South Carolina Storage Services Contract - Self-Employed

Description

How to fill out Storage Services Contract - Self-Employed?

You may spend numerous hours online attempting to locate the legal document format that meets the federal and state criteria you will require. US Legal Forms provides thousands of legal templates that can be reviewed by experts.

You can effortlessly download or print the South Carolina Storage Services Agreement - Self-Employed from our services. If you possess a US Legal Forms account, you can Log In and then click the Download button. After that, you can complete, modify, print, or sign the South Carolina Storage Services Agreement - Self-Employed. Every legal document format you purchase is yours indefinitely.

To obtain another copy of a purchased form, navigate to the My documents section and click the corresponding button. If you are using the US Legal Forms site for the first time, follow the simple instructions below: First, ensure that you have selected the correct document format for the region/city of your choice. Review the form description to confirm you have chosen the appropriate form. If available, use the Review button to browse through the document format as well.

- To obtain another version of the form, use the Search field to find the format that fits your needs and requirements.

- Once you have found the format you desire, click Acquire now to proceed.

- Select the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to purchase the legal form.

- Select the format of the document and download it to your device.

- Make modifications to your document if possible. You can complete, edit, and sign and print the South Carolina Storage Services Agreement - Self-Employed.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Use professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

In South Carolina, self-employed individuals can perform work on projects valued at up to $1,000 without requiring a contractor's license. This limit includes all labor and materials. If your project exceeds this amount, it's crucial to obtain the appropriate contractor license to comply with state laws. For those engaging in storage services, understanding these regulations can be beneficial when setting up your South Carolina Storage Services Contract - Self-Employed.

Red flags in a lease agreement include unclear terms, excessive fees, or restrictions on your access to the property. It's crucial to review contracts carefully to avoid misunderstandings. When using a South Carolina Storage Services Contract - Self-Employed, ensure all terms are straightforward and devoid of surprises.

Earnings for storage unit owners can vary widely based on location and management practices. On average, owners can earn a decent income, particularly in high-demand areas. A South Carolina Storage Services Contract - Self-Employed can help structure your business model effectively and enhance profitability.

Yes, purchasing abandoned storage units can be legal, but it often involves specific procedures. Auctions are commonly held for items in abandoned units, which must follow state laws. If you're looking to navigate this process, a South Carolina Storage Services Contract - Self-Employed can provide guidelines for your engagement.

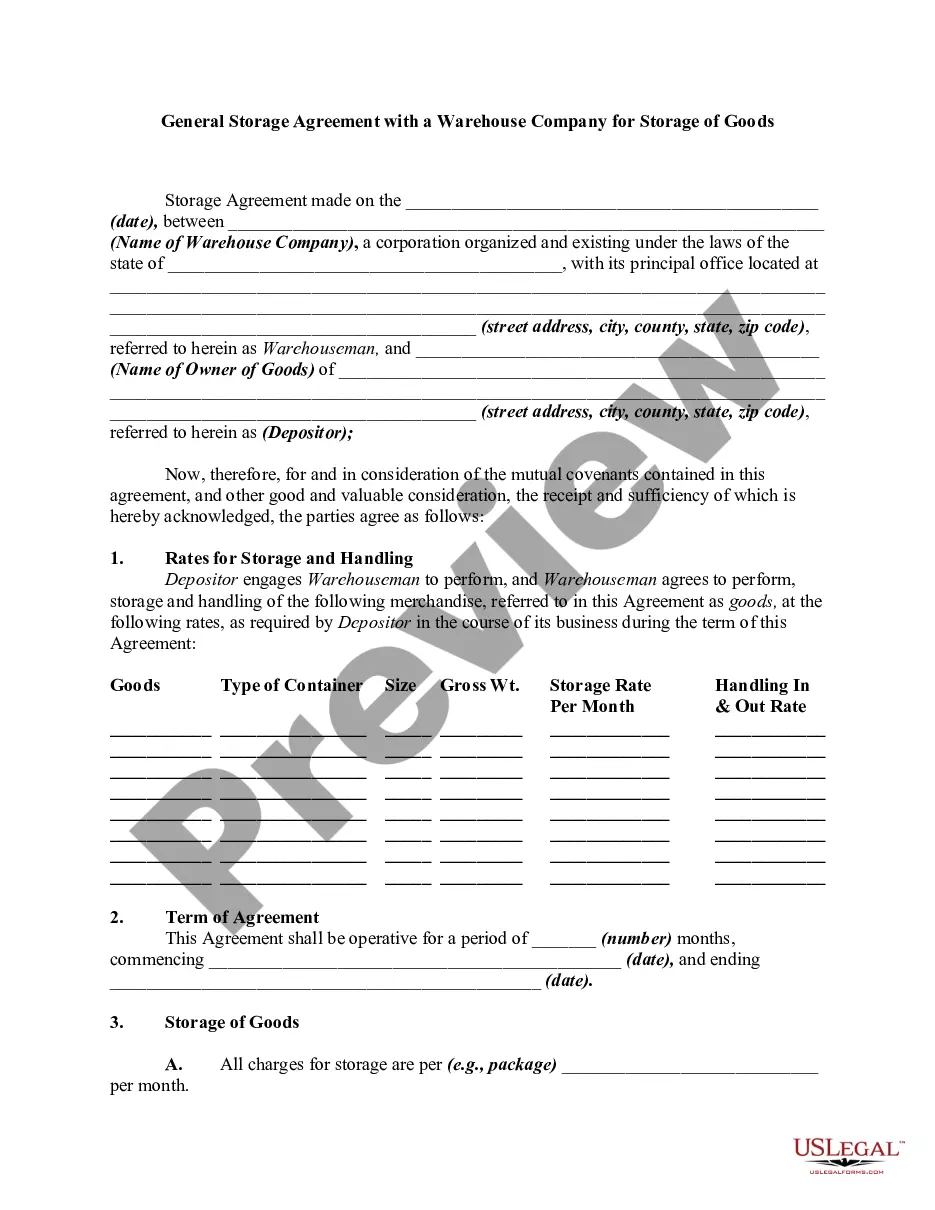

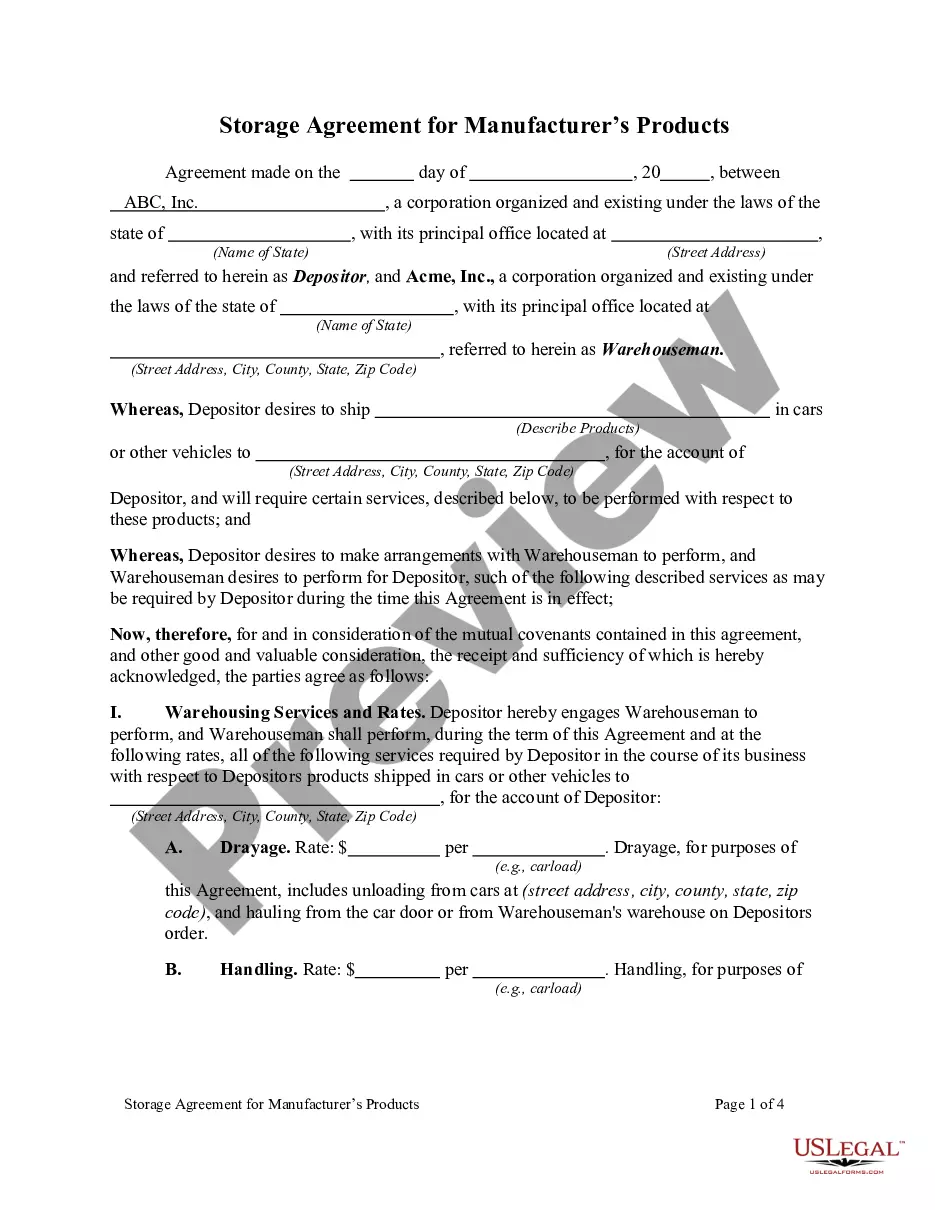

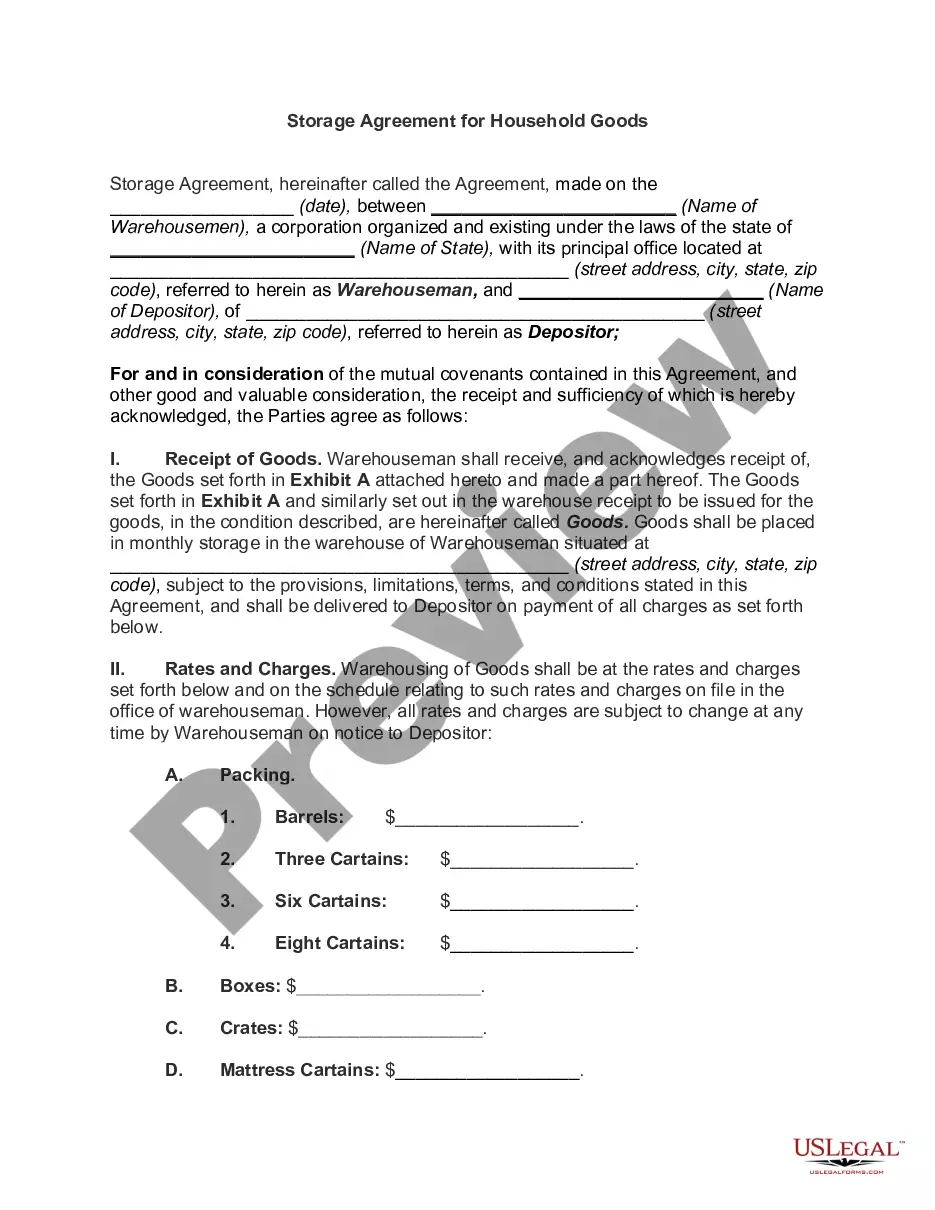

Storage contracts outline the responsibilities of both the storage facility and the renter. Generally, they specify the payment terms, duration of rental, and rules concerning access and liability. By using a South Carolina Storage Services Contract - Self-Employed, you ensure clarity in your agreement, which protects both parties.

In South Carolina, a contract becomes legally binding when it includes an offer, acceptance, consideration, and the intention to create a legal relationship. Both parties must understand the terms and agree willingly. A South Carolina Storage Services Contract - Self-Employed should clearly specify these elements to be enforceable.

A storage agreement and a lease share similarities, but they are not the same. A storage agreement primarily covers the rental of space for storing personal items, whereas a lease typically pertains to residential or commercial property. In South Carolina, a storage services contract - self-employed outlines the specific terms related to the storage of goods and whether the owner can access them.