South Carolina Tutoring Agreement - Self-Employed Independent Contractor

Description

How to fill out Tutoring Agreement - Self-Employed Independent Contractor?

Have you ever found yourself in a situation where you require paperwork for either business or personal reasons almost daily.

There are numerous legal document templates accessible online, but obtaining versions you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the South Carolina Tutoring Agreement - Self-Employed Independent Contractor, which are designed to comply with state and federal regulations.

When you locate the appropriate form, click Purchase now.

Select the pricing plan you want, provide the necessary information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you will be able to download the South Carolina Tutoring Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

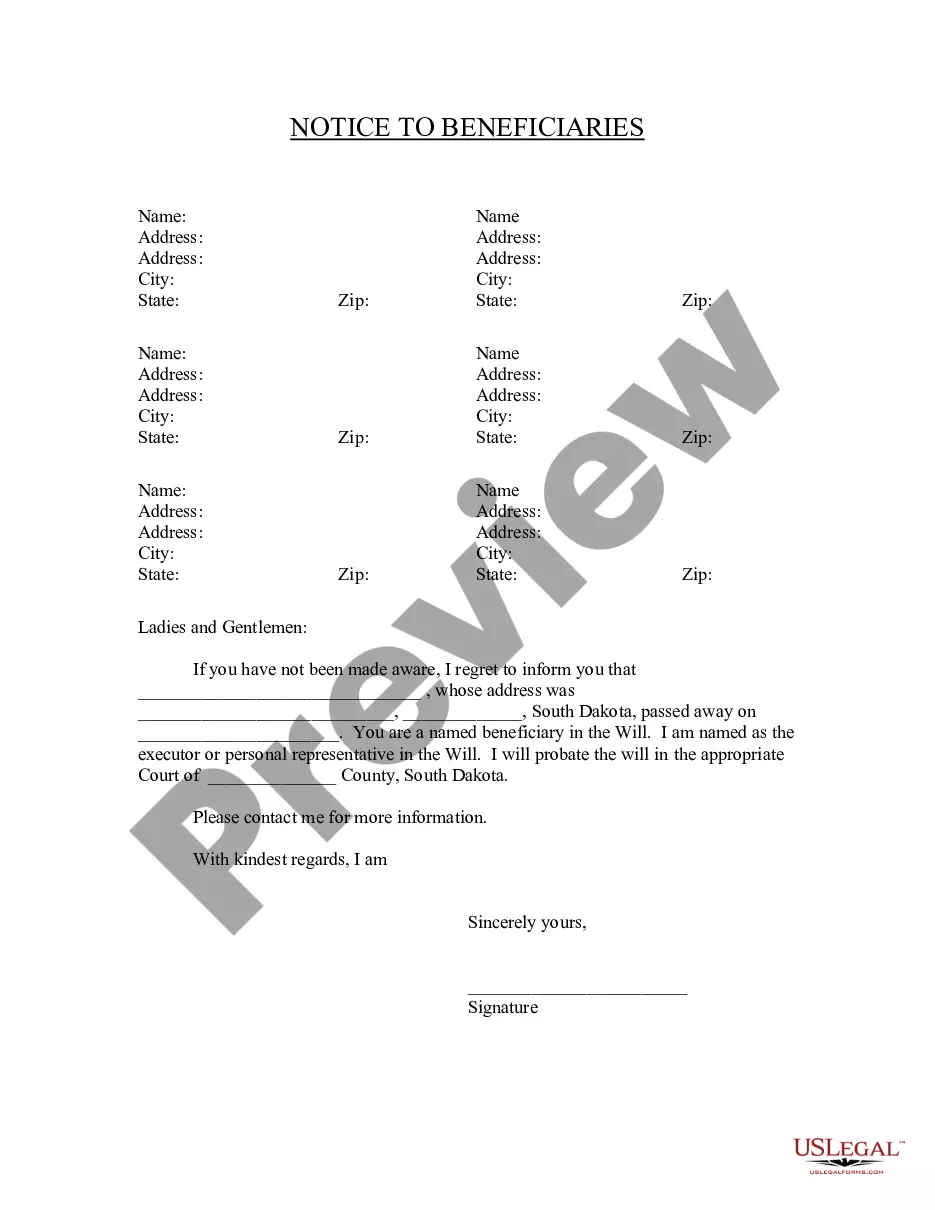

- Utilize the Preview feature to review the document.

- Check the outline to confirm that you have selected the correct form.

- If the form is not what you seek, use the Search box to find the form that meets your needs and requirements.

Form popularity

FAQ

Yes, if you hire a tutor as an independent contractor and they earn over $600 in a tax year, you are required to issue a 1099 form. This form helps the IRS track income for tax purposes and ensures compliance with federal tax laws. To simplify this process, you may want to use a South Carolina Tutoring Agreement - Self-Employed Independent Contractor, which establishes the financial terms and responsibilities for both parties.

Yes, a private tutor is typically considered self-employed. As a self-employed independent contractor, you operate your own tutoring business and set your own rates. This arrangement allows greater flexibility in scheduling and service offerings. When structuring your tutoring services, it's advisable to have a South Carolina Tutoring Agreement - Self-Employed Independent Contractor to clarify the terms of your engagement.

A basic independent contractor agreement outlines the terms and conditions of the working relationship between the contractor and the client. This document typically includes the scope of work, payment terms, and deadlines. By using a South Carolina Tutoring Agreement - Self-Employed Independent Contractor, you can ensure that both parties clearly understand their rights and responsibilities, fostering a professional and productive working arrangement.

Yes, an independent contractor is considered self-employed because they operate their own business and are responsible for their own taxes. This classification allows for greater flexibility compared to traditional employment arrangements. If you’re exploring options for tutoring agreements, a South Carolina Tutoring Agreement - Self-Employed Independent Contractor can provide the clarity and structure you need to ensure compliance and success.

The new federal rule on independent contractors, issued by the Department of Labor, aims to clarify how independent contractor status is determined. This rule emphasizes factors like the degree of control workers have over their tasks and the opportunity for profit or loss. For educators, understanding this rule is crucial when creating a South Carolina Tutoring Agreement - Self-Employed Independent Contractor, as it can significantly affect your operational framework.

The independent contractor law in South Carolina defines the criteria used to determine whether a worker qualifies as an independent contractor or an employee. This classification impacts tax responsibilities, benefits, and legal obligations for both parties. When drafting a South Carolina Tutoring Agreement - Self-Employed Independent Contractor, it's essential to understand these legal nuances to protect your business and personal interests.

Tutors who operate under a South Carolina Tutoring Agreement - Self-Employed Independent Contractor are generally classified as 1099 workers, not employees. This classification means that tutors handle their own taxes and are not entitled to employee benefits. If you are a tutor, it is crucial to maintain accurate records of income and expenses, as this will aid in filing taxes correctly. Be sure to consult with a tax professional to understand your obligations better.

An independent contractor is typically a person who provides services to another under a written or verbal agreement. To qualify, the contractor must have control over how they perform their work, along with the ability to work for multiple clients. In the context of a South Carolina Tutoring Agreement - Self-Employed Independent Contractor, this means that the tutor maintains flexibility in their scheduling and teaching methods. Understanding these criteria ensures compliance and protects both parties.

Creating a South Carolina Tutoring Agreement - Self-Employed Independent Contractor starts with defining the scope of work. Clearly outline the services you will provide, the payment terms, and the duration of the agreement. You should also include terms regarding confidentiality and termination. Using platforms like uslegalforms can help streamline this process by providing templates tailored to your specific needs.

Yes, a tutor is typically considered an independent contractor when working with clients. In this role, they are self-employed and not directly controlled by the tutoring service or the students. Understanding this classification is essential, especially when drafting a South Carolina Tutoring Agreement - Self-Employed Independent Contractor, as it helps define rights and responsibilities.