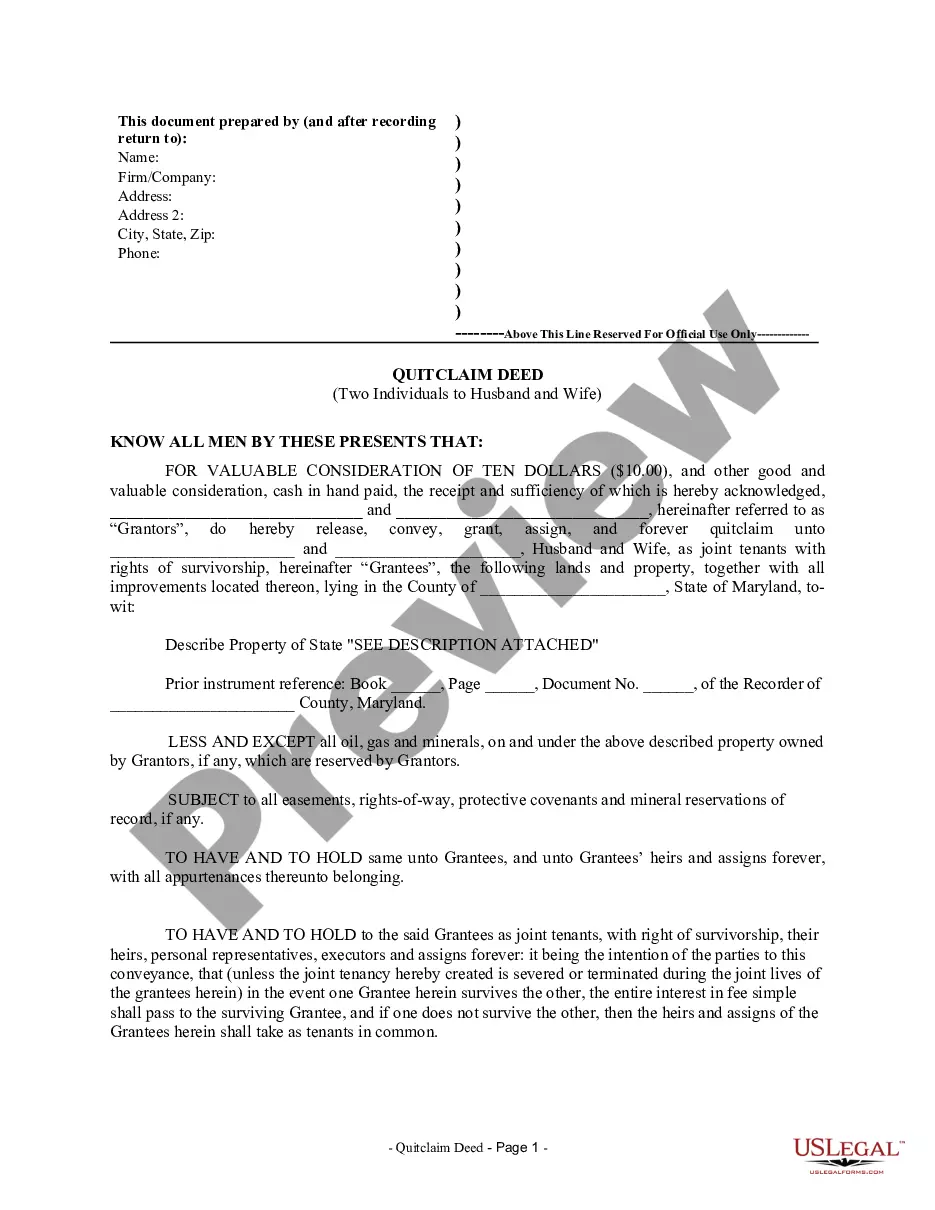

How to fill out Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

US Legal Forms - one of the most prominent collections of legal documents in the USA - offers a variety of legal document templates that you can download or create.

By using the website, you can access thousands of forms for business and personal use, categorized by types, states, or keywords.

You can find the most recent versions of forms such as the South Carolina Liquidation of Partnership with Sale and Proportional Distribution of Assets in just seconds.

Check the form summary to confirm you have chosen the right form.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you already have a membership, Log In and retrieve the South Carolina Liquidation of Partnership with Sale and Proportional Distribution of Assets from your US Legal Forms library.

- The Download button will appear on each form you view.

- You have access to all previously downloaded forms in the My documents tab in your account.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your area/region.

- Click the Review button to examine the content of the form.

Form popularity

FAQ

Property Distributions. When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts

After dissolution of a partnership the partners share in any assets remaining after payment of the debts to creditors. After such payment, the assets go to: 1. partners who have advanced money or incurred liabilities for the firm, 2. partners as a return of capital contributed and finally 3.

The gain will be taxed as capital gain or ordinary income depending on the nature of the property in the hands of the partnership, be it inventory or business or investment property. Previous deductions taken by the partnership such as depreciation may be recaptured and taxed as ordinary income.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

Only partnership assets are to be divided among partners upon dissolution. If assets were used by the partnership, but did not form part of the partnership assets, then those assets will not be divided upon dissolution (see, for example, Hansen v Hansen, 2005 SKQB 436).

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

Partnership reports distributions of all other property on Schedule K, line 19b and on Form 1065, Schedule M-2. Liquidating partner determines if he must recognize gain or loss from the transaction on his Form 1040.

Liquidation of Partnership Property Provided the liquidation terminates your entire interest in the partnership, your tax basis in the distributed property is equal to your adjusted basis in the partnership interest minus the cash distributed to you.